Table Of Contents

What is the Crown Jewel Defense?

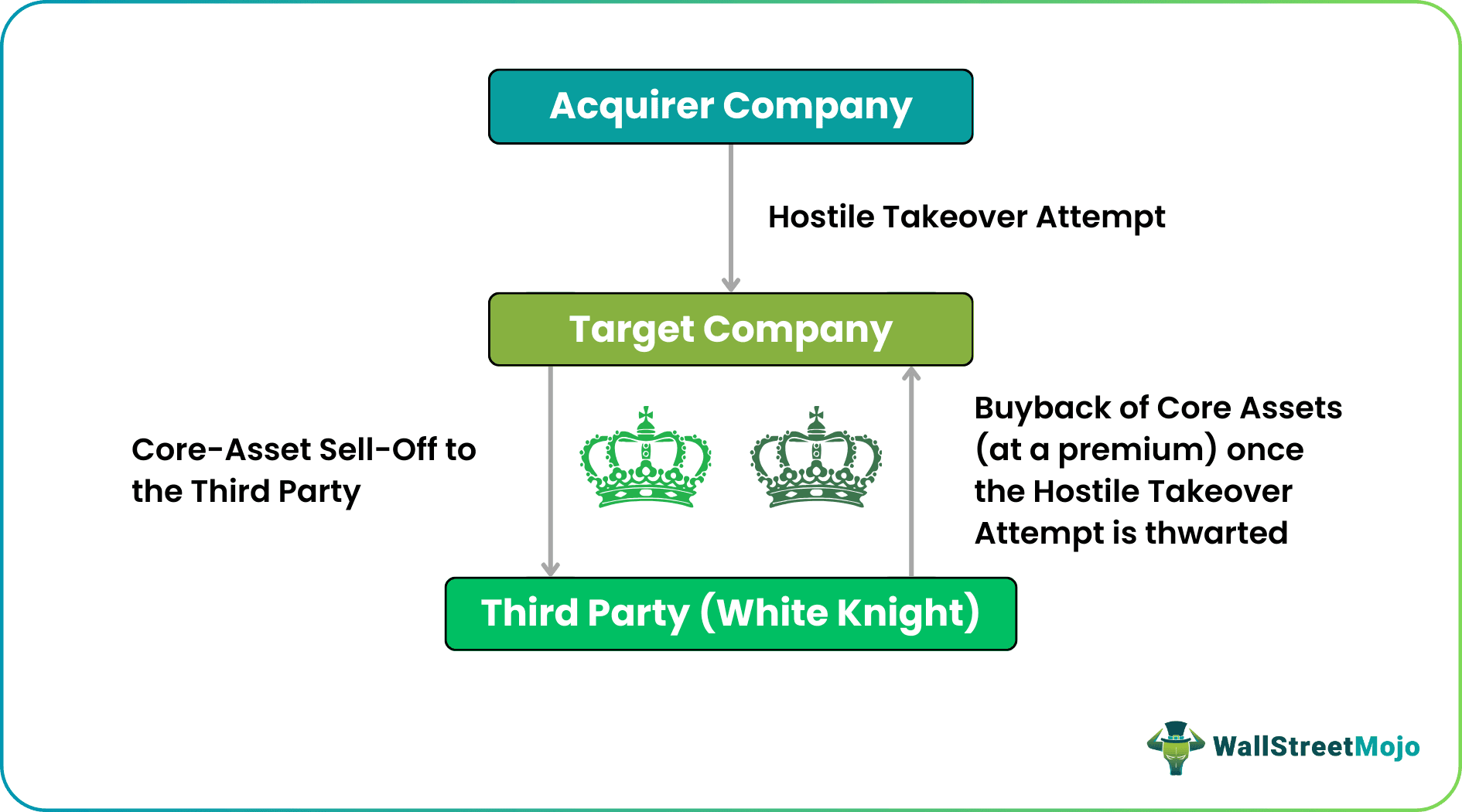

The crown jewel defense strategy is an anti-takeover strategy applied during the mergers and acquisitions by the target company by selling off its most valuable assets to reduce the attractiveness of the hostile takeover. It is the last-resort strategy to be applied to stop the seizure.

Table of contents

- What is the Crown Jewel Defense?

- The crown jewel defense strategy refers to an anti-takeover approach imposed when the mergers and acquisitions by the target company through selling the most valuable assets to lessen the hostile takeover appeal. Moreover, it is the last-resort strategy to stop the seizure.

- The most valuable corporation units are based on profitability asset value, and prospects are crown jewels.

- Often, it is assumed that a crown jewels defense strategy ruins the target company and destroys it. But this idea needs to be corrected. Instead, one may utilize the plan better when the target company sells the valuable assets to a friendly third party and repurchases them as the hostile bidder take back the bidding.

Explanation

We can define crown jewels defense as a takeover defense strategy where the target firm agrees to sell off or sell off its most valuable assets to a third party to become a less attractive acquisition target.

- This defense strategy is applied to avoid a future hostile takeover by another company. In addition, since the most valuable assets are sold to a friendly third party, the target company becomes less attractive to the unfriendly bidder.

- The white knight is the friendly third party to sell the valuable assets. However, since the target company becomes less attractive, it might eventually compel the purchasing company to withdraw the bid.

- When this hostile bidder cancels its bid, the target company again purchases these assets back at a predetermined price from the friendly third party. So, this defense strategy does not always destroy the target company.

For example, the Research and Development (R&D) team is a highly valuable department in a telecommunications company. This division term as the telecommunication company’s crown jewel. When making a hostile bid, the company may sell its research and development division to another company or spin it into a separate corporation.

What Are Crown Jewels?

The most valuable units of a corporation are based on profitability, asset value, and prospects are crown jewels. The crown jewels may also include the line of business that produces the most popular items that a company sells or a department with all the intellectual property for a particular project that may have great value after completing the project. Crown jewels of a corporation are protected and guarded heavily and allow certain people to access trade secrets and proprietary information since the crown jewels are worth a lot of money.

A company’s crown jewels vary from other companies as it depends on the industry and nature of the business. So, to fully understand this strategy, we must be aware of what crown jewels are.

Crown Jewels Defense Video

How Does Crown Jewel Work?

Let us have a look at the process of this defense strategy: -

- X Co. makes a bid to acquire Y Co.

- Y Co. does not approve the bid and rejects it.

- X Co. still pursues the acquisition and offers Y Co. a 15% premium to buy its shares.

- In this situation, Y Co. reaches out to a friendly third-party company- Z Co., to purchase Y Co.’s valuable assets. The two companies- Y Co. and Z Co., signed an agreement that Y Co. would buy back its assets at a slight premium once the hostile bidder- X Co., retracts its bid.

- Since the most valuable assets of Y Co. are sold off, X Co. withdraws its bid as Y Co. becomes less attractive for acquisition.

- Since the hostile bidder- X Co., is out of the picture and has retracted its bid Y Co. buys back its assets from Z Co. at the predetermined slightly premium price.

We can conclude from the process that in a crown jewels defense, the target company intentionally destroys its value by selling off its most valuable assets and kills the company to stop it from being acquired. Since the target company sells its valuable assets, it becomes less attractive to the potential bidder.

Example - Sun Pharmaceuticals Industries Ltd. vs. Taro Pharmaceuticals Industries Ltd.

We consider Sun Pharmaceuticals Industries Ltd. vs. Taro Pharmaceuticals Industries Ltd. a perfect example of a crown jewels defense. There was an agreement between Sun Pharmaceuticals Industries Ltd. and Israeli company Taro Pharmaceuticals Industries Ltd. and a merger of Taro Pharmaceuticals Ltd. in May 2007. As per Taro Pharmaceuticals Industries Ltd., some violations of terms unilaterally terminated this agreement with Sun Pharmaceuticals Industries Ltd. Despite acquiring a 36% stake for ₹470 crores. The Supreme Court of Israel has injuncted Sun Pharmaceuticals Ltd. for non-closure of the deal. Taro Pharmaceuticals Industries Ltd. has implemented various defense strategies like crown jewels defense, selling off its Irish unit, and non-disclosure of financials to prevent Sun Pharmaceuticals Industries Ltd. The deal between Sun Pharmaceuticals Industries Ltd. and Taro Pharmaceuticals Industries Ltd. is still looming in uncertainty.

Conclusion

It often assumes that a crown jewels defense strategy destroys the target company and kills it. But this is a misconception. One can also use this strategy better, where the target company sells the valuable assets to a friendly third party and repurchases them once the hostile bidder retracts its bidding.

Frequently Asked Questions (FAQs)

Veolia made a hostile bid in 2020 for Suez by purchasing 29.9% of shares. At the time, Suez used the crown jewel strategy to contrast the takeover bid. Sun Pharma and Taro are the crown jewel strategy examples.

The crown jewel event was initiated on Saturday, November 5, 2022, at Mrsool Park. It was the second Crown Jewel to arrive at the venue after the inaugural 2018 event when it was formerly referred to as King Saud University Stadium, which was changed to Mrsool Park in 2020.

The crown jewel defense refers to a hostile takeover defense engaging the target firm's crown jewels sale to make them less fascinating to the acquirer.

The crown jewels defense strategy may be physical assets. They can also be intangibles like patents, intellectual property, or trade secrets. It is a hostile takeover defense involving selling the target firm's crown jewels to make it less appealing to the acquirer.

Recommended Articles

This article is a guide to Crown Jewel Defense. Here, we discuss how crown jewel defense works and the practical example of Sun Pharma vs Taro. You may learn more about M&A from the following articles: -