Table Of Contents

Marking to Market Meaning

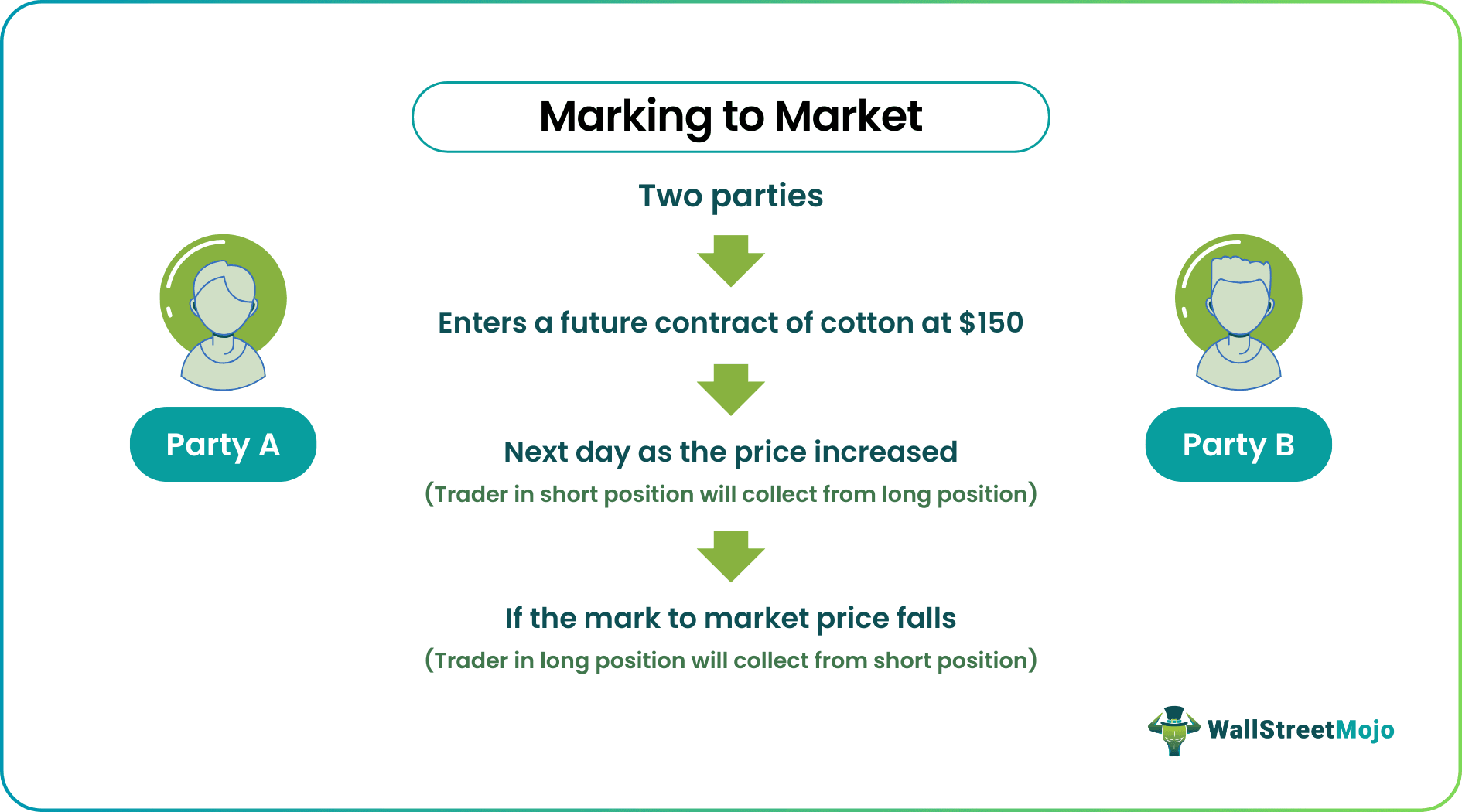

Marking to Market (MTM) means valuing the security at the current trading price. Therefore, it results in the traders' daily settlement of profits and losses due to the changes in its market value.

- Suppose on a particular trading day, the value of the security rises. In that case, the trader taking a long position (buyer) will collect the money equal to the security's change in value from the trader holding the short position (seller).

- On the other hand, if the security value falls, the selling trader will collect money from the buyer. The money is equal to the change in the value of the security. It should be noted that the value at maturity does not change much. However, the parties involved in the contract pay gains and losses to each other at the end of every trading day.

Table of contents

Steps to Calculate Mark to Market in Futures

Mark to market in futures involves below two steps:

Determining Settlement Price

Various assets will have different ways of determining the settlement price, but generally, it will involve averaging a few traded prices for the day. Within this, the last few transactions of the day are considered since it accounts for considerable activities of the day.

The closing price is not considered as it can be manipulated by unscrupulous traders to drift the prices in a particular direction. The average price helps in reducing the probability of such manipulations.Realization of the Profit/Loss

The realization of profit and loss depends on the average price taken as the settlement price and pre-agreed upon contract price.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example of Marking to Market Calculations in Futures

Example #1

Let's assume two parties are entering into a futures contract involving 30 bales of cotton at $150 per bale with a 6-month maturity. It takes the value of security to $4,500 . At the end of the next trading day, the price per bale increased to $155. The trader in a long position will collect $150 from a trader in a short position * 30 bales for this particular day.

On the flip side, if the mark to the market price for every bale falls to $145, this difference of $150 would be collected by the trader in a short position from the trader in the long position for that particular day.

From the perspective of maintaining the books of accounts, all gains would be considered ‘Other Comprehensive Income' under the Equity section of the Balance Sheet. On the assets side of the Balance sheet, the account of marketable securities will also increase by the same amount.

The losses will be recorded as 'Unrealized Loss' on the income statement. Therefore, the marketable securities account would also decrease by that amount.

Example #2

Let us consider an instance whereby a farmer growing apples is in anticipation of the commodity prices to rise. Therefore, the farmer considers taking a long position in 20 apple contracts on July 21. Further, assuming each contract represents 100 bushels, the farmer is heading against a price rise of 2,000 bushels of apple .

Say, if the mark to the market price of one contract is $6.00 on July 21, the farmer's account will be credited by $6.00 * 2,000 bushels = $12,000. Now depending on the change in price every day, the farmer would either make a gain or loss basis the initial amount of $12,000. The below table would be helpful.

(in $)

| Day | Future Price | Change in Value | Gain/Loss | Cumulative Gain/Loss | Account Balance |

|---|---|---|---|---|---|

| 1 | 6 | 12,000 | |||

| 2 | 6.15 | 0.15 | 300 | 300 | 12,300 |

| 3 | 6.12 | -0.03 | -60 | 240 | 12,240 |

| 4 | 6.07 | -0.05 | -100 | 140 | 12,140 |

| 5 | 6.09 | 0.02 | 40 | 180 | 12,180 |

| 6 | 6.1 | 0.01 | 20 | 200 | 12,200 |

Whereby:

Change in value = Future Price of Current Day – Price as of Prior Day

Gain/loss = Change in Value * Total quantity involved

Cumulative Gain/Loss = Gain/Loss of the current day – Gain/Loss of Prior Day

Account Balance = Existing Balance +/- Cumulative Gain/Loss.

Since the farmer is holding a long position in the apple futures, any increase in the value of the contract would be a credit amount in their account.

Similarly, a decrease in the value will result in a debit. It can be observed that on Day 3, apple futures fell by $0.03 , resulting in a loss of $0.03 * 2,000 = $60. While this amount is debited from the farmer's account, the exact amount would be credited to the account of the trader on the other end. This person would be holding a short position on wheat futures. This theory becomes a gain for one party and a loss for another.

Benefits of Marking to Market in Futures Contract

- Daily marketing to the market reduces counterparty risk for investors in Futures contracts. This settlement takes place until the contract expires.

- Reduces administrative overhead for the exchange;

- It ensures that when the daily settlements have been made at the end of any trading day, there will not be any outstanding obligations, which indirectly reduce credit risk.

Drawbacks of Mark to Market in Futures

- It requires continuous monitoring systems, which are very costly and can be afforded only by large institutions.

- It can cause concern during uncertainty as the value of assets can swing dramatically due to the unpredictable entry and exit of buyers and sellers.

Conclusion

The purpose of marking market prices is to ensure that all margin accounts are kept funded. Therefore, if the mark to market price is lower than the purchase price, i.e., the holder of a future is making a loss, the account has topped up with a minimum/proportionate level. This amount is called the variation margin. It also ensures that only genuine investors are participating in the overall activities.

Credit has to be made in the margin account if a holder makes a profit. The ultimate purpose is to ensure that the exchange, which bears the risk of guaranteeing the trades, is firmly protected.

It should also be noted that if the holder of futures makes a loss and cannot top-up the margin account, the exchange will "close the member out" by taking an offsetting contract. The quantum of loss is deducted from the client's margin account balance, and the balance payment is made out.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.