Table of Contents

What Is SEC Form 144?

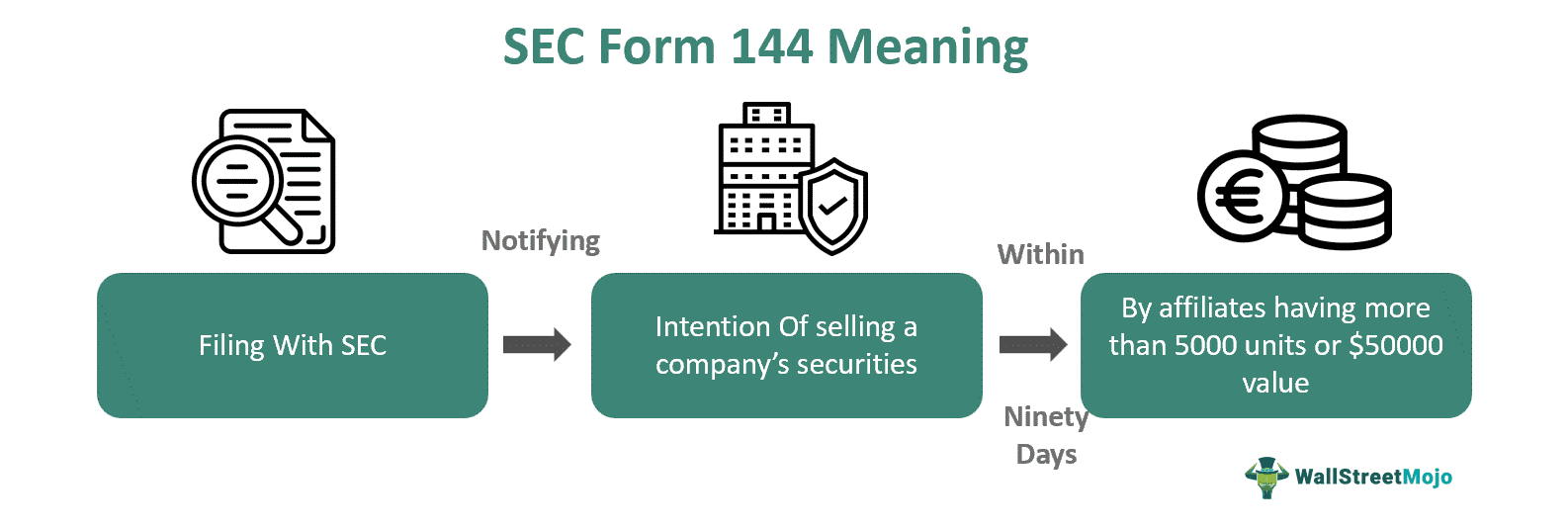

SEC form 144 refers to filing with the Securities and Exchange Commission (SEC) for the intention of selling a company's shares within a ninety-day period when the securities exceed 5,000 units or have more than $50,000 value. It serves to notify the SEC regarding the intention of an affiliate of a firm to sell restricted or controlled securities.

It is also called the Notice of Proposed Sale of Securities because it has to be filed by individuals when selling unregistered shares. SEC has mandated electronic filing of Form 144 and is also exempt from posting copies of filing to stock exchanges pertaining to publicly traded firms.

Key Takeaways

- SEC form 144 communicates the SEC about the selling of control or restricted securities beyond $50,000 and 5,000 units by affiliates.

- Its filing requires notifying the SEC 90 days before securities sale by affiliates with serious intentions, within the extended deadline, and adhering to certain conditions for exemption from registration requirements.

- Its filing involves ascertaining if form-filing is needed, filling in necessary details, obtaining access codes, preparing and submitting the form electronically, and selling within 90 days.

- It notifies the SEC about the expected securities sale, whereas Form 4 states any change in the security's beneficial ownership.

SEC Form 144 Explained

SEC Form 144 meaning can be explained as an intimation of the expected sale of securities to be entirely filed with the SEC by a company's affiliate when they intend to sell a significant portion of unregistered shares, like control or restricted shares. Further, the affiliates can be significant shareholders, officers, or directors who have to sell more than a threshold limit of $50,000 or 5,000 units of shares within a 90-day window.

It brings transparency and integrity to the markets by preventing market manipulation and insider trading, as it requires affiliates to disclose their intended sales. Private companies use it to get liquidity by having a regulated path for selling holdings by their affiliates. It allows for compliance with SEC rules by affiliates by filing using an electronic system called EDGAR as the closing of the trading day during the proposed sale.

It offers investor protection while balancing the need for liquidity in the securities market. Furthermore, it also conserves fairness and transparency, building confidence and trust in the financial system.

Filing Requirements

The requirements of SEC form 144 filings are listed below;

- An affiliate must notify the SEC 90 days prior to the sale of securities, relying on Rule 144, when the amount exceeds between $ 50,000 and 5,000 units or shares.

- The Form 144 filing party must be severe and have bonafide intentions to sell the securities as per the form.

- Starting from 13 April 2023, all Forms 144 reporting securities sales concerning reporting companies have to be filed electronically on the EDGAR database of the SEC.

- The Form 144 filing must be done with the extended deadline from 5.30 PM-10 PM.

- Any resale needing exemption from the requirements of Securities Act registration must satisfy certain conditions regarding resale, like control or restricted securities.

How To File?

Let us look at the stepwise SEC Form 144 filing instructions to file From 144 given below:

- First, determine if Form 144 has to be filed or not. If yes, then fill in all the details required as per SEC.

- Then, ascertain the bonafide intention of selling the securities within the timeframe.

- Obtain access codes like CIK and CCC of EDGAR well in advance because every affiliate filing form 144 must have its codes.

- After that, electronic Form 144 per EDGAR system on SEC is to be created and submitted using the EDGAR online forms website.

- The filing of Form 144 must be done electronically by 10 PM ET on the day the order for selling securities has been placed without sending a copy to SEC Form 144 via email.

- Finally, make sure the selling of securities is within three months or ninety days; otherwise, a new filing of form 144 has to be done.

Examples

Let us use a few examples to understand the topic.

Example #1

An online article published in January 2021 discusses proposed amendments by the SEC to rule 144 and from 144 related to the selling of restricted securities. It says that the amendment targets to simplify form-filling requirements and also resolve the risk due to unregistered distributions. Currently, rule 144 offers guidelines regarding selling control, restricted and unregistered securities specifying holding tenure to ascertain compliance. However, the proposed amendment in rule 144 centers on market-adjusted securities, making clear that conversion marks its holding period and is applicable to unlisted securities users.

Furthermore, the amendment recommends aligning from 144 filing with the deadline of filing from 4 in electronic form. Other than that, it also ends the need to forward the Form 144 official notification to the principal exchange and the need to fill out certain fields in it. All these amendments aim to enhance regulatory efficacy and speed up the process of selling restricted securities.

Example #2

Let us assume that Jane, who is an executive at Old York Corporation, wants to sell 10,000 shares of Old York Corporation. Therefore, Jane declares her intention to sell her shares within the next 6 months by filing SEC from 144 on May 10, 2024. The form established that Jane had received these shares by exercising the company's stock option scheme during the last two years. It also detailed that Jane had a total stock holding amounting to 60,000 shares to adhere to SEC rule 144's volume cap.

Further, Jane also gave all the required information, like the tentative date of selling her stocks and the name of the broker undertaking such an exercise. Thus, Jane transparently ascertained full compliance with SEC rules in the eyes of the public and investors.

SEC Form 144 vs Form 4

Both forms help in adding transparency to the securities market by preventing insider trading but are different as per the table below:

| SEC Form 144 | Form 4 |

|---|---|

| It notifies the SEC about the expected securities sale. | States any change in the security's beneficial ownership. |

| Mandatory requirements during sales of more than 5,000 or $50,000 unregistered shares. | Mandatory for all insiders like officers, directors, and other beneficial owners with greater than or equal to 105 of a firm's total outstanding stock |

| It contains information like the timeline, type, and number of the proposed shares sold. | It contains details like the reporting person, price, date, and type of security. |

| After filing, provide 90 days before the share sale | The share sale must be filed two days after the security sale transaction. |

| Leads to transparency and insider trading prevention during the sale of securities. |