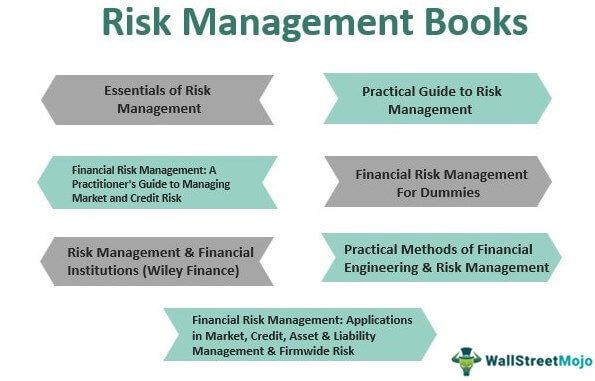

7 Best Risk Management Books [2025]

Risk management has always been a critical area for the financial industry. Still, it has acquired a newfound meaning in the post-2008 credit crunch era, as many financial institutions are willing to go that extra mile to ensure they understand the element of risk well enough. Below is the list of 7 best books on risk management you must read in 2025:

- The Essentials of Risk Management ( Get this book )

- A Practical Guide to Risk Management ( Get this book )

- Financial Risk Management: A Practitioner’s Guide to Managing Market and Credit Risk ( Get this book )

- Financial Risk Management For Dummies ( Get this book )

- Risk Management and Financial Institutions (Wiley Finance) ( Get this book )

- Practical Methods of Financial Engineering and Risk Management: Tools for Modern Financial Professionals ( Get this book )

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide Risk (Wiley Finance) ( Get this book )

Let us discuss each risk management textbook in detail, along with its key takeaways and reviews.

#1 - The Essentials of Risk Management

by Michel Crouhy (Author), Dan Galai (Author), Robert Mark (Author)

Book Review

This book is an excellent treatise on risk management, elucidating the nature of financial risks faced by businesses and ways of effectively handling them. In this risk management book, the author draws on lessons learned from the 2008 financial crisis and explains how it exposed shortcomings of traditional risk management during the financial crisis, which led to a series of financial reforms in the aftermath. As a result, readers are introduced to the current regulatory framework, the latest credit risk assessment and management methodologies, and Enterprise Risk Management (ERM) implementation for managing organization-wide risks. Some of the essential topics covered in this work include post-crisis regulatory framework, corporate governance and risk management, measuring market risk, asset/liability management, commercial credit analysis risk, quantitative approaches to credit, credit transfer markets, counterparty risk, operational risk, model risk, and stress testing and scenario analysis among others—a complete guide on efficient management techniques in the post-crisis era for risk professionals as well as amateurs.

Best Takeaway

This textbook on risk management is a detailed guide on how financial risk management underwent a sea change in the aftermath of the 2008 financial crisis and the evolution of complex risk management strategies and regulatory frameworks in the post-crisis era. The authors cover a wide range of topics, including effective methods of measuring, managing, and transferring credit risk, different forms of risk faced by businesses, and streamlining organizing organizational risk management. It is a concise yet excellent guide on credit risk and other financial risks faced by corporations in the post-crisis era and methodologies devised to assess and manage them efficiently.

#2 - A Practical Guide to Risk Management

by Thomas S. Coleman (Author)

Risk Management Book Review

This work dwells at length on the very idea of risk and how one can measure it, along with how measuring and managing risks are two completely different activities that organizations must coordinate carefully. As a result, the author helps create a better understanding of risk measurement and quantitative risk management tools for financial organizations, which can significantly help finance professionals and business managers. Some of the key topics covered by the author include risk management and risk measurement and how the ideas of randomness and luck create uncertainty. At the same time, probability and statistics help provide a rational perspective on managing anticipated and unanticipated risks. Other concepts discussed are financial risk events, systemic vs. idiosyncratic risk, quantitative risk measurement, methods of estimating volatility and VaR, analyzing risk, risk reporting, credit risk, and limitations of risk measurement. Risk professionals and people from other walks of life interested in understanding financial risk and methods of measuring it would benefit significantly from this literary work.

Best Takeaway from this Book

This book on risk management is an excellent work on risk management as an effective tool for managing a financial organization. That introduces several concepts related to risk measurement and discusses tools and techniques employed for the purpose. The author intends to create a more fundamental understanding of risk measurement and techniques for measuring risk and outlines their potential and limitations as tools for effective organizational management—a complete guide on organizational management from a unique risk management perspective.

#3 - Financial Risk Management

A Practitioner's Guide to Managing Market and Credit Risk

by Steve L. Allen (Author)

Book Review

This textbook on risk management is a definitive guide on financial risk management authored by a top risk management expert detailing every aspect of isolating, quantifying, and effectively managing risk. The author elaborates on the nature of market and credit risk and illustrates with examples how to implement methodologies and strategies for measuring and managing risks. Several real-world issues were addressed, including mark-to-market valuation of trading positions, structuring limits for controlled risk-taking, and review of mathematical models as practical tools for managing various forms of risk to bring added practical value to the work. Along with more conventional methods and approaches, several derivative instruments are also discussed in terms of their utility for hedging risk. The current edition of this risk management book comes with a companion website that provides a great deal of supplementary information on risk management and updated examples to help understand various aspects of risk management. A recommended risk management work for finance professionals and those new to the field.

Best Takeaway

This book is one of the best risk management books. It has a complete resource on market and credit risk measurement and management from a risk expert meant to develop a detailed understanding of strategies and principles for measuring and managing these risks. This work covers some of the most fundamental questions related to risk measurement. In addition, it methodically takes the reader through some of the most complex methods, including using derivative instruments for risk hedging and mathematical models for effective risk control. It is a highly recommended read for anyone interested in understanding practical risk management.

#4 - Financial Risk Management For Dummies

by Aaron Brown (Author)

Book Review

This book is a relatively concise work on risk management, but one which systematically covers every aspect of understanding risk, evaluating different forms of risk, and developing suitable strategies for risk management for any size and scale of organization. Penned by the winner of the GARP Award for ‘Risk Manager of the Year,’ this work breaks down a comprehensive approach to risk management in steps small and simple enough to be understood and followed clearly by anyone with an understanding of fundamental concepts related to risk management. This exceptional clarity of concepts related to managing, measuring, and communicating risk effectively in any financial organization sets this work apart from most risk management books available. In addition, the author describes the responsibilities of a financial risk manager and helps the reader develop a personalized strategy to succeed at it. Complete work on risk management for aspiring or even experienced risk managers, which would get them on the path of career success and discover little-known financial truths about the industry.

Best Takeaway

Written by an award-winning author, this is an introductory yet detailed guide on risk management primarily intended for financial risk managers. This book lays down step-by-step instructions on managing, measuring, and communicating risk within an organization to efficiently control the element of risk. It is a must-read for risk managers of all experience levels or anyone interested in understanding the significance of risk management for any organization.

#5 - Risk Management and Financial Institutions (Wiley Finance)

by John C. Hull (Author)

Book Review

This comprehensive work adopts a multi-layered approach to the field of risk management to enhance the understanding of risks faced by financial institutions of various kinds and the issues involved. Make no mistake; this is not working for those with a casual interest in risk management, but for those striving to understand better how different institutions are affected by risk and how it should be measured and dealt with. The author leaves no stone unturned to reveal how complex variations in the regulatory structure of financial institutions shape risk management practices and how different types of risk manifest in different types of financial institutions. In the ultimate analysis, the author exposes the dangers inherent in the financial system and how risk management can help better secure financial institutions and the financial industry if correctly applied. It is highly recommended work for risk managers and finance professionals to understand the complex nature of financial industry relations and their relation with risk management practices.

Best Takeaway

It can be explained as a lucid work on a complex area related to risk management, that of its relevance to financial institutions in the context of financial industry regulations. The author stands out in his approach to the subject by methodically exposing the problem layer by layer while providing a viable longstanding solution in the form of carefully devised and implemented risk management practices. It is a must-read for those interested in widening their understanding of financial industry regulations from a risk management perspective.

#6 - Practical Methods of Financial Engineering and Risk Management

Tools for Modern Financial Professionals

by Rupak Chatterjee (Author)

Book Review

This work is nothing less than a wake-up call for the financial industry, where the author challenges conventional concepts about market risk exposure and shows how things work differently in the post-2008 scenario. He argues why risk management requires a different approach in the existing market conditions and introduces readers to advanced tools and techniques with greater relevance in today’s financial realities. These statistical tools could enable risk professionals to measure actual market behavior, anticipate significant market swings, and prepare to make the most of it. The author provides enough material to work out probability distributions for the accurate valuation of financial instruments and risk modeling, among other applications outlined in this work. On the whole, an excellent guide for those not afraid of challenging conventional notions and putting their mathematical skills to define and tackle financial risks in a whole new way.

Best Takeaway from this Book

It is an excellent guide to accurate financial risk evaluation and understanding market behavior with the help of an array of advanced statistical tools placed at the disposal of the modern trader. In addition, this work deals with how risk management has changed in the wake of the 2008 credit crunch and how one should evaluate and manage risk in different forms. It is a highly recommended read for mathematically literate traders and risk professionals to enrich their risk evaluation and management tools and techniques.

#7 - Financial Risk Management

Applications in Market, Credit, Asset and Liability Management and Firmwide Risk (Wiley Finance)

by Jimmy Skoglund (Author), Wei Chen (Author)

Book Review

This book is a masterful work on risk management practices in the context of the banking industry, with some of the most complex tools and techniques at the disposal of risk professionals. The authors have dealt at length with the increasing significance of developing and implementing advanced risk analytics in the modern banking industry and how the change in market behavior and specific fundamental changes in risk-seeking behavior have changed everything about banking in the conventional sense. A complete approach has been outlined for risk management, especially as applicable to banking operations, from a purely quantitative perspective. This work discusses the market, asset, credit, liability risks, and macroeconomic stress testing and deals with the latest regulatory practices, model risk management, and firmwide risk. In totality, a highly recommended work on modern risk management practices can help professionals and amateurs better understand how to evaluate and manage risks in the banking industry.

Best Takeaway

A complete treatise on risk management in modern banking operations meant for aspiring and practicing risk professionals to enhance their understanding of the banking industry from a risk perspective. The authors delve at length into how the latest regulatory practices influence risk practices and introduce readers to advanced concepts in model risk management. A gem of work in terms of a quantitative risk perspective on the banking industry.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com