Table Of Contents

Ask Price Meaning

The ask price is the lowest price of the stock at which the prospective seller is willing to sell the security he holds. In most exchanges, they quote the lowest selling prices for the trading. The seller has the right to state whether the ask price is negotiable or fixed.

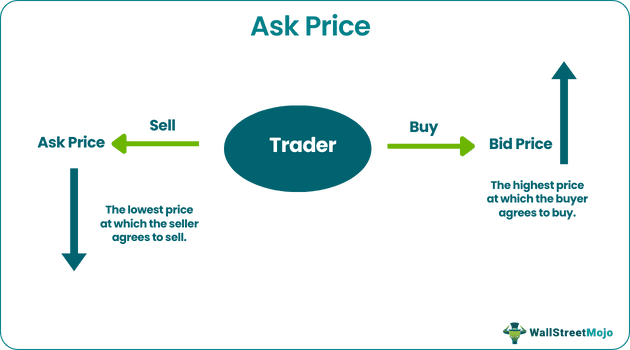

Along with the price, asking for a quote might stipulate the amount of security available for selling at the given price. With the ask quote in the market, there is a bid price, which is the highest price the prospective buyer is willing to pay for purchasing the security. The difference between the ask and bid prices is known as the bid-ask spread.

Key Takeaways

- The ask price is the lowest stock price at which the potential seller is willing to part with the security that one owns. For trading, the majority of exchanges typically quote the lowest selling prices. Requesting a quote may also include a specification of the security amount that can be sold for the bid price.

- The bid-ask spread is the distinction between the ask and bid prices.

- One may utilize the asking price in the stock market and all other financial markets, including those for bonds, derivatives, and foreign exchange.

Ask Price Explained

The ask price for stock is the minimum price the security seller will receive. The buyers who purchase the company's securities from the financial market use the ask price. When the investor is ready to buy the stock of any company, they need to determine at what price someone is willing to sell the securities.

For this, they would look at the best ask price, the lowest price at which someone is willing to sell the securities. Suppose an investor places the market order ready to purchase any company's securities. In that case, the order will be executed automatically for the required quantity at the prevailing ask quote of the security.

The ask quote in the market is always higher when compared with that of the bid quote. The difference between the ask and the bid prices is known as the spread. In case the spread is calculated between the ask quote and the bid quote is very wide. In that case, security is bought at the high end of the spread and sold at the low end. Therefore, it is difficult for traders to generate profits from trading securities.

The ask quote and the bid quote of the security in the market keep changing at different points in real-time. So, there is no fixed ask rate and no fixed bid rate for any security. These price changes are based on the market's current demand and supply of security. This is applicable even for ask price in forex.

Suppose the market order is placed by the investor willing to purchase any company's securities. In that case, the order will be automatically executed for the required quantity at the prevailing ask price of the security. From the seller's perspective, the trader would sell the security at the ask quote if the order is the limit order.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us look at some examples to understand the concept.

Example#1

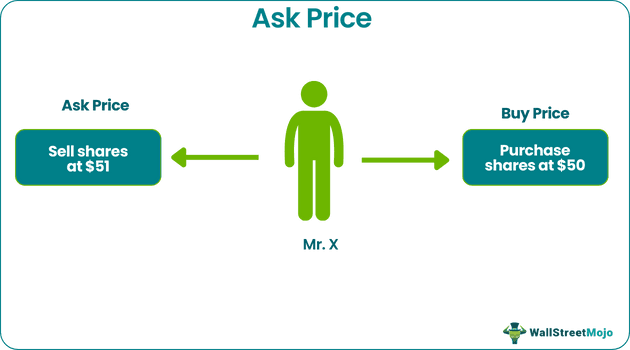

Mr. X is a retail investor who recently opened an account with the brokerage firm to buy and sell the securities of different companies listed in the financial market. He presently has some money with him using which he wants to invest in the stock of the company ABC Ltd.

Mr. X wants to purchase the 200 shares of the company ABC Ltd. when the market price of the company's shares was $50 per share. But at that time, the ask quote and the bid price of the shares of the company ABC Ltd. were $51 and $49, respectively.

Analysis

In the present case, Mr. X wants to purchase 200 shares of the company ABC Ltd. when the market price of the company's shares is $50. However, the stock's lowest price at which the prospective seller is willing to sell the security, i.e., the ask price for stock, was $51 per share.

So, if Mr. X is willing to buy the security now, he needs to pay $51 per share, which is its ask price, and not the current market price, which is $50 per share. So, the total cost of Mr. X to purchase the 200 shares of the company ABC Ltd. would come to $10,200 (200 * $51).

Example#2

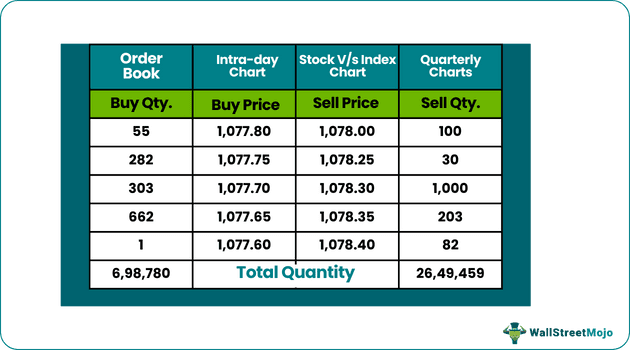

The below image quotes the bid and best ask price for a stock Reliance Industries, where the total bid quantity is 6,98,780, and the total sell quantity is 26,49,459. These are the top five bids and ask quotes.

Advantages

- One can use the ask quote in the stock market and nearly all financial markets such as bonds, derivatives for option ask price, and foreign exchange where we check the ask price in forex.

- From the seller's perspective of the security, the ask quote describes the price willingness of the seller of the security, i.e., the lowest price of the stock at which the prospective seller of the stock is willing to sell the security he holds.

Disadvantages

- The ask quote is mostly, in all cases, more significant than that of the share's current market price. So, the person buying the security has to pay an amount higher than the current market price, increasing its purchasing cost.

- Some investors, especially those new in the market, do not know about the ask price and how it differs from the current market price of the security they want to buy. If they place the market order, one will execute the investor's transaction at the ask quote. It can create confusion in the mind of the investors. This is applicable for all securities including option ask price.

Ask Price Vs Bid Price

Ask price is the lowest price the seller is ready to accept to sell a security and bid price is the highest price the buyer is willing to pay to buy a security. Some differences between them are as follows;

| Ask Price | Bid Price |

| The lowest price a seller is ready to accept. | The highest price is buyer is ready to pay. |

| Ask price is usually more than bid. | Bid price is usually less than ask. |

| It signifies the supply of securities. | It signifies the demand for the securities. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The ask price in forex refers to the rate at which a dealer sells the same currency.

Usually, the security ask price must be higher than the bid price. One can apply it to the expected behavior that an investor may not sell a security (asking price) for lower than the price they are willing to pay bidding price.

The bid price is the most significant price a buyer will ever pay to purchase a specific quantity of stock shares. Conversely, the lowest price a seller will accept for the stock is the asking price. As a result, the ask or offer price will virtually always be the same as the bid price.

The bid price means the price a buyer is ready to pay for the stock. In addition, it is majorly always lower than the asking price. The asking price is the price the seller prepares to sell the stock. Therefore, one should buy the stock at the bid price, which is only sometimes possible.