Table Of Contents

What is the Format of the Audit Report?

An Audit Report describes the financial condition and internal accounting controls by an independent auditor. The board of directors, the organization's stakeholders, shareholders, investors, etc., use this report. It is the responsibility of the Auditor to make this audit report in a standardized format every year after reviewing the organization's financial statements. The auditor must be meticulous and unbiased while preparing the report.

Investors tend to rely on the auditor's report before investing in any company. The Audit Report provides a clear picture of the company's financial health without having to analyze the reports on your own. The report gives a reliable summary of an organization’s financial health.

An auditor’s report describes the audited financial statements in the introductory paragraph. The scope paragraph gives a brief on the nature of the audit. The auditor expresses their opinion in the opinion paragraph.

If you want to learn more about Auditing, you may consider taking courses offered by Coursera -

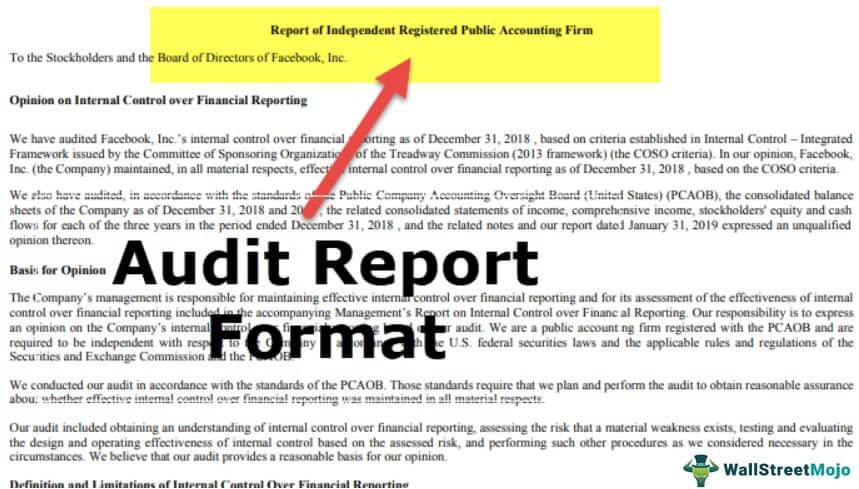

Audit Report Format

The audit report format is as follows –

- Title

- Addressee

- Introductory Paragraph

- Management’s Responsibility

- Auditor’s Responsibility

- Opinion

- Basis of the Opinion

- Other Reporting Responsibility

- Signature of the Auditor

- Place of Signature

- Date of Audit Report

Let us discuss the above format of the audit report in detail.

#1 - Title

The title should mention - ‘Independent Auditor’s Report.’

#2 - Addressee

The addressee should mention to whom the report is being presented.

#3 - Introductory Paragraph

A statement that the financial statements described in the report have been audited.

#4 - Management’s Responsibility

This section of the audit reports format should mention the Management's Responsibility for the integrity of the financial statements, which gives an overview of the company's financial condition, cash flows, and financial performance. It should mention that the financial statements are the responsibility of the organization's management. It is their responsibility to formulate and execute necessary financial controls to ensure the accuracy of the financial records. The responsibility also includes the maintenance of accounting records to prevent fraud.

#5 - Auditor’s Responsibility

The auditor's responsibility is to plan and execute the audit to procure assurance regarding the financial statements. The Auditor's responsibility is to depict an unbiased opinion on the financial statements and issue an audit report. The report is based on Standards on Auditing. The Standards require that the auditor complies with ethical requirements.

#6 - Opinion

The most critical content in an Audit Report is the Auditor’s Opinion. It mentions the impression derived after auditing the financial statements.

#7 - Basis of the Opinion

It should mention the basis of achieving the opinion as reported and the facts of the premise.

#8 - Other Reporting Responsibility

Any other responsibility relating to reporting exists. It may include Regulatory requirements. The auditor has to mention the same.

#9 - Signature of the Auditor

The auditor needs to sign the audit report, thereby confirming the report's authenticity.

#10 - Place of Signature

The name of the city in which the signing of the report happened.

#11 - Date of Audit Report

The date on which the audit report is signed/reported;

Sample Audit Report Format Example:

Below mentioned is a sample format of an Auditor’s Report :

Independent Auditor's Report

To the Members of X Company

Report on the Financial Statements

We have audited the accompanying consolidated balance sheets of X Company (the Firm) as of December 31, 20XX, and the related statements of income, comprehensive income, retained earnings, changes in stockholders' equity, and cash flows for the year then ended, and a synopsis of the accounting policies and other information. We also have audited the Firm’s internal control over financial reporting as of December 31, 20XX.

Management’s Responsibility for the Financial Statements

These financial statements are the responsibility of the Firm’s management. The Firm’s Board of Directors is responsible for the matters concerning preparing these financial statements that give a true and fair view of the firm's financial position, financial performance, and cash flows following accounting principles generally accepted in the United States of America.

Auditor’s Responsibility

Our responsibility is to express an opinion based on our audit on these financial statements. The audit has been conducted following the auditing standards generally accepted in the United States of America. The standards necessitate us to plan and perform the audit to gain assurance on the authenticity of the financial statements and ensure that it is free from any misstatements or possible frauds. The audit includes an inspection of the amounts and disclosures in the financial statements. The audit will provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present justly, the financial position of X Company as of December 31, 20XX, conforms to the accounting principles generally accepted in the United States of America. Also, in our opinion, the Firm maintained effective internal control over financial reporting as of December 31, 20XX.

Recommended Articles

This article has been a guide to the Audit Report Format. Here we discussed the basic contents of an Auditor’s report format along with the sample audit report example to understand it better. You can learn more about accounting from the following articles –