GAAP (Generally Accepted Accounting Principles)

Table Of Contents

GAAP Definition

GAAP (Generally Accepted Accounting Principles) are standardized guidelines for accounting and financial reporting. These principles should be followed when preparing a company’s financial statement.

It is mandated by the US Securities and Exchange Commission (SEC) for reporting publicly traded companies. GAAP establishes a proper classification and measurement criteria for financial reporting. These principles assist investors in comparing the financial performance of different businesses. It is a legal procedure that ensures transparency and accuracy.

- Generally Accepted Accounting Principles (GAAP) is a framework that chalks down rules, procedures, guidelines and best practices for financial accounting and reporting of business transactions.

- Generally Accepted Accounting Principles ensure consistency, transparency, objectivity, materiality, and full disclosure.

- These principles are set forth and reviewed by the Financial Accounting Standards Board (FASB).

- The Securities Exchange Board (SEC) obligates publicly traded companies to prepare and record their business operations using these principles.

GAAP Explained

GAAP, or the US GAAP, is a framework that shows the right way of accounting to the organizations. Although it isn't compulsory for every business entity, the Securities and Exchange Commission (SEC) has made it mandatory for publicly listed companies. The Generally Accepted Accounting Principles are issued by the Financial Accounting Standards Board (FASB). FASB follows the Financial Accounting Standards Board Advisory Council's (FASAC) directives for improving these principles. One hundred ten countries in the world follow International Financial Reporting Standards (IFRS). The IFRS specifies, prepares, and discloses financial statements of companies globally.

In simple words, Generally Accepted Accounting Principles are a collection of commonly used rules and procedures. These are the principles to be followed when preparing a financial statement of a company or a Firm. They set a foundation for preparing income statements, balance sheets, and cash flow statements. By doing so, they aid the taxation process. Further, these principles initiate proper classification and measurement criteria for financial reporting. Ultimately, investors get a better picture of various firms and their financial performances.

Without these principles, there would be fraudulent accounting, which could potentially hinder an organization's market credibility. In addition, in the absence of principles, companies would be free to decide what financial information to report and how to report it. An absence of protocol would make it very difficult for investors and creditors who have a stake in a firm. In simple words, these principles are all about uniformity. When followed, auditing is easy, and as a result, a firm's performance and policies are transparent.

GAAP Principles in Accounting

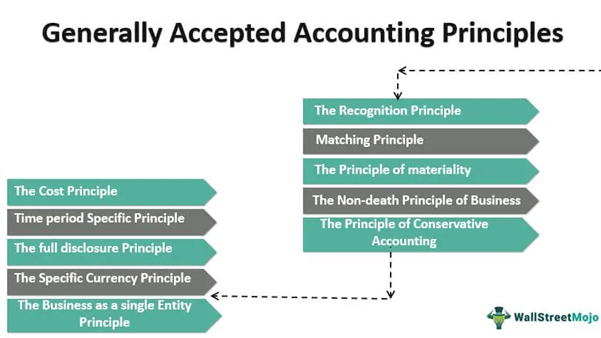

Given below are 10 GAAP principles that frame the base of this accounting standard:

#1 - Principle of Regularity: This is the foremost principle that assures that the accountant has adhered to Generally Accepted Accounting Principles norms.

#2 - Principle of Consistency: The company should adopt a single accounting standard like Generally Accepted Accounting Principles or IFRS for reporting the financial position. This prevents confusion. Also, these principles make the comparison of financial statements from different periods easier, which is why, whenever an organization switches to a different accounting standard, they are required to state the reason clearly. This is mentioned as a footnote in the financial statement.

#3 - Principle of Sincerity: After interpreting all the data, the accountant should represent the company's financial position accurately.

#4 - Principle of Permanence of Methods: The accountant should use the same accounting method every time. Standardization is crucial as these reports are often used for comparative studies.

#5 - Principle of Non-Compensation: The only purpose of financial reporting should be transparency in accounting. Irrespective of positive or negative information, transparency has to be upheld.

#6 - Principle of Prudence: Financial accounting has no space for speculation and should always be pillared upon actual data.

#7 - Principle of Continuity: It relates to concern, which presumes that the business will keep operating forever.

#8 - Principle of Periodicity: The financial statements pertain to a specific period, i.e., end time and start time. Business transactions should be recorded on time. For instance, the balance sheet is to be reported annually.

#9 - Principle of Materiality: This Principle makes the adjustment of minute errors possible. That is, while maintaining accounting reports, there could be some minor errors like a $5 not matching. This principle can be used to adjust such errors.

#10 - Principle of Utmost Good Faith: This principle is a belief that all the parties involved in the business transaction have been honest and trustworthy.

Advantages and Disadvantages

The application of Generally Accepted Accounting Principles in the accounting process mirrors the absolute financial position of the company. The standardization helps shareholders, investors, and creditors by maintaining a level of transparency. Thus, these principles help retain the trust of the investors and shareholders. The principles also help creditors decide whether to extend credit to an organization or not. Such transparency, though, can hurt struggling firms.

It brings consistency and accuracy to a firm's accounting procedure. It also facilitates the comparative study of different business entities based on their financial statements. Moreover, the internal analysis and identification of key improvement areas become easier with Generally Accepted Accounting Principles. Because, thanks to these principles, management now has a complete report of the company's losses, expenses, investment, income, and revenues.

However, there are certain GAAP disadvantages that cannot be overlooked. Preparing a financial report is not effortless. For small businesses, following all the stated principles becomes a challenging task. Moreover, as the companies go global, they need to switch from Generally Accepted Accounting Principles to International Financial Reporting Standards (IFRS) since the former is applicable only in the US.

GAAP vs. IFRS vs. Non-GAAP

In accounting, there are different standards used for financial reporting; their uses and acceptability vary depending on the country, industry, and scale of operations. Generally Accepted Accounting Principles are guidelines for the preparation and reporting of a company's transactions. In the US, the SEC requires publicly listed companies to follow these standards. But these principles are not accepted globally.

On the contrary, the International Financial Reporting Standards (IFRS) are accounting guidelines recognized worldwide. They facilitate corporate accounting for international companies. Therefore, when domestic organizations become international, they have to resort to the IFRS.

The Non-GAAP measure contrasts both GAAP and the IFRS. It is Pro-forma accounting which is not standardized. Instead, it is a method of adjusted earnings and calls for reconciliation with GAAP-based earnings. At times though, this standard does produce accurate figures for revenues. The measures used under "Non-GAAP" include EBITDA, EBIT, free cash flow, and operating income.

Frequently Asked Questions (FAQs)

Generally Accepted Accounting Principles (GAAP) are the Financial Accounting Standards Board's (FASB) prescribed guidelines for accounting and financial reporting. The primary principles of accounting are as follows:

1. Consistency

2. Objectivity

3. Prudence

4. Materiality

GAAP standardizes the process of accounting and thus helps the company in self-analysis. These principles instruct the firms to disclose their financial statements to the shareholders. The uniformity further enables investors to interpret the organization's financial health. Due to transparency, investors and stakeholders can easily compare the stats of competing firms. Ultimately these principles help investors make an informed decision.

The law doesn't abide all organizations to follow GAAP; only the companies registered under the Securities and Exchange Commission (SEC) need to record their financial statements based on these standards. Basically, the SEC obligates publicly listed companies to follow Generally Accepted Accounting Principles.

Recommended Articles

This has been a guide to GAAP (Generally Accepted Accounting Principles) and its definition. Here we discuss GAAP basics, top 10 principles in accounting, advantages, and disadvantages. You can learn more about Accounting from the following articles –