Table Of Contents

What Are Blue Sky Laws?

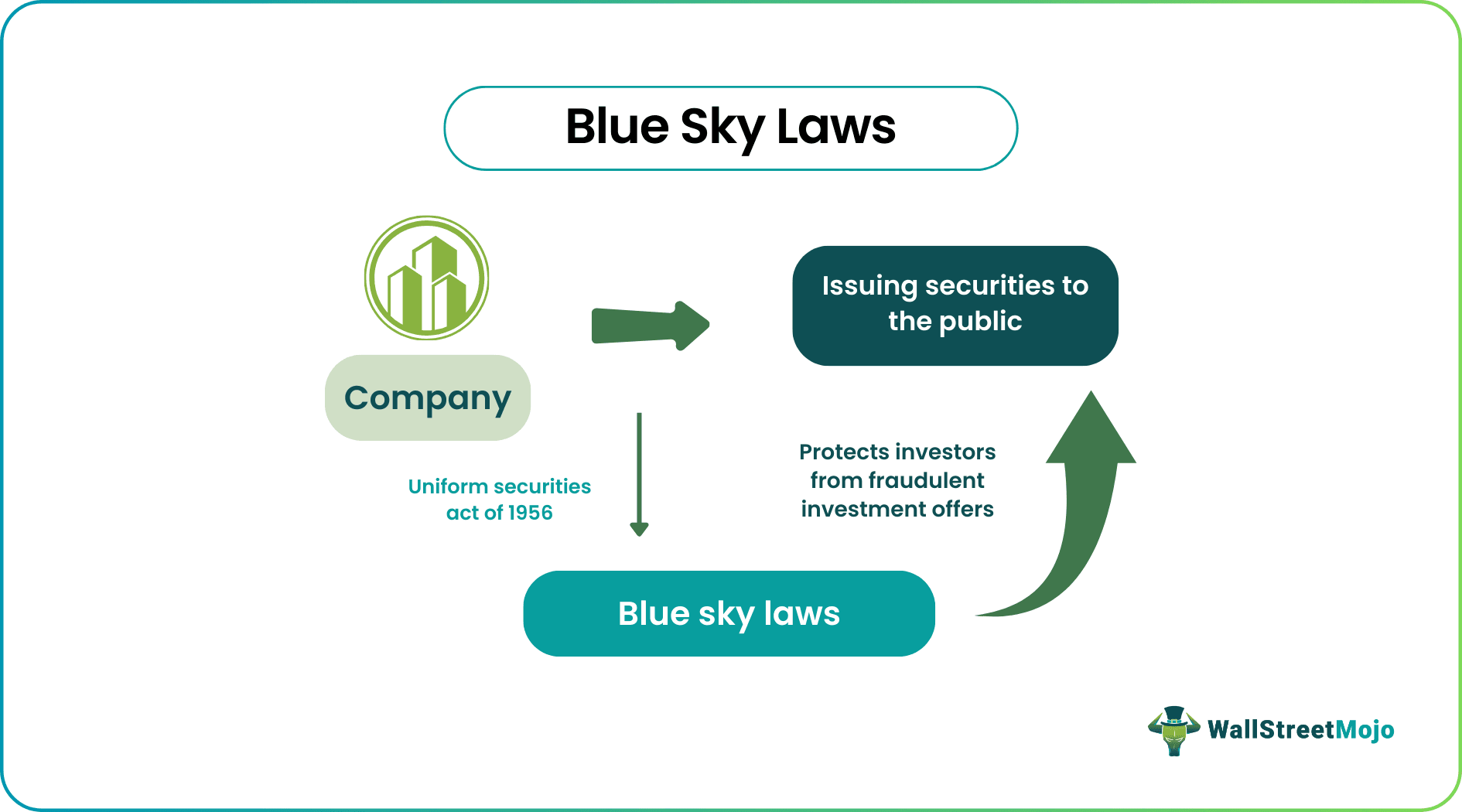

Blue sky laws aim to bring about certain regulations towards the offering and selling of securities, i.e., stocks and bonds. In addition, it implements protection for investors against fraudulent security trade. This law also tends to vary from state to state in the U.S.

Thus, they are protection for investors against stock-related fraudulent activity. Any company issuing stocks must provide all the deal’s financial details and register the offering. This provides investors with enough information to make an informed decision regarding whether to invest in the offer. It also allows legal authorities to take action in case of any complaints.

Key Takeaways

- Blue sky laws intend to bring specific regulations towards offering and selling securities, i.e., stocks and bonds. In addition, it protects investors against fraudulent security trade. In addition, it also may vary from state to state in the U.S.

- It safeguards investors from any security fraud. Overall, it also protects the investor's interest in buying and selling securities, whether stocks or bonds.

- The new issuers must register the current offering and declare the deal's financial details and the involved entities. Therefore, investors are enriched with valuable security information and make a sound judgment on whether to invest in the stock or bond.

- The blue sky laws in the United States are formed to regulate investments' fraudulent sales and activities and determine the effects of investor protection law on firm financing decisions and investment activity.

Blue Sky Laws Explained

The state blue sky laws aim to protect investors from any security fraud. Overall it protects the investor’s interest in buying and selling securities, whether stocks or bonds. It requires the new issuers to register their current offering and declare the deal’s financial details and the involved entities. Thus, investors are enriched with valuable security information in this process and can make a sound judgment on whether to invest in the stock or bond.

These laws protect investor rights and prevent fraudulent activities or practices. For example, they ensure excessive offer prices and bogus issuing do not cheat investors. They also target companies that are facing operating or financial problems.

The state blue sky laws vary but follow guidelines similar to the ones in the SEC. The law also allows the employment of security regulators for every state, who is responsible for seeing that every state follows the guidelines prescribed under the blue sky law.

The laws are adopted by 40 states induced by the Uniform Securities Act of 1956. In addition, every state in the U.S. has its own set of blue sky laws that target disclosure and merit review. This law targets companies to provide full disclosure of their sale and offers.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Who Regulates Blue Sky Laws?

The blue sky laws are regulated by the state. Some forty states' blue sky laws are currently designed under the Uniform Securities Act of 1956. Generally, the SEC (Securities Exchange Commission) regulates and enforces these laws, but each state has its security regulator to enforce them. In addition, it replicates many regulations, which the SEC does. The state security regulators also look over the investment advisors who manage securities for less than twenty-five million dollars.

Examples

Let us take the example of ABC Ltd that is into manufacturing of cosmetics. The company has expanded at lot due to which it had to take huge loans. But due to sudden rise in competition in the cosmetics industry, the sales and revenue of ABC Ltd has gone down.

The above situation is a significant threat to the company’s survival because the financial condition has become weak. However, the management decides to issue new equity shares and raise funds. For this purpose, the company hides financial data to make the financial statement look profitable and deceive investors. Here come the blue sky laws, which help identify loopholes and the possibility of fraud so that investor money is saved.

Roles

Let us try to understand the roles of the laws.

- It regulates the offer and sale of securities in the jurisdiction of every state, which has its pre-described law and regulation.

- It enforces new securities going live in the market to provide complete disclosure information about the safety and the company information to provide a high level of transparency among investors planning to invest.

- The state government implemented the blue sky to safeguard their citizens when the federal government was not responsible.

- Nowadays, even the federal government has pitched in. They target to protect investors from fraudulent sales and activities of security trading. The blue sky laws mutual funds help in investor protection in case of mutual funds.

- These are also involved in issuing brokerage firms, brokers, and investment advisors licenses. But, again, the laws vary from state to state, and the rules are implemented keeping in mind the state’s blue sky laws exemptions.

Implications

The blue sky laws in the United States were designed to control the fraudulent sale and activities of investments and estimate the rolling effects of investor protection law on firm financing decisions and investment activity. Same is the case with blue sky laws mutual funds.

In addition, it regulates firms to opt for dividend increment, equity issuance, and size growth. Finally, the law even supports operating performance and valuation of the market.

It has some major implications on corporate laws and policy design. Every state has laws that implicate most rules and regulations guided by SEC guidelines. Every state also has a state security regulator whose prime function is to ensure they are following the guidelines thoroughly after considering the blue sky laws exemptions.

Reasons

- The blue sky laws are regulated by the state, where many states have adopted the federal security law pattern and depend on the SEC to enforce them. Still, even if the rules may be similar to the SEC pattern, their interpretation differs from state to state, where this pattern is called blue sky.

- To protect investors based in various states in the U.S. from getting cheated or involved in fraudulent activities in the securities trade.

- To monitor the investment advice provided by investment advisors.

- They also issue licenses to brokerage firms and investment advisors.

- To see that the laws and regulations imposed are well under the guidelines of the SEC.

- These also aim at solving many problems related to the company's operating performance and financial strategies.

- To protect investors from unjustifiable and overestimated offerings made by companies so they do not get cheated.

- It sets up a liability for security issuers, allowing authorities to take action against them if they fail to comply with the laws' provisions.

Importance

- Every state in the U.S. has blue sky laws that target disclosure and merit review. This law targets companies to provide full disclosure of their sale and offers.

- Failure to pass an assessment of merit, the company cannot issue its security in the market, as stated by the law.

- Forty states adopt the laws from the Uniform Securities Act of 1956.

- They target to solve problems like capital deficiency, negative worthiness, lack of income, excessive outstanding options and warrants, unjustifiable offerings, cheap stock, loans to company officials, a discrepancy in voting rights, etc.

- It also regulates the investment advisors who provide advice and security information to other investors.

- Many states have adopted the federal security law pattern and depend on the SEC to enforce them. Still, even if the rules may be similar to the SEC pattern, their interpretation differs from state to state, where this pattern is called blue sky.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The blue sky laws began in the early 1900s, encouraging widespread use when a Kansas Supreme Court justice declared a desire to safeguard investors from speculative ventures that possess no more basis than so many feet of 'blue sky.'

Every state in the U.S. implements blue sky laws that aim for disclosure and merit review. Moreover, it targets companies to disclose their sales and offers fully.

The Corp. Code §§ 25110, 25120, and 25130) restricts security offers or sales in California without qualification until either or both of the following apply: the offered security is a covered security (Section 18(b) of the Securities Act of 1933, as amended (Securities Act) (15 U.S.C.A).

Few securities listed on stock exchanges, like NASDAQ or NYSE, are exempt from state blue sky laws. In addition, securities exempt by Rule 506 are also exempt.