Table Of Contents

Investment Advisers Act Of 1940 Definition

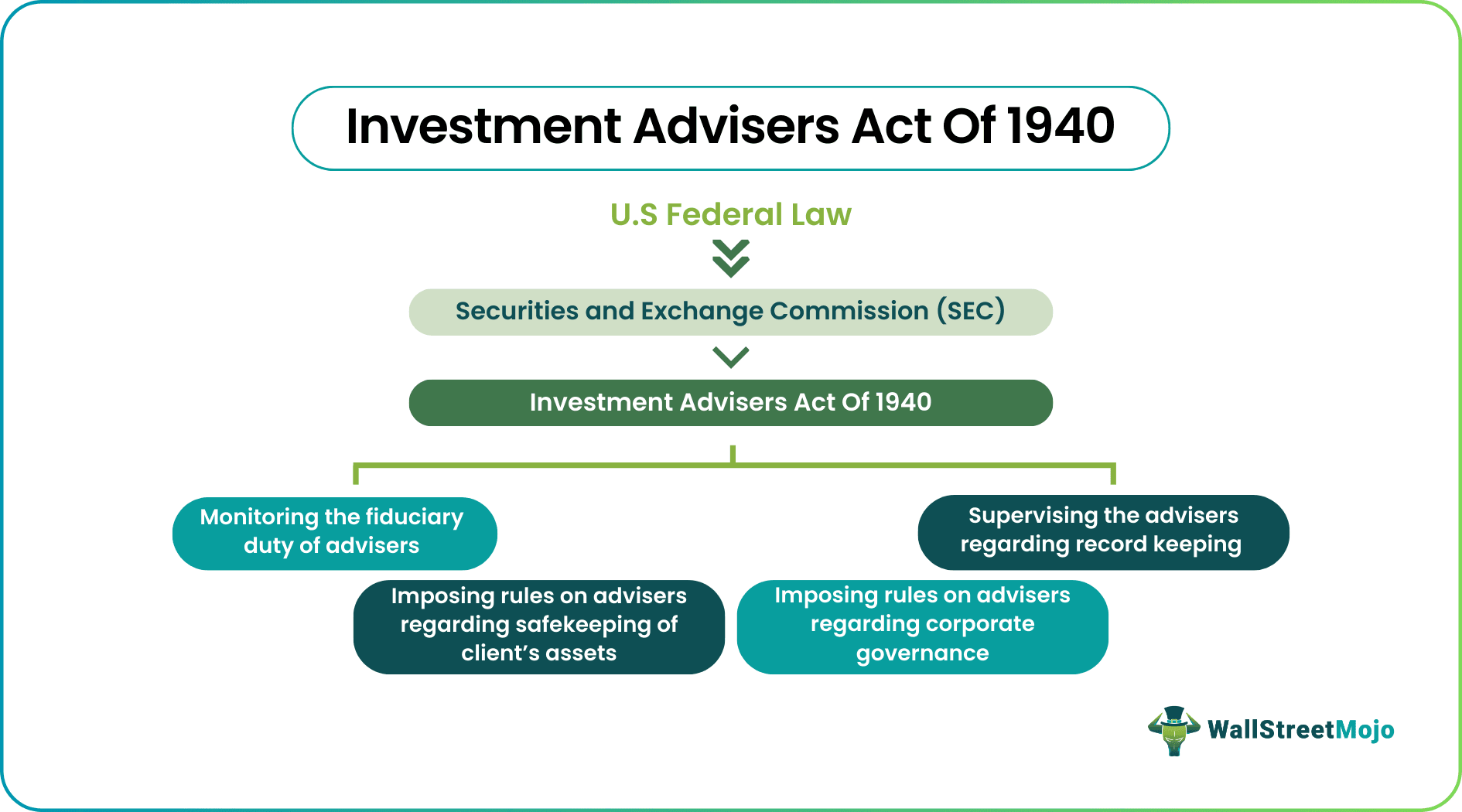

The Investment Advisers Act of 1940 defines the responsibilities and duties of investment advisers. It falls under U.S Federal Law, which states who is eligible to register with the Securities and Exchange Commission (SEC) to become an adviser under the supervision and control of the Act to protect investors.

This law was initiated by a report submitted by SEC in 1935 and states that any firm or person whose profession is to provide investment advice should register with the SEC. The law oversees the work of advisers to act in the best interest of their clients, who might be individuals, pension funds, or institutions requiring investment advice.

Table of contents

- What Is the Investment advisers act of 1940?

- The Investment Advisers Act of 1940 defines who is eligible to become an investment adviser and states the responsibilities of the person or firm engaged in investment advisory services.

- The Act is a part of U.S. Federal Law.

- According to the Act, any investment adviser should be registered under the SEC so that it is possible to supervise and regulate their activities.

- The advisers should always act in the best interest of their clients, who might be individuals, pension funds, or corporates requiring expert investment advice.

Investment Advisers Act Of 1940 Explained

The Investment Advisers Act of 1940 states that all persons or firms under the profession of investment advisory service should register with the SEC to become eligible for the role and look after the client’s interest with utmost honesty and integrity.

Every investment adviser under the Act is monitored to keep track of their operation. There are certain exemptions to the Act. However, all advisers must follow transparent and fair practices to do the work. There should be proper documentation and disclosure of information to the clients whenever and wherever required. The conduct and behavior must comply with the rules and are inspected by the SEC from time to time.

The SEC can implement any rule that helps maintain the Investment Advisers Act of 1940 code of ethics and keep a check on fraud or dishonest conduct by advisers so that investors stay protected.

To become an investment adviser under the Act, a firm or individual should provide service or advice related to investments like purchasing or selling assets in the financial market that is considered risky and earn income from that field. For example, the assets might be bonds, stocks, notes, mutual funds, deposits, etc.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Rules

There are specific rules that advisers should follow:

- First, any work of the investment advisers related to security analysis, reports, publications, advice, writing, or releases is appropriately distributed among clients.

- Any contracts and agreement terms between them and their clients must be negotiated relatively and transparently and exchanged through the mail so that the Act of 1940 code of ethics is followed.

- All the work done by the investment advisers should be primarily related to purchasing or selling securities traded in the stock exchanges in different states over the counter.

- Apart from stock exchanges, assets and securities can also be offered by various financial institutions or banks and their subsidiaries under the Federal Reserve System and related to interstate commerce.

- The transaction should take place in large volumes affecting interstate commerce, the exchanges where various financial securities are transacted, and the banking system and economy of the country.

- If the adviser has custody of the client's assets, it is necessary to follow the investment advisers act of 1940 custody rule. In addition, a qualified custodian must maintain the fund.

- It is also essential to meet the requirements related to the safekeeping of the assets. For example, suppose the adviser has the power to withdraw fees from the client’s account; as per the Act of 1940 custody rule, getting the custodian's verification is unnecessary.

Fiduciary Duty

Let us understand the fiduciary duties of investment advisers:

#1 Correct attitude towards clients

The advisers’ fiduciary duty refers to having a sense of loyalty, obedience, care, and accountability towards their clients. They should work to meet the financial interest and goals of their clients.

#2 Client’s interest first

According to the investment advisers act of 1940 conflicts of interest is dangerous. Therefore, advisers should always put the investor's interest above their own and function to give the best advice to the investors.

#3 Clarity of information

The information regarding investments should be correct and complete in all respects, which results from striving to maintain accuracy using good knowledge and analysis. There should be no discrepancy or unnecessary information that might mislead clients, leading to miscommunication.

#4 High efficiency and low cost

Whenever trading in stocks or securities is done, the advisers should try to perform the jobs most efficiently at the lowest cost.

#5 Disclosure of information

Following the Act of 1940 conflicts of interest criteria are essential. In case of conflict, a proper disclosure is compulsory to avoid misunderstanding and maintain a good relationship with the clients. Moreover, the disclosure will increase the client's faith in the adviser.

Record Keeping Requirements

An investment adviser registered under the SEC must maintain the following records related to their fiduciary duty.

- Any journals that give details of the entries of the ledgers must be maintained in an organized manner.

- The general ledger should give the details of income, expense, reserve, capital, liabilities, and assets.

- Organizing any communication details regarding any order the adviser places on the client’s behalf is essential.

- There should be records from the bank, including bank statements, cash settlements, checkbooks, details of canceled checks, etc.

- Records should include bills, bank statements, and documents detailing the adviser's work.

- Every detail of the financial statements and audit-related working papers must be available as required.

- All communication with the clients in written form must be readily accessible whenever required.

- There should be a list of all the client accounts under the discretionary power of the adviser (power of attorney).

- A written list of all the agreements with the clients must be there.

- The adviser must maintain all copies of advertisement-related materials properly.

- The adviser must maintain any report related to a personal transaction.

- Statement related to disclosures to obey the "Brochure Rule."

- All acknowledgments from clients and lawyers' disclosures should be in place.

- Details of all the documents or books of accounts supporting claims made on previous performance must be available.

- Purchase or sale-related records and current access details of the client's securities are required.

- Documents related to the corporate structure and governance are also important.

Advisers need to maintain some particular records in case they have custody of the assets of any client. They are:

- Journalized details of any security-related transactions.

- Ledger of each client.

- All copies related to any trade transaction.

- A detailed record of all the securities in the client’s holding showing the location and value.

If an investment adviser has the right to proxy-vote on the client’s behalf, then they need to maintain a separate set of records as follows:

- Copy of the policies related to proxy voting.

- Copy of any proxy statement that the adviser has received regarding the security.

- If the adviser casts any vote on the client’s behalf, keeping a record of the same is essential.

- Documents of decisions taken regarding the procedure of casting votes.

- If the adviser has proxy-voted on the client's behalf, it is necessary to maintain all related correspondences.

Apart from the above, the adviser should maintain all documents related to the corporate governance of the advisory firm or business. They include stock certificates, articles of association, books of minutes, details regarding rules and code of conduct, etc. It is vital to keep them in the office, in an easily accessible place till the business terminates and up to three years after termination. Keeping any other record for up to five years is a must and may be moved to other places. Even then, they should be easily accessible.

Email scrutiny has now become an essential part of the inspections for SEC-registered advisers. However, the general record-keeping rules do not state any provision regarding emails. Thus, it is crucial to maintain all email correspondence in a proper and organized manner.

Exemptions

Any individual or firm in the investment advisory business should qualify for registration under SEC or fall under the exemption category. The exemptions are divided into two groups as follows:

#1 Exemptions related to advisers of private funds

An adviser does not have to register with the SEC if it only advises private funds in the United States whose total asset under management is below $150 million. This kind of fund that satisfies Section 3(c) (1) or Section 3(c) (7) is a pooled investment that has less than 100 investors and does not intend to make any public offering. In addition, the SEC has proposed certain new obligations and requirements that private fund advisers should follow. However, no final decision has yet been taken.

#2 Exemptions related to advisers of venture capital

An adviser does not have to register with the SEC if it only advises venture capital funds. This fund should also satisfy Section 3(c)(1) or Section 3(c)(7) and flows the strategies of investment as venture capital. A minimum of 80% of the fund should be invested in the equity of private companies. No more than 15% of its capital should be borrowed or used as a guarantee. If the fund borrows money, it should be less than or equal to 120 days. The investors cannot redeem or withdraw the interest from their investment in the fund.

#3 Exemptions of registration

If the adviser manages assets less than $25 million, it must register with the state’s regulator of securities, where the adviser’s office is located. It is exempted from registering with the SEC.

Thus, any adviser exempted from registering with the SEC will not have to follow the specific rules and regulations imposed on the investment advisers who are registered with the SEC, like rules related to record keeping, advertisement, rules, or procedures. However, it has to abide by the legal and fiduciary duties, which the SEC will inspect from time to time.

Updated Marketing Rule Under The Investment Advisers Act 1940

There are some changes in the rule related to investment advisers' marketing in place of the Advertising Rule and the Cash Solicitation Rule. This new law states the provision and the required steps for compliance.

Advertisements will no longer refer to only written communication. Instead, it will also include social media or any other electronic form, which may be direct or, sometimes, indirect. However, according to the new rule, the advertisement will include only those types of correspondence that give new or updated advice regarding investments. Any communication or report which is not investment-related advice will not fall under the advertisement category.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The Securities and Exchange Commission (SEC) of the United States administers the law. This law is the primary source of rules and regulations for investment advisers so that the investor interest is protected by making them aware of the risks.

Over the years, the investment advisers act of 1940 has helped keep a close watch on all who manage and advise investors on individual funds, pension funds, or corporate investments. The law has controlled and regulated the advisers’ activities so that they act in the best interest of the clients or investors. They must keep the client's interest above their own.

All kinds of investment organizations or individuals who offer investment-related recommendations or analysis of securities are subject to the investment advisers act of 1940. However, they should be mainly in investment, reinvestment, and security trading in the stock market.

Recommended Articles

This article has been a guide to what is Investment Advisers Act Of 1940 & its definition. Here, we explain its rules, fiduciary duty, record keeping requirements and exemptions. You may also find some useful articles here -