Table Of Contents

Clayton Antitrust Act Definition

The Clayton Antitrust Act is an antitrust law in the United States codified in 1914. It prevented trade practices that were unfair and harmful to the competitiveness of markets in their infancy. Henry De Lamar Clayton was behind drafting this act, and it came into being under the presidency of Woodrow.

Under sections 4 and 16, the act permits oppressed parties to impose treble damage in cases of violations of either the Sherman Act or the Clayton Act. The clayton antitrust act purpose is that the oppressed party can sue the violating party for three times the damages suffered, including costs incurred in seeking attorney aid, court fees, etc.

Key Takeaways

- The Clayton Antitrust Act is a landmark antitrust law enacted in 1914 in the United States. Its purpose is to prevent unfair trade practices that can harm market competitiveness.

- The Act was drafted by Henry De Lamar Clayton and passed during Woodrow Wilson's presidency.

- The Clayton Antitrust Act filled gaps and addressed deficiencies in previous legislation to protect competition. It established specific prohibitions, enforcement mechanisms, and remedies to strengthen the requirements of the Sherman Antitrust Act.

- Prominent examples of cases brought under the Clayton Antitrust Act include Kodak and Heinz Inc.

Clayton Antitrust Act Explained

The Clayton Antitrust Act further removed unclarified and missing provisions to safeguard the spirit of competitiveness. In addition, it listed some prohibitions, enforcement, and remedial measures in this regard and aimed at strengthening the requirements of the Sherman Antitrust Act.

Due to the growing number of companies of all sizes, the United States law bodies sought to address the unfair and anti-competitive practices that could victimize the smaller companies at the hands of the larger organizations. As a result, the U.S. Congress passed the Sherman law in the late nineteenth century.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

History

Before the Clayton Antitrust Act of 1914, the formation of cartels was prevalent. The regard for anti-competitive practices was negligible. It sparked the labor commissions and unions to compel the U.S. to make strong amendments to the existing Sherman act. The Clayton act made procedural and substantive amendments to U.S. federal antitrust law. It took cognizance of malpractices in competing markets in its inception.

The Clayton Act has been the basis for some of the most popular historical lawsuits involving large corporations. In addition, being more detailed and fool-proof than its predecessor Sherman Act, it has served a great deal to the cause of fair competition and trade practices.

They amended the Clayton Antitrust Act in 1976. The improvements came through the Hart-Scott-Rodino Act, which required firms to notify the governments of any mergers and acquisitions beforehand.

Sections

The act has several provisions described in several sections of the text. However, this article should sufficiently introduce three of the most important and widely used clayton antitrust act purposes.

- The act prohibits companies from restricting the formation of labor unions. Thus, labor unions can protest against employers regarding wages, exploitation, etc. Hence, labor parties exempt strikes, boycotts, bargaining, etc.

- The act prohibits companies from merging with other companies in any way that lessens competition and/or creates a monopoly in the market. It is inscribed in section 7 of the act and described in section 8.

- The Clayton Antitrust Act also sets restrictions for the pricing of products. In some situations, the price floor is exploited by larger manufacturers, thereby eating away at the margins and revenues of smaller firms. These practices regulate by setting minimum price levels for certain products.

Moreover, it is important to note that the above sections modified the then-existing U.S. Federal antitrust laws.

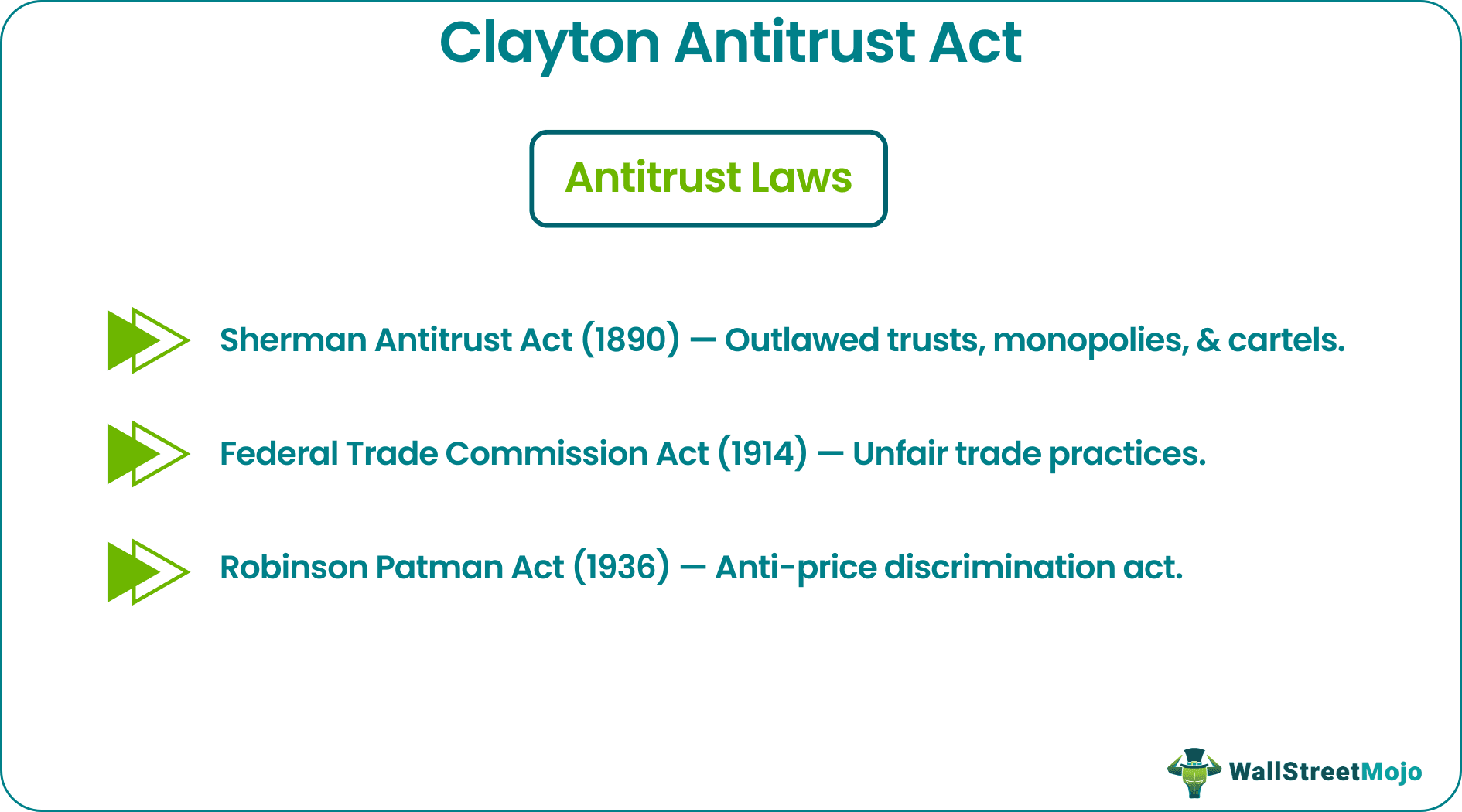

Several other antitrust laws are worth mentioning: -

- Sherman Antitrust Act (1890) – Outlawed trusts, monopolies, and cartels.

- Federal Trade Commission Act (1914) – Unfair trade practices.

- Robinson Patman Act (1936) – Anti-price discrimination act.

Examples

Let us understand the concept better with the help of a couple of examples from the real world of business. These examples will help us understand the clayton antitrust act purpose in a deeper sense.

One can use a simple example to understand price discrimination. Suppose a firm fixes the selling price of an air cooler at $150. A lawyer files a lawsuit in the interest of people who bought five air coolers. The litigation is the evidence finding that the air cooler price should have been $125. The matter takes to the court as a civil suit, and the judges agree with the public lawyer upon factual testimonies.

The court shall now order to pay for the damages suffered by the people who bought five air coolers. The destruction would be three times the overcharge paid or ‘treble damage’ laid down in the Clayton Act. Hence, each consumer is liable to get ($150 – $125) three times the amount, or $75 in reparation.

U.S. antitrust lawsuits have come a long way, and two of the well-known examples are as follows: -

Example #1 - Kodak

Kodak has a long history of antitrust lawsuits. Kodak dominated the camera and film market for a very long time. As a result, it had to deal with lawsuits over competition and trade practices, several of which it won. However, some of the cases led to improvements in the federal antitrust law regime in the United States.

Example #2 - Heinz Inc

Another example is the intended merger of Heinz Inc. with Gerber and Beech-Nut. Heinz Inc. is the leader in the food industry and combined with the other two companies. The post-merger entity would have become a significant player in baby food, leading to monopolistic market prices. The U.S. antitrust body, Federal Trade Commission, challenged the proposed merger in 2001. Following a lawsuit, Heinz dropped the union, thus safeguarding competition in the industry.

Advantages

Through the discussion below, let us understand the advantages and disadvantages of having such an elaborate act in place for an important purpose.

- The act brought all the participating firms to a similar level of competitiveness. Moreover, it largely eliminated the practice of predatory pricing and shielded every firm on this account.

- The act regulates the conduct of mergers and acquisitions so that a person cannot serve on the boards of two competing companies. In precision, they cannot be in a position to make decisions on two boards.

Disadvantages

- Stricter antitrust laws in the U.S. make it difficult for U.S. companies to compete with companies from other geographies.

- Antitrust laws can be difficult to interpret as they contain extensive provisions. For example, one can interrupt ‘unfair’ trade practices differently in different contexts and circumstances.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The Clayton Antitrust Act targeted various industries and business practices that could result in anticompetitive behavior. It specifically addressed price discrimination, exclusive dealing contracts, tying arrangements, and mergers and acquisitions that may lead to reduced competition.

The Federal Trade Commission (FTC) plays a significant role in enforcing the Clayton Antitrust Act. The FTC is responsible for investigating and prosecuting violations of antitrust laws, including those outlined in the Clayton Act. In addition, it has the authority to take legal action against companies engaged in anticompetitive practices, seek injunctions, and impose penalties to ensure compliance with the law.

The effectiveness of the Clayton Antitrust Act in preventing monopolistic practices has been a subject of ongoing debate. While the act has provided a legal framework to address anticompetitive behavior and has helped promote competition in certain cases, monopolistic practices can still exist in some industries.