Table Of Contents

What is Uptick Rule?

The uptick rule is a trading rule enforced by the U.S. Securities and Exchange Commission (SEC) to restrict the short selling of stocks whose prices are falling. The rule allows a stock to be sold short only when there is an uptick, i.e., its current price is above its last trading price. It strives to maintain market stability and protect investor confidence by controlling downward spirals of stocks resulting from bear raid action.

First adopted in 1938, the uptick rule, also referred to as the plus-tick rule, was repealed in 2007. However, SEC reintroduced it in 2010 after the 2008 economic crisis to prevent manipulation of stock prices by traders. The rule has proved to be an effective tool in limiting short sales on a large scale in stock exchanges and saving the markets from negative impacts.

Table of contents

- What is Uptick Rule?

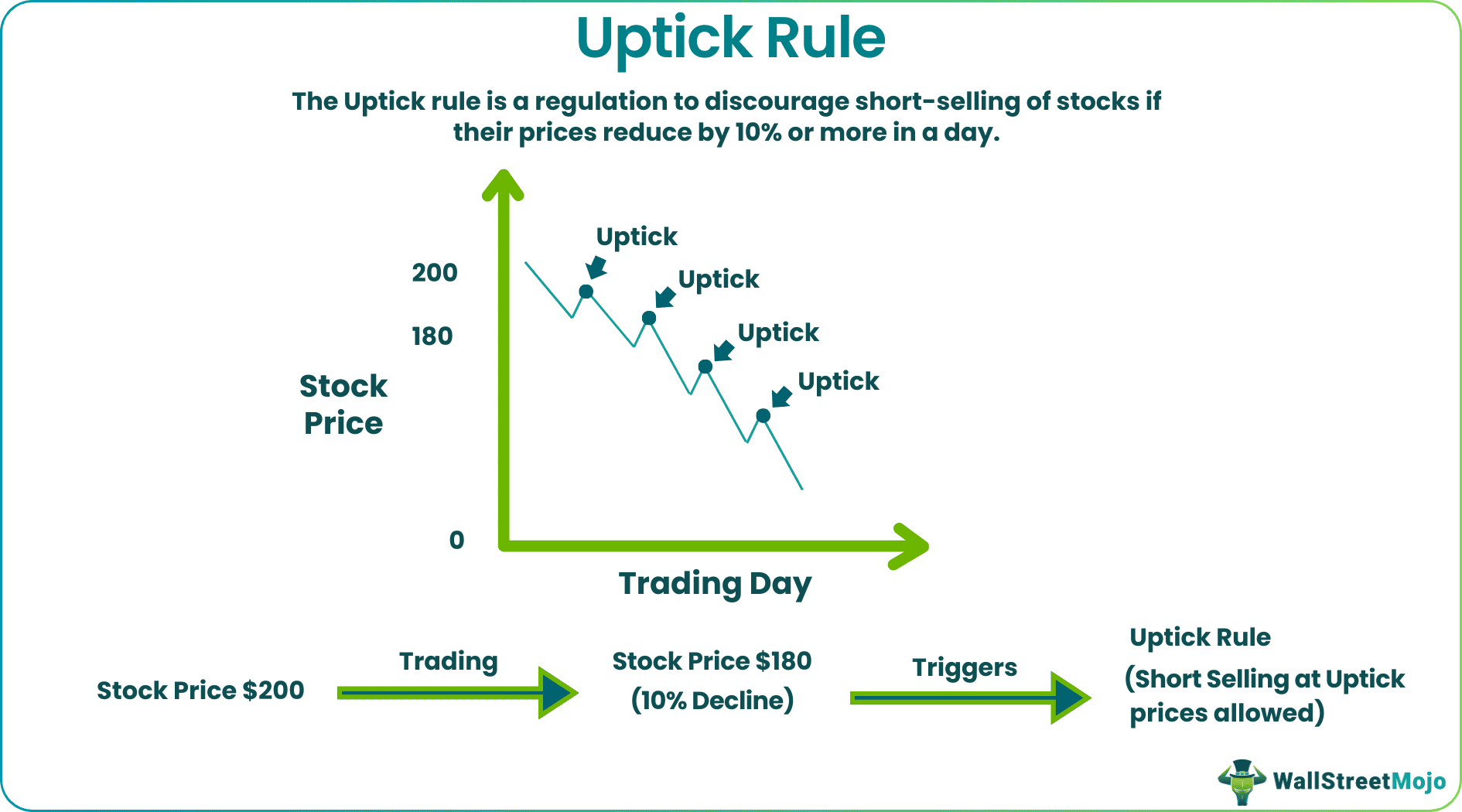

- The uptick rule is a regulation to discourage short selling of stocks if their prices reduce by 10% or more in a day.

- As per the rule, such stocks should be traded at a price higher than their last trading price.

- The US SEC reintroduced the Rule 201 as an alternative uptick rule in 2010 after repealing it in 2007.

- The rule prevents the artificial decline of stock prices induced by the traders' deliberate short selling of the stocks.

- It plays an important role in maintaining market stability and improving investor confidence.

Uptick Rule Explained

The uptick rule primarily deals with prohibiting the short sale of stocks at a lower price than their last trading price. As per Rule 201, the prices of the stocks must be down by 10% or more from the previous day's closing price for the curbs to be applicable.

Short sales occur when the stockholders foresee that price of a particular stock is about to fall and start to borrow and trade it for profits. Although short selling is effective in maintaining pricing efficiency and liquidity in the markets, when done on a large scale can pull the prices of the already falling stock further down, leading to a steep decline.

Traders try to intentionally reduce the price of certain stocks by deploying short sales so that they can earn huge profits. Hence to discourage such malpractices, the US SEC enforced Rule 201 in 2010. The rule made it mandatory to sell a stock at a higher price than its last trading price if its price declined 10% or more in a day. It applies to the short selling of every stock under the impression of an impending price decline from the investors' point of view.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Features of Alternative Uptick Rule or Rule 201

Rule 201 has the following characteristics:

- Circuit breaker: The circuit breaker gets activated for a stock if its price declines by 10% or more in a trading day.

- Duration of restriction: The rule for such stock is applicable for two consecutive days—circuit breaking day and the next day.

- Security covered: The rule covers all the equity stocks listed on a national stock exchange.

- Implementation: All trading centers must have written guidelines to implement the rule.

How Does the Uptick Rule Work?

The uptick rule revolves mainly around the short selling of stocks. Short selling is related to the sale of a security by an investor who is not the owner of the security or who has borrowed the security for trading. While shorting a certain stock, the trader expects to buy the same stock in the future at a lower price to make a good profit.

Let's understand it with an example. Suppose X expects the price of ABC Inc. stock trading at $2 to fall. So, X borrows ABC stock from his friend Y and sells it in the market at $2. Now, when the stock price drops to $1, he buys back the stock at $1 from Z. Thus, he makes a profit of $1 ($2-$1) and returns the borrowed stock to Y. This is short selling.

If many traders engage in short selling at the same time by taking advantage of a stock's weakness, it may trigger panic sales and affect the markets adversely. It may even lead to a stock market crash. Such a market manipulation of Citigroup’s stock prices triggered the financial crisis in November 2007.

Thus, to prevent such practices, contain the negative impacts of short selling, and preserve confidence in the stock markets, SEC introduced Rule 201. As per the rule, the stock exchange initiates a circuit breaker as soon as a stock’s price declines by 10% or more on a single trading day. After that, short selling is permissible only if the security price is over the prevalent U.S. best bid or above the closing price of the last trading day.

Let us understand this rule using a small illustration. Suppose the XYZ Inc. stocks had a price of $500 on the previous trading day. And today, its stock price is trending at $450, which is a 10% decline. As per the uptick rule, the circuit breaker immediately activates and prevents the short sale of XYZ stocks below $450.

Uptick Rule Video Explanation

Benefits and Drawbacks of Uptick Rule

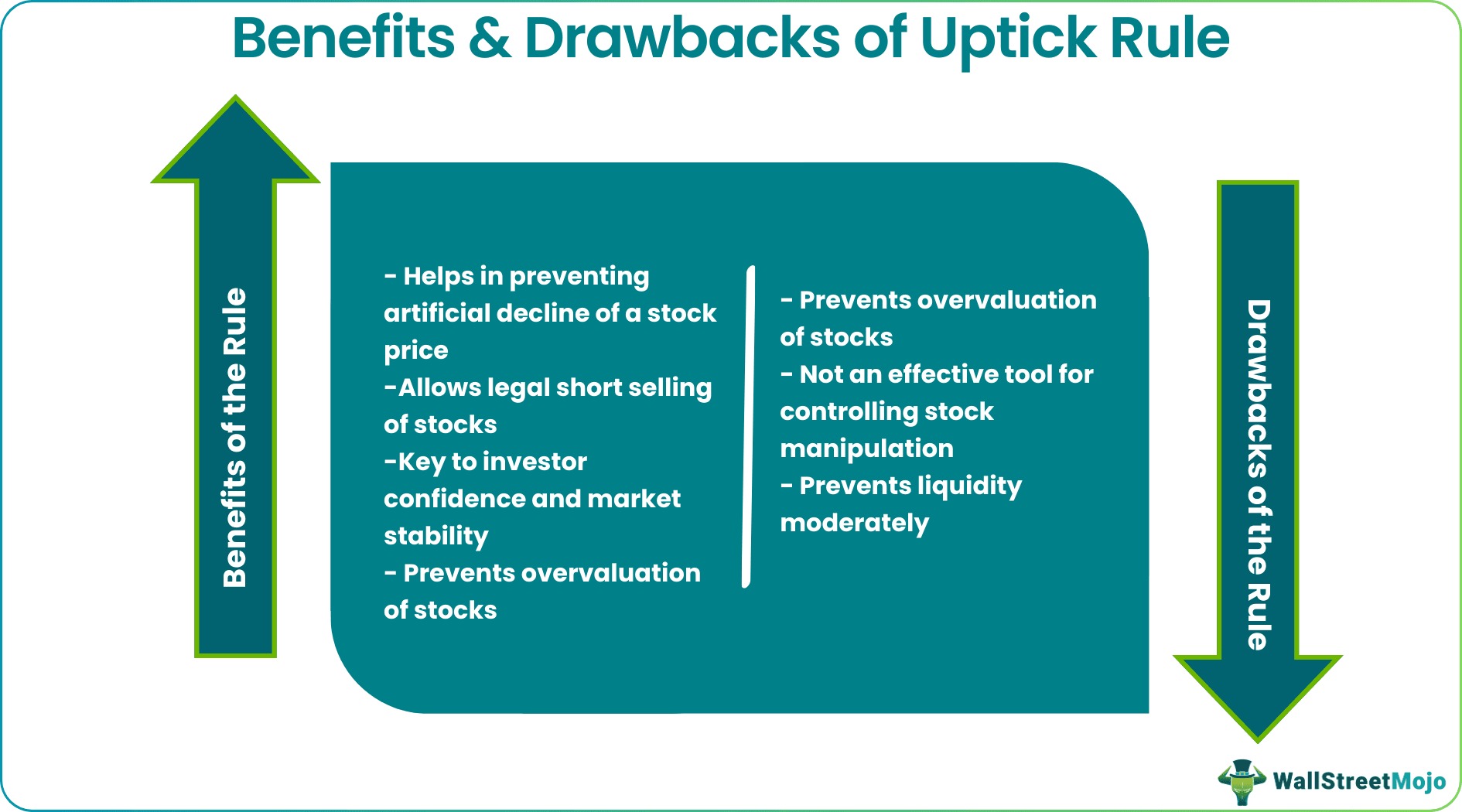

The below figure provides the pros and cons of using the rule.

Examples

Let us look at the following examples to understand the concept of the uptick rule better:

Example #1

On New York Stock Exchange (NYSE), the price of ABC Inc. stock was $1000 on the previous trading day. However, it stands at $900 at the start of the current trading day. As evident, there is a 10% decline in the stock price.

Though ABC stock price is facing downward pressure, it may move up at times during the trading day. So, as per the uptick rule, the short selling of ABC stock must be allowed only when its price picks up above $900.

Thus, traders can engage in short selling whenever the stock rises above its last trading price. They can short the stock legally even if it is a penny higher than the current market price.

Example #2

Suppose the stock of DEF corp. is overvalued at, say, $10. And investors expect it to decline to $8. So, they start shorting the stock from the brokerage firm at a certain fee.

But if the price of the stock decline to $9 in a day, which is a 10% decrease, then the investor will be able to sell the stock only at a price above $9, which is the plus-tick rule.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The uptick rule is important for legitimate short selling of stocks displaying a downward price trend. It also prevents traders from aggravating the downfall of the stocks already witnessing a decline. Thus, it seeks to sustain market stability and uphold investor confidence.

The rule applies only when a stock’s price plunges by 10% or more from the previous day's closing price. It permits short selling of such stocks at a price higher than their last trading price.

The SEC removed the plus-tick rule as it was presumed to be ineffective in controlling the stock markets in July 2007. However, after the economic crisis of 2008, the lawmakers and the regulators felt the need for the reintroduction of the uptick rule to manage the short selling of stocks and restore confidence among investors and the market alike.

Recommended Articles

This has been a Guide to What is Uptick Rule. Here we explain the uptick rule for short selling & how it works with features, benefits, drawbacks, & examples. You may also have a look at the following articles to learn more –