Table Of Contents

What Is A Buy Limit Order?

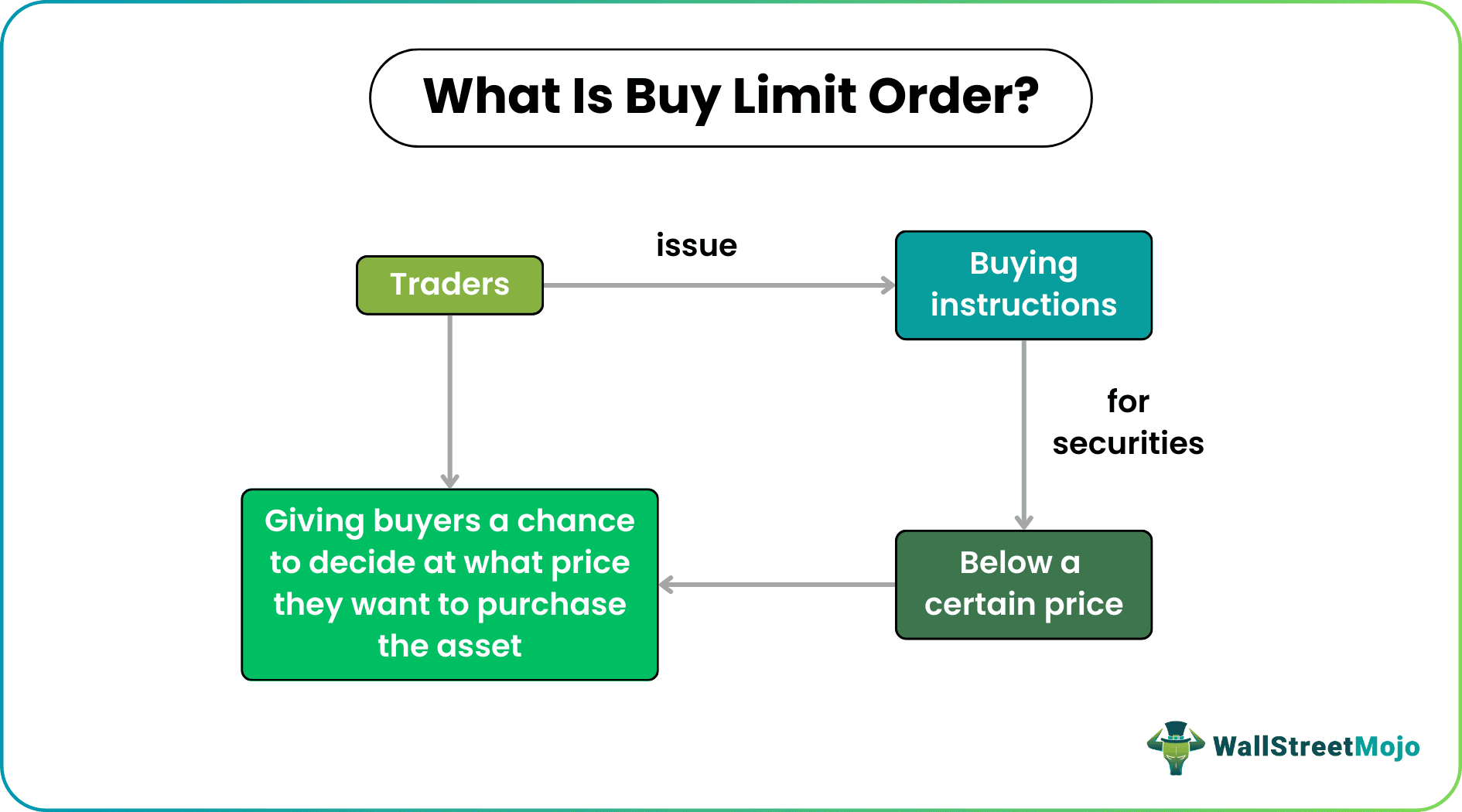

A buy limit order is a trading system wherein the trader provides instructions to buy security only below a certain price, deciding how much exact investment they want to make in that security. It helps buyers decide the price at which they want to make a buying transaction.

A buy limit order, however, can be placed, but it might not be filled, and the transaction might never actually be executed if the set limit does not work for traders. This method is the best for investors who think asset prices might go up. Buying this order lets them purchase assets when they are within a limited price range.

Key Takeaways

- Buy limit order is a parameter instructed by the investor that determines the highest price at which a share/security is to be purchased.

- It determines the highest amount an investor is willing to invest and signifies the risk appetite.

- While buying a share/security, an investor may set a buy limit order, wherein he/she determines the highest price at which investors will buy the security. So when the fluctuating price of the security comes within this limit, the order executes.

- It can be a good way for investors to control their risk appetite, though it can cause a few missed opportunities.

How Does A Buy Limit Order Work?

A buy limit order, as the name suggests, is the trading measure that allows investors to take trades per their suitability. It gives them an opportunity to enter a trade on their own terms. They limit the buying price as soon as they sense the rise in the share prices that they want to buy.

In the event of a price rise, they buy the assets at a specific price or below that as decided. This, in turn, helps them own the assets within their convenient limit. However, if the buy limit order moves above the market price, it leads to the non-execution of the deal.

Buy limit order is an important feature for investors and traders who want a specific price to enter a trade. Though it does not guarantee the execution, it creates comfort in the buyer’s mind for the price if they wish to enter into buying of security. Investors or traders use various analyses, such as fundamental and technical analyses, to decide the right price to place a limited order and capture opportunities. The risk in the process minimizes with a sell stop order to avoid huge losses in case of a change in price trend and manage risk in a highly volatile market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example

Let us consider a buy limit order example where an investor/trader wants to buy 100 shares of Microsoft Corp. The current market price is $152 per share. However, the investor doesn’t want to invest more than $15000 in Microsoft Corp. Hence, the person places a buy limit order specifying the limit price at $150 per share for 100 shares. In such a scenario, there can be three instances:

- The market price of Microsoft Corp falls to $150 (at least $149.99) per share, and trade for 100 shares occurs. The buyer gets the investment at the desired price and saves $200 in investments.

- The market price of Microsoft Corp. does not change much in a direction that remains stagnant. Hence, the buyer order remains pending and unexecuted after a certain time as per the system.

- The market price of Microsoft Corp. goes up to $164 in a few days, and eventually, the buyer misses the opportunity to invest in this security because if the price rise by almost 8%. If the investor wants to buy these shares, the person has to invest much more than what was available before.

Although for long-term investors, these things might not matter, it matters for short-term investors and traders. The buyer limit order is a useful tool that allows them to enter a trade at their desired price.

Advantages

Knowing the advantages helps understand the buy limit order meaning better. Let us have a look at them:

- It makes sure buyers make a transaction at the price they want.

- For traders and investors, it gives the precise price as per their analysis of trade.

- If investors set the buying limit and the trade does not occur on a given day with the market price of stock moving below the limit order price the next day, the buyer will get these shares at a price below the desired price.

- Large institutional investors get the benefit of averaging the investment price. Since they prefer to place an order at a different price level instead of placing one large order at one price, this creates a high risk in case of a sudden fall.

- Buying a limit order is highly useful for the volatile period in the market, which helps many traders to avoid panic attacks, stick with the strategy and place an order at the desired price. The trade, however, executes only if the price moves below a given price.

Disadvantages

The limit order has many pros, but at the same time, it has a few cons too:

- No guarantee for execution. The deal occurs only after the security price falls below the specified limit price.

- It might turn into a missed opportunity for traders or investors who want to catch the price trend. Paying the right amount is important, but capturing trading opportunities at the right time is even more important for traders.

- In case of a gap-down movement, if the limit order remains overnight, investors need to execute the buying trade immediately. This is because of the risk of a change in price trend.

Buy Limit Order Vs Sell Limit Order Vs Buy Stop Order

| Basis of Comparison | Buy Limit Order | Sell Limit Order | Buy Stop Order |

|---|---|---|---|

| Definition | It is an order that gives the investor an opportunity to buy certain financial security at the desired price below the current market price, controlling how much they want to pay. | A sell limit order gives the investor the to sell certain financial security at a desired price above the current market price resulting in higher profit. | If an investor or trader wants to buy a certain security above a certain price to capture a fresh uptrend or in case of a Short sell Trader wants to limit his losses above a certain price order, which is placed in the system, is known as Buy Stop Order. |

| Mechanism | For the order to be executed, the security market price needs to fall below the limit order price. | For the order to be executed, the security market price needs to trade above the limit order price. | In the case of the Buy stop order price of a stock needs to go higher than the entered price in order, and then it will be treated as a market order and will be executed at the best offer price immediately. |

| Purpose | For catching the opportunity of uptrend movement of price in invested security, and for buying a security at the right price and catching uptrend price movement while utilizing the current small fall in price as catching the right opportunity at the right time. | For booking profit in security or in case creating Short Sell to catch downtrend in security for traders; | Buy stop order is used for capturing fresh new uptrends above a certain price indicating major movement and also for protecting profit and limiting loss in case of short selling for traders. |

| Focus | Capturing trade at the right price. | Profit booking or selling at a most favorable price; | Protection against losses and capturing fresh price uptrend in security immediately. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is a limit decided to determine the highest price at which investors can purchase a share/security. In comparison, Stop Loss is to prevent an already held share/security from losing value beyond a certain price by automatically selling at a low price.

While it is a lucrative option for investors to limit their investment value and decide the maximum price at which a share/security is to be purchased, it can also cause a few missed opportunities. For example, the Buy Limit Order option doesn't factor in price fluctuations and volatility.

It is a subjective option for investors to buy a share/security at the market price or buy a limit order. The market price option would be suitable if the investor wants to be more updated on price fluctuations. However, the latter would be a safe option for a low-risk investor.