Table Of Contents

What Is A Market Order?

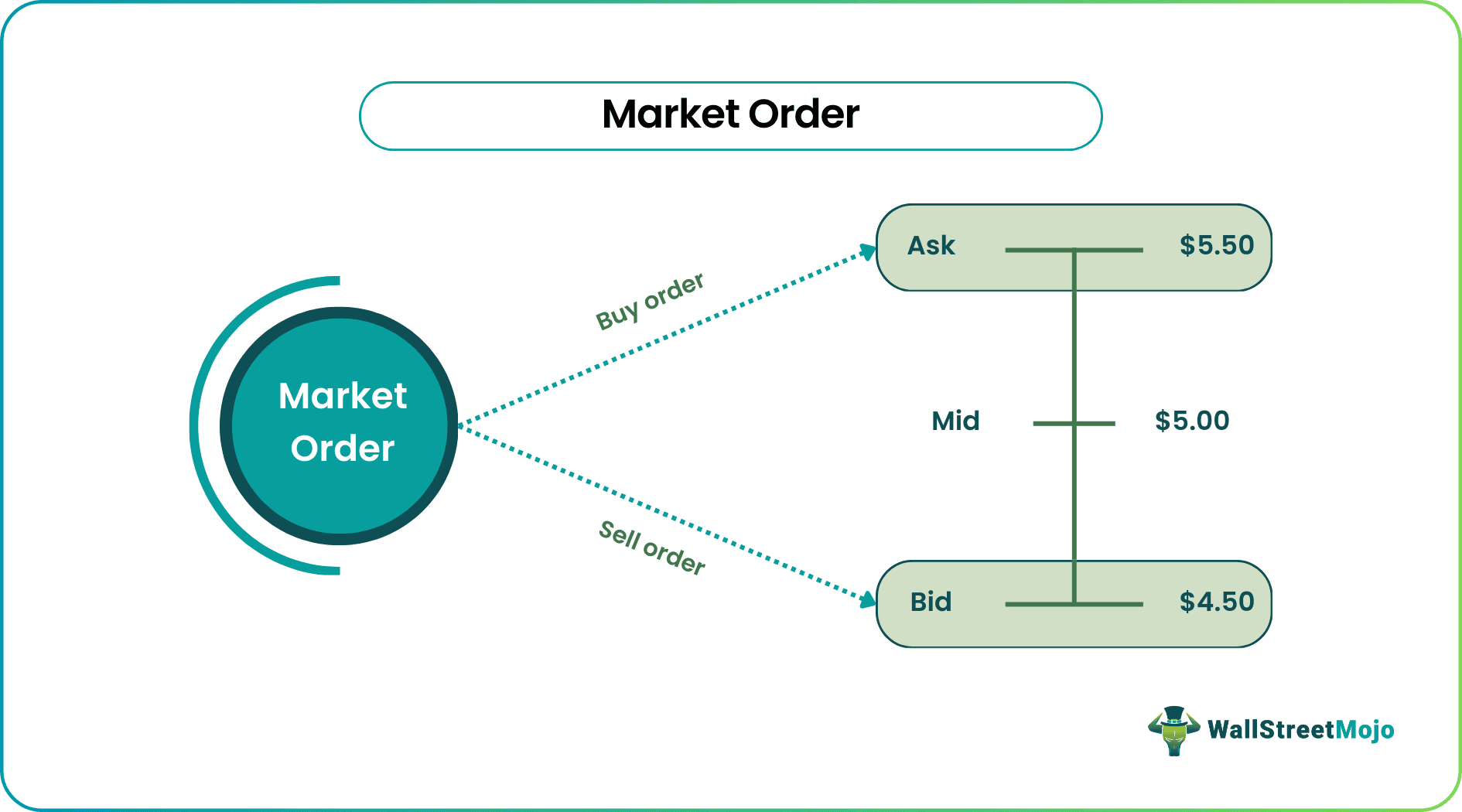

A market order is an instruction to buy or sell a stock at the best price. These orders are usually executed immediately. It is an instruction from an investor sent to a broker or brokerage firm. It is a real-time transaction; there is no guarantee that the order will be executed at a specific price.

An investor or trader cannot place buy/sell orders outside market hours. Usually, investors place an order when they think the price is right. But, the price might vary slightly by the time the trade is executed.

Table of contents

- What is a Market Order?

- A market order is a regular buy or sells order placed by an investor through a stock broker. The investor purchases or sells at the current market price—at the trade time.

- People often confuse a buy or sell order with a limit order. A limit order is an instruction to sell or buy an asset at a specific price. But buy/sell orders execute a purchase or sale at the prevailing price.

- A stop order instructs a broker to sell the stock if it reaches a particular price (usually price decline). This way, the investor can avoid or curtail losses.

Market Order Explained

Market orders are purchase and sale decisions made by an investor. It is not associated with the stock market alone. In a financial market, if an investor buys or sells securities while the market is in session, it is referred to as a market order.

The security could be a bond, currency, crypto, or other financial product. Investors can place buy or sell orders only during market hours.

(Source)

(Source)

A buy or sell market order is an instruction to buy or sell a stock at the best available price; usually, this is executed immediately. A pre-buy or pre-sell order allows an investor to place an order minutes before the market opens. Pre-orders are executed immediately—as soon as the market session begins. Also, if a buy or sell order is placed after closing, it will be executed the next business day; this is known as an after-order.

People often confuse a buy or sell order with a limit order. A limit order is an instruction to sell or buy an asset at a specific price. But market orders execute a purchase or sale at the prevailing price.

Every stock quote has three elements—the highest bid, the lowest bid, and the last trade price. The last trade price may not necessarily be the stock's current price and might vary slightly. However, due to the dynamic and fast-moving nature of markets, metrics like the current bid and the offer price are more important than the last trade price (LTP).

Similarly, there is a provision called a stop order. A stop order instructs a broker to sell the stock if it reaches a particular price (usually price decline)—this way, the investor can avoid or curtail losses.

Compared to limit orders, a buy or sell order is riskier (due to the immediate nature of the transaction). Stock markets are volatile; they are prone to unfounded speculation. Mere conjectures about war, political tension, or foreign news can cause an overreaction.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us look at some market order examples to understand the concept better.

Example #1

Gerrard is an investor contemplating purchasing ten shares of Apple Inc. from NASDAQ. At the time, the stock was trading at $134.19. Gerrard is a long-term investor and is okay with the price.

But, by the time Gerrard’s order gets executed, the price became $135.45. So, naturally, Gerrard ended up buying at the current market price.

Example #2

Nine months later, Gerrard checks his portfolio and observes that he has earned 90% returns. His initial investment of 135.45 (10 shares of Apple Inc. at the price of 135.45) became $2573.55.

Gerrard ponders that it is about time that he sold. Gerrard placed an order to sell ten shares of Apple Inc. when the stock was trading at $257.35.

But, by the time the order was executed, the price dropped by $0.90. Gerrard ended up selling at $256.45. He received $2564.5 in his account.

Market Order vs Stop Order vs Batch Order

Now, let us look at market order vs stop order vs batch order to distinguish between them.

- Market orders instruct the broker to buy or sell at the current market price. In contrast, a stop order is executed only when the price is within the acceptable range. On the other hand, a batch order is a behind-the-scenes transaction between brokerages.

- Buy or sell orders are executed as soon as possible. In contrast, the stop order is triggered only when the price crosses a predetermined level. Batch orders comprise multiple trading orders.

- Market orders and stop orders can be executed within market hours. In contrast, batch orders are executed before the market opens.

- Buy orders, sell orders, and stop orders are individual orders. In contrast, the batch order is the sum of all orders for a particular stock.

Market Order And Limit Order

Now let us compare market orders and limited orders.

- Buy or sell market orders are large in numbers; there is a threat of price differences. In addition, large orders can be time-consuming. However, no such issues are encountered with limited orders; the buy/sell price is predetermined.

- Primarily, a buy or sell order prioritizes speed over price. In contrast, limit orders prioritize the price; if the security value is outside the limit order's parameters, the transaction will not occur.

- If a buy or sell order is placed after trading hours, it will be executed at the market price when the next trading day begins. In contrast, limit orders placed outside market hours; they are queued for processing as soon as trading resumes.

- Buy/sell orders are voluminous, and by the time a particular order is placed, the price fluctuates multiple times. This is not the case with a limit order.

- Buy or sell orders are suitable for all kinds of stock. In contrast, a limit order is recommended when a stock is thinly traded. It is also suitable for stocks that are extremely volatile or possess a widespread.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

To mitigate volatility risks, there is a provision called the stop order. A stop order instructs the broker to sell the stock if it reaches a particular price (usually price decline)—this way, the investor can avoid or curtail losses.

If a buy or sell order is placed after closing, it will be executed the next business day; this is known as an after-order.

People often confuse a buy or sell order with a limit order. A limit order is an instruction to sell or buy an asset at a specific price. But buy and sell orders execute a purchase or sale at the prevailing price. Buy or sell orders are suitable for all kinds of stock. In contrast, a limit order is recommended when a stock is thinly traded. Also, limit orders suit stocks that are extremely volatile.