Table Of Contents

What Is Good 'Til Cancelled?

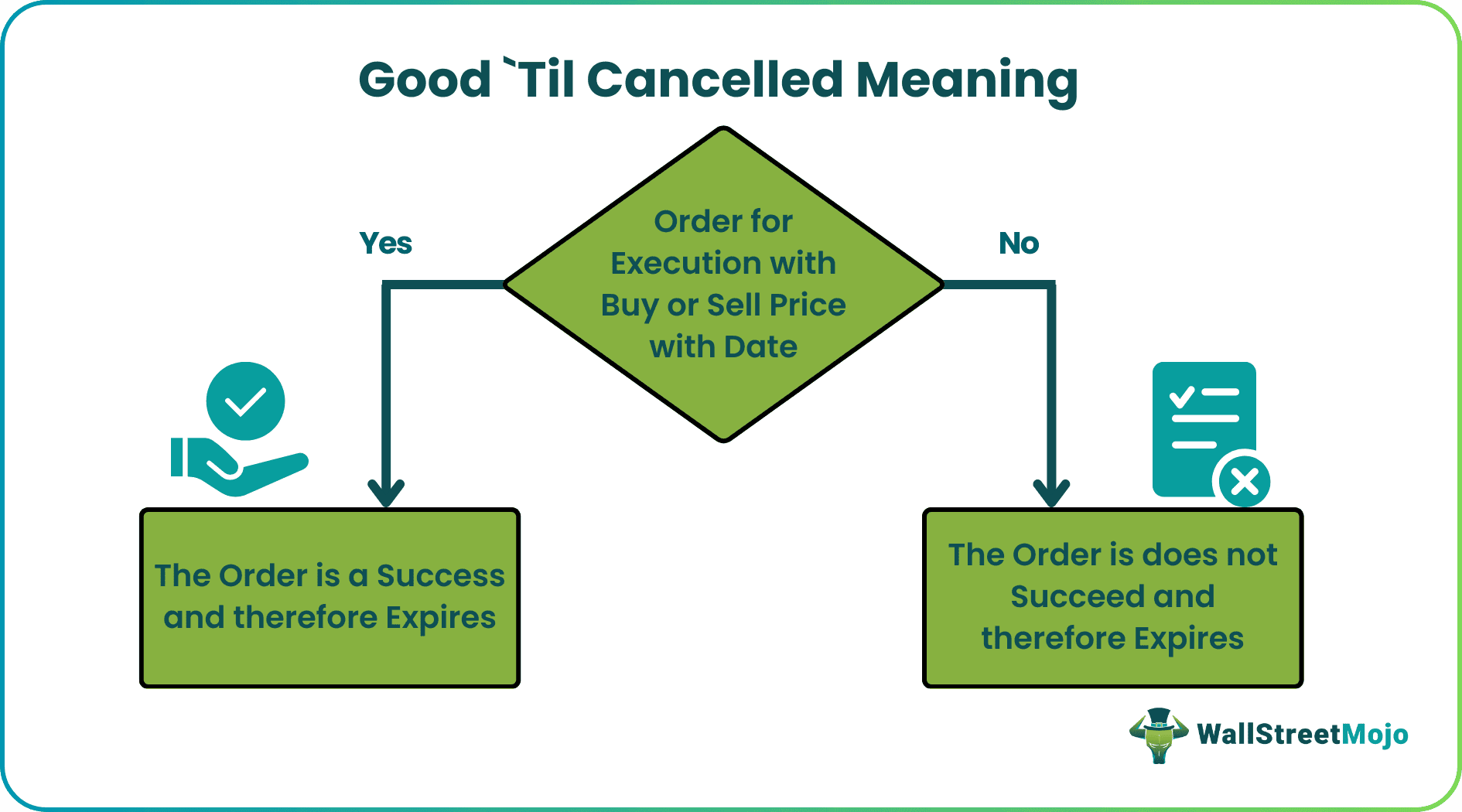

Good 'Til Canceled is an order set for securities trading that lasts until the order is executed or canceled. Unlike usual commands, they last for longer durations, typically 60-day expiration. The order tickets will remind investors before the order is submitted and when it will expire.

Good 'Til Canceled (GTC) orders are helpful to traders who are unable to devote themselves to trading full-time. These orders allow them to place an order knowing its execution will occur when it meets the predetermined price. The greatest advantage of a GTC is not having to take further action or monitor the markets constantly.

Key Takeaways

- Good 'Til Canceled is a trading method traders and investors use to trade. This method initiates the trade order at a predetermined price for a fixed period.

- When the securities reach a specific amount, the execution of the order takes place automatically. However, if the order remains unexecuted, it expires after the set date.

- GTC orders help traders stop losses and take profits. In addition, it aids the traders in realizing their financial goals and stops them from making emotional decisions when volatile market.

Good 'Til Cancelled Explained

Good 'Til Cancelled (GTC) is an order that traders or investors initiate to execute a trade. It helps to purchase or sell securities at a specific price whenever available. Such an order might remain in place indefinitely until the investor either cancel the order or buys or sells the security at the predetermined price.

Unless the investor extends them, a good 'til canceled order can expire after 30 to 60 days if they are not filled. In addition, the good 'til canceled after hours does not exist. This type of order is good (stays) until its completion, or the trader who placed it cancels it, hence the name "Good 'Til Canceled."

Generally, traders or investors execute trades when they find the right price. This price may be on the lower end of the current security price when they want to purchase and on the higher end when they want to sell. In a good 'til canceled order, the traders can choose a special price they want to purchase or sell their security. With the attainment of the price, the execution of order takes place.

The traders usually set the execution price, and the good 'til canceled limit order stretches for 60 days on average, an advantage for traders who cannot constantly watch the markets. Two benefits of this are stopping losses and taking profits. Both these orders are triggered or executed by the asset reaching the predetermined value.

A GTC saves traders from having to re-enter stop losses and profit targets every day and instead opt for auto execution. Active, long-term orders help investors attain these benefits. In certain ways, it also saves them from making emotional decisions. It will also make them focused on their financial goals irrespective of the ups and downs of the market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example

Let us try to understand the concept of good 'til cancelled order with the help of a suitable example.

Let us take the case of Daisy, a trader. Daisy placed a GTC order to sell 1000 "ABC" shares on 7/7/2022 for $200 per share. Its current price was $150 at that time. She set the order execution date as 7/8/2022 (one month). The execution of the GTC order will occur if the ABC Company's shares rise to $200 from $150 within a month. If not, the order will be canceled for not reaching the required levels.

The above example clarifies the concept of a good 'til canceled order, where we see that the order remains valid for a month, which means that if the price rises to $200 within one month, Daisy earns a profit. If the prices reach the desired level after one month expires, the order is not executable or good anymore. It gets canceled after that. Thus, even though the stock price reaches $200, Daisy is unable to book the profit.

Good 'Til Canceled Vs Day Order

In terms of general equities, a day order from the trader is to purchase or sell a security. Without cancellation or execution, the order will expire automatically on its placing. Conversely, a good 'til canceled also helps execute trades but has more time for execution.

They differ on a few points, such as:

Execution Period

A good 'til canceled order limit typically extends for 60 days (or more). At the same time, day orders have a period of one day.

Purpose

Day orders and good 'til canceled are both trading methods, but GTC suits better for an exit strategy. Choosing a price that gives a maximum profit on the return on investment for a set period guarantees better returns than day trading.

Risk

Day orders carry more risk as they are for a short period. For example, suppose the stock price of a stock sold by an investor increases after the day of its selling. This will be an undesirable situation. In good 'til cancelled limit order, traders calculate the returns they want and fix a date to cover the maximum period.

The advantage of a long period is that the trader can cover the market's ups and downs. In addition, with more time, the asset may reach its full potential, aiding the trader in realizing higher profit rates.

Market Watch

The main advantage of executing a GTC is that a trader does not have to keep watch on the market volatility. If the order is to sell, the traders can execute orders when there is high volatility and the prices go high.

On the other hand, if the order is to buy, in volatile times, the price may go exceptionally low, and there is a chance to buy at very low prices. In both cases, the trader does not need an update daily unless necessary. On the other hand, day orders need frequent attention from the trader's side.

Thus, the above points list all the important details about the differences between the two types of orders used in the financial market. It is necessary to understand them in details so that traders can effectively use them on time and take advantage of market fluctuations to earn profits.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is one of the order execution forms that traders use for trading. Under this, the trader sets an order to buy or sell an asset or security at a particular period. If the price is attained, the order gets executed. If it does not, the order expires.

Although GTC is said to have an unlimited period once the order is created, it is far from the truth. These orders typically remain for 30-60 days. This is to prevent them from being forgotten after some time.

The Good 'Til Canceled listings are orders used to create lists on e-commerce sites. Where sellers use it to list items for a fixed time at a predetermined price, this is also a way of trading, except they are goods and not securities.