Table Of Contents

What Is Bid-Ask Spread?

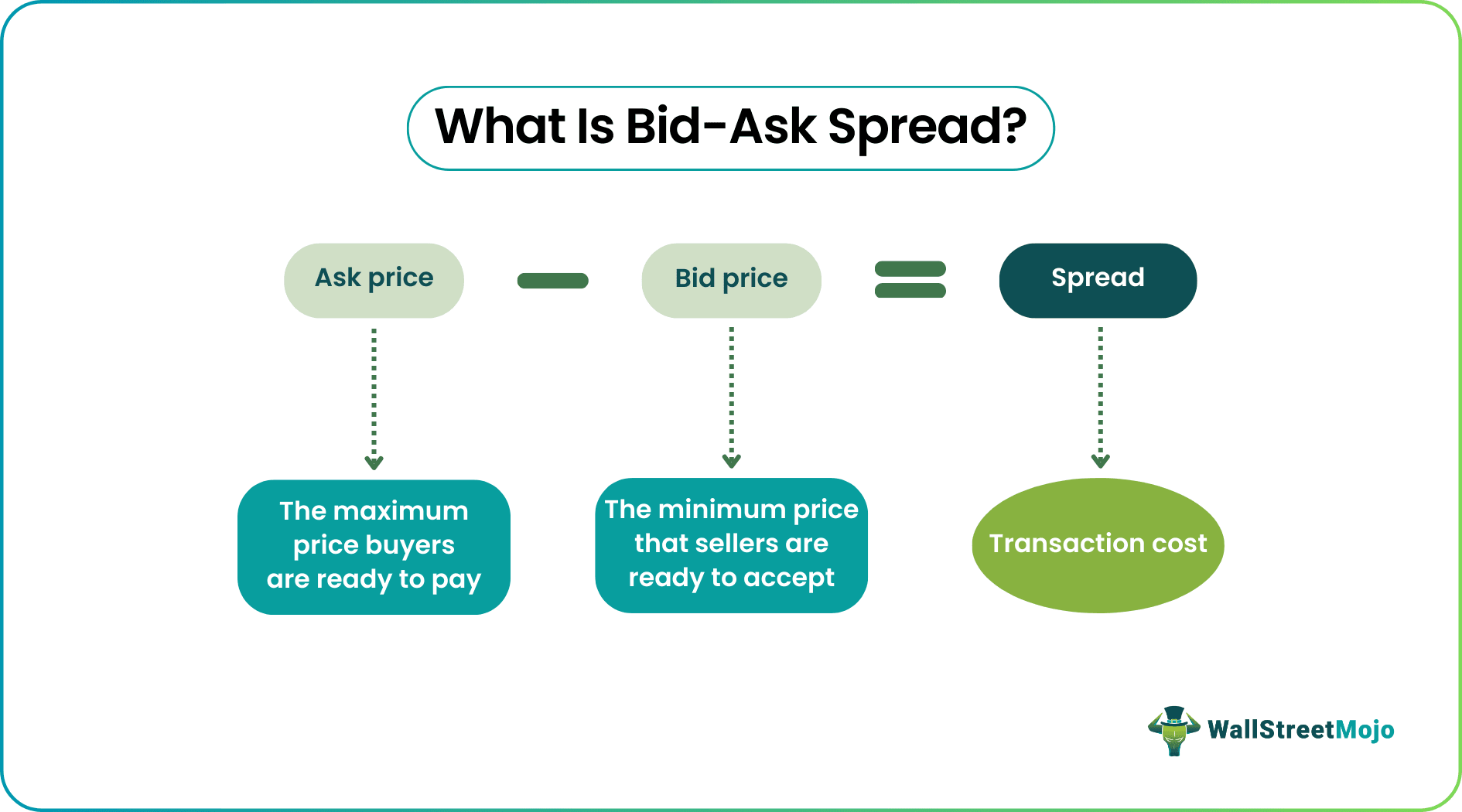

A bid-ask spread is a difference between the maximum price buyers are willing to pay for an asset, and the minimum price sellers are ready to accept. While the bid price is the price put forward by the buyers, the ask price is the cost at which the sellers want to get the deal done.

This spread is the transaction cost recorded as the trade exchange occurs and determines the stock's liquidity. The wider the spread, the less liquid that stock tends to be. The ask price is always more than the bid price, which results in a positive trade. It is an indicator of liquidity and market efficiency, that helps traders discover prices of financial instruments.

Key Takeaways

- The bid-ask spread refers to the transaction cost obtained when a stock's bid price is subtracted from its ask price.

- The ask price is the lowest price of the stock at which the prospective seller is willing to sell the security they hold.

- The bid price is the highest price the prospective buyer is willing to pay for purchasing the security.

- The difference or spread is the profit for the market makers who initiate a trade for buyers and sellers.

Bid-Ask Spread Explained

The concept of bid ask spread explains the value of an asset at a certain point in time as perceived by the market. To understand this process, it is important to have an idea about the two parties involved in it, which are the market maker, who offer the securities at a particular price as well as bid to buy them, an the investor who trades in them, which may be selling or buying.

This is a basic concept trader must know when they enter the market to take trades. The market identifies a bid-ask spread data mainly when there is a misbalance in the supply and demand of the assets. This friction in the availability of assets affects their prices, narrowing or widening the difference between the bid and ask prices, termed a spread.

Brokers or market makers offer assets or securities with two price tags. They put the selling price, which is the ask price, for the asset, and the cost price, which is the bid price, for the same asset. The bid is the maximum price that the buyer is ready to pay for the asset, and the ask is the minimum price that the seller is ready to accept for the same asset. A narrow gap will indicate a high level of liquidity for the asset because some more buyers and sellers wish to trade. Similarly, a wide gap will show that there are significantly fewer traders for that security, proving that the instrument is less liquid.

The investors compare the stock bid ask spread prices and decide whether to buy or sell the stocks. Depending on their perspective of profit, they choose either of the two. However, no matter which bid-ask spread options they choose, the difference between the ask and bid prices would be the profit of the market makers who offer the deal.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Bid-Ask Spread Explained In Video

Trading Strategies

The trading strategies must be known first to understand the bid-ask price meaning perfectly. Here, traders can take trades by placing their orders in two ways – market orders and limit orders. When the investors place the market order, they choose to purchase the stocks at the ask price. As the prices go up, investors observe the widening spread, thereby getting a room for more and more profits. Though this trading strategy using stock bid ask spread works wonders in reaping trade profits for investors, it is essential that the market fluctuations boost the stock prices and do not affect them negatively.

In scenarios where the bid-ask spread data widens significantly, investors might choose another option to book their trade profits. They can place a limit order, executed only when the prices of the assets fall below a certain limit. Investors can enter the trade at the entry-level to ensure they do not miss the chance to profit from the spread. They buy the security and sell the same when the prices move to the original ask price or above, which is always the figure below the bid price. This tends to be the best investment alternative for those with a set profit goal.

Factors

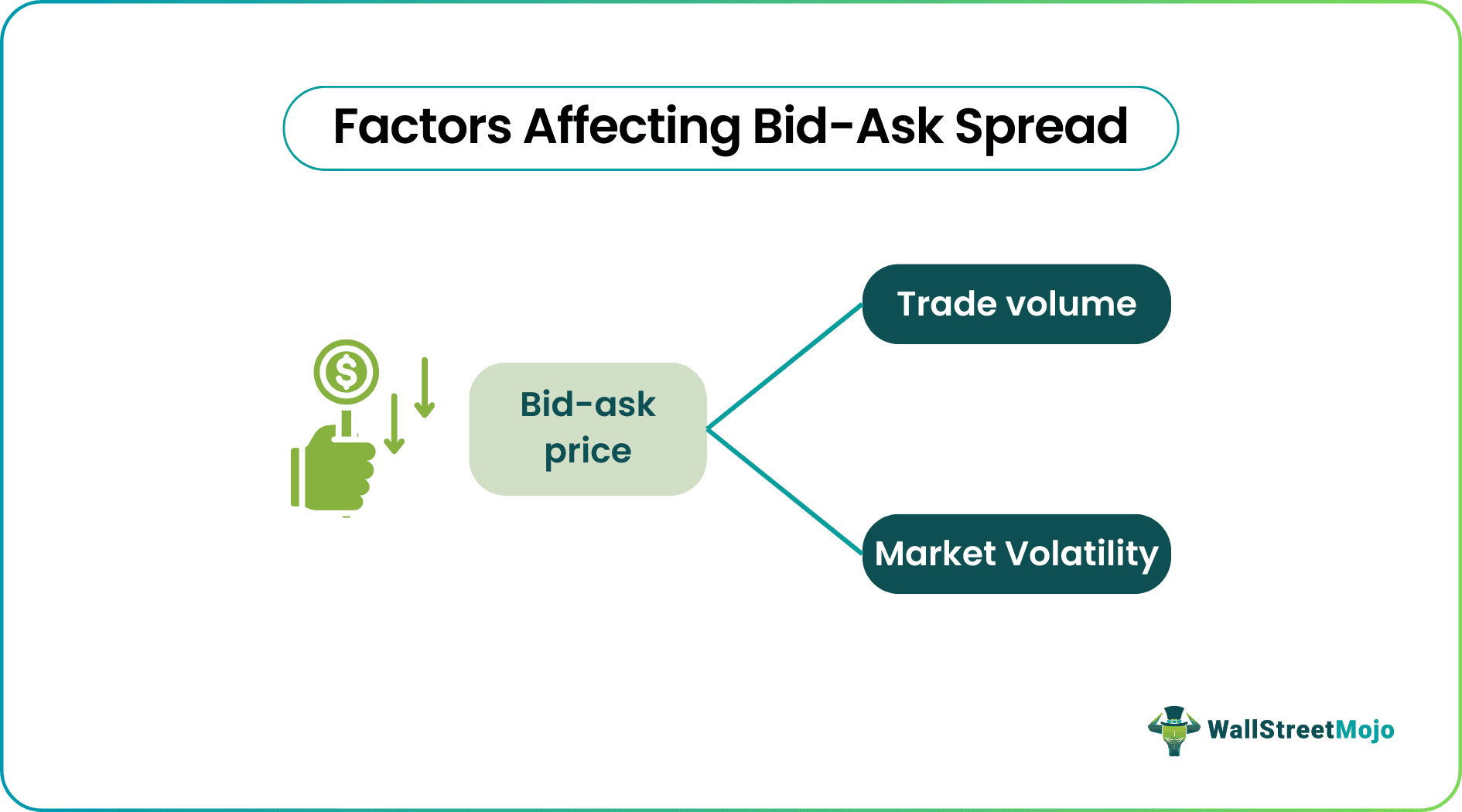

When traders calculate stocks or option bid ask spread, they obtain results for one stock share. Hence, the trade volume or the number of traded stocks is an important factor as it highly affects the results. The stocks that are thinly traded have higher spreads. This width of the spread is not constant, and it differs from one security to another, given how liquid the stocks are. The spread is low in a market with high liquidity and better trading volume as the number of traders, both buyers, and sellers, is higher.

Another factor that highly affects the bid-ask spread is market volatility. When the market undergoes frequent fluctuations, the spread widens.

Formula

The following bid-ask spread formula is used to make the required calculations:

Spread = Ask Price-Bid Price

In the given formula, we see that the spread is calculated by finding out the differences between the ask and the bid price. This formula is widely used to calculate the spread of various instruments among which the most popular ones are commodity and forex. Traders also use stocks or option bid ask spread in the financial market.

Example

Let us take a practical bid-ask spread example to see how it works.

Tim decides to buy a few stocks with the savings he has. He thinks of investing in M Co's stocks. Thus, he connects with his friend, Brown, a long-time investor who asks the former to find out the spread for the company beforehand. The investor knows that understanding the bid-ask spread could help Tim in future investments.

Thus, Brown provides the following details: –

- The bid price (an assumed one) of a stock of M Co. is $100.

- The asking price (also an assumed one) of a stock of M Co. is $102.

Since Tim is a new investor, he does not understand the spread. So, he finds out the formula and applies it. And in one go, he calculates the spread of the stock of M Co. Here is his calculation: –

Spread = Ask price of a stock – Bid price of the same stock

= $102 – $100

= $2.

The spread of a stock of M Co. here is $2.

Importance

Let us identify the importance of the concept.

- As stated above, the difference between ask and bid prices becomes the profit for those who sell the stocks. Hence, understanding how it is computed is an important aspect of trading.

- Furthermore, as the bid-ask spread helps assess market liquidity, booking profit at the right time becomes easier for investors. Therefore, it helps in evaluating the liquidity level of the financial security.

- If the spread is small, it indicates that the market is stable, and the information about the stock prices offered for sale and purchase are almost similar. In such scenarios, the volume of securities available for trade is huge. On the other hand, if the spread is wider, it indicates a significant difference in the opinion of sellers and buyers. Plus, the volume of assets also remains limited.

- From the above point, it can be derived that the bid-ask spread percentage is a measure of the efficiency level of the market. It is easy to find sellers and buyers in the market when the spread is very narrow. Therefore, competitive prices can be expected at such levels.

- Spreads play an important role in discovering prices. Since the bid is the maximum price buyer will pay and ask is the minimum price the seller will accept, the fair market value of the asset can be determined.

- Since a wide value of spread is an indication of difference of opinion, as explained in the above points, this also show that the market is very volatile and uncertain. This information helps in risk assessment of stocks or any other financial instrument and take investment decisions accordingly.

- From risk assessment and volatility comes the sentiments of the market. A narrow spread shows confidence of investors in the stability of the market and the opposite is true in case of a big spread.

- It is also to be noted that regulators and policymakers refer to this metric to understand the quality of the market and monitor it. An unusually wide level of spread indicate market manipulation and malpractices which affect the integrity of the market.

We can thus summarise that this concept of bid-ask spread percentage is a great guide to providing information related to market efficiency, liquidity and risk and an overall condition of the financial market.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Traders buy stocks at the bid price and proceed to make those stocks available for the next set of investors. They offer the bid price (price to buy) and ask price (price for sale) for the stocks. The difference between the bid and ask prices becomes the profit for them.

The narrower the spread, the higher the demand. It indicates the slight difference between the bid price and the ask price. On the contrary, the wider spread reveals the less liquid status of the market. The average spread for S&P 500 stocks is around 13% to 18%.

Investors purchase the stocks at the ask price. Then, they further sell it at a bid price. In this deal, the ask price is more than the bid price, which does not allow investors to enjoy this spread. Instead, the same becomes a transaction cost for the investors and profits for money makers or brokers.