Table Of Contents

What Is A Cross Trade?

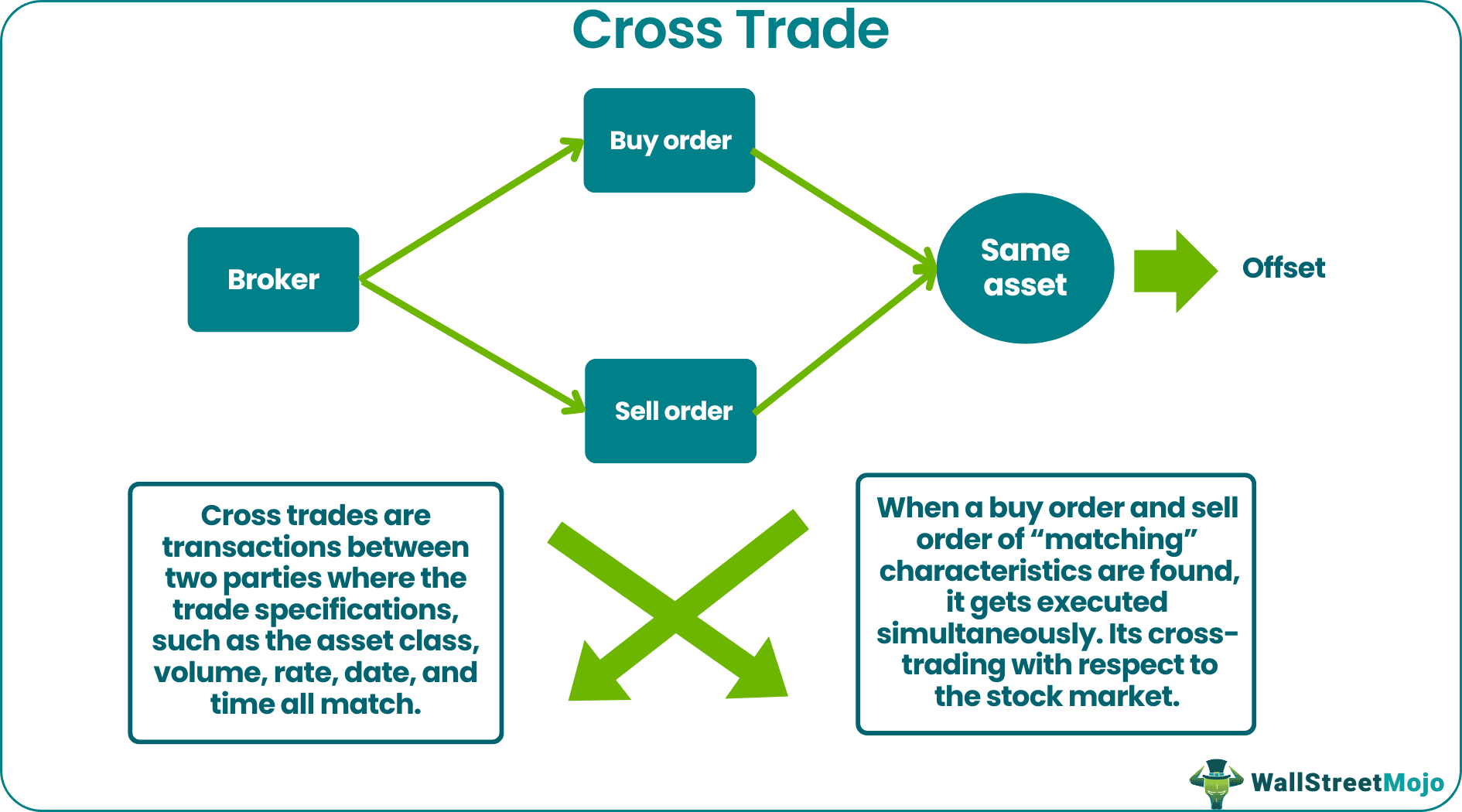

Cross trade is the technique of offsetting buy and sell orders for the same financial instrument without notifying the exchange of the transaction. When an equal amount of buy and sell options for a financial instrument arise from different clients simultaneously, matching the orders can happen and lead to offsetting the orders.

Cross trades are supposedly much cheaper than open market trades. It serves as an alternative to trading on public markets. The commissions involved are zero or very minor compared to other brokerage fees, as the broker does not need to seek counterparties for the deal. However, occasionally, a commission may be payable for bookkeeping services.

Key Takeaways

- Cross trade is the technique of offsetting purchase and sell orders for the same financial instrument without notifying the exchange of the transaction.

- It serves as an alternative to trading on public markets.

- Wash trade and block trade differ from cross trade because investors buy and sell the same instrument in the wash trade technique, and several smaller orders are executed through different brokers in a block trade.

- Cross-trades are permissible if they comply with the requirements outlined in Rule 17a-7 of the Investment Company Act of 1940.

Cross Trade In Stock Market Explained

A cross trade occurs when a broker or portfolio manager successfully transfers an asset from one client to another and eliminates the deal's spread. In other words, cross trade is the transfer of assets between two separate accounts without first passing through a public market. When a broker executes matching buy and sell orders for the same securities across different customer accounts and publishes them on an exchange, the practice is legal, given the cross trade is carried out at a price that reflects the current market price. It highlights the significance of prompt reporting.

One or both customers may not get the current market price available to other non-cross trade market participants when the deal is not logged through the exchange. Investors might not be informed whether a better price would have been available as the orders are never publicly posted. Cross trades are occasionally authorized on big exchanges, such as when the buyer and seller are both customers of the same manager or the broker, and the cross trade price is deemed competitive at the time of the deal.

The advantages of cross trade are significant because fees and other transaction costs are avoided on both sides of a cross-trade. Therefore making these trades cheap in terms of fee and cost involved. Trading fees differ within categories of financial instruments, including shares, derivatives, currencies, and across nations. Transaction costs include all expenses related to managing investments, including the time spent evaluating and making investment decisions. They consist of direct expenses like commissions and taxes and indirect expenses like the bid-ask spread, market impact expenses, delay expenses, and the opportunity costs of missing a trade. As a result, the charges associated with trading might be as high as 4% of the total amount.

According to Rule 17a-7 of the Investment Company Act of 1940, several regulations are in place to prevent illegal cross-trading. Rules include involving the asset whose market quotations are easily accessible. The trade shall be executed at the independent current market price of the security in the transaction. All transactions are required to comply with each fund's policy. No commission, fee, or other forms of compensation shall be paid in connection with the transaction. The board (including a majority of independent directors) must take specific actions, and the fund must maintain specific records, among other things.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example

On February 28, 2022, at 11:00 AM, a client placed a buy order for 5,000 ABC shares. On the other hand, another client placed a sell order for the same number of ABC stocks on the same day and time, February 28, 2020, at 11:00. The broker completed the two orders as a cross trade instead of submitting them to the stock market to be filled, and afterward reported the transactions promptly and time-stamped with the price and time of the cross.

Cross Trade vs Wash Trade vs Block Trade

Let us look at the major differences between cross, wash, and block trades:

| Basis | Cross Trade | Wash Trade | Block Trade |

|---|---|---|---|

| Meaning | Offsetting of buy and sell orders from different clients for the same asset. | The investor buys and sells the same instrument. | Several smaller orders were executed through different brokers. |

| Explanation | A cross-trade is a trade between two accounts inside the same fund or assets. | Wash trades are purchases and sales of securities identical in price, volume, and execution time and don't result in a change in beneficial ownership. This type of trade is a transfer with a single account across both sides of the trade. | A block trade is an acceptable off-exchange, privately negotiated transaction executed at a fair and reasonable price and is not part of the central limit order book. It is executed on a quantity of futures or options contracts equal to or greater than the minimum threshold quantity set by the exchange. |

| Transfer of ownership | The parties involved are different; hence there is a transfer of ownership from one to another. | The parties involved are the same; hence there is a transfer of ownership from one account to another account of the same person. | The parties involved are different; hence there is a transfer of ownership from one to another. |

| Legality | They are permissible as long as complying with regulations. | They are illegal. | Similar to cross trades, they are legal to the extent that they comply with rules. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It occurs when a broker matches purchase and sell orders for the same security for two different client accounts and subsequently registers the transaction as a "cross trade" on the relevant exchange; the transaction is then considered legally executed.

Cross-trades are acceptable if they abide by the SEC's standards, specifically under Rule 17a-7 of the Investment Company Act of 1940. The rules include requirements such as that the traded security should have readily available market quotations and that the transaction must adhere to each fund's policy.

Encouraging the practice of cross trade could erode market confidence. Other market players will not get the chance to interact with such orders, even if certain cross-transactions are theoretically permissible. One of those orders would have piqued the interest of market participants, but they were denied the opportunity since the deal took place outside of the exchange.