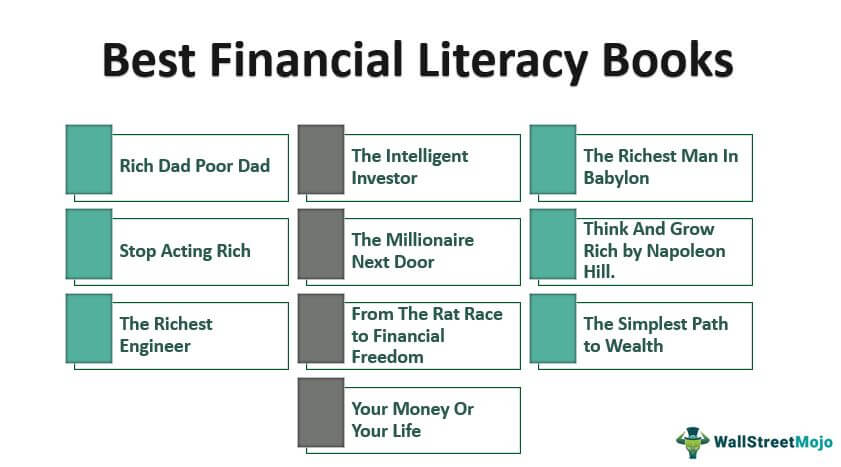

Top 10 Financial Literacy Books [2025]

Robert Kiyosaki says, ‘Every person who graduates from school is financially illiterate.’ Add the books on financial literacy to your reading list to increase your financial literacy. Below is the list of the top 10 financial literacy books you must read in 2025:

- Rich Dad Poor Dad ( Get this book )

- The Intelligent Investor ( Get this book )

- The Richest Man In Babylon ( Get this book )

- Stop Acting Rich ( Get this book )

- The Millionaire Next Door ( Get this book )

- Think And Grow Rich by Napolean Hill ( Get this book )

- The Richest Engineer ( Get this book )

- From The Rat Race to Financial Freedom ( Get this book )

- The Simplest Path to Wealth ( Get this book )

- Your Money Or Your Life ( Get this book )

Let us discuss each financial literacy book in detail and its key takeaways and reviews.

#1 - Rich Dad Poor Dad

By Robert Kiyosaki

Book Review:

The book is a fun story in which the writer shares the story of his learning and experiences from his two fathers, one he called the “Poor Dad” and the other he named the “Rich Dad.”

Writer-speaker-billionaire Robert T.Kiyosaki advocates the importance of financial literacy through this book and provides basic rules and principles to achieve financial freedom.

Key Takeaways

- Rich don’t work for money; they make their money work for them.

- The rich acquire assets, but the poor accept liabilities.

- Understand the true meaning of assets and liabilities.

- Money without financial intelligence is money soon gone.

#2 - The Intelligent Investor

By Benjamin Graham.

Book Review:

It is a globally acclaimed book on value investing ( an investment tactic to select under-valued stocks). Investopedia says serious physicists read about Sir Isaac Newton’s theories about gravity and motion. And serious investors read Benjamin Graham’s Books teachings about finance and investment.

Key Takeaways

- While analyzing stocks, throw emotions of greed and fear out of the window.

- Focus on the company’s value and not trust the media hype.

- Protect yourself from significant losses. Diversify your portfolio.

#3 - The Richest Man In Babylon

By George S. Clason.

Book Review:

The classic was first published in 1926, but its concepts and teachings are still valid in current scenarios. The book is a fascinating story set in ancient Babylon that reveals the success secrets to personal wealth.

Key Takeaways

- Keep ten percent of your earnings for yourself.

- Invest the money you save.

- Advice is free.

- Take advice from experts in their field

#4 - Stop Acting Rich

And Start Living Like A Real Millionaire

By Thomas Stanley

Financial Literacy Book Review:

The book gives readers a clear and straightforward message: "lasting wealth and happiness are rarely found through buying expensive things. Instead, it shows you how to live like a rich person by accumulating more wealth and using it to achieve financial freedom.

Key Takeaways

- Learn the difference between being rich and acting rich.

- Wealthy people invest their money to meet their long-term goals.

- A nonmillionaire tries to imitate the ultra-wealthy and ends up with financial disasters.

#5 - The Millionaire Next Door

The Surprising Secrets of America’s Wealthy

By Thomas Stanley.

Book Review:

The book is a result of extensive profiling of people of America whose net worth exceeds one million dollars done by its writers, Stanley and Danko. The book tries to bust the myth about millionaires and shows the millionaire’s path, which one could follow to achieve financial freedom.

Key Takeaways

- Millionaires believe more in financial independence than showing off their top-class social status.

- Efficiently allocate your time, energy, and money to build wealth.

- Choose the proper occupation and grab market opportunities.

#6 - Think And Grow Rich by Napolean Hill

By Napoleon Hill

Book Review:

The book is based on the philosophy of “helping yourself.” He says this philosophy can help people succeed in any line of work, just innovative thinking. The book teaches the science of success and the art of growing your net worth.

Key Takeaways

- To become a millionaire, you better learn from a millionaire.

- Decide a goal and be flexible about your plans.

- Feel free to change projects that are not working.

#7 - The Richest Engineer

A Story That Will Unravel The Secrets Of The Rich

By Abhishek Kumar

Book Review:

The writer asks a fundamental question in his book: "have you ever wondered why some people get rich easily while others struggle financially all their lives?” He answers this question with the help of a story and conversation between two friends, Vinay and Ajay.

He says individuals should accumulate wealth by investing their income correctly. He also provides some basic principles that one must follow to achieve the desired goal.

Key Takeaways

- Anyone can become rich.

- We have been wrongly taught about money throughout our life.

- How to change our attitude towards money.

- Learn ways to increase your income and decrease expenses and taxes while maintaining your current standard of living.

#8 - From The Rat Race to Financial Freedom

By Manoj Arora

Book Review:

The book tries to teach the true meaning of “Financial Freedom” in the simplest way possible. Manoj says every one of us is trapped in a mindless rat race (a way of life in which people are trapped in a fiercely competitive struggle where they want to earn more and more money)

He adds that if one wants to get out of the rat race and achieve financial freedom, he must take control of his finances and construct a personal financial plan.

Key Takeaways

- Financial freedom is not defined by your net worth or your social status.

- The level of your earnings doesn't matter.

- How much you save and how you invest matters.

#9 - The Simplest Path to Wealth

By J.L. Collins.

Book Review:

The book quotes, "Since money is the single most powerful tool we have for navigating this complex world we have created, understanding it is critical." First, however, the book provides some simple approaches to acquiring and accumulating wealth.

Key Takeaways From This Top Financial Literacy Book:

- Avoid debt. Learn the dos and don’ts if you have it.

- The reality of stock markets and how it works.

- The truth behind social security.

#10 - Your Money Or Your Life

9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

BY

Book Review:

The book is about transforming your relationship with money, which is much more than just earnings, spending, savings, or debts. It includes the time you must spend on these four functions. It also takes care of the sense of satisfaction when you are connected to your family.

The book follows a 9-step questionnaire to achieve financial freedom. Some of those are discussed in key takeaways.

Key Takeaways

- Do you have enough money?

- Do you spend time with your family and friends?

- Are you satisfied with the contribution you made to the world?