Table Of Contents

What Are Financial Planning Apps And Softwares?

Different financial planning apps are available in the market, which helps professionals make informed decisions concerning managing the clients' funds and other research. It also helps the investors keep track of their expenses and income, prepare budgets, etc. Some apps include the Mint app, which automatically tracks the money after someone enters some basic information.

In addition, the Level Money app suggests how much a person can spend during the specified time, helping in financial planning, etc. Overall, these apps and software are gaining huge importance in the financial market as a means to plan, make budget, or implement strategies that will create a portfolio to maximise returns through proper risk management, efficiently, in a paperless form.

Financial Planning Apps & Softwares Explained

Financial planning apps are needed by professionals and individual investors alike. Professionals rely on such tools to make informed decisions regarding their clients’ fund management, financial research, etc. In contrast, individual investors use financial apps for creating budgets, keeping track of their income and expenses, collating their investment details in one place, making it paperless and hassle-free, and connecting all their accounts together, be it personal, retirement, or mortgage and loans to arrive at a holistic picture of their net worth.

There are certain basic financial planning apps and tools that one can use for attaining simple objectives like keeping track of your expenses and savings, to certain other complex ones that provide detailed financial data and financial statements along with expert analysis about individual companies, like profit & loss statements, dividend history, financial ratios and information about various markets, finance, business, indices, and financial news, financial forecasting in Excel. In addition, they also provide expert analysis, updates on the upcoming IPOs, how IPOs fare on the indices, and their current valuations.

Top Free Financial Planning Apps & Softwares

These apps and softwares have various features that are helpful in keeping track of expenses and incomes of individuals. They are perfect tools for money management that not only acts as a guide in planning but also, quite often gives details about areas where overspending is taking place through proper categorization or receipts and payments.

These apps also send reminders from time to time, related to bill payments so that they are not missed out and the user may not end up paying penalty charges. They are perfect in tracking the progress of how th wealth is multiplying and whether the returns are being properly reinvested and used in a productive manner. The weekly and monthly summarised transactions give an overview about the cash inflow and outflow.

In other words, they save a lot of time by maintaining an intelligent and methodical approach that gives a discipline to savings and investment. Tracking of income and expenses help in saving and carrying over the saved funds for the future for better returns.

Here is the list of the best free financial planning apps and software:

Top 4 Free Financial Planning Apps

People are so busy with their lives that it becomes difficult for them to focus their energies on the most important aspect of earnings, savings. Investment Banking professionals especially wealth managers, are in the business of handling money. Still, suppose you are looking for some first-hand experience and want to look after your finances personally. In that case, one can download various mobile applications readily available in cyberspace. Such mobile apps provide quick and smart solutions to collect all your financial information in one place, making it less tedious and almost paperless.

Several free mobile apps are available in the market. Some of them are as under.

#1 - Mint (Money Management App)

Mint is one of the most known mobile financial planning apps that automatically helps you track your money. All you need to do is enter basic information, and Mint takes care of the rest of it by providing you with vital information from time to time.

#2 - Pear Budget (Expense Tracking App)

Pear Budget is another web-based financial planning app based on a spreadsheet format wherein one must manually enter the information. It has certain basic expense categories, which one may alter later. It isn't as automated as its peers but serves the purpose, especially for first-timers.

#3 - Level money (Financial Planning App)

Level money, as the name suggests, levels the amount of money you can spend in a month, week, or day. This financial planning app automatically picks data from your smartphone and keeps sending reminders about the amount left to spend, thus leveling the savings and expenses rate. It also gives you a glimpse of your spending habits based on the information received by it.

#4 - GnuCash (Financial Planning App)

GnuCash, a financial planning app, is a Linux-based system that thrives on double-entry bookkeeping. It is a serious accounting tool but can be used for business and home. It helps you track your expenses and savings along with bank and investment accounts.

Many bank websites also provide mobile applications wherein you can enter data about accounts, loans, investments, insurance, etc. In addition, they help you keep track of your income and expenses and provide information about their new products from time to time.

Example

Let us take an example to see how a financial planning application can be properly used to manage wealth and introduce discipline in cash flow.

We assume Mark is a professional who has recently completed his Masters in Business Management in finance and is currently in a lucrative investment banking job. He had taken a student loan of $125,000. He was in a lot of dilemma regarding how he will be able to plan his finances so that he is able to repay is loan installments on time. He started using the Mint, which is a very useful money management application which has lots of features that helped him stay motivated about the loan repayment. He was able to track his cash flows that made him identify opportunities to save as well.

Initially he was not sure whether this app will provide enough safety to the financial data because he has often learned about applications which could be easily hacked and data is misused. But many of his friends had already started using it and foud it to be really safe as well as easy to use. The best part according to him is the information about his credit score, which rapidly increased due to timely loan repayment. Therefore the app gave him multiple benefits due to which it still continues to be his favorite medium of fund management.

Top Wealth Management App

Many portfolio management websites offer such financial planning apps free of cost, where you can create an account and enter your investment details. The tools update the respective values of shares, mutual funds, or fixed-income securities but also analyze your investment portfolio, along with giving suitable recommendations on its asset allocation, your net worth, and how your investment portfolio is performing as compared to the market indices.

Websites like Morning Star, Personal Capital, JP Morgan, Principal Global, and various other mutual fund websites provide detailed financial data on the current market, economic trends, and the bonds market. Exchange-Traded Funds(ETFs), stocks, Closed Ended Funds(CEFs), and Personal Finance. You can also calculate your cash flow and net worth i.e., assets minus the liabilities by entering your personal and saving account details, cash and investments, bonds and stocks, as well as your debts and liabilities, i.e., mortgage, loans, credit cards, etc.

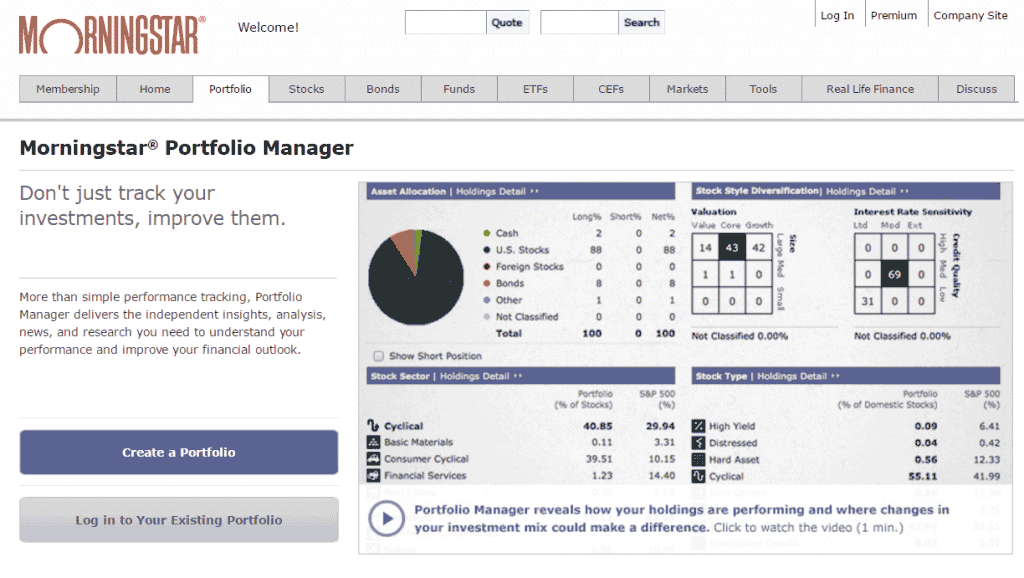

#1 - Morning Star

There are also free versions available for them. For instance, if you wish to subscribe to a basic version (14-day free trial) of Morningstar, go to this MorningStar and hit the “Register” button.

Mutual funds charge fees for managing your funds; such fees are known as expense ratio which can adversely affect your retirement corpus. Many websites also provide the fee analyzer tool, which helps to analyze the hidden fee and how adversely it costs you. Their concept is simple, "Don't let high fees erode your savings."

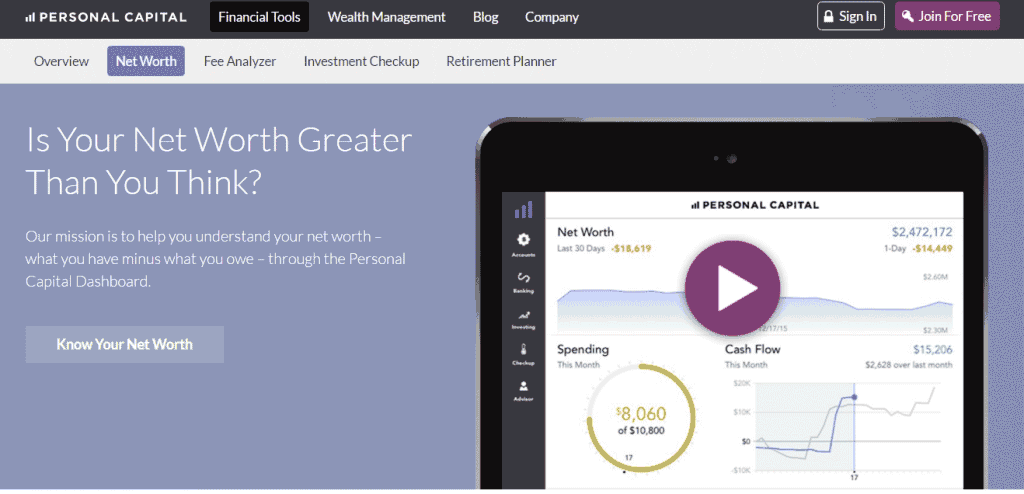

#2 - Personal Capital

IAn investment check-up or taking a second opinion on your portfolio is a good practice. This app helps you determine your current standing vis-a-vis the goal you want to achieve. The investment check-up tool lets you put your investment under a microscope and analyze it in detail. It helps you determine current asset allocation and the probable one.

Along with it, Net Worth calculators are also available free of cost. It helps you determine your net worth, which means what you have minus what you owe, wherein you can link all your account's investments, retirement, and bank accounts to get a holistic picture of the total net worth of an individual. Moreover, you can use personal capital for the same.

Financial Planning News and Research App

Many news agencies, like Bloomberg, Wall Street Journal, and the FT, provide a lot of information about the various investment options available in the market. Information about stocks listed on Dow Jones, FTSE100, and S&P 500, futures, options, currencies, and commodities, is available on their website. In addition, you can find a lot of information on the companies you plan to invest in. Annual reports, Profit & Loss statements, and other financial information are available for eager investors.

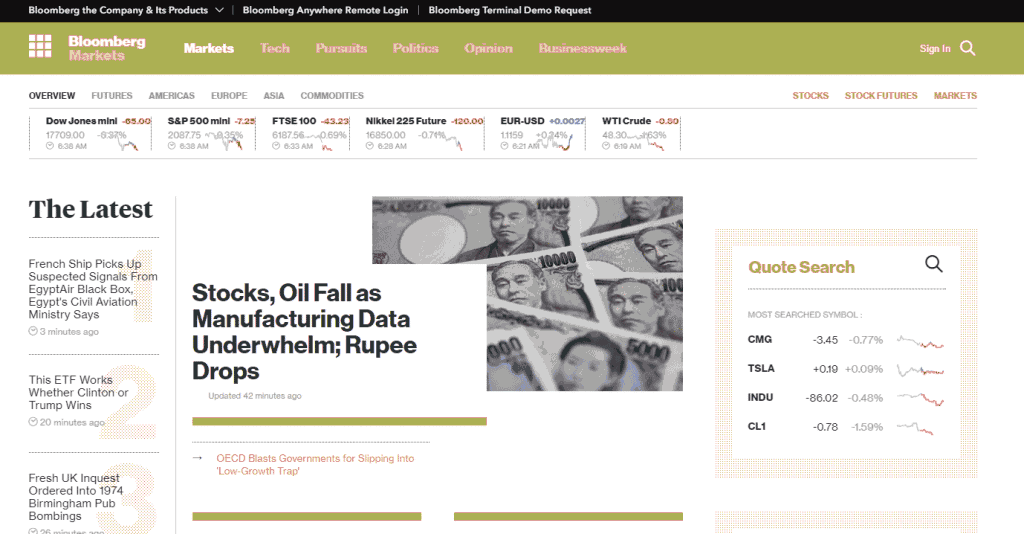

#1 - Bloomberg

Bloomberg.com provides a lot of financial information on its "Markets" page regarding stocks, currencies, commodities, rates + bonds, Benchmark, and Economic calendar. In addition, you can also find financial data about the various companies, indices, et al., which is very useful in creating financial models.

News Agencies also provide the latest financial and economic news and their analysis. Investment bankers consider news agencies like Bloomberg and Wall Street Journal as their holy grail and rely on their information. Financial data is readily available on the website professionals across investment banks use to analyze and do financial modeling. However, access to advanced data is available only for the paid version of Bloomberg.

#2 - Reuters

Reuters is a part of Reuters Group, PLC, which provides financial data. Reuters is an international news agency that provides financial equity reports and data. It is a collaboration of thousands of journalists whose information collates onto the Reuters website. As a result, the news is available on various topics ranging from Finance, Economics, Politics, Business, technology, et al., along with loads of valuable information on stocks, indices, derivatives, world markets, and crucial financial statements of various companies.

On the market page of Reuters.com, you can find a lot of data about U.S Markets, European Markets, Asian Markets, Currencies, Stocks, Options, Futures, Indices, Bonds along with Earnings per Share and Dividends of globally renowned companies.

Dividend Tracker App

As the name suggests, the Dividend Tracker collates all the dividend data about a particular stock. Such trackers are in the form of mobile applications where you can create multiple entries of different stocks. For example, you can enter the company's details and view its complete dividend payment history, a summary, and detailed data. Financial ratios include earnings per share or EPS, P/E Ratio, PBV Ratio, the stock's current price, the 52-week range, the dividend declared, and yield and payout ratios.

Dividend Tracker also displays the complete dividend history for 3 months, 6 months, and a year to 5 years. The same can also be seen as a chart for better understanding and analysis by the user. A Dividend Tracker is useful for professionals who can benefit from the immense amount of detailed information available and for individuals who seek to maintain a record of their dividend history.

Thus, from the above list of software and application details, we understand that these are quite flexible in usage facility and can be used in various type of devices. They simplify money management both for corporates as well as individuals. They can often track business transactions and financial data. The simple yet detailed interfaces prove to be very advanced financial management apps that keeps monthly budget under control and prevent the user from going overboard with spending by calculating any deviations.

Recommended Articles

This article is a guide to what are Financial Planning Apps & Softwares. We explain them related to financial planning, wealth management & dividend. You may also have a look at these articles below to learn more about finance: -