Table Of Contents

Finance Terms Definition

Finance terms refer to terminologies used in the financial world. The glossary of finance terms is vast and never-ending, but at the same time, it is important to know the most basic finance terms to achieve financial fluency and to deal with business functions.

Finance comprises diverse areas like corporate finance, personal finance, public finance, etc. Every field has its vernacular. There are financial product terms, terms used for financial services, etc. therefore, it is quintessential to know and understand the most used finance terminologies when dealing with diverse finance fields.

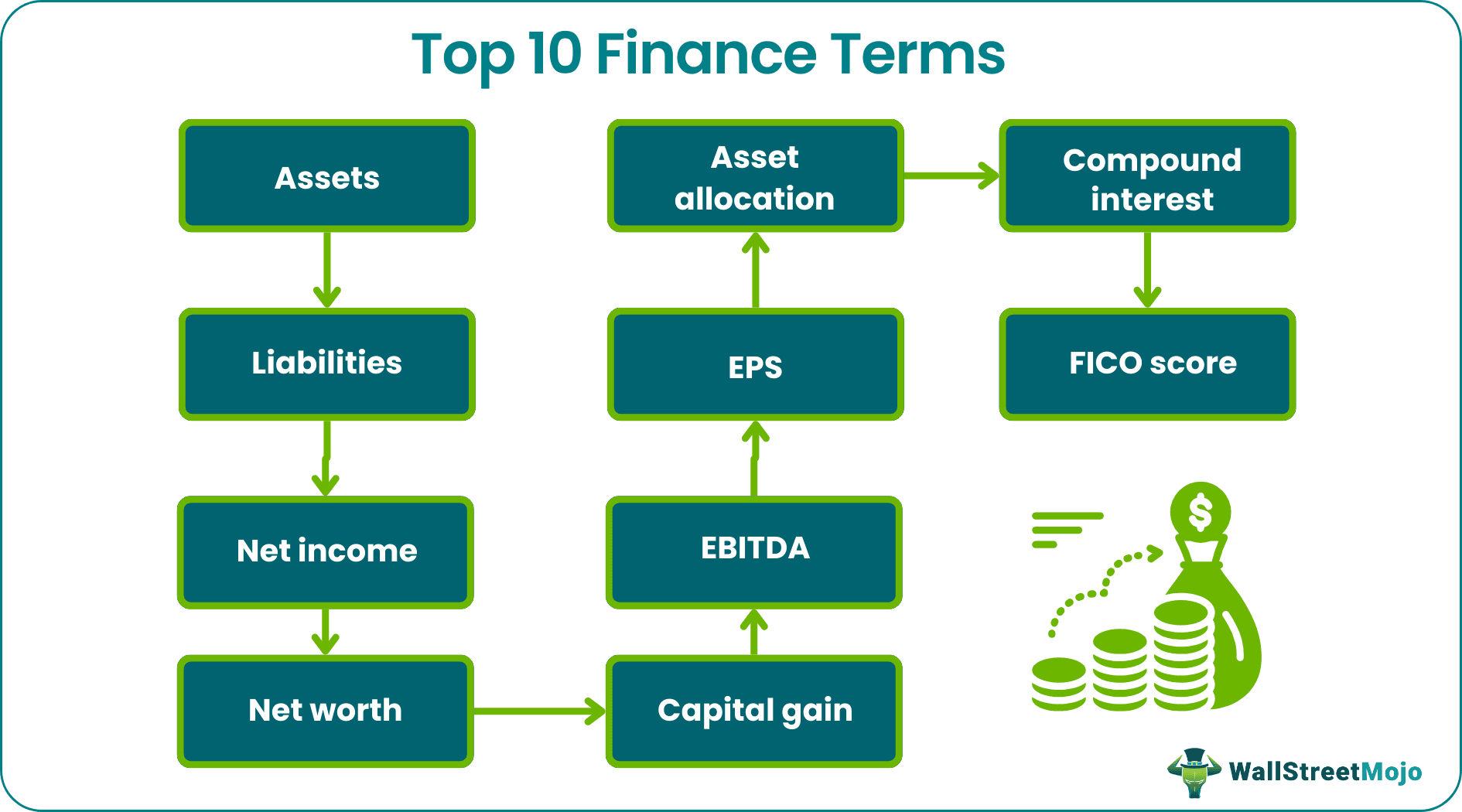

Top 10 Finance Terms Explained

Let's explain in brief ten basic finance terms:

#1 - Assets

Asset refers to the resource with financial value owned by an entity. In business, assets are used to produce economic value or future benefits. The values of assets owned by an entity are listed on its balance sheet (statement of financial position), and it is divided into current and non-current assets. Examples are cash, accounts receivables, and PPE.

#2 - Liabilities

Liabilities refer to the obligations in monetary values owed by an entity to other entities. Based on the time fixed for its settlement, they are differentiated into current and non-current liabilities on the balance sheet. The liabilities of an entity are easily analyzed from its balance sheet. Examples of liabilities are accounts payables, taxes payable, and accrued expenses.

#3 - Net Income

Net income is also known as net earnings, net profit bottom line, etc. In simple words, it is the difference between total income and total expenses. From the profit and loss account, it is calculated as the income or sales minus the cost of goods sold, all expenses, depreciation and amortization, interest, and taxes. The net profit from the profit and loss statement flows to the balance sheet and cash flow statement.

#4 - Net Worth

Net worth is the difference between total assets and total liabilities. This finance term points to the degree of the financial soundness of an entity. A positive net worth indicates the condition of wealth outweighing the debts; the entity is in a favorable state. Conversely, a negative net worth discloses an alarming state of debts outweighing the assets. The net worth is equivalent to the shareholder's equity value on a firm's balance sheet.

#5 - Asset Allocation

Another important finance term is asset allocation. It refers to an investment strategy that tries to balance the risk and reward by designing the investment portfolio to include a mix of assets in line with various factors like risk tolerance and the investor's goals. It is one of the most important terminologies in finance because it not only provides a blueprint and planning for investments, but also the reasonable practice of it can help an entity to smart spread their investment in such a way that no crash, downfall, or bad news can bring a complete loss.

#6 - EPS

EPS stands for earnings per share. In simple terms, it is total earning or net income divided by outstanding common shares. Specifically, it is calculated by dividing "Net income-Preferred dividends" by the weighted average common shares outstanding. A high EPS value points to the business's profitability; hence high EPS is attractive to investors.

#7 - EBITDA

EBITDA is the acronym for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's a measure of profitability. It can be easily calculated using the company's balance sheet and income statement details. For example, one of the methods of calculating EBITDA is adding taxes, interest expense, depreciation, and amortization to the net income.

#8 - Capital Gain

The finance term capital gain refers to the gain realized when a capital asset is sold because of an increase in its value compared to its purchase price. Capital gains remain on paper and are only realized when an asset is sold. For example, if a person buys a house today at $100,000, and after five years, the house's market value goes to $250,000. The person plays smartly and ends up selling the home for $260,000. The total $160,000 is the capital gains that the person earns from selling the property. The opposite is a capital loss when there is a decrease in the asset's value.

#9 - Compound Interest

Compound interest occurs when the interest is earned against the deposits and the accumulated interest. The interest is not solely derived from the principal but from the already earned interest also and increasing the total balance. For instance, for a $100 account balance in the savings account with 2% interest per annum, the account holder will have $2 ($100*2%) as interest income and $102 as account balance in the first year. The second-year interest income will be $2.04, and the account balance will be $104.04.

#10 - FICO Score

A FICO (Fair Isaac Corporation) score is a type of credit score presented in three digits (ranging from 300 to 850) which informs creditors about the possibility of a client returning the borrowed money based on their credit history. Hence, it helps creditors in credit approval or decline decisions.