Table Of Contents

What Is Financial Planning?

Financial planning is the process of understanding the future financial requirements and making provisions for them accordingly. It does not start and end in a specified time frame. Hence, it will not be wrong to say that it is an ongoing process.

You can call it the process of knowing our current financial standing, and understanding where we want to reach by charting out the way and taking appropriate steps to attain our goals.

But like any other plan, a financial plan also needs to be reviewed from time to time to understand whether they are off track and to take corrective measures if so.

Every individual works hard to earn money to save for themselves and their family's future requirements. Investing the saved cash into appropriate and suitable investment options is the key to securing a financial future. Different individuals have different requirements depending upon their income, expenses, and risk appetite.

At the onset of a career, a person can take more risks than those with more responsibilities. Therefore, different investment options catering to the varied needs of people are readily available in the market.

Investment options include stocks, equity, and debt, serving diverse requirements such as accessible liquidity, regular income, cash flow, and a capital increase.

A holistic financial plan guards short-term as well as long-term financial requirements. It also helps teach the golden habit of saving and determining whether an individual needs a particular asset.

As Warren Buffet rightly said about spending and savings," If you buy things you do not need, soon you will have to sell things you need," and," Do not save what is left after spending, but spend what is left after saving."

Let us understand what financial planning is and how can it benefit us?

In layman's language, financial planning continuously evaluates one’s financial position and to take care of investments accordingly, keeping one’s goals or objectives in mind.

Each one has different life goals to be achieved in varying stages of life. Let us understand how to formulate plans and the steps in attaining them.

Key Takeaways

- Financial planning involves understanding future financial needs and making provisions accordingly. It is an ongoing process that does not have a definite time frame.

- Financial planning starts with setting short-term, medium-term, or long-term goals.

- Sound financial planning is crucial to avoid missing essential life goals.

- It provides a roadmap to achieve financial objectives and reduces future uncertainties by managing money for personal satisfaction.

- Financial planning is a holistic approach that includes tracking expenses, budgeting, retirement planning, and assessing risk tolerance to organize finances effectively.

Financial Planning Process

It starts with establishing short-term, medium, or long-term goals.

- Do you want to be a millionaire before turning 40?

- Do you want to keep a buffer for harder times in life?

- Do you want to pre-plan for all future expenses like marriage, child's education, and retirement?

The answer lies in getting an objective and sound financial plan in place for everyone.

Where Do You Stand?

The next step involves correctly evaluating the assets and liabilities, what they currently own and what plan to own in the future.

That gives a clear understanding of the net worth and the current financial position vis-à-vis the objectives. In addition, it provides an idea of how far one is from the goal and the run rate to achieve the desired objective.

In other words, it helps determine the expected rate of return in the required number of years needed for attaining the set financial goal.

How To Create A Sound Financial Plan?

The third step in creating a sound financial plan is to develop a road map for the objectives.

The essence of creating a financial plan is to consider the short, medium, and long-term objectives. Then, investment is made accordingly in options that do not hamper liquidity for the short-term and medium-term. Whereas, for the long term investment, chances are chosen to keep the long-term perspective that usher increased invested capital.

Financial Plan - How Far Have You Reached?

It makes for a good financial plan if reviewed from time to time after implementation. Implementation is the key to achieving goals but along with it, what holds more importance is to keep checking the plan periodically. Financial planning is not static; it is an ongoing process that requires monitoring and reviewing financial decisions, at the very least, yearly. As they say, if one cannot control their finances, they will restrain them.

Financial planning is about being clutter-free and organized. It involves classifying the goals into short, medium, and long term and making provisions for them, keeping the cost of inflation in mind, and providing any untoward incident that might occur in the future. It provides you with a sense of security and confidence in dealing with whatever the end has in store for you more easily and lessens anxiety.

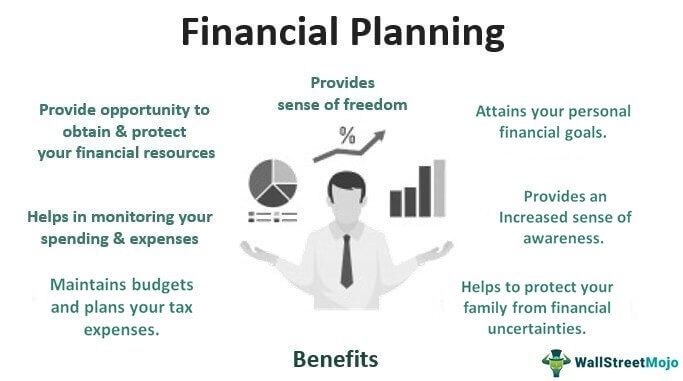

Benefits Of Financial Planning

Financial planning is a very beneficial practice. Without sound financial planning, one can miss out on important life goals. It provides a roadmap to achieving financial goals and reduces uncertainty about the future by managing your money to achieve personal monetary satisfaction. A holistic financial plan can increase one's quality of life and provide the following benefits: -

- It provides a sense of freedom as far as financial anxiety concerns investing properly to attain life goals easily through early anticipation of expenses and investment. It is an attempt to be future-ready and achieve personal financial plans simultaneously.

- It provides an increased sense of awareness and control of financial goals. In addition, since individuals are completely in control of their expenses, it saves them from facing unwarranted debt or reliance on others for financial stability or even bankruptcy in certain cases.

- The most important function of financial planning is safeguarding the economic future, thereby protecting personal relationships. A sense of security for the family members leads to enhanced personal connections and less trouble in the future.

- It also provides a comprehensive roadmap for future obligations, thereby obtaining and protecting financial resources.

- It helps monitor spending and expenses by planning your tax expenses, maintaining budgets, and increasing cash flow.

- It provides a better financial understanding of the current economic condition and what it may take to maintain the same standard of living in the future. Appropriately investing money in the current financial options can save for the future depending upon the objectives and risk appetite.

- It helps understand whether one needs a particular asset at a given point in time or not. So often, individuals accumulate unnecessary assets to cushion their current standard of living, thereby putting more pressure on their expenses. A good and sound financial plan helps avoid making such mistakes.

Importance Of Financial Planning

There is a myth that financial planning is for people with surplus money. On the contrary, a well-planned and holistic financial planning process can benefit everyone. It provides savings, investments, planning for education, major purchases, retirement, insurance, and other financial needs.

According to forbes.com, only 31% of financial decision-makers in families say they have created a comprehensive financial plan either on their own or with professional help. It also states that 35% of people have a plan to save for emergencies and only two-thirds have a plan to meet any of the six savings goals, such as emergencies, retirement, a child's education, or a down payment on a house.

Financial plans are designed for people from all walks of life, irrespective of their earning level. However, most people opine that financial goals are for the older ones. That is a complete myth! If individuals keep investing early, they will better achieve life goals than many peers. Most millionaires and billionaires are the ones who got hooked on financial planning at an early age and kept track of their financial decisions.

One of the biggest mistakes made is not to invest early. Investing at the onset of a career provides large scope for any gaps that might occur in the future. It also helps in determining spending habits. One can manifold their savings by making simple lifestyle changes and refraining from high-rate loan debt, such as credit cards. Experts at Randall Wealth Group emphasize that while starting early is crucial, a sound financial plan also requires regular adjustments across different life stages. Professional advisors help individuals balance liquidity, retirement planning, and risk exposure so that short-term goals don’t undermine long-term wealth security.

The easiest mantra to conjure up savings is to save first and spend later.

One can also check out some free financial planning software which could help you attain your financial planning goals.

Financial Planning And Analysis

A healthy financial plan suits the requirements of a particular individual, considering the monetary standing at that specific time. For example, a financial plan for a person in his 20s would be completely different from the one in his 40s.

#1 - Early 20s Financial Planning

Just at the onset of a career, a financial plan would incorporate long-term savings primarily into retirement funds or increase the contribution to the 401(k) plans. It is more important for individuals to comprehend the importance of saving and spending wisely. It is also essential to have ample liquidity by maintaining at least six months' salary in a fund for any unwarranted situation.

#2 - Mid 30s Financial Planning

If a person is in their 30s, they must buy life insurance to safeguard the future cash flows of their family. Investment options that provide liquidity in times of a crisis and finance future needs are the need of the hour. Spending habits need to be revisited, with ample attention paid to buying assets that drain future savings. An expensive car or house to impress the neighbors is better when it does not burn a hole in the pocket.

#3 - Late 40s Financial Planning

If a person is in their late 40s, their kids must be ready for a college education. Therefore, that is the right time to start thinking about their retirement and post-retirement care plans along with their kids' education funding. In addition, a medical condition might further put pressure on their savings. Hence, having a contingency fund is a good idea.

#4 - Early 50s Financial Planning

That is the time to lap up and bask in the glory of all the hard work one put in all those years. If any individual has not saved anything for retirement until now, this is the time to gear up and mobilize all their savings towards their retirement planning.

Experts claim that the amount of equity exposure in their early 20s or even mid-30s is much higher than what one can have in their 50s. Hence, it is time to play safe now and orient their savings towards debt instruments rather than equity.

Interested in learning more? You can check out our Financial Planning and Analysis course to increase your knowledge and have an edge in financial planning.

Related Articles: Certified Financial Planner.

Conclusion

As Antoine de Saint-Exupery has said, "A goal without a plan is just a wish." A detailed financial plan helps establish priorities, saving with an objective, and investing with a future roadmap leading to success; like everything else in life, planning and regular monitoring and reviewing leads to greater financial freedom.

"People often confuse financial planning with investing, but financial planning is much broader than that," said Noel Maye. Financial planning is a holistic and all-encompassing approach to the financial organization, which involves keeping track of spending, expenses, budgeting, risk tolerance, and retirement planning.

As has been rightly said, "Life is inherently risky. There is only one big risk you should avoid at all costs, and that is the risk of doing nothing", so do not sit still by doing nothing. Instead, secure the financial future by making a financial plan if one has not already done so.