Table Of Contents

Difference Between Forbearance vs Deferment

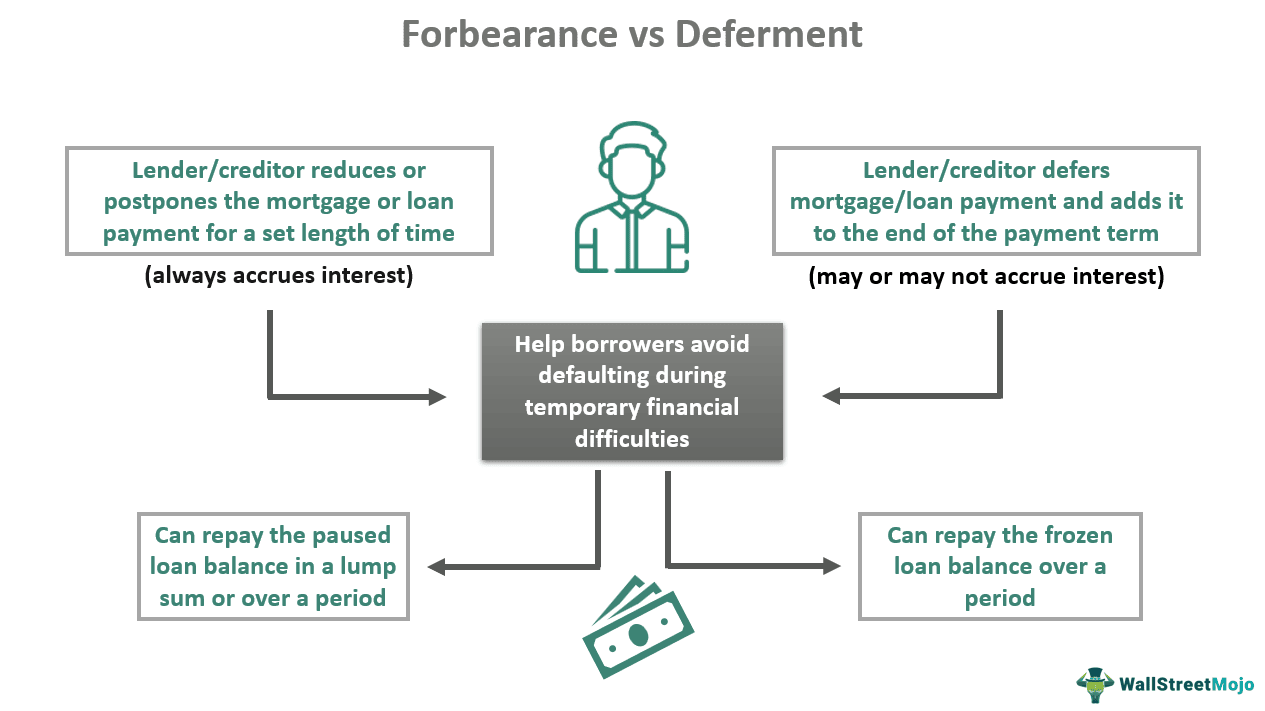

Forbearance refers to a provision wherein the lender or creditor temporarily reduces or postpones the mortgage or loan payment. On the other hand, deferment is the process of deferring payment and adding it to the end of the loan term. Both these options help borrowers avoid defaulting when they are experiencing temporary financial difficulties.

Interest always accrues in forbearance, regardless of loan type, but it may or may not be the case with deferment, depending on loan type. In addition, the debtor has the option of returning the paused loan balance in a lump sum or over a period after forbearance, but they can repay it over time in deferment.

What Is Forbearance?

Forbearance is an arrangement between a lender or creditor and a borrower or debtor that allows the latter to stop making payments on their mortgage or loan for a set length of time. Also, they are free to request it if they are on the verge of missing out on paying an installment or are unsure about their current financial status.

This provision works the best when individuals suffer from temporary financial hardship as they get time to arrange for finances to resume the repayment once the contract is over.

The reduction in the loan repayment amount or extension of the loan term does not imply any concession in the loan balance that borrowers are liable to pay. Instead, it is only temporary relief for them until they regain financial stability and resume repayments. The interest, however, continues to accrue during the forbearance period. It means that the borrower must repay any missed payments along with additional interests after the agreement is over.

The non-payment of installments during the forbearance period does not make the borrower defaulter as it is an agreement between them and the lender. However, after the tenure is over, any missed payments would make them a defaulter.

Borrowers can either pay the loan at once or over a period as per their suitability post forbearance. The terms, conditions, and eligibility for the provision vary from lender to lender. Thus, exploring the same is highly recommended.

Types Of Forbearance

Forbearance is applicable for student loans, credit card loans, and mortgage loans. The provision is beneficial to students who take on debt to complete their education. They can request it until they find a decent job to begin repaying the loan.

It is usually of two types - General and Mandatory. The lender may provide general forbearance in light of the borrower's financial troubles due to unemployment or medical emergencies. Individuals enrolled in internships or residencies in medicine or dentistry, the Federal Family Education (FFEL) Program loans, working with the AmeriCorps or the National Guard, on the other hand, are all eligible for mandatory forbearance.

Forbearance Example

If a borrower requests to postpone their loan payments for September, October, November, and December, they must make all four payments in January, including the amount for that month. It is worth noting that the debtor must not miss out on any installments post forbearance.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

What Is Deferment?

Deferment is often confused with forbearance. The words, however, denote two completely different scenarios. The borrowers opting for it can freeze their repayment for a set period and have the money added to the end of the loan.

The deferred loan repayment may or may not incur interest, making this process a more convenient alternative to forbearance. The duration varies depending on the type of loan. Similarly, whether interest may incur on the deferment repayment depends on the loan type:

| Interest May Accrue | Interest May Not Accrue |

|---|---|

| Direct Unsubsidized Loans | Direct Subsidized Loans |

| Direct PLUS Loans | Federal Perkins Loans |

| Unsubsidized Federal Stafford Loans | Subsidized Federal Stafford Loans |

| Unsubsidized portions of Direct Consolidation Loans | Subsidized portions of Direct Consolidation Loans |

This option is applicable for both mortgages and loans. Unemployed people, cancer patients, students, and military personnel are all eligible for this arrangement. It is a post forbearance scenario wherein the lender adds missing payments to the end of the loan term with or without any interest for the deferment period.

In the wake of the COVID-19 pandemic in 2020, the United States Federal Housing Finance Agency has introduced a new deferment option for homeowners with Fannie Mae and Freddie Mac-backed mortgages.

Under this option, effective from July 1, 2020, borrowers can ask their lenders to put a hold on their mortgage payments. Additionally, they can pay off the loan balance all at once after the loan term or when they sell or refinance their properties. The deferred repayment, in this case, will not accrue any interest. Furthermore, it will not last for an extended period, unlike traditional mortgage deferment.

Deferment Example

If a borrower skips 90 days of payments, the lender will allow them not to pay off the loan for the next three months. However, the life of the loan repayment would increase consecutively, adding the amount to be paid in the extra three months post forbearance period. So if someone has 10 years remaining to pay off a loan, the debt will extend to 10 years and three months. The borrower can repay the deferred amount over a period. Thus, they do not have to struggle with paying a lump sum for the loan balance.

Forbearance vs Deferment Infographics

Forbearance vs Deferment Comparative Table

Here is a table to state the differences between forbearance vs deferment:

| Particulars | Forbearance | Deferment |

|---|---|---|

| Definition | Temporarily reduces or postpones the mortgage or loan payment for a specific period | Defers the mortgage or loan payment and adds it to the end of the loan term |

| Option | Main Domain | One of the repayment options post forbearance |

| Eligibility | Financial difficulties due to unemployment, medical emergencies, divorce, natural disasters, internships or residencies in medicine or dentistry, the Federal Family Education (FFEL) Program loans, serving with the AmeriCorps or the National Guard, etc. | Financial struggle due to job loss, medical treatment like cancer or serving in the military, etc. |

| Interest Accrual | Interest accrues for the non-payment period and adds to the loan balance later, which increases the monthly payment | Interest may or may not accrue for the non-payment period depending on the loan type |

| Beneficiary | Lenders or creditors (banks or financial institutions) | Borrowers or debtors |

| Approval | At the lender’s discretion or per federal government ruling on meeting specific criteria | Depends on the lender or loan service provider |

| Span | Up to 12 months at a time with an extension of up to 18 months as proposed by federal entities | Length varies depending on the type of loan and deferment option. Could last for up to three years or even more |

| Payment benefits | Reduced or paused payment | Paused payment |

| Repayment terms | To be paid in one lump sum after the agreement or over a period | To be paid over a period |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Recommended Articles

This has been a guide to forbearance vs deferment. Here we discuss the top differences between forbearance vs deferment, along with infographics and a comparison table. You may also have a look at the following articles –