Table Of Contents

What Is The Troubled Asset Relief Program (TARP)?

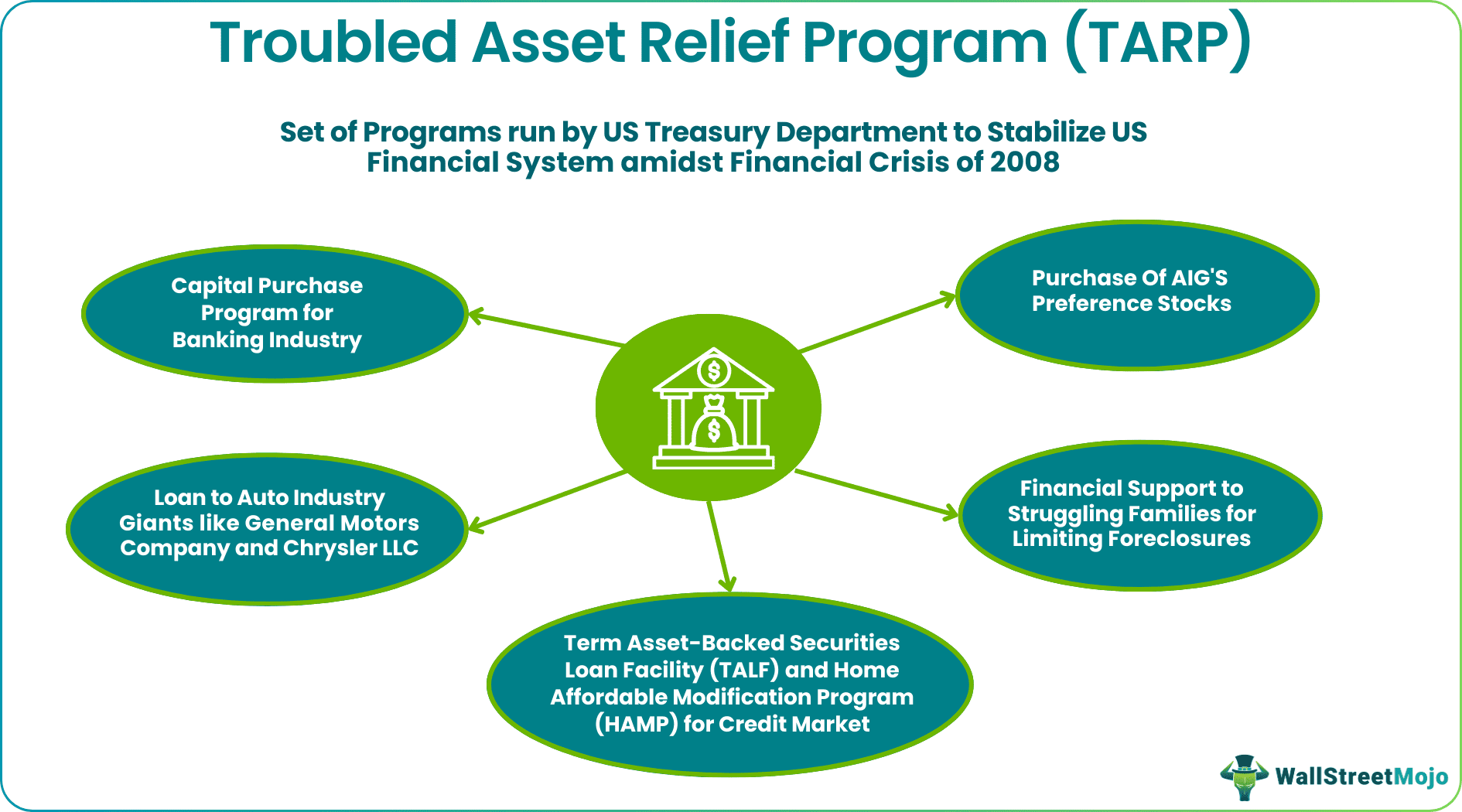

The Troubled Asset Relief Program (TARP) was a program created by the US government in response to the 2008 financial crisis. Its purpose was to stabilize the country's financial system by purchasing assets and equity from financial institutions that were struggling with toxic assets, such as mortgage-backed securities.

The TARP was unique because it allowed the US government to take ownership stakes in financial institutions, effectively nationalizing parts of the financial system. The program was controversial, with many arguing that it was a bailout for Wall Street that did not do enough to help struggling homeowners. Despite these criticisms, the TARP is widely credited with stabilizing the US financial system.

Table of contents

- What is the Troubled Asset Relief Program (TARP)?

- The Troubled Asset Relief Program (TARP) was an effort of the Federal government to stabilize, revive and support the US money market, credit market, auto industry, and other businesses during the financial crisis of 2008.

- TARP was proposed by Treasury Secretary Henry Paulson and recognized by President George W. Bush under the Emergency Economic Stabilization Act.

- TARP aimed to stabilize the financial system, support economic growth, revive the credit market, and prevent foreclosures.

- The Dodd-Frank Act limited TARP's initial assignment of $700 billion to $475 billion.

Troubled Asset Relief Program Explained

The Troubled Asset Relief Program (TARP) was a program introduced by the US government in 2008 to stabilize the country's financial system and prevent a collapse of the banking sector during the global financial crisis. It involved the purchase of troubled assets from banks and other financial institutions, as well as funding for struggling industries and support for struggling families.

In 2008, the US financial market faced a difficult time when the housing bubble burst, and homeowners failed to pay their home loans. This sharply declined US housing prices, leaving financial institutions struggling to recover their loans. As a result, banks had numerous mortgaged houses but lacked the funds to extend loans, while big names in the global financial market, such as Freddie Mac and Fannie Mae, also faced hardship. In addition, the auto sector, insurance companies, and other businesses were also in trouble.

Henry Paulson, the 74th US Treasury Secretary, played a pivotal role in resolving the financial crisis of 2008 with his innovative idea called the Troubled Asset Relief Program (TARP). TARP aimed to stabilize the US financial system and provide liquidity in the US money market. Paulson proposed that the federal government purchase mortgage-backed securities from the banks and other financial institutions to help minimize their losses and provide them with funds for further loan disbursement. On October 3, 2008, then-US President George W. Bush signed TARP into law under the Emergency Economic Stabilization Act, which provided the necessary support to alleviate the financial crisis.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Purpose of TARP

The Troubled Asset Relief Program was an attempt to deal with the consequences of the 2008 financial crisis. It was a redressal program to uplift the financial system of the US post-crisis. The initial sanctioned amount for TARP was $700 billion, but later it was decreased to $475 billion by the Dodd-Frank Act.

The program intended to stabilize and support the following areas of the financial system:

- US banking institutions: The government initiated the Capital Purchase Program with $245 billion of TARP funds to buy mortgage-backed securities, I.e., preferred stocks at 5% dividend from the banks. The dividend on these preferred stocks would rise 9% in 2013 to attract banks to buy back these securities. These banks included JP Morgan, Wells Fargo, Morgan Stanley, Bank of America, Goldman Sachs, Citigroup, etc.

- Credit market: The Fed sanctioned $27 billion to revive the credit and housing market through the Term Asset-Backed Securities Loan Facility (TALF) and Home Affordable Modification Program (HAMP). The credit providers used TALF funds to extend loans to homeowners and businesses, thus ensuring uninterrupted lending operations. In addition, the HAMP ensured a lower monthly payment and incentives for investors, homeowners, and employees.

- US auto industry: Another $80 billion were allowed to revive the auto industry. The aim was to bring the three automobile giants, General Motors Company and Chrysler LLC, from bankruptcy. In addition, it was an effort to save around a million jobs.

- American International Group (AIG): The government also purchased the preferred shares worth $40 billion of the biggest insurance provider AIG. It further extended the financial aid of $28 million to keep the business going.

- Struggling families: The Fed contributed $48 billion to the programs to support the families struggling to make loan repayment and planning for the foreclosure of their home loans.

Examples

According to a report by the US Treasury Department published on March 30, 2011, the TARP was profitable for taxpayers. The Treasury reported making a profit after receiving the payment of $7.4 billion from the three financial institutions, which has made the recovery amount to $251 billion. Now, let us see some instances where the TARP proved worthy:

Example #1

The Term Asset-Backed Securities Loan Facility (TALF) was a joint program with the Federal Reserve launched in March 2009 under TARP. The program aimed to revive the asset-backed securitization (ABS) markets, which had been severely impacted by the financial crisis, by providing non-recourse loans to buyers of AAA-rated asset-backed securities to stimulate consumer and business lending. TARP funds were used to provide credit support for these loans.

On June 30, 2010, TALF closed for fresh lending, while the outstanding TALF loan balance was $9 billion as of December 31, 2011. The Treasury Department believes that the taxpayers will make a good lifetime return from this program, estimated at $430 million.

Example #2

In May 2011, the automobile giant Chrysler foreclosed its TARP loan six years before the due date. After the interest, repayment sum, and cancellation amount, the government exited the company on receiving $11.2 billion out of $12.5 billion. Further, on December 9, 2013, Fed sold General Motors' $31.1 billion shares for full and final and recovered $39.7 billion out of the $51 billion investment.

Pros And Cons

The economists were divided into two different mindsets where; one believed that TARP was successful, and the other found it a failure. However, there were both advantages and disadvantages of this program, as discussed below:

Pros:

- Saved the banks like JP Morgan, Well Fargo, Morgan Stanley, Freddie Mac, Fannie Mae, and many others from collapsing during the financial crisis of 2008.

- Revived the credit and housing sector, which was shattered by the housing market bubble burst.

- Reduced the number of foreclosures by home loan borrowers struggling to pay the monthly installments.

- Turned out to be profitable for the federal government by generating $15.3 billion of profit for the taxpayers.

- Rescued the global economy from facing the worst consequences of the crisis.

- Saved around a million jobs and thus controlled unemployment.

Cons:

- It was unnecessary, according to the critics who believe it to be a profit-making opportunity for Wall Street.

- Paulson's first TARP concept of setting up the reverse auction failed since the banks were unloading their bad debts by selling the securities to the Treasury Department in this asset relief program.

- The banks posed hurdles in front of the borrowers by refusing loans to applicants with low equity.

- Around 100 banks failed to pay back the funds they availed from the government.

- Even after introducing this program, the US housing market faced a tough time for many years.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The Troubled Asset Relief Program (TARP) addressed the Great Recession by assisting troubled financial institutions, purchasing toxic assets, and injecting capital into the banking system to prevent a broader economic collapse. In addition, it aimed to stabilize the financial system and restore confidence in the markets.

TARP was controversial, but it did achieve its primary objective of stabilizing the financial system and preventing a broader economic collapse. It also helped restore confidence in the markets, although it had mixed results in reducing foreclosures and supporting small businesses. Furthermore, the overall impact of TARP on the US economy is still debated. Still, it is considered critical in preventing a deeper and longer-lasting recession.

The TARP experience provides several important lessons for future government interventions in the financial sector, including the need for clear and consistent messaging, the importance of oversight and accountability, and the risks of unintended consequences. It also highlights the complex trade-offs in balancing stakeholders' needs, such as taxpayers, investors, and the broader economy.

Recommended Articles

This has been a guide to what is Troubled Asset Relief Program (TARP). Here, we explain the topic in detail with its purpose, pros, cons, and examples. You can learn more about it from the following articles –