Table of Contents

Ghost Employee Meaning

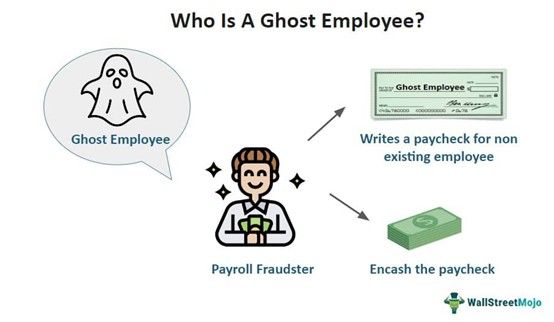

A Ghost Employee is an individual who is added to the employer's payroll but doesn't provide any services to the organization in reality. It is a fraudulent practice whereby a payroll staff maintains a salary account of such people to prepare and encash paychecks in their name intentionally.

Ghost employee cases are prominent in payroll fraud, which is common in companies that operate globally, have a decentralized payroll or accounting system, and issue paychecks in different currencies. The potential fraudsters working in the payroll department often find an opportunity to unethically draw money by issuing paychecks in the names of fictitious individuals or ex-employees of the firm.

Key Takeaways

- A ghost employee is a real or fake person whose name appears on the company's payroll database, but such an individual never shows up in the office for work.

- It is a fraud scheme where the payroll fraudster (someone from the payroll department) writes a paycheck in the name of a fictitious or ex-employee in the payroll system and draws the money.

- The easiest way to detect such fraud is to conduct a payroll audit, whether internal or third-party.

- The employer can prevent such malicious practices by constantly checking employees' backgrounds and strengthening the payroll system.

Ghost Employee Explained

A ghost employee, as the name states, symbolizes the presence of an invisible spirit, here employee. They are a worker on the payroll database, but they do not work for the company. It is an undue advantage taken by the payroll or accounts manager of their position in the organization. The manager keeps writing paychecks on fake employees' names at the end of each pay period. They withdraw these paychecks by falsely entering their secondary account numbers against such fake names.

Such crimes are often spotted in large organizations with an extensively decentralized structure. Also, it happens if the company has a strong global presence, massive turnover, a third-party payroll system, and no payroll audits.

A ghost employee perpetrator first finds a scope of conducting such fraud by keeping an employee's name in the pay records even after they leave the organization. Or they enter a fake or real person's name and details in the firm's payroll. Then, they maintain fake employee master records, timesheets, and wage rate information for such workers. Next, they write and issue a paycheck in the name of the ghost employee. And lastly, they keep the cash or withdraw money against these paychecks, which drops into their secondary bank account.

Examples

Let us consider the following scenarios to understand how such frauds occur:

Example #1

Zambia's Office of the Auditor General submitted audit report in September 2022, stating that the government ministries have disbursed more than $45 million as salary to around 9,800 employees who do not even exist. This audit indicated the massive misuse of public money in paying off workers whose identities are not known or verified.

Moreover, under this ghost employee scheme, 87 people were found to transfer government employees' salary funds to their private accounts. Even suspended officials have been receiving paychecks for the last 14 years. Others were either drawing double salaries or additional allowances.

Example #2

Another case of ghost employee fraud was detected when 73-year-old Thomas Brennan, a Fort Myers man, was found guilty of the RICO conspiracy and was sentenced to eight years of imprisonment. When Triangle Services of Florida undertook the contract of cleaning the Southwest Florida International Airport, Brennan added ghost employees to the payroll. These were the real individuals who had never performed the work yet were added to the third shift roaster.

Detection

It is quite difficult to spot such illegal activities. However, there are some ways of detecting such employees on the payroll database, one of which is an official payroll audit, which is the most effective. Once identified, the individuals or entities involved in the fraud are subject to severe ghost employee punishments.

Let us discuss the other ways of exposing such occupational fraud:

- Carrying out third-party payroll audits to verify the employees' master records and reviewing the company's accounts and payroll payments.

- Looking out for canceled checks since no real employee would cancel their paycheck.

- Identifying employee accounts with no or low tax deductions compared to the standard rates.

- Checking for the employee's social security number to verify their identity.

Prevention

Although ghosting employees on payroll is not always intentional, it may sometimes occur due to ignorance. Sometimes, the HR manager mistakenly forgets to remove a particular employee who exited the company from the payroll database. In such a case, the salary drops into the respective employee's account.

Either way, it is essential to prevent such instances in the organization to avoid misuse or draining of operating funds. Following are the different ways to ensure such frauds do not happen:

- Perform frequent background checks of the employees.

- Distribute payroll responsibilities among employees in the payroll department to ensure cross-verification and multi-party approvals.

- Maintain employee records and conduct regular audits using the official auditing system and software.

- Outsource the payroll process to a payroll partner to maintain transparency for large organizations.

- Build a robust payroll and financial procedure to eliminate the scope of discrepancies.

- Use a facial recognition system to record employee attendance.

- Train employees to adopt anti-fraud strategies.