Table Of Contents

What Is Agency Cost?

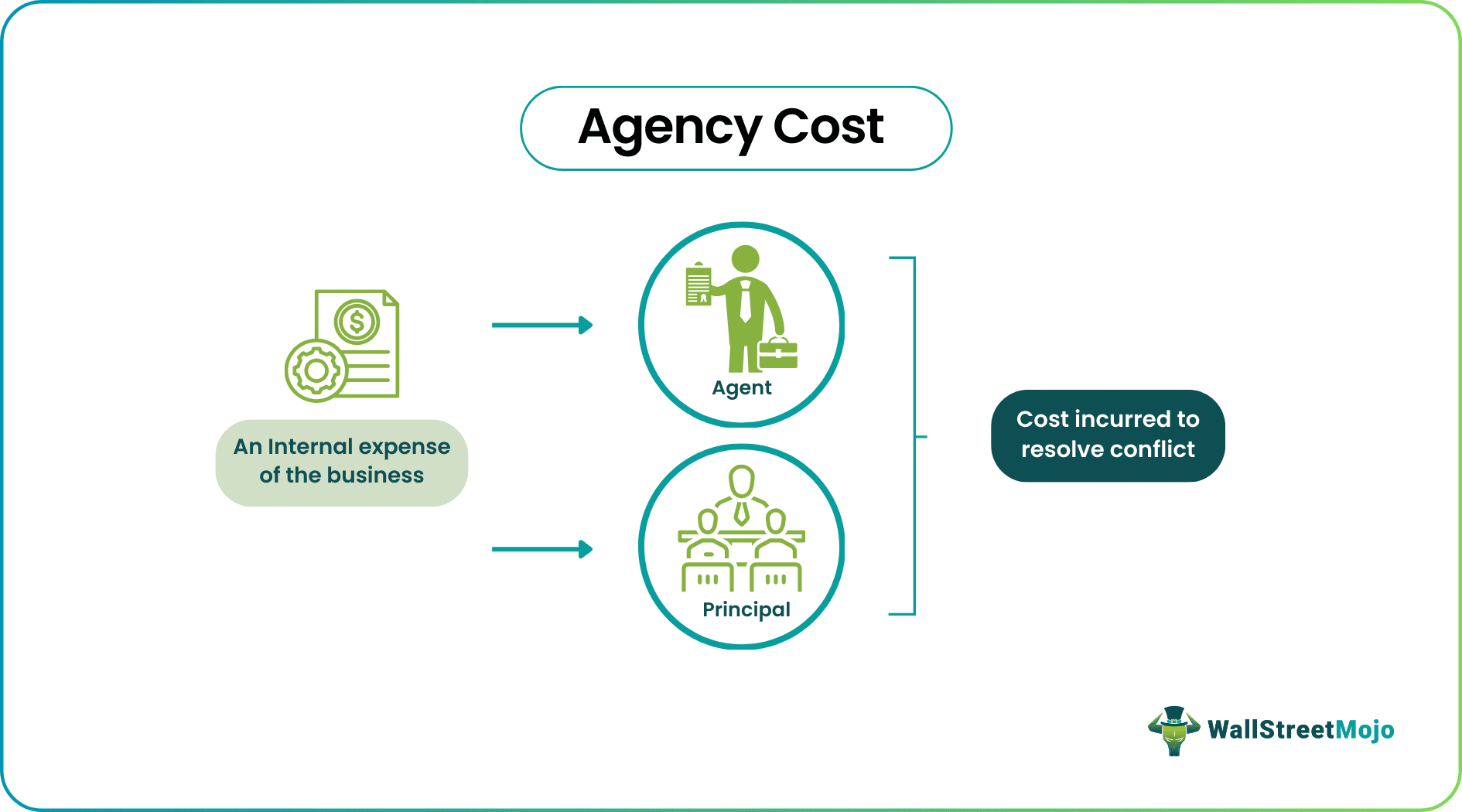

Agency cost is commonly referred to as the company's disagreements between shareholders and managers and the expenses incurred to resolve this disagreement and maintain a harmonious relationship.

This form of dispute becomes obvious as the principals or the shareholders want the company's managers to run it to maximize the shareholders' value. On the other hand, the managers want to operate to maximize the wealth. This might even affect the market value of the company. Therefore, the expenses to handle these opposing interests are termed agency costs.

Key Takeaways

- Agency cost refers to a typical corporate situation due to disagreements between shareholders and managers; the cost incurred to resolve the conflict and maintain a cordial relationship is known as agency cost.

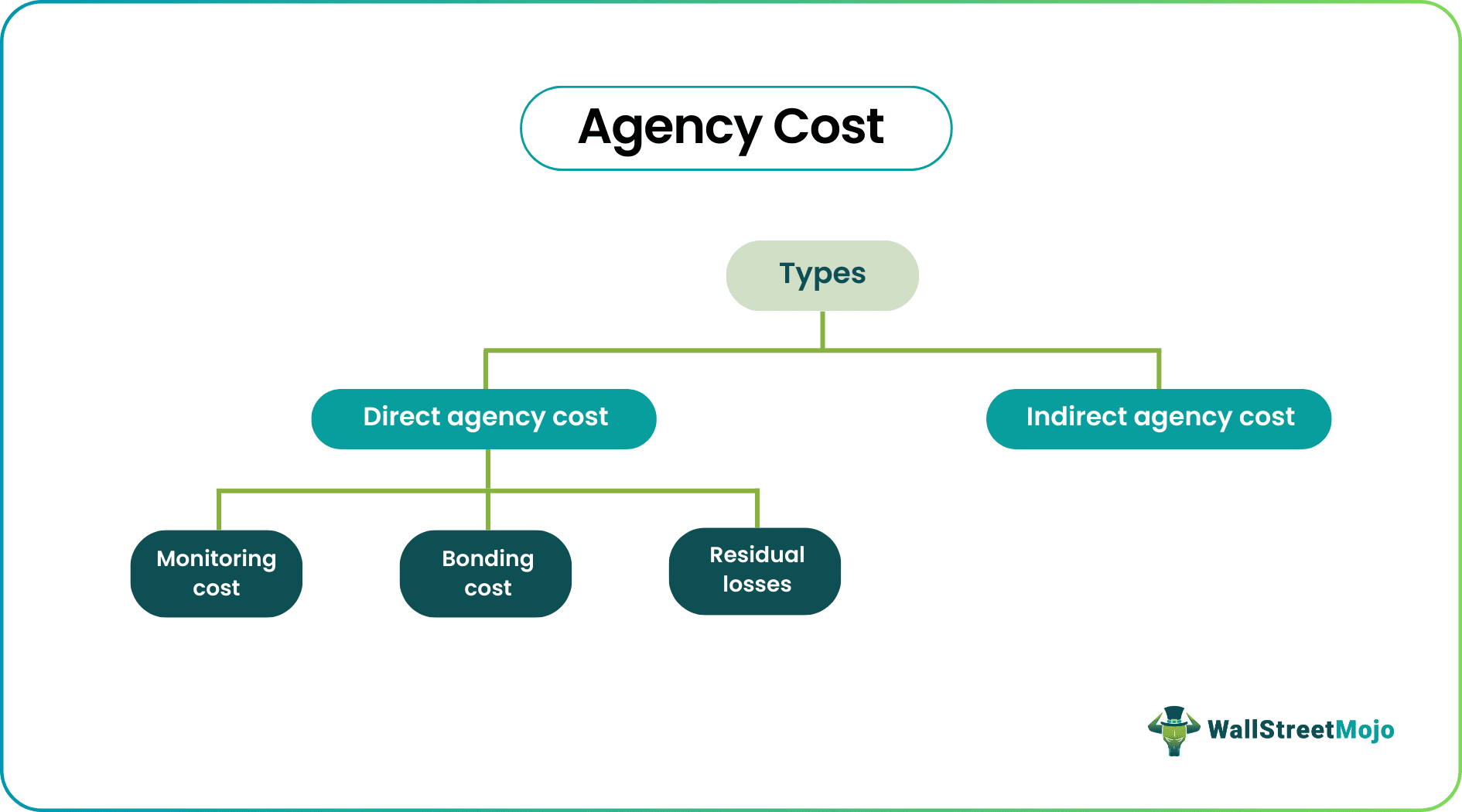

- These costs are of two types: Direct agency costs include monitoring costs, bonding costs, and residual losses. Indirect agency costs refer to costs incurred when companies cancel potential projects.

- It intends to harmonize the interests and benefits of management and shareholders. On the other hand, if a debt is involved in agency costs, it may affect the share price of the company's stock.

Agency Cost Explained

Agency cost theory refer to the various costs and problems that arise due to mismanagement or inefficiency and give rise to conflict of interest among the company stakeholders. Such kind of conflict is not limited to only management or employees, but also between the management and shareholders, management and creditors, etc.

Here the main problem starts when the agency, which may be an individual or a group, does not follow the rules of business and ethics. They are entrusted with the responsibility of important decision making but unfortunately, they look at their own interest and deviate from the actual objective.

Groups that do not contribute to the common interest of the stakeholders and objective of the company often lead to expenses which affect the shareholder value directly or indirectly. Sometimes the management may not be competent ad confident enough to take up projects that are risky but generate more return.

The situation might also be just the opposite, where the management takes up too much risky projects, hoping to get higher return without proper competency, thus leading to huge loses. Even lack of proper flow of communication and incentive to motivate for work may lead to such problems within he organization.

It is important to note that agency costs are nearly impossible to be eliminated by any corporation. However, as mentioned, the incentive schemes should be appropriately used as they help to reduce agency costs. If left to handle the disagreements and competing interests, the management would mean acting in its good and incurring much higher prices.

Types

Agency cost finance can be broadly classified into two types: Direct and Indirect Agency costs.

#1 - Direct Agency Cost

- Monitoring Costs: When the activities of the company's management are aligned to the benefits of the shareholders, and these restrict the activities of the administration. The direct agency cost of maintaining the board of directors therefore to a certain extent, is also a part of the monitoring costs. Other examples of the monitoring costs are the employee stock options plan available for the employees of a company.

- Bonding Costs: Contractual obligations are entered between the company and the agent. A manager stays with a company even after it is acquired, who might forgo the employment opportunities.

- Residual Losses: If the monitoring bonding costs are not enough to diverge the principal and agent interests, additional costs are incurred, called the residual costs.

#2 - Indirect Agency Cost

The indirect agency cost theory refer to the expenses incurred due to the opportunity lost. For example, there is a project that the management can undertake which might result in the termination of their jobs. However, the company's shareholders believe that if the company undertakes the project, it will improve its values. If, however, the project is rejected, it will have to face a huge loss in terms of shareholders' stake. Since this expense is not directly quantifiable but affects the interests of the management and shareholders, it becomes a part of the indirect agency costs.

Example

Let's take the example of agency cost finance.

If the management involves building an office area and premises on huge acres of land and then hiring personnel to maintain the same, where the land does not add value to its costs and the employees, the management is simply adding up the operating costs of the company. This reduces the company's profits and thereby affects the value of the benefit received by any shareholder. This is a form of opposing interests and needs to be addressed – which involves a type of cost named the agency costs.

How To Reduce?

The most common method to handle the indirect or direct agency cost involved in a company is implementing an incentive scheme, which can be of two types: financial and non-financial incentives schemes.

#1 - Financial Incentives Scheme

Financial incentives help the agents by motivating them to act for the interest of the company and its benefits. The management receives such incentives when performing well on a project or achieving the required goals. Certain examples of the financial incentives scheme are :

- Profit-Sharing Scheme: The management becomes eligible to receive a certain percentage of the company's profits as a part of the incentive scheme.

- Employee Stock Options: A predetermined number of shares are available to be bought by the employees at a price that is usually lower than the market.

#2 - Non-financial Incentives Scheme

This scheme is less prevalent than the financial incentives scheme. These are less effective in reducing agency costs when compared to the financial incentives scheme. Some of the common examples are :

- Non - financial rewards and recognition from peers and colleagues.

- Corporate services and added benefits.

- Better workspace.

- Better or improved opportunities.

Benefits

Some of the benefits are as follows:

- They are targeted towards aligning the management and shareholders' benefits and interests. This means keeping the company in good shape for both parties.

- Due to the right application of these agency costs, the firm's market value remains intact and improves in the eyes of the stakeholders of the company.

- The concept points out the fact that incentives and compensation is important to achieve the common objective. It should align both so that there is motivation to work and a sense of competition among employees to perform better.

- It encourages a strong and transparent system of reporting and monitoring work practices so that there is accountability, and the significance of corporate governance is highlighted.

- It also leads to efficient allocation of resource and less wastage because the management or parties responsible for the high agency cost have better incentive, skill and competence to reduce it.

- The process also highlights the role of shareholders and help them to play an active role.

Limitations

Some of the limitations are as follows:

- It means the involvement of financial resources which ultimately impacts the company’s balance sheet. The cost of running the business may go up significantly due to high compensation and better monitoring system.

- It might involve higher or more resources than usual practice in some cases where both the parties – the principal and agent- are difficult to align with all incentives or costs involved.

- They might impact the share price of the company's stock in case a substantial size of the debt is involved.

- Sometimes the alignment of objectives may focus more on short term benefits, which can be detrimental to the business and lead to loss or opportunities in the long term.

- Analysis of the agency cost problem is not easy. Measuring it is quite complex and involves many parties and situations within the business. It is very difficult to exactly assess or estimate the magnitude of the cost.

- It is necessary to understand the fact that this kind of cost can be kept under control but cannot be totally eliminated from the organization. there will always be some amount of conflict of interest and misalignment of objectives because there are many factors that are a part of it. They include human behavior and organizational dynamics that cannot always be controlled.

Thus, we come to the conclusion that no doubt this concept of agency cost problem helps in aligning the business objective with the performance of management, employees and other stakeholders and at the same time it gives important ideas about how to conduct the process for improving decision making and efficiency of the business. However, it has its own share of limitations and complexities which highlights the fact that it should be done with careful study, evaluation and consideration.