Table Of Contents

Cumulative Voting Meaning

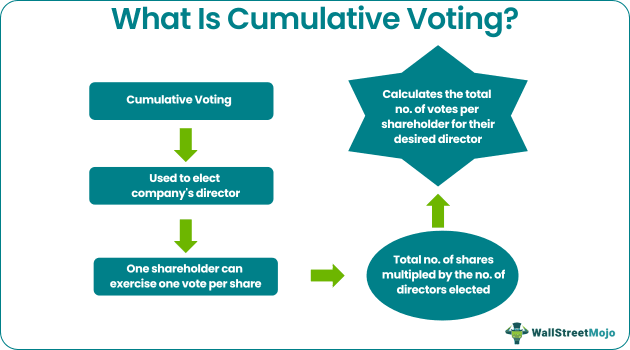

Cumulative voting, also known as accumulation voting or weighted voting, is the process through which the shareholders elect their company’s directors. In this procedure, the companies allow each shareholder to exercise one vote per share. Therefore, the total number of votes they cast for their desired candidates is calculated by multiplying the number of shares they hold in the company and the number of directors to be elected.

This voting system helps protect the minority shareholders' interest in the company. Under this system, each shareholder can allocate all applicable votes to a single candidate to ensure their desired candidate for the profile wins and gets elected.

Key Takeaways

- Cumulative voting refers to a method employed by the shareholders to choose the firm's directors.

- It is also known as accumulation voting or weighted voting.

- Each shareholder has a vote equal to their shareholdings times the number of directors to be elected in this process.

- It benefits minority shareholders by providing them a better chance to select the candidate of their choice.

- The organization may use cumulative voting to safeguard the minority shareholders' interest while choosing the directors.

- While selecting directors, companies can adopt straight voting and cumulative voting.

How Does Cumulative Voting Work?

Cumulative voting gives every shareholder an opportunity to participate in the voting for directors. As a result, they can utilize their existence to the best possible extent. The process preserves the rights of the minority shareholders and gives them a chance to elect the candidate of their choice as the company director.

In the normal voting process, a shareholder can vote for 1,000 votes for a single candidate. As a result, the chances would have been very less for that candidate to get elected if other major shareholders don’t vote in favor of that candidate. However, with 5,000 votes, the chances for that candidate to get selected significantly increase.

An organization can use this voting method to protect the interest of minority shareholders while choosing the directors. Minorities get more election power with this method. If they decide on this voting system wisely, there are good chances that they will select their preferred candidate on the board.

In the cumulative voting system, shareholders can elect one of their candidates out of the total seats available. For example, suppose a shareholder has 500 shares of a company, and four directors are elected. In that case, the shareholder can cast 500 multiplied by four, which means 2,000 votes favor a single candidate. The shareholder can also cast 1,000 votes each to 2 candidates or divide his 2,000 votes in whatever way between 4 candidates. That will strengthen the chance of winning that candidate. Thus, minority shareholders can also impact the board.

Example

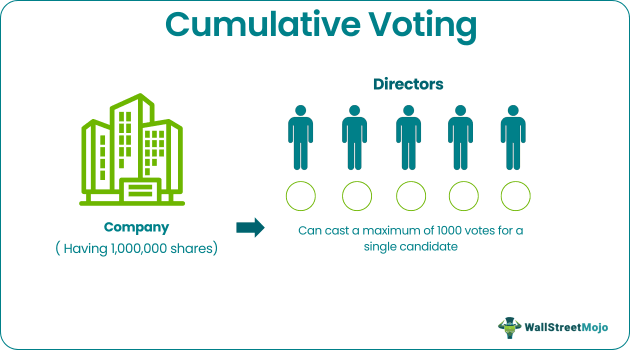

Suppose a company has 1,000,000 shares in total. An investor named Mr. A has 1,000 shares out of 1,000,000 total shares. The company needs to choose five directors. In straight voting, A can only cast a maximum of 1,000 votes for a single candidate. But in cumulative voting, he can divide his shares in whichever way amongst the candidates. For example, suppose he wants to elect a single candidate.

In that case, he can vote 1,000 multiplied by five, which means 5,000 votes for a single candidate, and suddenly the chances of getting that candidate increase. On the other hand, if the shareholder likes two candidates, he can divide his 5,000 votes between these two candidates.

Advantages

This process of cumulative voting has an extensive set of advantages, which one must explore. Some of them have been listed below:

- Cumulative votes are used to empower minority shareholders.

- Groups of minority shareholders can team up and have very high chances of electing their preferred candidates.

- It reduces the probability that the majority shareholders choose the same candidates.

Disadvantages

The cumulative voting process is not devoid of flaws. It has a few disadvantages. Let us have a look at them too:

- It can result in instability in the organization, resulting in less continuity.

- This method is less useful if there is no proper communication channel in the organization.

Cumulative Voting vs. Straight Voting

When choosing directors, companies can employ two types of voting: straight voting and cumulative voting. Let us understand the difference between the two using the example below:

If four candidates need to be selected and a shareholder has 100 shares, then,

- The shareholder can only vote 100 shares for each candidate in straight voting. Therefore, though he has 400 votes, he can only vote 100 times for a candidate.

- In cumulative voting, the same shareholder can cast 100 multiplied by 4, which means 400 votes for the same candidate or 200 votes for two candidates. The shareholder can split his 400 votes into four candidates as desired. Thus, the winning chances of his preferred candidate increase.