Table Of Contents

What Is The Full Form Of AGM ? - Annual General Meeting

The full form of AGM is the Annual General Meeting. AGM can be defined as an official gathering of the stockholders and directors of an incorporated company in every calendar year, and the most purpose of the annual general meeting is to ensure that there is 100 percent compliance concerning all the lawful requirements like preparation and presentation of the company’s financial statements, the appointment of an auditor, etc.

This meeting is a yearly event where the shareholders of the company come together to discuss about important matters related to the company management and make decisions. It is crucial for transparency and corporate governance point of view. It also helps the shareholders. know the company better as well as express their own concerns and questions regarding its operations.

Full Form Of AGM Explained

AGM is used for Annual General Meetings. An AGM can be defined as a mandatory meeting that must be convened by incorporated companies (both private and public) once in every financial year. It must be held at the incorporated company’s registered office, and it must be conducted on a business day during office hours only.

As the full form of AGM in company suggest, this annual event allows the shareholders to express their concerns regarding various operational initiatives undertaken by the business as well as understand the business process in a better way. It is a method through which every company communicate directly to their shareholders in order to maintain transparency, good relation and accountability.

In this meeting the directors elected by the shareholders themselves, present the reports related to the company which addresses various strategies and policies undertaken by the company to increase efficiency, generate better returns and improve overall performance.

Shareholders who have right to vote, will cast vote related to appointment of directors, decisions regarding compensation of executives, dividend payout, auditor appointment, etc. The various issues related to other important matters are discussed and communicated to shareholders. A separate time is allotted to allow them to ask questions and clear doubts. In this way the executives and the shareholders exchange their views and opinions and interact with each other.

The rules of AGM may change, depending on the place where the company is operating and the governing laws of the company. The rules also vary for public and private company.

Purpose

As the full form of AGM in company suggest, the purpose of the Annual General Meeting is to ensure full compliance with all the independent statutory requirements such as preparation and presentation of a company’s financial reports, auditor/auditors’ appointment, the election of a board of directors, and so on. In this light, it can be said that the AGMs are held to ensure that the business of a company is appropriately conducted on behalf of it, to make significant decisions concerning the welfare of the company, to approve the audited financial statements, to update the equity holders regarding the past and upcoming activities of the company, and so on.

Objectives

As per the full form of AGM in bank or a company, AGMs are conducted with an objective of transacting about ordinary as well as special business.

#1 - Objectives Pertaining to Ordinary Business

- To present the audited accounts in front of the company’s members and equity holders and get the same approved by them.

- To elect the new BODs or board of directors by means of a voting system.

- To appoint the auditors for the upcoming calendar year.

- To declare and affirm the dividends as provided by the company’s BOD.

#2 - Objectives Pertaining to Special Business

- To seek the members and equity holders’ approval if the board of directors wishes to enhance the company’s authorized equity capital.

- To seek approval of members and equity holders if the BODs want to alter the company’s articles of association.

- To address any conflicts, issues, or grievances raised by the investors of the company.

- To safeguard the interests of the investors of the company.

It is held so that the incorporated company’s equity holders and members can vote on matters like selecting the board of directors, viewing the audited accounts of the concerned company, giving their approval on the same, etc. As per the full form of AGM in bank or a company, in large companies, it is the only meeting conducted in a calendar year where the equity holders and executives interact. SEC or Securities and Exchange Commission has made it mandatory for public companies to keep their stockholders informed about the past, present and future activities of a company by means of an AGM. Public companies must conduct an AGM each financial year. The time between two consecutive AGMs must not exceed over fifteen months, and it is even mandatory for companies to send a notice in writing and that too at least 21 days ahead of the AGM’s date, mentioning all the details of the same.

Example

ABC, a newly incorporated company, wishes to hold its first AGM. Take ABC through all the requirements that it must necessarily fulfill to conduct an AGM.

Solution

ABC is a newly incorporated company that must hold its first annual general meeting within a period of nine months right before the end of a financial year. The company must ensure that it sends a written notice to all its members and equity holders at least 21 days before it is planned to be conducted. ABC must make sure that it is maintaining the quorum of AGM to be levied with the status of a valid meeting. If ABC is a private company, it must have a minimum quorum of 2 members, and if it is a public company, it must have a minimum quorum of 3 members.

Importance

Now let us study the importance of AGM in the corporate environment.

- The annual general meeting holds huge importance and acts as a medium for incorporated companies (both public and privately held companies) to disclose significant information to the members and equity holders of the company.

- It is also conducted to get the audited financial reports of the company approved by the members and equity holders of the same. They are highly important from an equity holder’s point of view too.

- Equity holders during an AGM get to share their issues, concerns, and grievances, and they also get to know their share of dividends and the company’s ongoing and plans.

- It is a forum, where both the management and the shareholders can engage actively with each other to ask questions, express their own concerns and also give feedback.

- In this meeting, the shareholders get the opportunity to exercise their right to vote and have a say in various important matters of the company like dividend payment, director appointment, etc. This gives them a sense of satisfaction that their concerns are given importance.

- Since the shareholders get the chance to elect directors who will help in running the company efficiently and also represent the shareholders it is crucial process because it helps in establishing a say in the corporate governance of the company.

- The shareholders come to know of various plans, programs, investment strategies and innovations taking places within the company. It gives them an idea about how the money contributed by them are actually being used and whether such methods are really profitable for the company in the long term or not.

- It also gives a long term vision about the future prospects of the company in terms of growth, expansion, profitability, efficiency and return. If the shareholders are satisfied that the company is performing well, they tend to invest more in it.

Thus the above are some of the points that clearly state the importance of this meet both from the shareholders and company management point of view.

Benefits

The process proves to be extremely beneficial for any company due to the following reasons.

- An annual general meeting formulates a way for initiating communication between a company and its equity holders. The owners of the company, i.e., shareholders, get an insight into the present, past, and upcoming activities of the company, such as its performance, plans, strategies, targets, and so on.

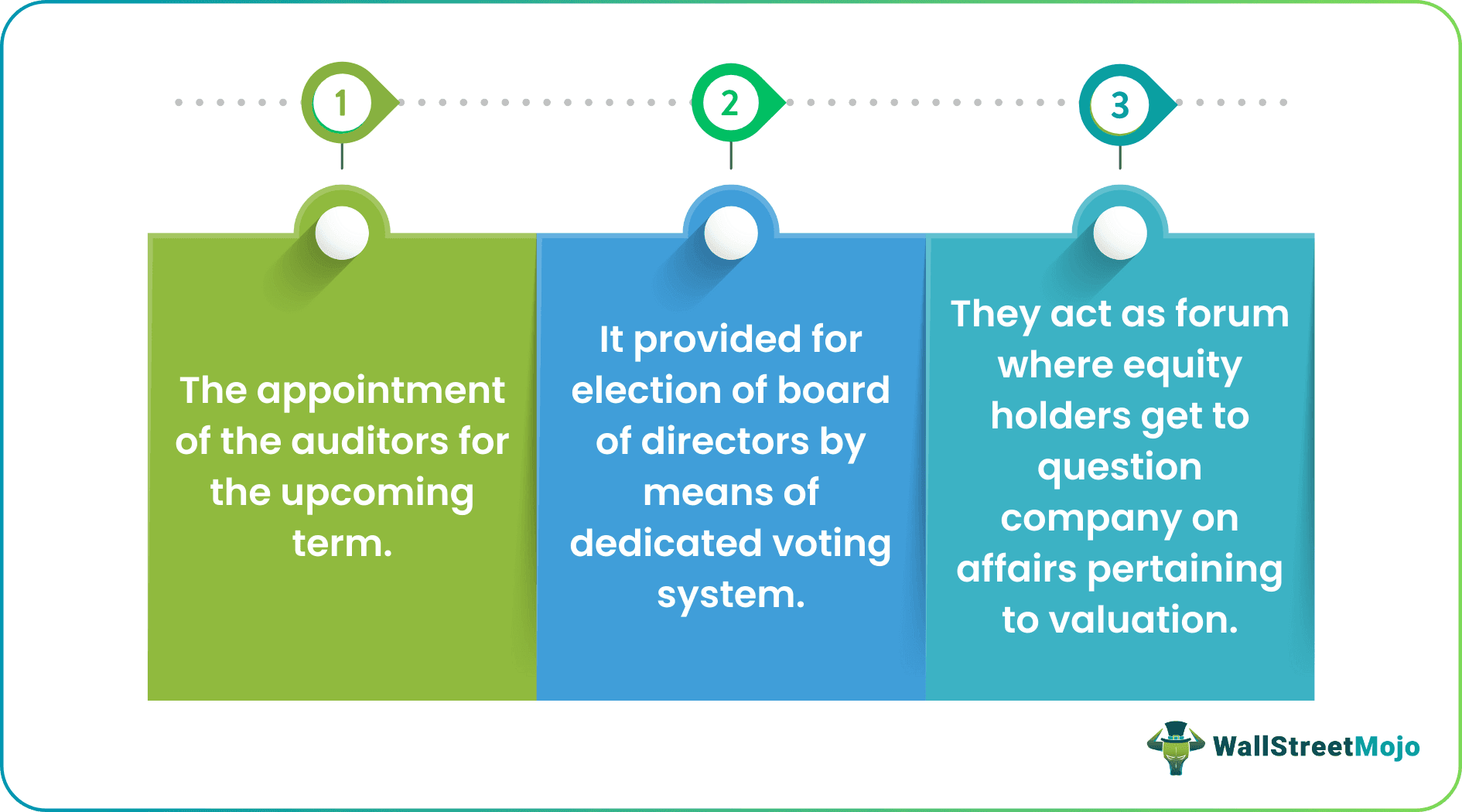

- They also act as a forum where the equity holders get to question the company on affairs about the valuation of their holdings and growth prospects too.

- The appointment of the auditors for the upcoming term is another advantage of conducting an AGM.

- It also provided for the election of the board of directors using a dedicated voting system.

- Another benefit of having an AGM could be a proposal and confirmation of dividends that the company’s investors will supposedly receive on their holdings.

Annual General Meeting Vs Extraordinary General Meeting

The key difference between the Annual General Meeting and Extraordinary General Meeting are-

- An AGM is convened by the Board of Directors, whereas an EGM is convened by the Board of Directors, Board on the requisition of the equity holders or tribunal.

- A penalty is levied in case if an AGM is not summoned within the prescribed time, whereas the same is not levied in the case of an EGM.

- An AGM can be conducted on any day apart from national holidays and during office hours only, whereas an EGM can be conducted on any day irrespective of whether it is a national holiday or not and also at any given time of day.

- An AGM is concerned with ordinary and special business, whereas an EGM is concerned only with special business.

Thus, the above are some noteworthy differences between the AGM and EGM. It is necessary to have good idea about them in details so that investors get an idea about how important it is to participate in such meeting and learn more about the business in which they are investing. It also provides an assurance that the money is being channelized in useful purpose which will be ultimately beneficial for them.