Table Of Contents

Société Anonyme Definition

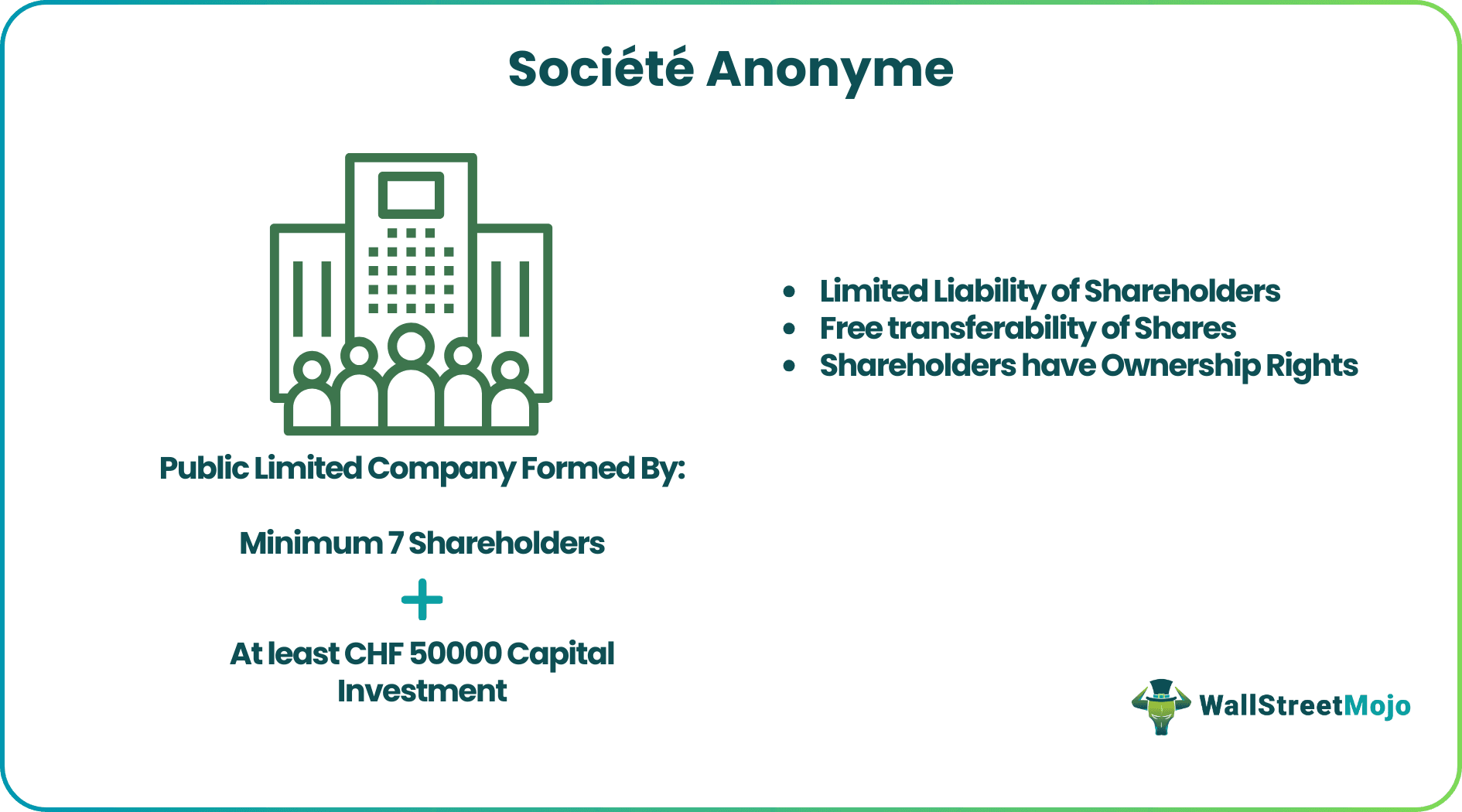

Société Anonyme (SA) refers to a public limited company that holds property ownership rights, and is accordingly responsible for the benefits and liabilities associated with the venture. It is a French term for corporation, a common type of business structure in the United States. Shareholders in an SA have limited liability proportionate to their investments.

An SA is a business entity, with equivalents in several countries, such as the UK, the US, Belgium, Switzerland, and others. However, certain characteristics of this incorporation may differ from one country to another. For instance, it is a public limited liability company in Luxembourg. The essence of an SA is defined by certain peculiar features that can be called its universal attributes. These are the limited liability clause, shareholders' ownership rights, and share transferability.

Key Takeaways

- Société Anonyme (SA) is a term of French origin referring to a “public limited company”. It is a separate business entity formed by two or more shareholders who hold ownership rights in the organization, and their liability is limited to the amount

- Globally, an SA has multiple equivalents. For instance, it is called a public limited company in the UK, a corporation in the US, and a public limited liability company in Luxembourg.

- These establishments (i.e., SA) were initially defined and formed under the French Commercial Code in 1807. In 1808, a new code was written to regulate commerce and discourage speculation in the market.

Société Anonyme Explained

Société Anonyme is a French term that translates to “anonymous society” in English. A business organization in this form is similar to a public limited company, where shareholders have limited liability, and the shares traded on the stock market represent ownership rights. An SA can sign contracts and transfer property. As an independent legal entity, an SA is obligated to accept accountability if lawsuits are filed against it.

The entity, however, has a different name in every country. In Germany, it is renowned as Aktiengesellschaft (A.G.), and in the US, as mentioned above, it is a corporation.

Let us consider some primary features of a Société Anonyme:

- Limited Liability: Shareholders are not personally liable for company debts and obligations beyond their investment in the company.

- Ownership: The company's ownership is divided into shares, and shareholders hold these shares to represent their ownership stake.

- Board of Directors: The company is managed by a board of directors elected by the shareholders. The board makes significant decisions and oversees the company's operations.

- Capital: The company raises capital by issuing public or private investors' shares. The funds acquired from the sale of shares are used to finance the company's activities.

- Disclosure and Transparency: Sociétés Anonymes are subject to specific reporting and disclosure requirements, ensuring transparency and accountability toward shareholders and the public.

- Transferability of Shares: In most cases, the shares of an SA can be freely transferred or sold to others, subject to certain legal restrictions.

An SA can be a large organization or a small or medium enterprise (SME). Also, no restrictions are imposed on the activities or businesses an SA undertakes. Such an organization is often funded by many investors who find an opportunity to maximize their returns on investment at limited risk. Hence, SAs are crucial for the economy as they encourage the circulation of money and promote business growth and prosperity.

History

Société Anonyme was introduced in France during the early 19th century when the French Commercial Code was enacted in 1807. This legal structure enabled businesses to raise capital from multiple investors while providing limited liability protection to shareholders. In those days, the most attractive feature of SA was that the shareholders could stay anonymous and transfer their shares without revealing their identity to the company's management.

The French Government defined certain provisions under the Commercial Code (Code de Commerce) on January 01, 1808, to regulate the formation and structure of SAs. The Commercial Code also had specific provisions to curb market speculation during the French Revolution, which had reached an all-time high. This new code defined and categorized business entities into three main types - the société en nom collectif, the société en commandite, and the société anonyme.

Over time, the idea of Société Anonyme became widely accepted and spread to various other countries, leading to its adoption as a common form of business organization worldwide. In different jurisdictions, this type of company may be referred to by other names, such as “corporation” in the United States or “public limited company” in the United Kingdom.

Société Anonyme has played a pivotal role in economic development, spanning diverse industries, including manufacturing, technology, finance, and more. They remain significant in the modern business landscape, offering companies opportunities to expand and attract investments while mitigating individual shareholders' risks.

Requirements

The guidelines governing the establishment of a Société Anonyme may differ from country to country, depending on its laws and regulations. However, in general, some essential prerequisites are:

- At least seven shareholders who can be natural people or legal entities must be part of the founding team.

- CHF 50000 minimum share capital investment is needed.

- Limited liability for shareholders, i.e., to the extent of their invested capital, will be considered in cases where financial responsibility needs to be assigned.

- Forming a board comprising directors responsible for significant decisions and operations is mandatory.

- Disclosing the company's purpose, structure, and internal regulations in its statutes and articles of association is deemed necessary.

- The newly formed entities are required to be registered with relevant government authorities.

- Financial reporting, auditing, and adherence to good corporate governance practices are mandatory.

Examples

Here are a few examples of similar establishments with legal standing in other countries.

Example #1

In the United States, a business structure similar to a Société Anonyme (SA) is commonly called a corporation (Inc or Corp). A corporation has a separate legal identity and is considered distinct from its shareholders, providing limited liability protection to its owners. It can issue shares to the public and trade them on stock exchanges. For instance, Walmart, Renault S.A., Telefónica S.A., and Microsoft are examples of SAs in the US.

Some other examples of SAs are Perseroan Terbatas Terbuka (P.T. Tbk.) in Indonesia, Sociedad Anônima (S.A.) in Spain, Latin America, and Mexico, Kabushiki Gaisha (K.K.) in Japan, and Naamloze Vennootschap (N.V.) in the Netherlands.

Example #2 - BenevolentAI Société Anonyme (AMS:BAI)

The leading public limited company (Société Anonyme) BenevolentAI has successfully combined science and technology to discover and develop drugs for as many ailments as possible. Their AI chemistry, pharma partnerships, and powerful search engines for global reach are versatile and scalable, known to find solutions for many diseases.

In this way, this organizational structure, which can reliably meet resource requirements, can facilitate the operations of companies functioning in diverse fields.

Advantages And Disadvantages

| Advantages | Disadvantages |

|---|---|

| Limited Liability: Shareholders' assets are protected as their liability is restricted to the amount of their investment in the company. | Complex Formation: Establishing an SA involves complying with numerous legal and regulatory requirements, making the process time-consuming and expensive. |

| Access to Capital: SAs have the advantage of raising capital by issuing shares, making it easier to attract investors and finance business expansion. | Public Disclosure: An SA must adhere to extensive financial reporting and disclosure requirements, which may expose sensitive information and increase scrutiny. |

| Continuity: The company's existence is not dependent on its shareholders, ensuring its continuity even if shareholders change over time. | Shareholders' Control: With a diverse shareholder base, decision-making can become complex, potentially leading to challenges in maintaining control and dealing with conflicting interests. |

| Enhanced Reputation: Being publicly listed can boost an SA's reputation and credibility in the market, attracting potential customers, partners, and investors. | Performance Expectations: Publicly traded SAs may face pressure from shareholders and the market to meet short-term performance expectations, impacting long-term strategic planning. |

| Shares Transferability: Shares can be easily transferred between shareholders, providing increased liquidity and flexibility. | Legal and Regulatory Compliance: Ongoing compliance with regulations and corporate governance standards can be demanding, necessitating additional resources to ensure adherence. |