Differences between both the schedules are given as follows:

Table of Contents

What Is Schedule 13g?

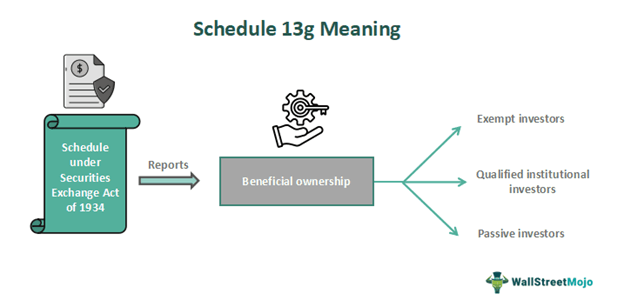

Schedule 13G is a schedule under the Securities Exchange Act of 1934 that applies to beneficial ownership. It is an option of filing a short form statement for individuals in lieu of filing a statement under schedule 13D of the Securities Exchange Act of 1934.

Individuals can exercise filing a shorter version of the statement instead of 13D only when certain conditions are fulfilled. The Securities Exchange Commission (SEC) oversees the procedures, and they are implemented to enhance the reporting of beneficial ownership. Filing under this schedule helps maintain proper market functioning and ensures market integrity.

Key Takeaways

- Schedule 13G, as under the Securities Exchange Act of 1934, states the reporting requirements of beneficial ownership.

- It is a facility that gives options to investors to file shorter statements than filing reports under Schedule 13D.

- The schedule covers three main categories of investors: exempt investors, qualified institutional investors, and passive investors.

- Each category has a different reporting timeframe based on the percentage of securities they own.

- Reporting under the schedule ensures transparency and maintains market integrity.

- Filings are made through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) website by submitting necessary documents under the specified timeframe.

Schedule 13G Explained

Schedule 13G is a schedule that deals with beneficial ownership reporting. A beneficial owner, as defined by the U.S. SEC, is a person who shares investment or voting power, either directly or indirectly. Voting power refers to the ability to make decisions on a company's future, while investment power refers to the ability to sell securities. The 13G schedule enables individuals to file a shorter statement in lieu of filing under Schedule 13D. The law under 13D requires filing or reporting when a group of persons or individuals obtains beneficial ownership of a voting class of securities in a company totaling more than 5%.

Filing under the schedule is required for three investor classes: exempt investors, qualified institutional investors, and passive investors.

- Exempt investors: These are investors who purchase all securities before the issuer registers under the Exchange Act. They also include those who don't acquire additional same-class securities after such registration, provided these securities were acquired in the preceding 12 months or in excess of 2% of the securities. Exempt investors are individuals or entities that own more than 5% of equities with exemption under Section 13D.

- Qualified institutional investor: Filing under Schedule 13G is available for specific institutional investors or qualified institutional investors who have held or acquired securities without any motive. It is also available for those involved in transactions without the intention of influencing the issuer's control.

- Passive investors are those who own less than 20% of the security class without the intention of influencing or acquiring control of the issuer. It shall be noted that a passive investor can neither be a director nor an officer working for the issuer.

Filing Requirements

Specific Schedule 13G filing requirements for exempt investors, qualified institutional investors, and passive investors are as follows:

- Exempt investor requirements: Exempt investors are required to report only the positions held that are greater than 5% as of the calendar year-end. Reporting shall be done either in case of amendments in the already provided information or their initial report. The initial reporting is typically due 45 calendar days after the end of the calendar year, which is when the person has to file. Similarly, amendments are also due within 45 calendar days after each calendar year's end.

- Qualified institutional investor filing requirements: They need to report their holding positions that are greater than 5% at the end of the calendar year, either as initial reports or amendments in case of changes. Suppose the qualified institutional investment buyer owns securities in excess of 10% at the end of any month; the filing shall be done, or amendments shall be made within 10 calendar days. The amendment shall be made for the close of the month.

- Passive investor filing requirements: If a passive investor crosses the holding limit of 10%, the investor is required to file under schedule 13G within 10 calendar days of the month's end. After crossing the 10% limit, the investor shall file immediate amendments for every increase or decrease of 5% in the ownership status. In addition to this, amendments to the schedule shall be reported within a 45-day calendar period after the calendar year-end for reporting changes to the existing information that has been disclosed.

How To File?

U.S. Securities and Exchange Commission's site, Electronic Data Gathering, Analysis, and Retrieval (EDGAR), is used for filing. Given below are consolidated steps for filing Schedule 13G.

- The individual shall log into the EDGAR website and select the 13G submission type. They can choose to amend the schedule here.

- On the main screen, provide the CCC information, filer's and company's CIK, name, and IRS information.

- Documents shall be attached in the 13G Schedule tab.

- Validate the documents by selecting the Doc Validation button provided.

Examples

Let us look into some examples to understand the concept better

Example #1

Let's imagine Roger as an investor's story. Roger is a qualified institutional investor who had 9% equity class securities in ABC Ltd in 2023. However, in 2024, he acquired additional securities from the same class. This increased his holding, and it increased to an additional 11%, making it a total of 20%. Earlier, his holdings had not crossed the 10% mark, but now it has increased significantly. As a result, he now has to file within 10 calendar days after the closing of the month.

Example #2

In 2022, Northview Acquisition Corp filed a report under Schedule 13G and given below are some of the details in the report.

- The type of reporting person- here an LLC company.

- The percent of the class and the amount.

- The total amount of beneficial ownership under each person.

- The number of shares that each reporting person beneficially owns, whether it carries sole voting power, shared voting power, etc.

- Name and address of the principal office.

- The title of the class of securities: Common stock.

- CUSIP number.

Schedule 13G Vs. 13D

| Aspect | Schedule 13G | Schedule 13D |

|---|---|---|

| 1. Filing requirement | Qualified institutional buyers, exempt investors and passive investors who meet specific criteria are required to file reports under this section. | Any individual acquiring equities in excess of 5% is required to file under this section. |

| 2. Initial filing period | Qualified institutional investors are required to file within 45 calendar days after the end of the calendar year if they hold in excess of 5% at the year's end. Similarly, they shall file it within 10 calendar days if the person's beneficial ownership crosses 10% of the equity class securities at the end of the month. Exempt investors are required to file within 45 calendar days after the calendar year in which they became eligible. Passive investors have to file within 10 calendar days after acquiring them. | Individuals are required to file within 10 calendar days after their acquisition. |

| 3. Amendments | As per Schedule 13G amendment reporting rules, filers are required to report changes in disclosed information within 45 calendar days after calendar year-end. Note that passive investors and qualified institutional investors have additional conditions to fulfill regarding reporting amendments. | As per Schedule 13G amendment reporting rules, filers are required to report changes in disclosed information within 45 calendar days after calendar year-end. Note that passive investors and qualified institutional investors have additional conditions to fulfill regarding reporting amendments. |