Table of Contents

What Is Tax Notice?

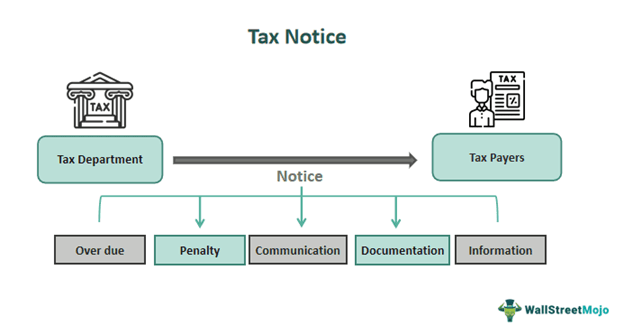

A tax notice is a communication letter from the Internal Revenue Service (IRS) alerting a taxpayer to an issue with their account or tax return. These notices are dispatched for various reasons, such as notifying individuals about corrections on returns, outstanding balances, or overpaid taxes.

These notices serve to handle different tax-related issues, such as errors in filings, unpaid taxes, audits, or requests for deduction substantiation. They aim to ensure adherence to tax laws, resolve inconsistencies, and collect owed amounts. Depending on the situation, the notices may necessitate a response or payment. They could lead to further scrutiny or penalties if not promptly addressed.

Key Takeaways

- A tax notice issued by the IRS alerts taxpayers to issues with their accounts or returns, aiming to ensure tax law compliance and resolve discrepancies.

- These notices address various matters like filing errors, unpaid taxes, audits, or deduction verification.

- They require timely response or payment to avoid penalties. The IRS issues diverse notices concerning refunds, inquiries, identity verification, or additional information requests.

- Taxpayers must read carefully, review, and respond promptly. They should pay the required amount and retain copies. Moreover, they should not neglect or get into panic mode.

Tax Notice From IRS Explained

A tax notice serves as an official written communication from the Income Tax Department (IRS, in the U.S.) to a taxpayer. It highlights issues within their tax account. These notices may arise for various reasons, including concerns related to income tax return filings or non-filings, assessment issues, or requests for specific information.

Upon receipt of such a notice, the taxpayer must take action within the designated timeframe and engage with the tax authorities to resolve the matter. Each notice or letter from the Income Tax Department elucidates the reason for contact and provides instructions on addressing the issue effectively.

The IRS issues notices and letters for diverse purposes, such as outstanding balances, adjustments to refunds, inquiries regarding tax returns, identity verification, or requests for additional information. These notices aim to inform taxpayers about their tax status and any necessary steps they must take.

Additionally, the IRS employs various types of letters and notices tailored to specific circumstances These include notifications about tax adjustments, special tax notices, refund utilization, inquiries about income or tax information, and notices of intent for penalties or adjustments. It also deals with denial of credit claims (home heating), refunds used for debts, intent of offsetting, etc. Each type of notice serves to ensure compliance with tax regulations. Moreover, it facilitates effective communication between taxpayers and tax authorities.

How To Check?

Taxpayers wishing to access their account information, such as balance, payments, and tax records, can log in to their IRS online account for quick and easy access. To determine if a tax notice assessment has been received from the IRS, they can log in to their account or follow these steps:

- Regularly check for mail, including any correspondence from the IRS.

- Look for official IRS letterhead, identification numbers, and contact information.

- Carefully read the notice to understand the issue, required actions, and deadlines.

- Note any reference numbers or specific tax years mentioned in the notice.

Each notice provides clear instructions on addressing the inquiry. If a correction notice is received, it should be reviewed and compared with the tax return. If agreement is reached with the correction and no payment is due, no response is necessary.

- Disagreement with the correction requires a response within 30 days, as instructed in the notice.

- For queries, taxpayers should call the number provided in the upper right corner of the notice. It's advisable to keep tax returns and correspondence handy when contacting the IRS.

- In case of queries, taxpayers can call the official phone number or visit the IRS website.

Examples

Let us look into some examples to understand the concept better:

Example #1

Imagine the story of a salaried employee, Dan, who receives income tax notice news. The notice from the IRS stated a discrepancy in his previous year's income report. The IRS requests additional documentation to support his reported income and deductions.

After reviewing the notice, Dan organizes his income and deductions chronologically. He explains any discrepancies or variations between the reported amount and the figures. Moreover, he includes copies of his salary and insurance slips as supporting documentation.

In addition, he attaches a cover letter stating that he has provided the requested information to substantiate his reported income and deductions accurately. Dan submits his response within the specified timeframe and keeps copies of all the documents for his records.

Dan’s diligent approach and accurate record-keeping demonstrate his compliance and cooperation with the IRS. This approach aided in effectively addressing the issue and resolving any discrepancies in his tax return.

Example #2

In September 2023, the US Internal Revenue Service (IRS) notified Microsoft of an ongoing dispute regarding the allocation of its profits across various countries and jurisdictions. The income tax notice states that the IRS seeks an additional tax payment of $28.9 billion, along with penalties and interest, for the tax years spanning from 2004 to 2013. This dispute arises from the IRS's scrutiny of Microsoft's transfer pricing practices and its use of offshore entities to manage its global tax liabilities.

Dos And Don'ts For Taxpayers Who Get A Letter Or Notice From The IRS

It can be challenging to go through IRS letters or notices, but knowing what to do and what not to do can help.

Dos

After receiving a notice, the taxpayers shall take the following steps:

- Read: Taxpayers shall carefully read the instructions. In most cases, they do not have to reply to the letters.

- Review: Carefully examine each notice or letter as it contains valuable information. check for its nature, such as special tax notices, etc. Taxpayers should compare the details provided in the notice or letter with those in the payer's original return if adjustments were made to their tax return.

- Respond: If the notice or letter specifies a response deadline, comply to minimize additional interest and penalty charges. Preserve their appeal rights if they disagree with the changes. They shall reply as directed in the notice, which may include mail, fax, or digital submission through the IRS' Documentation Upload Tool.

- Payment: Pay as much as possible, even if the full amount owed cannot be paid. Utilize online payment options or apply for an Online Payment Agreement or Offer in Compromise. Taxpayers shall refer to the payments page for further information.

- Retain a copy: Keep a copy of all notices or letters with tax records for future reference.

Don'ts

After receiving a notice, the taxpayers shall not:

- Neglect: Avoid neglecting it. The majority of IRS letters and notices concern federal tax returns or tax accounts. These communications clarify the purpose of contact and provide instructions for necessary actions.

- Panic: Stay composed. The IRS and some of its authorized private collection agencies typically reach out to taxpayers via mail. Usually, simply reading the letter attentively and taking appropriate action suffices.