Table Of Contents

Offshoring Meaning

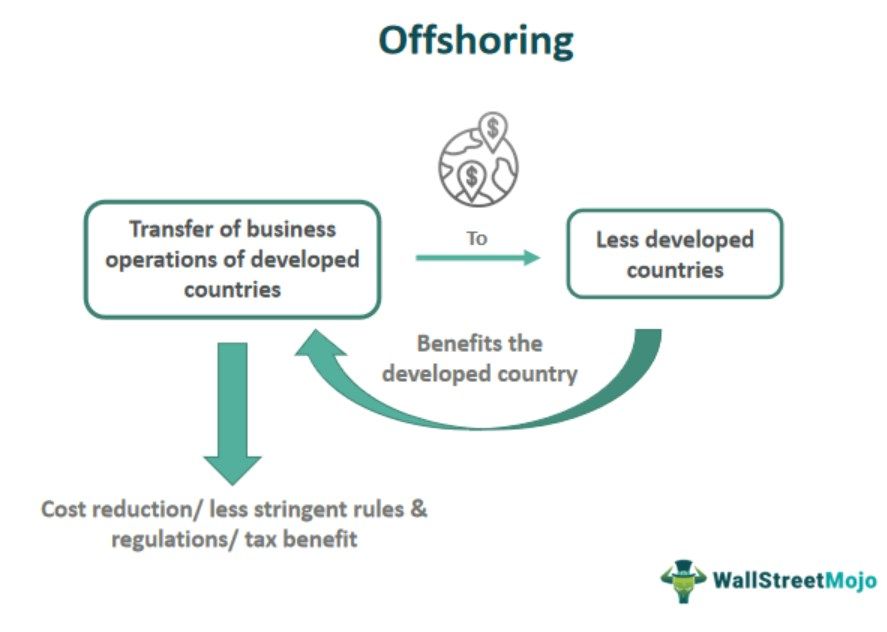

Offshoring is a practice of processing business operations from one country to another, usually from developed industrialized countries to less-developed/developing countries, with the motive of cutting down the cost of doing business, enjoying tax benefits, and complying with less stringent requirements regulations.

Thus, one country transfers its business process or ownership partly or totally to another country which has the advantage of a new skill set and knowledge base of professionals at a much lesser cost which is highly advantageous be it a large enterprise or a developed economy.

Key Takeaways

- Offshoring is a business practice where a company transfers its operational activities from one country to another, typically from developed industrialized countries to less-developed or developing countries.

- This is often done to reduce business costs, obtain tax benefits, ad take advantage of less strict regulations and control in other countries.

- The practice of offshoring dates back to the 1960s when manufacturing jobs started moving from developed countries to overseas markets.

- It often involves acquiring new strategies and skill sets through outsourcing to leverage cost savings, obtain specialized expertise, and tap into global markets.

Offshoring Explained

The process of business outsourcing in the overseas market for expanding the business and reducing the cost of business operations as in the case of developing countries, usually there are lenient environmental regulations, low labor cost, more proximity to raw materials, favorable tax conditions.

Various offshore financial centers, such as Bermuda, Cayman Islands, Switzerland. Different financial centers have different levels of transparency and regulatory standards.

Offshoring services generally occurs among foreign banks, deposits, investments, corporations, etc. OFCs improve the flow of capital and business transactions. For some, it is a means of reducing tax liabilities.

It is a strategic move for the financial advantage of the offshoring companies. New strategies and new skill sets are provided by offshoring a business.

The burden of a company head is reduced as a wide range of professionals are involved with a huge knowledge base, which helps in the expansion of business and, in turn, leads to higher profits by reaping benefits of cheaper cost, expertise solutions, focus on core business activities, etc.

Also, it has certain advantages such as communication issues, additional cost, time travel, legal compliance, etc. Overall it is advantageous for large business organizations.

Examples

- Individual banks offshore back-office functions to other countries that provide an efficient and cheap workforce.

- Offshoring manufacturing the first stage of production of goods in another country where the raw material and labor cost is cheap and keeps finished products in its own country.

- Labor services of staffing agencies offshore to other countries.

- Goods are imported from foreign markets to domestic markets by the retailers.

- Import Inputs and raw materials from cheaper markets.

Evolution

- First offshoring companies dates back to the 1960s when in the developed world, jobs in the manufacturing sector moved out of the country to the overseas market than in the 1970s; the service sector jobs were outsourced to different countries.

- Primarily factories got transferred from developed to developing countries, which caused a structural change in the world from industrial to post-industrial society.

- Reduced cost of transportation and communication during the 20th century with a higher difference in pay rates made offshoring an easy option. Then, with the internet's growth, fiber optics and world wide web offshoring services became a usual practice.

Reasons

- To stay away from protectionism and fully utilize free trade areas in the overseas market.

- To reap the benefits of cheap labor costs as low in offshore markets.

- To make full utilization of resources available.

- To supply goods and services in international markets for the targeted audience.

- To get skilled and efficient workforce supply.

Benefits

- Companies that offshore their businesses may offer their services and products at lower rates, but still, they earn huge profits as production costs get cheaper.

- The resources that are not available in the internal market can be accessed easily in the international market with the help of offshoring.

- Processes that are offshored, like customer service, information technology, software development, etc., will be handled by experts; hence the problem of talent shortage and a specific skill can be dealt with.

- Focus on main business activity can be maintained as the back-office task can be offshored. It leads the company head to focus on core business and improve productivity and output quality.

- New technologies can be embraced to speed up the process of business, which helps in making the best use of investment with the least interruption.

- With this business help, risk management can be easily done during technical crises, natural calamities, or market fluctuations. The other part of the company will have things properly to respond rapidly to any uninvited situation.

- Consumers also benefit when offshoring a business due to affordability as they can save more money, which will increase the value of the company in the economy.

- It globally also provides a wider talent base that utilizes new skills, innovative strategies, and new capabilities.

Advantages

Global offshoring has some advantages, as follows.

- Increased Availability - When offshoring a business, different time zones, and workforce with 24*7 working capacity, the availability of business increases. It provides a wider opportunity for businesses to support their clients as and when needed.

- Reduced Risk - Multiple teams work in different countries to help reduce risk. At the time of natural calamity or any uninvited danger, the data and products at multiple sites help in supporting the business.

- Control - This helps have a dedicated staff working only for an individual company. It leads to internal accountability of the business from direction to training. The staff is done as the company head wants.

- Staff Access - Highly skilled university staff is available in foreign markets, which becomes advantageous for the business looking for specific talent.

- Business Growth - Cost of production is reduced due to cheap labor and high tax savings that lead to a higher profit margin.

Disadvantages

Global offshoring has some disadvantages, as follows.

- Communication is one of the biggest hindrances in overseas operations as the languages and time zones are different.

- The exchange rate in different countries is ever-changing and different.

- Implications for Corporate social responsibility

- Companies have to incur an additional cost of time and travel.

- Risk of quality and longer supply time.

- Legal and tax-related complications

Offshoring Vs Outsourcing

The former is a process of sending the work of one company in one country to another country whereas the latter is the process of entering into a contract with another party to get perform a job.

The former creates jobs in another country because in it, a function of a business of one country is transferred to another, whereas in the latter, jobs may be created in the same country because the function is not transferred to another country.

In case of offshoring manufacturing or any other function, since the function is performed in the same country, there may not be any reduction in labor cost but in case of offshoring companies take advantage of reduced cost of labor of another less developed country.

The former may reduce employment opportunity in the domestic country, but the latter will not.

The former may face barrier related to language, economic issues, communication problem, etc, which is not the case with the latter since the job remains in the same country.