Table Of Contents

Cash Flow Statement with Examples

A cash flow statement is a financial statement that provides a detailed analysis of how the cash inflows and outflows happened because of its operations and any external investment and financing in the given accounting period. Combined with the Balance Sheet and Income Statement, the Cash flow statement describes the overall financial health. The advantage of cash flow statements for analysts is that they are less prone to accounting adjustments because of total dependence on cash inflow and outflow.

The cash flow statement mainly has the below three components:

- Cash flow from Operating Activities

- Cash flow from Investing Activities

- Cash flow from Financing Activities

Table of contents

Video Explanation Of Cash Flow

Examples of Cash Flow Statement

Below are some practical examples of the Cash flow statement to understand it better.

#1 - Amazon Cash Flow Statement

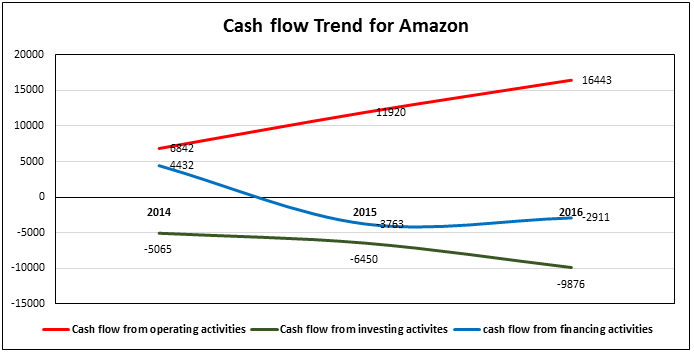

Let us discuss the example of Amazon's Cash flow statement for 2014, 2015, and 2016 below and the various factors that have affected its cash flow.

We can see that Amazon’s Ending cash from 2014 to 2016 has increased from $14.6 Bn to $19.3 Bn. Let’s start discussing all three components of cash flows one by one:

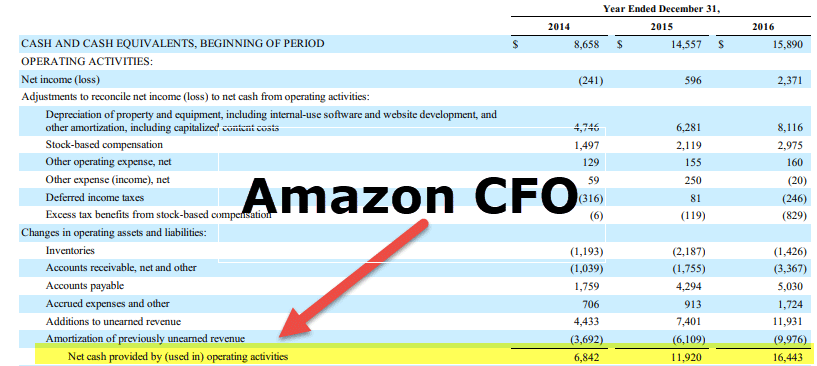

#1 - Cash Flow from Operating Activities

source: Amazon SEC filings

Amazon’s cash flow for Operating activities has increased from around 6.8 Bn to 16.4 bn (more than double in just two years), which is quite impressive. One reason for that is an Amazon revenue increase, mainly because of AWS. From 2015 to 2016, Amazon has some good inventory management policies; its "change in inventory" is going down despite an increase in revenue.

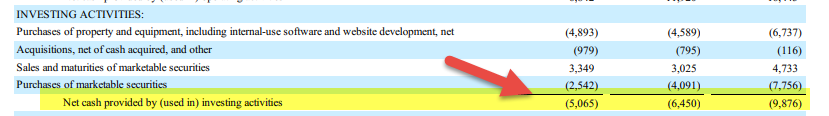

#2 - Cash flow for Investing Activities

Its "Cash flow from Investing Activities" primarily consists of buying property or buildings. Because of the expansion, investment in a property, etc., has increased from around $5 Bn to $7Bn. Since maturities of marketable securities are quite short, every year, Amazon sells some of its securities and buys others mainly because of hedging purposes. The amount of bought Securities will be shown as negative cash in this section since cash goes out while buying them, while sold securities will be shown as a positive amount.

#3 - Cash Flow from Financing Activities

Financing Activities mean taking loans, debts, etc., to buying assets. In 2014, Amazon bought a long term debt of around 6.4 Bn to expand its business. That’s why in 2014, it had positive cash flow from financing, but negative in 2015 and 2016 because now it is trying to pay off its debt.

#2 - Walmart Cash flow Statement

Walmart is a multinational retail organization with a chain of supermarkets, especially in the USA. It has a net income of more than $10 Bn per year. From 2016 to 2018, its cash has decreased from $8.7 Bn to $6.8 Bn. Let's see the components of its cash flows:

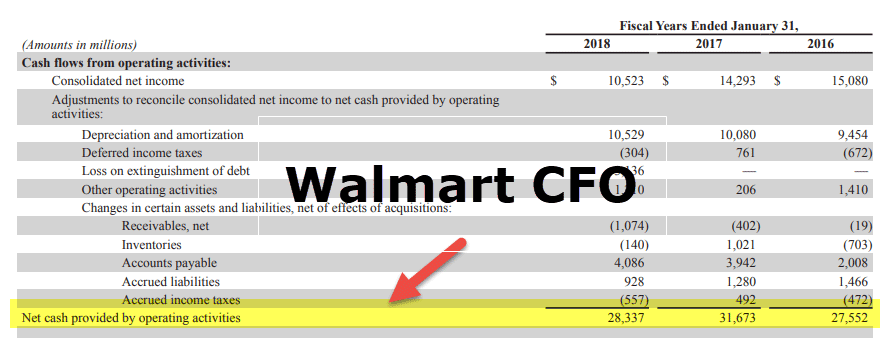

#1 - Cash flow for Operating Activities

Source: WMT-2018_Annual-Report

Its Cash from Operating Activities has changed from USD 27.5 Bn to $28.3 Bn. One of the major components is the depreciation of buildings. Walmart has lots of physical assets such as buildings, warehouses, etc. These are getting depreciated yearly, which is being recorded in Net Income because of the accounting process, but that depreciation is added back again in cash flow. It also has a very strict policy in its working capital. That’s why you will see its inventory and account receivable change almost negligible or zero while its accounts payable is increasing every year, which helps overall increase its cash balance.

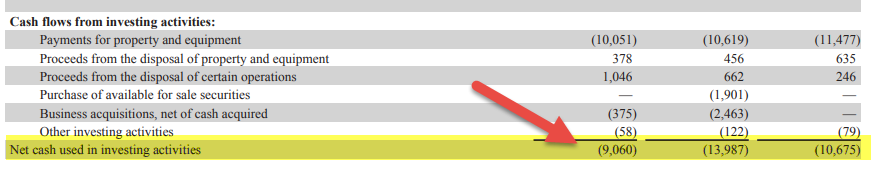

#2 - Cash Flow from Investing Activities

Walmart spends much of its revenue on investing in its retail store and buildings. You will see the main component of Cash flow for Investing activities in "Payment of Property and Equipment," which is almost consistent each year.

#3 - Cash flow for Financing Activities

Because of the heavy Capex purchase of buildings, it has to take a great amount of debt each year. Its Cash flow for financing has changed from -USD16.2 Bn to -$19.9 Bn from 2016 to 2018

#3 - Software AG Cash Flow Statement

Software AG was the 2nd largest software vendor in Germany, with around 900 million euros in 2017. Its net income in 2017 was around Euro 141 million, with “cash and equivalents” at around Euro 366 million. Let’s look through various cash flow segments for this company:

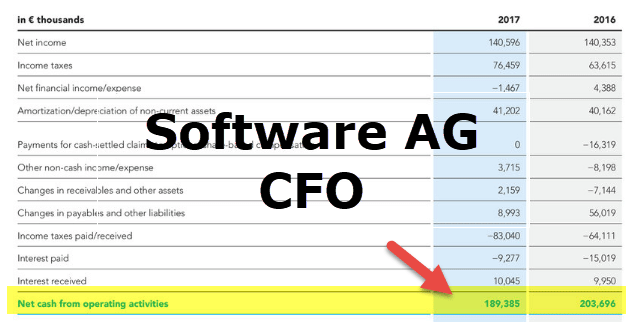

#1 - Cash flow for Operating Activities

Source: softwareag.com

Its Cash flow from Operations has decreased from Euro 203 million to 189 million. One of the differences between the structure of the above two companies (Amazon and Walmart) cash flow (which were GAAP standard) and Software AG (which is IFRS) is that in the above two companies, the tax is shown in an only one-line item, known as a deferred tax. But here, in the second row, the total tax amount for the year has been added in one line, and in the other line, the tax amount paid has been subtracted.

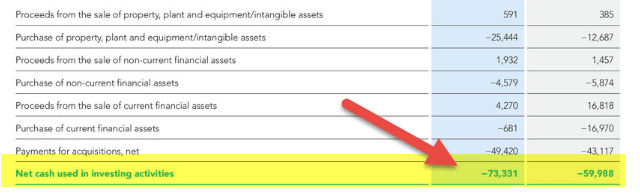

#2 - Cash flow for Investing Activities

The main components of investing activities can be investing in "property, plants and intangibles" and acquiring other companies. Software AG's investment in property, the plant has been doubled from 2016 to 2017 (from 13 million Euro to 25 million Euro), which is the main reason for the change of "Cash flow for investing Activities" from -60 million Euro to -73 million Euro.

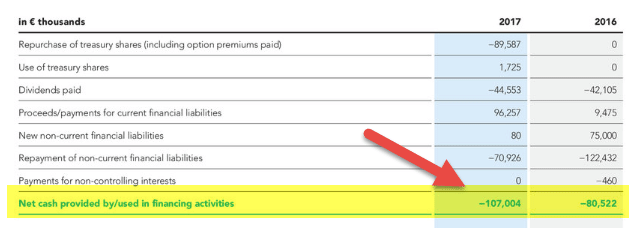

#3 - Cash flow for Financing Activities

In 2017, Software AG repurchased treasury shares worth around 90 million euros. That is why its net cash from financing activities has decreased from (-80 million Euro to -107 million Euro).

Overall, looking at the change in Cash and equivalents, 2017 was not a healthy year for Software AG. Its net cash decreased in 2017 by 9 million despite having a net income of Euro 141 million.

#4 - TCS Cash Flow Statement

TCS (Tata Consultancy Services) is the biggest software company in India, with a revenue of around 123,000 crores Rupees in 2018 and a net income of around 26,000 crores Rupees. It is a cash-rich company with cash and equivalents of around Rs. 5,000 crores in FY 18 compared to Rs. 4,000 crores in FY 17.

Source: TCS.com

#1 - Cash flow from Operating Activities

Cash flow from Operations for TCS is steady at around Rs. 25,000 cr in both 2017 and 2018, almost the same as the Net Income for the firm.

#2 - Cash flow from Investing Activities

Cash flow from Investments mainly consists of the purchase of investments, including 709 crores (March 31, 2017: ` 890 crores). Proceeds from disposal/redemption of investments include ` 1,182 crores (March 31, 2017: ` 726 crores) held by TCS Foundation, formed for conducting corporate social responsibility activities of the Group.

#3 - Cash flow from Financing Activities

In FY 18, TCS bought back shares worth Rs. 16,000 cr from the market. Also, it paid around Rs.11,000 cr, the two main components of its Cash flow for financing activities.

Recommended Articles

This article has been a guide to Cash Flow Statement Examples. Here we discuss, analyze, and explain practical examples of Cash flow statements, including Amazon, Walmart, Software AG, and TCS. You can learn more about financing from the following articles –