Table Of Contents

What Is A Pro Forma Cash Flow Statement?

Pro forma cash flow statement refers to the cash flow statement prepared by the business entity to prepare the projections of the amount of cash inflow and cash outflow they expect to have in the future from the different activities, including operating and investing, and financing activities.

It is an integral part of financial planning and forecasting. Management uses it to quantify the strategic initiatives irrespective of the firm's size or its subsidiary. However, it requires continuous updation and monitoring. It should be treated as a planning tool which provides estimates rather than actual prediction of future cash inflow and outflow.

Pro Forma Cash Flow Statement Explained

Pro Forma Cash Flow Statement is a popular accounting practice that reports a voluntary statement prepared by a firm for presenting financial projections. It can be defined as the probable amount of cash inflows and outflows expected in future periods for a specific duration of time.

- Pro-forma Cash Flow Statement business plan can be developed as part of the annual budgeting or forecasting process. It may be created as part of a specific request for cash flow information, as required by prospective investors or company management for future decision-making.

- It also plays a vital role in new businesses, startups, or SMEs in the planning stage as they provide a possible representation of the future running a business. It can help credit lenders identify and provide financing to such businesses, which might not be operational today, but might be the next growth story in the future.

- A-Pro forma cash flow statement must be based upon objective and reliable information to create an accurate projection of financial needs and status that can help convince the investors.

- While a pro forma offers no guarantee, when done right, it demonstrates that management has done its homework with accurate assumptions based on industry standards. Since pro forma cash flow statements are estimates, they are flexible, and adjustments are made as and when required. It cannot be ascertained whether the suggestions are made by investors or other ideas that adjust costs, thus representing a dynamic nature.

Template

This kind of statement typically spans over one year or more than one year. It can also be made on a monthly, quarterly or annual basis. The template has three important sections or parts, as given below.

- Operating activities – It contains all the cash inflow and outflow that happens due to the core operations of the entity. It includes the heads like cash paid to suppliers and received from customers, cash paid to employees, or cash outflow due to any other operating expense. Any tax or interest payment or receipt is also accounted for in this part. It the net cash flow in this part is positive, it indicates that the business is able to generate good cash from its main business operations.

- Investing activities – This part includes activities related to buy or sell of investments or long-term assets. In case the company buys new assets, invests in some projects, there will be cash outflow. In case of sales or receiving returns from investments, cash will flow into the business. If the business is able to generate good investment returns then the cash flow in investing activities will be positive.

- Financing activities – This section includes any cash inflow or outflow related to the financing process or capital structure of the business, like issue of stocks, borrowing, paying or receiving devidends, debt repayment, stock buyback. The net change in the cash flow due to financing activities are reflected in the capital structure of the business.

After the above sections are compiled, the net change is calculated from the three sections to get the value of net change in cash. This is added to the cash balance at the beginning of the period to get the end balance balance to get a pro forma cash flow statement sample.

Video Explanation Of Cash Flow

How To Create?

Let us try to understand and list the various steps needed to create a pro forma cash flow statement through different assumptions and estimates.

- Gather data – The first step is to collect the financial data related to the past years which includes the income statement, cash flow statement and balance sheet. This will be used as a reference point to identify any pattern or trend.

- Decide the time period – It is necessary to understand the time period for which the statement is to be prepared. It may be for one year or for many years and that may be broken down into quarterly or monthly.

- Projections – Making projections require a lot of research and understanding of market trends. The historical performance has to be analysed to forecast the future trends in sales, revenue, operating and non-operating expenses, etc. the projections will also depend on the season or part of the year, the economic and political conditions of the country, market fluctuations, and so on.

- Forecast investing and financing activities – Investment activities like planning for new projects, addition of new products and services, investment in advertising, debt and equity issuance, debt repayment, dividend payment, all come under this category.

- Account for working capital changes – It is important to calculate the working capital in detail since they impact the cash flow to a huge extent. This includes accounts receivable and payable, inventory tracking, etc.

- Calculate cash flow – The next step is to calculate the cash flow by making all adjustments.

- Compilation of data – Then the data calculate will be entered in the pro forma cash flow statement under the sections mentioned in the template part of this article and derive the closing cash balance of each period.

- Performance analysis and review – It is important to evaluate and analyse the assumptions and changes so as to evaluate the impact of the variables in cash flow projections. It is important to maintain the accuracy level and make necessary adjustments.

Thus, the above are the steps to make or create a pro forma cash flow statement sample.

Example

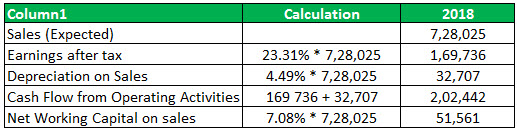

As a pro forma cash flow statement example, consider the following financial numbers of a hypothetical firm.

As per the given pro forma cash flow statement example, estimated earnings after-tax on sales should be 23.31%, an average of the last five years. Therefore, it is an ideal representation of estimates per the pro forma cash flow statement.

Similarly, depreciation on sales can be estimated at 4.49% and net-working capital on sales at 7.08% as per previous year trends. Based on these estimations following Pro forma cash flow statement can be prepared for analysis in the year 2018.

Based on these figures, the firm can ascertain the cash flow at the end of the current financial year.

Types

A pro forma cash flow statement business plan can be prepared for the short term, medium-term and long term based on the requirements of the management.

#1 - Short term

The preparation of short-term statements is monthly, weekly, or daily. The use of these is to make short-term decisions. I.e., for day-to-day operating decisions like budgeting for an expense, planning for temporary cash deficits, etc.

#2 - Medium-term

The preparation of Medium-term statements is for a period not exceeding a year. These statements are used to make decisions for the financial year under consideration, like an estimation of revenues, profits, etc. The purpose of these types of statements is to satisfy medium-term objectives.

#3 - Long-term

The preparation of Long-term statements is for durations exceeding a year. These statements are used for making long-term investments and strategic decisions by management and investors. For example, a decision on capital funding, the establishment of new ventures, etc., is based on long-term pro forma cash flow statements.

Advantages

Following are some crucial advantages of a pro forma cash flow statement

#1 - Business planning

Pro forma cash flow statements help in business planning and control. These statements help management in comparing their business strategies and alternative business plans. Analyzing projected numbers help in deciding what serves the company best as It is useful in estimating cash shortages soon.

- It helps plan for the reduction of avoidable expenditure.

- Taking future investment decisions in cases of excess cash availability;

- It is useful in planning a firm's operations and in anticipating the company's financial position.

- Identifying inorganic growth prospects and their impacts like mergers, acquisitions, or joint ventures;

#2 - Financial Modeling

Pro forma cash flow statements help perform mathematical calculations and create financial models. The what-if scenarios thus created help in:

- Testing different assumptions that can provide different scenarios of sales and production costs.

- Quantifying the future business plans and impact on future valuations;

- Studying the impact of variables on prices of labor, materials, and overhead costs;

Limitations

The following are some limitations of this mechanism.

- It may not target the effects of external market forces. Since these statements are based on estimations, they may not capture external forces affecting the company's financials. Various external factors affect organizations like changes in the tax rate structure, changes in raw material prices due to market conditions, inflation, recession, interest rate changes, technological changes, etc. These aspects largely influence the financials of the company.

- Sometimes, it may present misleading results due to incorrect estimations. Since the pro forma cash flow statement is based on past performance estimation of the company, it may not provide a perfect future picture, thus resulting in incorrect estimations. In such situations, pro forma cash flow can give misleading and unreliable results.

Recommended Articles

This article has been a guide to what is Proforma Cash Flow Statement. We explain it with example, template, how to create it, types, advantages & limitations. You may learn more about cash flows from the following articles –