Table Of Contents

What Is Operating Cash Flow (OCF) Formula?

The Operating Cash Flow Formula signifies the cash flow generated from the core operating activities of the business after deducting the operating expenses. It helps in analyzing how strong and sustainable is the business model of the company.

Operating cash flow (OCF) measures the cash that a business produces from its principal operation in a specific period. It is also known as cash flow from operations. It is not the same as net income neither EBITDA nor free cash flow.

Operating Cash Flow Formula Explained

Operating cash flow is an important and fundamental financial metric that shows how much cash flow a business is able to generate from the core operations. It is an indicator that helps analysts and investors understand the financial performance of the business. The information can be found in the cash flow statements.

If the cash generating ability of the business is positive if the resultant operating cash flow calculated is high. It also means the company is able to utilize its assets and resource's is the optimum way and there is very less wastage. The core operations are efficiently managed, and the company is in good financial state.

But on the other hand, a low cash flow from operations calculated using the net operating cash flow formula indicates an opposite situation, where the business operations are not able to generate good cash flow and resources are underutilized or mutualized. If OCF is negative, it means a company has to borrow money to do things, or it may not stay in business, but it may benefit the company in the long term. Thus, net operating cash flow formula provides valuable information regarding the cash generating ability of the entity.

Still, all are used for measurement of performance of a company as net income includes a transaction that did not involve the actual transfer of money like depreciation which is a non-cash expense that is part of net income not of OCF.

How To Calculate?

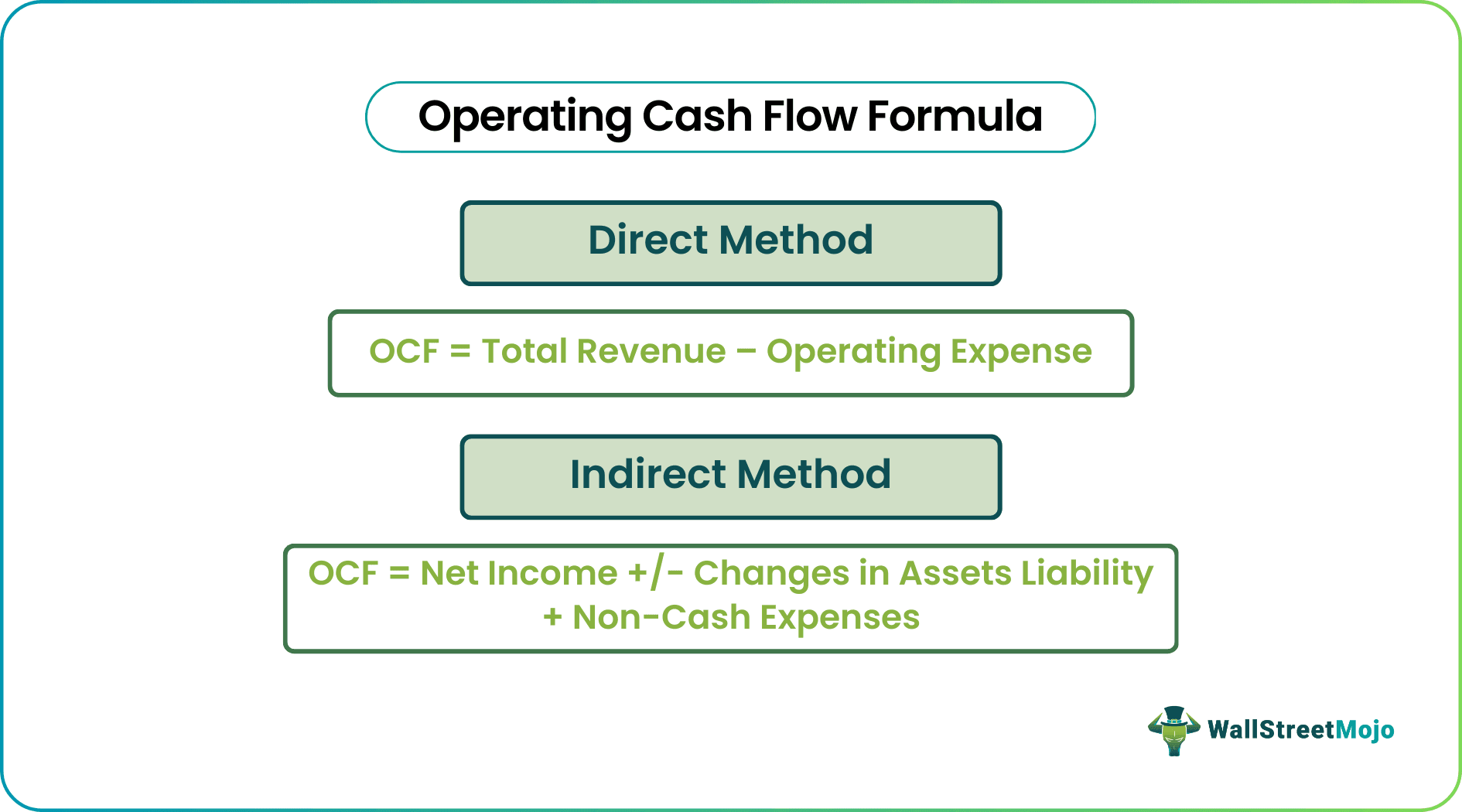

There are two formulas to calculate Operating Cash Flow – one is a direct method, and the other is an indirect method.

#1 - Direct Method (OCF Formula)

This method is very simple and accurate. But as it does not provide much detailed information to the investor, companies use the indirect method of OCF. OCF is equal to Total revenue minus Operating expense.

The formula to calculate OCF using the direct method is as follows –

Operating Cash Flow = Total Revenue – Operating Expense

#2 - Indirect Method (Operating Cash Flow Formula)

The indirect method is adjusted net income from changes in all non-cash accounts on the balance sheet. For example, depreciation is added to net income while adjusting changes in inventory and cash receivable. OCF calculates with net income, adds any non-cash item, and adjusts for changes in net capital. This provides total cash generated

Operating Cash Flow formula using the indirect method can be represented as follows –

Operating Cash Flow = Net Income +/- Changes in Assets Liability + Non-Cash Expenses

Video Explanation Of Cash Flow

Explanation

Now, let us see the main steps required to calculate free operating cash flow formula.

- Net income is considered as a starting point.

- All non-cash items are added like depreciation, Stock-based compensation, other expense or other income, deferred taxes.

- Changes in working capital adjustment that includes inventory account receivable and unearned revenue;

The full formula of Operating Cash Flow is as follows:-

OCF = Net Income + Depreciation + Stock-Based Compensation + Deferred Tax + Other non-cash items – Increase in Account Receivable – Increase in Inventory + Increase in Accounts Payable + Increase in Accrued Expenses + Increase in Deferred Revenue

Components

Let’s analyze the various component of the OCF Formula, which are as follows:-

- Net income is base income, it is a requirement.

- Depreciation helps to account for expensive property, plant, machinery, etc.

- The payment of Stock-based compensation is in non-cash form like in the form of shares.

- Other expense/income free operating cash flow formula includes unrealized gains or losses.

- Deferred Tax is a difference in tax which the company paid and its financial statements.

- Inventory is reduced in an OCF as an inventory increase leads to a decrease in cash.

- Accounts receivable is subtracted as an increase in account receivable reduces the cash, which means that a customer does not pay the amount.

Hence, in short, the OCF formula is:-

Thus, all the above requirements of the formula can be found in the financial statements of the business and the dat is taken to make the calculation. This is an important metric for analysts, investors and also the management who can make financial plans and take important financial decisions based of the results obtained.

Examples

Let us understand the concept with the help of some suitable examples.

Example #1

Suppose there is a company with a total revenue of $1,200 and an overall operating expense of $700. If one wants to calculate Operating Cash Flow, the Direct method will be used.

In the template below is the data for the calculation of Operating Cash Flow.

| Particulars | Amount |

|---|---|

| Total Revenue | $1,200 |

| Operating Expense | $700 |

| Operating Cash Flow (OCF) | ? |

So, the calculation of Operating Cash Flow (OCF) will be as –

i.e. OCF Direct = 1,200 – 700

So, OCF will be -

Therefore, OCF = $500

Example #2

Suppose a company has a net income of $756, a non-cash expense of $200, and changes in asset-liability, i.e., inventory is $150, account receivable $150. Then, Operating Cash Flow through the indirect method will be as follows:-

The below template is the data for the calculation of the Operating Cash Flow Equation.

| Particular | Amount |

|---|---|

| Net Income | $756 |

| Non- Cash Expense | $200 |

| Changes in Operating Assets and Liabilities | |

| Inventory | $150 |

| Account Receivable | $150 |

| Operating Cash Flow (OCF) | ? |

So, the calculation of Operating Cash Flow (OCF) using the indirect method will be as –

i.e. OCF Indirect = 756 + 200 – 150 – 150

So, OCF will be -

OCF = $256

GAAP requires a company to use an indirect method to compute the figure as it gives all the necessary information and covers the same.

Example #3

A company named Ozone Pvt. Ltd has financial statements in three sections, i.e., operations activities, finance activities, and investing activities. Below is an operational activity financial statement through which we have to calculate Operating Cash Flow.

Now, let’s calculate OCF for different periods using the above-given data.

OCF For 2016

OCF2016 = 456 + 4882 + 2541 + 250 + 254 + 86 – 2415 – 1806 + 4358 + 856 + 1351

OCF2016 = $ 10,813

OCF For 2017

OCF2017 = 654 + 5001 + 2681 + 300 + 289 + 91 – 2687 – 1948 + 5213 + 956 + 1405

OCF2017 = $ 11,955

OCF For 2018

OCF2018 = 789 + 5819 + 3245 + 325 +305 + 99 - 2968 – 2001 + 5974 + 1102 + 1552

OCF2018 = $ 14,241

Hence, we found OCF for a different period of a company.

Calculator

It may be possible that a company has a higher cash flow than net income. In this scenario, it is possible that a company is generating huge revenue but decreases them with accelerated depreciation on the income statement.

When net income is higher than OCF, it may be possible that they have a difficult time collecting receivables from the customer. As depreciation is added to the annual operating cash flow formula depreciation does not affect OCF.

Investors should choose a company with high or improving OCF but low share prices. A company can face loss or small profit due to large depreciation. However, it can have a strong cash flow since depreciation is an accounting expense but not in cash form.