Table Of Contents

What Is Killer Bees Defense Strategy?

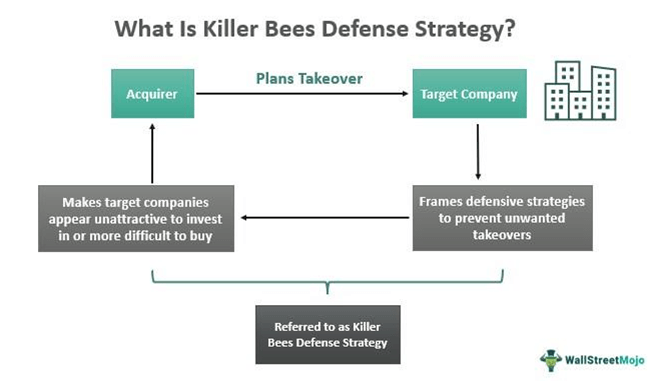

A Killer Bees Defense Strategy refers to how individuals and firms frame anti-takeover strategies to ensure they are not acquired by entities they don't want. These killer bees act aggressively to combat the takeover threat haunting the companies targeted for acquisition. Some of the killer bees in the industry are attorneys, investment bankers, tax specialists, accountants, etc.

The strategy is named after an insect that overpowers its victims with back-to-back stings to signify those that work on preventing unwanted takeovers. They make the target companies appear less attractive or expensive enough to afford or somehow difficult to acquire.

Table of contents

- Killer bees defense strategy is a technique adopted to prevent unwanted or hostile takeovers by making target companies appear unattractive or difficult to purchase.

- In consultation with the board members, the acquirers try to go for a friendly takeover, which, when denied, makes the whole process unfriendly.

- Killer bees, here, are individuals and firms that frame effective anti-takeover strategies to combat unwilling acquisition threats.

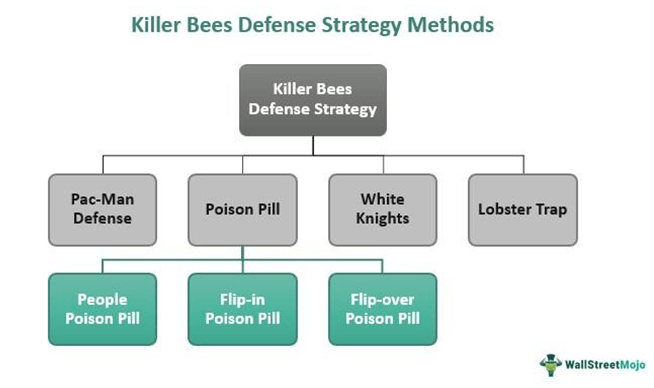

- Some of the most widely used killer bees methods include Pac-Man Defense, Lobster Trap, White Knights, and Poison Pill.

How does Killer Bees Defense Strategy Work?

A Killer Bees Defense Strategy is framed and developed to prevent hostile takeovers. When companies are ready for a takeover, they happily go for the mergers and acquisitions (M&A) option. However, there are instances where the target firms do not want an acquisition to happen. This is where firms and individuals adopt and implement such defense strategies.

The interested acquirers first consult the board of directors of the target company. If they agree, friendly takeovers happen. On the other hand, if the authorities decide not to sell their firm, the acquisition process turns hostile. As a result, the management and executives in the target company choose to resist the takeover.

The killer bees in the target companies start looking out for ways to ensure the potential acquirers lose interest in their targets. They help implement anti-takeover strategies making the target company less attractive or difficult to acquire.

Popular Mechanisms

Firms consider multiple killer bees defense strategies to ensure the hostile takeovers fail. They choose an ideal one depending on the mechanism that would work the best for a particular kind of target company. The most popular ones are as follows:

#1. Pac-Man Defense

It is a strategy whereby the target companies, in turn, place a bid to acquire their acquirer. This creates a situation where acquirers fear ending up being the takeover target themselves. However, this Pac Man Defense strategy might be expensive to adopt, given the resources and funds required to turn the table and target the acquirers.

#2. Poison Pill

A target company adopts the Poison Pill defense strategy to ensure it appears to be a less attractive takeover option. In doing so, these companies raise the acquisition cost significantly so that the interested buyer steps back. The targeted firms utilize all possible methods to increase their business share, including mergers, acquisitions, and strategic partnerships with other firms competing in the same market.

a. People Poison Pill

This is the strategy under which the entire management threatens to quit in the event of an acquisition. However, the People Poison Pill can only be effective if the acquirers are willing to retain the existing management after the takeover.

b. Flip-in Poison Pill

It allows the shareholders, except the acquirer, to buy extra shares at a discounted price. A Flip-in Poison Pill provides the shareholders with an instant profit, diluting the value of the acquirers' shares.

c. Flip-over Poison Pill

It lets the target company buy shares of the interested acquirer at huge discounts in a successful unfriendly takeover. However, due to Flip-over Poison Pill, the acquirer may reconsider proceeding with the takeover per the value dilution post-acquisition.

#3. White Knights

The White Knights are individuals or companies that acquire a target company already set for a hostile takeover by another acquirer. They become a savior against any hostility, with the current management remaining intact and investors receiving higher compensation for their shares. The White Knights help prevent unwanted takeovers due to their virtue and good relations with the target firm. This takeover makes the acquisition procedure a friendly affair.

#4. Lobster Trap

With the help of the lobster trap strategy, companies get an opportunity to have a provision in their charters to restrict shareholders with over 10% stake in the company from transferring their securities into voting shares. These securities include warrants, convertible preferred stocks, and bonds.

Examples

Let us consider the following examples to understand how the killer bees defense strategy works:

Example 1

Company X planned to take over Company Z. Since the latter did not want this acquisition to happen, it chose to implement anti-hostile takeover strategies in response. As the company stood together, the management and executives decided to produce mass resignation in the event of an acquisition.

Company X was sure that the human resources in the company were the real asset. It knew that without them, the venture wouldn't work. Hence, they dropped the idea of taking over Company Z. This is how the People Poison Pill strategy worked.

Example 2

During the 2008 financial crisis, JP Morgan Chase acquired Bear Stearns (Investment Bank & Brokerage house). If JP Morgan had not done so at the time, Bear Stearns might have considered filing for bankruptcy. Instead, JP Morgan became a savior and lent support to the target company as a White Knight.

Criticisms

Though entities implement killer bees methods to prevent a hostile takeover, they may prove detrimental to the interests of the employees and shareholders. In addition, it may impact the culture an organization builds over the years, and perhaps the entire sector as a whole. For example, when the company appears inexpensive and cheap, it affects shareholder valuation to a great extent, which becomes tough for them to handle.

The killer bees strategy may not be ethically correct, but they have been in practice in the past. Moreover, they have prevented hostility from taking place, which otherwise may have proven to have disastrous consequences.

Frequently Asked Questions (FAQs)

It is a mechanism adopted by target companies to remain prevented from unwanted or hostile takeovers. The strategy is named after an insect, which never lets its enemy overpower it at any cost. Similarly, when an interested acquirer plans to take over a target company, the firms, and individuals associated with the latter implement ways to avoid the takeover.

The defense strategy might not be an ethical way of dealing with hostile or unfriendly takeovers as it involves a false representation of a company's position, performance, and progress. However, it has been used widely for a long and has produced positive results.

Yes, sandbagging, in a way, might be considered one of the killer bees strategy examples whereby the firms pretend to be less productive than they are to appear unattractive to potential acquirers.

Recommended Articles

This article is a guide to what is Killer Bees Defense Strategy and its meaning. Here we explain how different defense methods work along with examples. You may learn more about Mergers and Acquisitions from the following articles –