Table of Contents

What Is Equity Sharing?

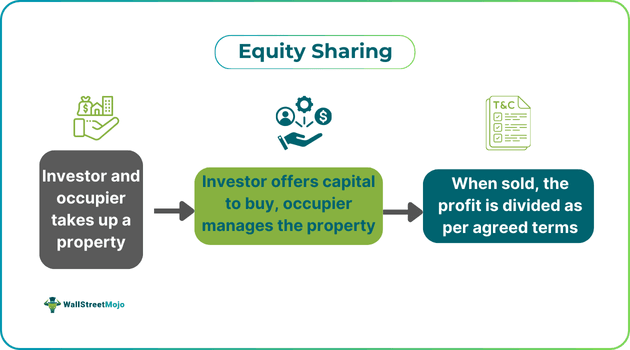

Equity Sharing is a real estate agreement between two or more parties in which one party accumulates funds to raise capital for purchasing the property, whereas the other party is responsible for managing it. When the property is sold, the profit is split according to the terms of the agreement. It is a form of shared ownership.

The equity sharing agreement plays an important role in defining the amount the occupier will owe to the investor. Both parties must have clear information about all the details of the contract terms. The repayment requirements may vary, but the final obligation will be based on the percentage of the occupier's home value at the end of the contract term.

Key Takeaways

- Equity sharing occurs when two or more parties collaborate to buy and manage a real estate property and share the returns as per agreement.

- There are two types of equity sharing in real estate: the appreciation sharing model and the home value sharing model.

- The common advantages of equity sharing agreements include no monthly payments, fewer restrictions, and hassle-free processing.

- In contrast, paying off a lump sum amount, risk of price decline, additional costs, and long-term commitment are common disadvantages of it.

- It is highly advised to read and confirm the contract terms before signing, as the final amount at the end of the contract term must be paid in full, which may result in foreclosure.

How Does Equity Sharing Work?

Equity sharing in real estate refers to the process of making a real estate investment by creating a shared equity finance agreement. This arrangement typically has two parties: an investor and an occupier. The investor provides the cash required for the down payment or to unlock the equity parallel to whom the occupier is responsible for living in the property, managing it, and paying all expenses.

When the finance agreement matures, the occupier buys out the investor by offering one lump sum amount of money, or the home is sold. The occupier is also liable to pay any additional amount based on the appreciated value of the property. In case the occupier fails to make full payment, they are forced to foreclose.

Equity sharing loans have become a convenient way for homeowners to get lump sum capital in exchange for a portion of the property's current value and future expected appreciation. They are especially meant for those people who do not want to take traditional loans, have a bad credit history, or simply do not want to pay monthly payments.

Equity sharing scheme, in addition, is also significantly practiced in companies when they introduce an equity sharing plan for selective management level employees and to particular designations offering actual long-term company ownership through stock options and other equity vehicles. Although it is not an uncommon practice, not many companies offer such equity-sharing plans.

Types

Based on the types of agreement, there are two types of equity sharing models -

- Share of appreciation model - The parties, as investors, receive a percentage of the property's appreciation when it is refinanced or sold in the market. For instance, if the property's value has increased, the investor benefits from a certain portion of the profit.

- Share of home value model - In this model, the investor receives a fixed percentage of the property's current market value when the agreement ends. This model only focuses on the value of the property at the time of sale or refinance, not on the appraised value.

Types

Based on the types of agreement, there are two types of equity sharing models -

- Share of appreciation model - The parties, as investors, receive a percentage of the property's appreciation when it is refinanced or sold in the market. For instance, if the property's value has increased, the investor benefits from a certain portion of the profit.

- Share of home value model - In this model, the investor receives a fixed percentage of the property's current market value when the agreement ends. This model only focuses on the value of the property at the time of sale or refinance, not on the appraised value.

Examples

Let us consider the following instances to understand the concept even better:

Example #1

Suppose Peter wants to buy a home for investment purposes but does not want to take out a traditional bank loan. Peter contacts multiple equity sharing companies to check if they are ready to finance the deal and it gets a firm set to finance its property. Now, the company becomes the investor, and Peter becomes the occupier.

For instance, Peter took 450,000 for a home for nine years at 3.6% of the price appreciation value. So, Peter, as an occupier, lives on the property, manages it, and pays for all the expenses for nine years. Since it is not a loan arrangement, there are no monthly payments or interest rates. After nine years, the value of Peter's home appreciated by 18%. Therefore, the value of the property became $531,000, but Peter will return the principal and 3.6% of the price appreciation as per the agreement.

Let us check the calculation below:

- The increase in the value = 531000 - 450000 = 81,000

- The appreciated value = 81000 x 3.6% = 2,916

- Hence, Peter will pay back 450,000 + 2916 = 452,916

This calculation indicates how it works with the appreciation model. In the other type, the investor receives a fixed percentage of the property's current market value.

Example #2

As per an October 2024 press release, Unison Mortgage Corporation announced the launch of its equity-sharing home loan in Oregon. This facility will allow homeowners to get cash at below-market rates. This service combines the benefits of home loans and equity-sharing agreements in a unique mortgage solution. The US home equity market is $32 trillion, and with this new mortgage lending service, homeowners will have low-interest first mortgages.

One of the key benefits of this equity-sharing home loan is lower monthly payments. Individuals with better credit reports will get better loan terms, there will be no penalty on early repayment, and the service will only be given to people eligible as per the criteria of a FICO score above 680. It will help the company prevent the risk of default and losing money.

Advantages And Disadvantages

The advantages of equity sharing loans are as follows:

The advantages of equity sharing loans are as follows:

- It is different from a loan because the occupier does not have to pay back the investor.

- When the property's value appreciates, both the investor and occupier enjoy the profit as per their agreement.

- From an occupier's perspective, if the home value depreciates, the investor will only bear the loss or lose some of their investment value.

- The occupier does not have to worry about applying for a loan, getting bank approval, making monthly payments, or dealing with interest rate fluctuations.

The disadvantages of equity sharing include the following:

- From an investor's perspective, if the home value drops, the investor will have to bear the loss.

- Repayment is a lump sum amount when the agreement ends.

- Not many mortgage companies offer home equity-sharing facilities.

- A portion of the home's value is required for surrendering.

- It comes with additional costs and fees that reduce the amount of cash the occupier receives.

- The whole concept is a long-term commitment, typically 10 to 30 years.