Table Of Contents

Viager Definition

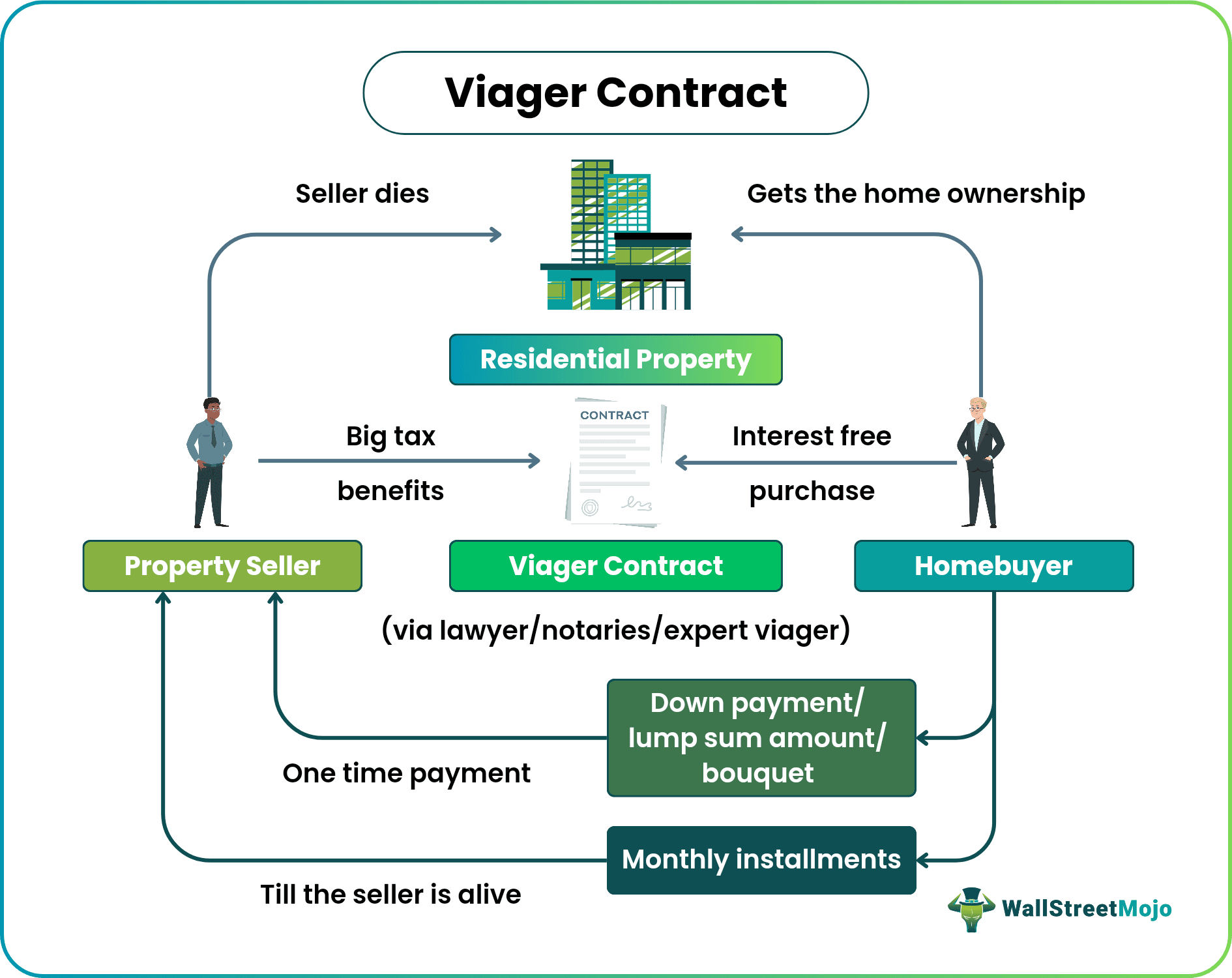

Viager is a home buying arrangement in France wherein a seller agrees to offer the ownership of their residential property to the buyer for an initial lump sum amount followed by monthly installments payable till the seller lives. It serves to be the best way of earning a livelihood for older people (usually widows and widowers) who have no assets besides their household.

A viager contract is considered a sort of gamble for the homebuyer as the amount of payment they make for the residential property entirely depends on the life span of the seller. In the case of the seller's death before the national average life expectancy, the buyer pays less than the actual cost of the property and vice versa. On the other hand, the contract allows the seller to live in their house while enjoying a regular source of income in the form of monthly payments.

Key Takeaways

- Viager meaning refers to a reverse life annuity scheme wherein the buyer agrees to settle a real estate deal for a one-time lump sum amount (called ‘bouquet’ in French), followed by monthly payments as long as the seller lives.

- The finally assessed value of the property, also known as the occupied value, could be up to 50% of the market value. The initial down payment or bouquet could be up to 30% of the said value, depending on the seller's age.

- In the scenario where the seller dies early, the buyer will get a massive discount on the occupied value and vice-versa.

- The older French population gets a place (their home) to stay for a lifetime while receiving monthly payments from the buyer besides the initial lump sum.

How Does Viager Work?

Viager is a French term that applies in the context of the real estate sale. The arrangement allows the aged population in France to financially secure their life post-retirement. The interested buyer pays a down payment (bouquet) upfront, becomes the property owner, and keeps making monthly payments to the seller as long as they live.

The seller's age, rather than the market value, determines the overall value of a property. The term occupied value refers to the final assessed value. The older population, especially widows and widowers, choose to associate with this scheme. Not only do they get a place to live for life, but they also receive a one-time lump sum amount and monthly payments for the rest of their lives.

However, the seller's death before the national average life expectancy would allow the buyer to get a massive discount on the occupied value. Because this value is less than the market value, it seems profitable agreement for them. But if the property seller is somehow able to live beyond the national average life expectancy, the buyer will have to pay way more than the occupied value, as agreed upon by them in the agreement.

Steps Involved In Viager

- The seller and the buyer sign a viager agreement containing the terms and conditions for the real estate transaction.

- A lawyer or an expert viager ensures these terms are accurately met and obeyed by the parties involved. Unlike other financial contracts, it does not require any bank or insurance company to mediate.

- The buyer pays a lump sum amount as a down payment, popularly known as a bouquet in France.

- Besides the lump sum, the buyer agrees to pay a particular percentage in monthly installments for the seller’s remainder life.

- The buyer, who becomes the new owner of the residential property, allows the seller to stay in it as long as they are alive.

- Once the seller dies, the property gets transferred to the new owner.

Examples And Calculations

Example #1

Mary, a 72-year-old widow who lives in Paris, France, lost her husband suddenly and ended up with no asset other than their house with a market value of €1,000,000. However, she was not looking forward to selling the property as she would be left with no place to stay after that.

It was when her family lawyer suggested going for a viager agreement. Before proceeding, she asked the lawyer to calculate the occupied value she would be eligible to receive. She found that being above 70 years, she can keep the occupied value up to 50% of the market price. Hence, she calculated the value as:

€1,000,000 * 50% = €500,000

Mary found the amount to be sufficient enough to earn her livelihood and enjoy living in her house. Hence, she agreed to opt for the viager scheme.

Example #2

John, an 84-year-old individual, wanted to go for a viager scheme. He had an apartment with a market value of €950,000. As individuals aging 70 or above are eligible to reduce the property value to up to 50%, the occupied value of his apartment would be -

€950,000 * 50% = €475,000

Also, the initial down payment/bouquet/lump sum amount would be 30% of the occupied value, i.e. -

30% * €475,000

= €142,500

Remaining value to be paid -

= €475,000 - €142,500

= €332,500

This remaining value would decide the monthly annuity the buyer would have to pay to the seller.

According to INSEE, the average life expectancy of people at aging 84 is 8.24 years as per the French law.

Therefore, annual installments would be -

= €332,500/8.24

= €40,351.941 or €40,352 (approx.)

So, the monthly payment would be -

= €40,352/12

= €3,362.66

Hence, the buyer would pay John €142,500 in the initial lump sum or bouquet and €3,362.6 in monthly installments for his property.

Advantages Of Viager Contract

- The viager agreement provides the buyer the allure of a discounted house purchase.

- It results in significant tax savings for sellers and an interest-free property buying option for buyers.

- It works similar to an annuity as the seller receives monthly payments for the rest of their lives.

- The viager arrangement allows the seller to stay at the property while enjoying the guaranteed financial perks.

- It gives the buyer complete ownership of the property immediately after the death of the seller.

- It enables the seller to retain the full ownership of the house, along with the bouquet other payments, in case the buyer defaults on installments.

- Buyers from France as well as from other countries can enter the contract.

Frequently Asked Questions (FAQs)

A viager is a reverse life annuity scheme that allows the older population in France to sell their residential property while getting the privilege of living in it till their death. The seller receives a lump sum amount followed by monthly payments for as long as they are alive.

The buyer and the seller sign a viager contract, under which the former agrees on paying the occupied value for the property, which includes the bouquet and monthly installments. The buyer allows the seller to stay within their property for their lifetime.

The initial down payment or bouquet that the buyer pays to the seller could be up to 30% of the occupied value of the property in question. The amount varies depending on the age of the seller.