Table Of Contents

What Is Cash On Cash Return (COCR)?

Cash on Cash Return is a metric used to measure the total return earned on the real investment property. The return is the total cash income earned on the investment property to put in simple words, Cash on cash return is earned by the investor made on by investing in the property than by mortgaging it.

It is calculated as the ratio of the total amount of rental income generated from the property and the total cash investment initially made in the property. Thus, it is a valuable metric that can be used to assess the profit-earning capacity of real estate. It helps investors compare properties for investment but does not account for tax benefits, capital appreciation, etc, which affect profitability.

Key Takeaways

- Cash-on-cash return determines the total return on the actual investment property. In addition, the return is the total cash income gained on the investment property.

- It is evaluated as the total rental income ratio created from the property and the primary cash investment. Using this, investors may compare the cash-on-cash returns in the real estate asset class and across classes.

- It is based on simple interest, not compound interest calculation. Therefore, an investment opportunity with a low compound interest rate is more favorable than an investment with a high cash-to-cash return.

Cash On Cash Return Explained

Cash on cash return is a financial metric that helps in evaluating the return on a real estate investment. It measures the income earned on the property with respect to the cash investment on the property.

The equity dividend rate gives the ratio of before-tax cash inflow by the amount of equity initially invested. It does not include the loans taken from the financial institutions while calculating cash on cash return ratio.

Although this is a simple metric, it does not tell everything about the rental property and should not be taken as the only measure to make an investment decision. COCR in real estate investing requires a deep and sophisticated level of analysis, which includes qualitative analysis like the property's location, prospects of the area, commercial aesthetics of the location, among other factors.

A good cash on cash return ratio does not consider the tax benefits, alternative financing sources, or possible financing structure. However, a good COCR ratio remains the most basic and essential metric to indicate a better investment opportunity.

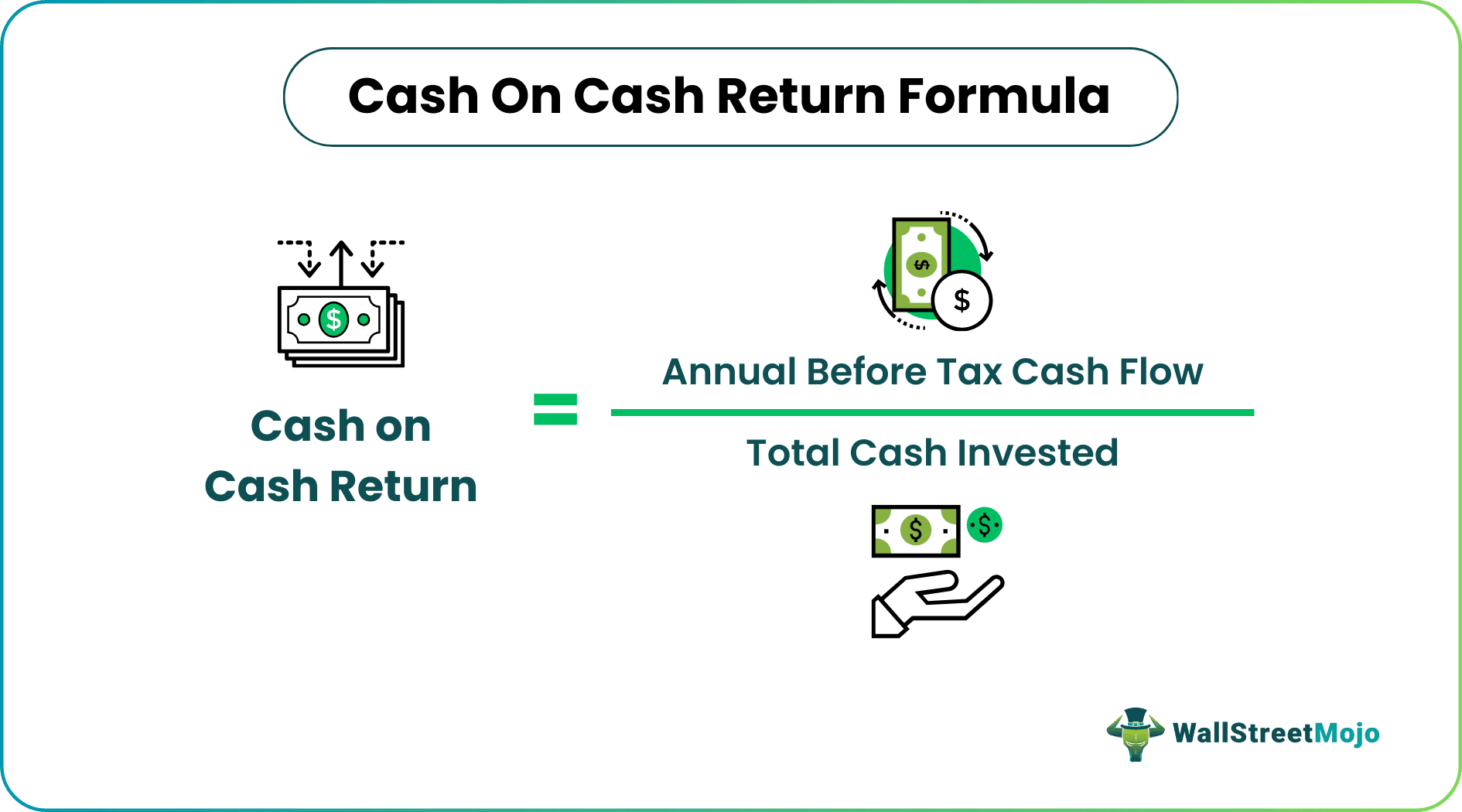

Formula

The cash on cash return equation can be expressed in the following manner.

This formula shows that the equity dividend rate only measures the return on actual cash invested, i.e., the equity involved in the investment. Thus, the measure does not include the debt involved in purchasing the property, which is a common financing instrument in real estate.

How To Calculate?

As per the above mentioned formula, in order to calculate the real estate cash on cash return we need to divide the before tax cash flow generated from the real estate by the total amount of cash that is invested in the property. Thus, if a property can generate before tax cash flow of $15,000, an the cash that is invested in the property is $100,000, then the return will be 15%.

It proved the investor with a clear picture of the viability of the investment after considering the actual amount of cash invested in it. It facilitates comparison of different opportunities and and decide about where to allocate the funds.

Examples

Let us consider the example to calculate the real estate cash on cash return:

Example #1

An investor purchases a property for $ 2,000,000 and receives a monthly rent of $ 8,000. He has to pay maintenance charges of the property of $ 2,000.

- Now, the monthly income on the property = 8000 – 2000 = $ 6,000

- Annual Income = 12 X 6000 = $ 72000

- Thus, COCR Formula = Annual before tax cash flow/Total cash Invested = 72000/2000000 = 3.6%

Example #2

An investor purchases a rental property of $ 2,000,000 with a down payment of $ 500,000. He receives monthly rent of $ 8,000 and pays maintenance and interest charges of $ 4,000 every month.

- Now, the monthly income after expenses of the investor = 8000 – 4000 = $ 4,000

- Annual income = 12 X 4000 = $ 48000

- Thus, Cash on Cash Return = 48000/500000 = 9.6%

In the examples above, the loan increased this ratio. Loans or leverage increases the risk for the investor. Any damage, extra costs, impairment losses, loss of capital have to be borne by the investor himself, and the banks need to pay back on time.

However, it is not always the case; this ratio depends on many other factors like the price, the loan amount, monthly rent, monthly loan payout, etc.

Advantages

- The ratio is easy to calculate COCR. The ratio is easy and quick to compare returns from various investment opportunities. The ratio allows an investor to compare returns within the annual cash on cash return in the real estate asset class and across asset classes.

Disadvantages

- The annual cash on cash return calculation is based on before-tax cash flow to the total cash invested. Since the ratio's numerator is before tax cash flow, it does not consider the individual's tax bracket and tax outflows. The investment opportunity may be influenced by the tax benefits and the tax outgo of an individual, which are not captured in the return ratio.

- The cash on cash return does not account for the return on capital. A return on capital can indicate a higher return as the return on capital is not an income.

- Other risks of owning the property are captured in the ratio. An investor should do due diligence and the return ratio calculation before investing in the property.

- The ratio is based on simple interest to calculate cash on cash return and not on compound interest calculation. An investment opportunity with an even low compound interest rate may be more excellent than an investment with a high cash-to-cash return.

- The ratio does not account for the time value of money. Hence, it gets effective only for the first year of investment if an absolute ratio is measured and the equity dividend rate on the single investment is measured.

Cash On Cash Return Vs Return on Investment (ROI)

Differences between COCR and Return on Investment (ROI):

Return on investment involves the total return on investment. It would consider capital gains on the investment as well. At the same time, this accounts for only the annual cash inflows. Since the COCR in real estate investing, the assets are held for a very long term, usually 10-20 years, capital gains are difficult to estimate. Further, capital gains on the property depend on the property's location, geopolitical scenario, economic conditions, and other factors.

Thus, to measure and compare the investment in real estate investing, cash on cash return equation is a better measure.

What Is A Good Cash On Cash Return Ratio?

The absolute number for a good cash on cash return varies. Experts say an 8% return is a good ratio, whereas some experts look for a range between 8-12%. Some investors may not invest if they are not guaranteed 15% or 20% COCR.