Table Of Contents

What is Exercise Price (Strike Price)?

Exercise price or Strike Price refers to the price at which the underlying stock is purchased or sold by the persons trading in the options of calls & puts available in the derivative trading. The exercise price, also known as the strike price, is a term used in the derivative market. The exercise price is always fixed, unlike the market price, and is defined differently for all available options.

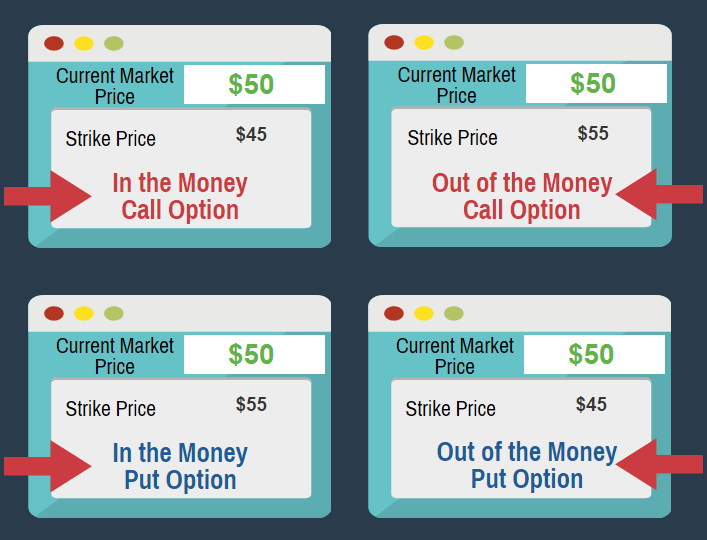

There are two types of options available: one is called, and the other is put. In the case of a call option, the right is there with the option holder to purchase the underlying security at the exercise price up to the date of expiration. In contrast, in the case of the put option, at the exercise price, there is a right to the option holder to sell the underlying security.

Table of contents

- The exercise or strike price is the fixed price at which the underlying stock is bought or sold in call and put options and derivatives. It's unique to each option.

- There are two types of options: call and put. A call allows buying at the exercise price until expiration, while a put allows selling at the exercise price.

- In a derivative contract, it determines control over the underlying stock. It remains unchanged, regardless of fluctuations in the asset's price. Call option buyers pay the strike price to the writer, while put option writers pay the strike price to the holder.

Examples of Exercise Price

Let’s see some simple to advanced examples of the exercise price to understand it better.

Example #1

If, for example, an investor purchased a call option of 1000 shares of an XYZ company at a strike price of $ 20, then say he has the right to purchase 1000 shares at the price of $ 20 till the date of expiration of the call option period no matter what the market price is. Now, if the market price of the shares rises to $ 40, then the holder of the option to purchase the shares at the rate of $ 20 and can book a profit of $ 20,000 as it allows him to sell the shares at the rate of $ 40 per share getting $ 40,000 after buying it at the rate of $ 20 per share spending $ 20,000.

Example #2

In the derivative market, the exercise price determines whether the money can be made by the investor or not.

Let’s take the different scenarios of Intel Corporation, where the underlying stock is trading at $50 per share, and the investor has purchased a call option contract of Intel Corporation at a premium of $5 per contract. The lot of each option contract is 50 shares; therefore, the actual cost of the call option is $250 (50 shares* $5).

Now the situation of the investor in different scenarios:

- At the contract's expiration, Intel Corporation Stock is Trading at $60.

In this scenario, the investor has the right to purchase the call option at $50, and then he can immediately sell the same at $60. Here the exercise price is below the market price; the option is said to be in the money. Now the investor will purchase the shares at $50 per share, spending a total of $2500 ($50*50), and then sell them at $60 per share getting $3500 ($60*50), making a profit of $1000. Hence, the net profit for the above transaction is $750, as a premium of $250 was paid while purchasing the option contract.

- At the contract's expiration, the Stock is Trading at $52.

Using a similar analysis done above, the worth of the call option will be $2 per share or $100 in totality. Here, the exercise price is very near to the stock market price. As the investor has paid a premium of $250, he has to book a loss of $150 ($250 – $100).

- At the contract's expiration, the Stock is Trading at $50.

Here the stock market price is at par with the strike price. So the investor has a loss equal to the option premium he paid, i.e., $250.The loss is always limited to the option premium paid if the stock price is at or out of the money.

Important Points

- While trading in options, the buyer of the option contract must pay the cost of buying the option, which is known as a premium. If the buyer uses the right, they are said to exercise the option.

- It is beneficial to exercise the option if the strike price is below the underlying security market price in the case of the call option or if the strike price is above the market price. One should exercise the option in the case of a put option.

- When the person is trading options, he can choose out of the different strike price ranges predetermined by the exchange. With time the entire range of strike prices may expand beyond initially listed boundaries because of the large market movements.

Conclusion

Thus the exercise price or strike price is the key variable between two parties in a derivative contract. It is the price where the person dealing with the option has control of the underlying stock if he chooses to exercise the option. In the call option, the strike price is the price that the buyer of an option must pay to the writer of the option, and the input option strike price is the price that the writer of an option must pay to the holder of the option. The same does not change and remains the same even if the price of the underlying security changes, i.e., regardless of the price at which the underlying security is, the exercise price remains fixed when one buys an option contract.

Frequently Asked Questions (FAQs)

Every stock option has an exercise price, also known as the strike price, representing the cost of purchasing a share.

Yes, the predetermined amount you must pay per share to exercise your stock options and become an owner is a strike, grant, or exercise price.

here is no cap on prices under the ESOP. Issuing below par value will give shares at a discount; therefore, the Companies Act requires the relevant clearance.

The choice of exercise price plays a role in determining the risk-reward profile of options trading strategies. Traders often select exercise prices based on their expectations of the underlying asset's future price movement

Recommended Articles

This has been a guide to what is Exercise Price or Strike Price. Here we discuss terms related to strike price (in-the-money, out-of-money, and at-money) along with practical examples. You can learn more about financing from the following articles –