Table Of Contents

Writing Put Options Definition

Writing put options is making the ability to sell a stock, and trying to give this right, to someone else for a specific price; this is a right to sell the underlying but not an obligation to do so.

Table of Contents

- Writing put options involves selling or shorting put options, obligating the option writer to buy the underlying asset at a predetermined price (strike price) if the option is exercised. This strategy generates income through the premium received upfront.

- Writing put options can be a source of income as investors collect the premium, especially if options expire worthless or the underlying asset remains above the strike price.

- Profit from writing put options is limited to the premium received, and the writer may face losses if the underlying asset's price significantly drops below the strike price, resulting in buying the asset at a higher price.

Explanation

By definition, Put options are a financial instrument that gives its holder (buyer) the right but not the obligation to sell the underlying asset at a certain price during the period of the contract.

Writing put options, also referred to as selling the put options.

As we know, the put option gives the holder the right but not the obligation to sell the shares at a predetermined price. Whereas, in writing a put option, a person sold the put option to the buyer and obliged himself to buy the shares at the strike price if exercised by the buyer. The seller, in return, earns a premium, which is paid by the buyer and committing to buy the shares at the strike price.

Thus, in contrast to the call option writer, the put option writer has a neutral or positive outlook on the stock or expects a decrease in volatility.

Call Options Vs Put Options in Video

Example

Suppose share of BOB trades at $75/- and it is one month $70/- put trade for $5/-. Here, the strike price is $70/- and one lot of put contract is of 100 shares. An investor, Mr. XYZ, has sold a lot of put options to Mr. ABC. Mr. XYZ expects that the shares of BOB to trade above $65/- ($70 – $5) till the expiry of the contract.

Let’s assume three scenarios of movement of BOB share at expiration and calculate the Payoff of Mr. XYZ (writer of a put option).

#1 - The Stock price of BOB falls below and trades at $60/- (option expires deep in the money)

In the first scenario, the stock price falls below the strike price ($60/-), and hence, the buyer would choose to exercise the put option. As per the contract, the buyer has to buy the shares of BOB at a price of $70/- per share. In this way, the seller would buy the 100 shares (1 lot is equal to 100 shares) of BOB for $7,000/- whereas the market value of the same is $6000/- and making a gross loss of $1000/-. However, the writer has earned an amount of $500/- ($5/ per share) as premium incurring him a net loss of $500/- ($6000-$7000+$500).

| Scenario-1 (when option expire deep in the money) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 60 |

| Net Pay-Off | -500 |

#2 - The Stock price of BOB falls below and trades at $65/- (option expires in the money)

In the second scenario, the stock price falls below the strike price ($65/-), and hence, the buyer would again choose to exercise the put option. As per the contract, the buyer has to buy the shares at a price of $70/- per share. In this way, the seller would buy the 100 shares of BOB for $7,000/- whereas the market value now is $6500/- incurring a gross loss of $500/-. However, the writer has earned an amount of $500/- ($5/ per share) as premium making him stand at a break-even point of his trade with no loss and no gain ($6500-$7000+$500) in this scenario.

| Scenario-2 (when option expire in the money) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 65 |

| Net Pay-Off | 0 |

#3 - The Stock price of BOB jumps and trades at $75/- (option expires out of the money)

In our last scenario, the stock price soars above instead of falling ($75/-) strike price and hence, the buyer would rather not choose to exercise the put option as exercising put option here does not make sense or we can say that no one would sell the share at $70/- if it can be sold in the spot market at $75/-. In this way, the buyer would not exercise the put option leading the seller to earn a premium of $500/-. Hence, the writer has earned an amount of $500/- ($5/ per share) as premium making a net profit of $500/-

| Scenario-3 (when option expire Out of the money) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 75 |

| Net Pay-Off | 500 |

In writing put options, a writer is always in profit if the stock price is constant or move in an upward direction. Therefore, selling or writing put can be a rewarding strategy in a stagnant or rising stock. However, in the case of falling stock, the put seller is exposed to significant risk, even though the seller risk is limited as the stock price cannot fall below zero. Hence, in our example, the maximum loss of put option writer can be $6500/-.

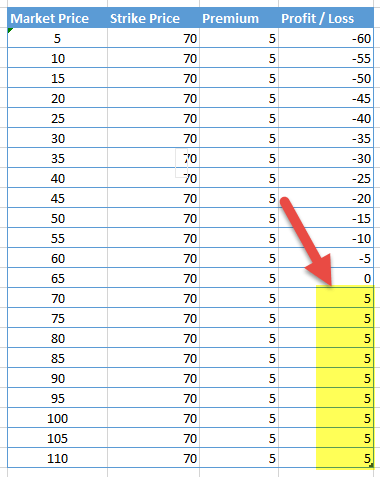

Below is the Payoff analysis for the writer of Put Option. Please note that this is only for one stock.

Options Contract Notations

The different notations used in the option contract are as follows:

ST: Stock Price

X: Strike Price

T: Time to expiration

CO: Call option premium

PO: Put option premium

r: Risk-free rate of return

The Payoff for Writing Put Options

A put option gives the holder of the option the right to sell an asset by a certain date at a certain price. Hence, whenever a put option is written by the seller or writer, it gives a payoff of zero (since the put is not exercised by the holder) or the difference between stock price and the strike price, whichever is minimum. Hence,

Payoff of short put option = min(ST - X, 0) or

- max(X - ST, 0)

We can calculate the Payoff of Mr. XYZ for all the three scenarios assumed in the above example.

Scenario -1 (when the option expires deep in the money)

The payoff of Mr. XYZ = min(ST - X, 0)

= min(60 - 70, 0)

= - $10/-

Scenario -2 (when the option expires in the money)

The Payoff of Mr. XYZ = min(ST - X, 0)

= min(65 - 70, 0)

= - $5/-

Scenario -3 (when the option expires out of the money)

The Payoff of Mr. XYZ = min(ST - X, 0)

= min(75 - 70, 0)

= $5/-

Strategies in Writing put options

The strategy of writing put options can be done in two ways:

- writing covered put

- writing naked put or uncovered put

Let’s discuss these two strategies of writing put option in details

#1 - Writing Covered Put

As the name suggests, in writing a covered put strategy, the investor writes put options along with shorting the underlying stocks. This Options Trading strategy is adopted by the investors if they strongly feel that stock is going to fall or to be constant in the near term or short term.

As the share prices fall, the holder of the option exercises at the strike price, and the stocks are purchased by the writer of the option. The net Payoff for the writer here is premium received plus income from shorting the stocks and cost involved in buying back those stocks when exercised. Therefore, there is no downside risk, and the maximum profit than an investor earns through this strategy is the premium received.

On the other hand, if prices of underlying stocks rise, then the writer is exposed to unlimited upside risk as the stock price can rise to any level, and even if the option is not exercised by the holder, the writer has to buy the shares (underlying) back (because of shorting in the spot market),

and the income for the writer here is only the premium received from the holder.

With our above argument, we can view this strategy as a limited profit with no downside risk but unlimited upside risk. The Payoff of the diagram of the covered put option is shown in image-1.

Example

Let’s assume that Mr. XYZ has written a covered put option on BOB stock with a strike price of $70/- for one month for a premium of $5/-. One lot of put option consists of 100 shares of BOB. Since this is a covered put writing, here, Mr. XYZ is short on the underlying i.e., 100 shares of BOB, and at the time of shorting, the share price of BOB was $75/per share. Let’s consider two scenarios wherein, in the first scenario, and the share prices fall below $55/- at expiration giving the holder the opportunity to exercise the option, and in another scenario, the share prices rallies to $85/- at expiration. It is obvious that in the second scenario, the holder will not exercise the option. Let’s calculate the Payoff for both scenarios.

In the first scenario, when the share prices close below the strike price at expiration, then the option will be exercised by the holder. Here, the Payoff would be calculated in two steps first, while the option is exercised, and second when the writer buys back the share.

The writer is in a loss in the first step as he is obliged to buy the shares at the strike price from the holder, making the pay off as the difference between stock price and strike price adjusting with the income received from premium. Hence, the Payoff would be negative $10/ per share.

In the second step, the writer has to buy the shares at $55/- which he has sold at $75/- earning a positive payoff off of $20/-. Therefore, the net Payoff for the writer is positive $10/- per share.

| Scenario-1 (Stock prices falls below strike price) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 55 |

| Income from shorting of shares | 75 |

In the second scenario, when the share price rallies to $85/- at expiration, then the option will not be exercised by the holder leading a positive payoff off of $5/- (as premium) for the writer. Whereas in the second step, the writer has to buy back the shares at $85/- which he sold at $75/- incurring a negative payoff of $10/-. Therefore, the net Payoff for the writer in this scenario is negative $5/- per share.

| Scenario-2 (Stock prices rallies above strike price) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 85 |

| Income from shorting of shares | 75 |

| Expenses towards buying back of shares | 85 |

| Net Pay-Off | -$500/- |

#2 - Writing Naked Put or Uncovered Put

Writing uncovered put, or naked put is in contrast to a covered put option strategy. In this strategy, the seller of the put option does not short the underlying securities. Basically, when a put option is not combined with the short position in the underlying stock, it is called writing uncovered put option.

Profit for the writer in this strategy is limited to the premium earned, and also there is no upside risk involved since the writer does not short the underlying stocks. On one side where there is no upside risk, there is a huge downside risk involved as the more the share prices fall below strike price more, and the loss writer would incur. However, there is a cushion in the form of a premium for the writer. This premium is adjusted from the loss in case the option is exercised.

Example

Let’s assume that Mr. XYZ has written an uncovered put option on BOB stock with a strike price of $70/- for one month for a premium of $5/-. One lot of put option consists of 100 shares of BOB. Let’s consider two scenarios, in

Let’s consider two scenarios. In the first scenario, the share prices fall below to $0/- at expiration giving the holder the opportunity to exercise the option, whereas, in another scenario, the share prices rally to $85/- at expiration. It is obvious that in the second scenario, the holder will not exercise the option. Let’s calculate the Payoff for both the scenarios.

The payoffsoffs are summarized below.

| Scenario-1 (Strike price < Stock Price) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 0 |

| Net Pay-Off | -6500 |

Table-7

| Scenario-2 (Strike price > Stock Price) | |

|---|---|

| Strike Price of BOB | 70 |

| Option Premium | 5 |

| Price at maturity | 85 |

| Net Pay-Off | 500 |

Looking at the payoffs, we can establish our argument that the maximum loss in uncovered put option strategy is the difference between the strike price and stock price with the adjustment of the premium received from the holder of the option.

Margin Requirement Exchange Traded Options

In an options trade, the buyer needs to pay the premium in full. Investors are not allowed to buy the options on margins since options are highly leveraged, and buying on margin would increase these leverage at a significantly higher level.

However, an option writer has potential liabilities and therefore has to maintain the margin as the exchange and broker has to satisfy itself in a way that the trader does not default if the option is exercised by the holder.

In a Nutshell

- A put option gives the holder the right but not the obligation to sell the shares at a predefined price during the life of the option.

- In writing or shorting a put option, the seller (writer) of the put option gives the right to the buyer (holder) to sell an asset by a certain date at a certain price.

- The Payoff in writing put option can be calculated as min(ST – X, 0).

- The strategy involved in writing put option is writing Covered put option & writing Uncovered put option or writing Naked put option.

- Writing covered put option holds a huge potential of upside risk with limited profits, whereas writing uncovered put option contains a huge downside risk with limited profits as premium.

- Due to high potential liabilities in writing a put option, the writer has to maintain margin with its broker as well as with the exchange.

Frequently Asked Questions (FAQs)

Writing a put option differs from buying a put option in terms of position and obligation. When buying a put option, the buyer has the right to sell the underlying asset at the strike price but is not obligated to do so. In contrast, when writing a put option, the writer has an obligation to buy the underlying asset if the buyer exercises the option.

The risks of writing put options include potential losses if the underlying asset's price declines significantly. The writer also faces the risk of assigning and purchasing the asset at a higher price than the market value. The rewards of writing put options include earning the premium upfront if the option expires worthless or the writer keeps the premium if the option is not exercised.

The tax implications of writing put options can vary depending on factors such as the individual's tax jurisdiction and specific circumstances. Generally, the writer may be subject to short-term or long-term capital gains taxes if the option is exercised.

Recommended Articles

- Put Option Examples

- Forwards vs. Futures Derivatives

- Swaps Meaning

- Interest Rate Swaps