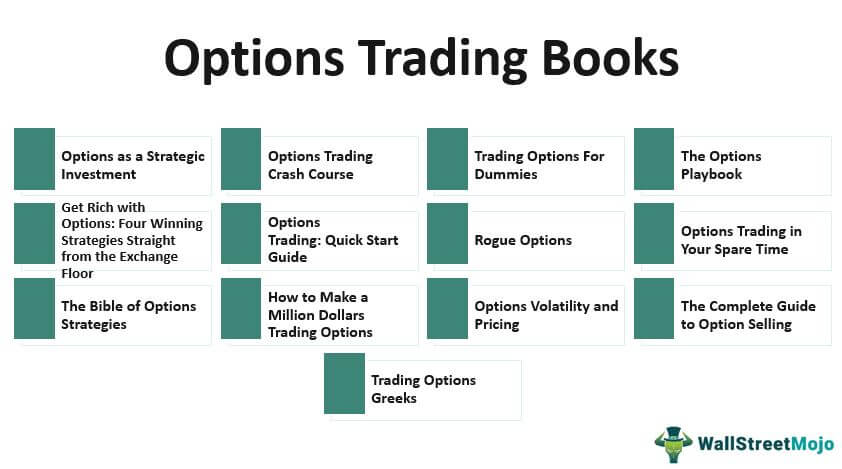

13 Best Options Trading Books [2025]

One must consider using options in investment endeavors to thrive in the present-day financial markets. In this article, we highlight the top 13 Best Options Trading books to read in 2025 that you may consider reading –

- Options as a Strategic Investment ( Get this book )

- Options Trading Crash Course ( Get this book )

- Trading Options For Dummies ( Get this book )

- The Options Playbook ( Get this book )

- Get Rich with Options: Four Winning Strategies Straight from the Exchange Floor ( Get this book )

- Options Trading: Quick Start Guide ( Get this book )

- Rogue Options ( Get this book )

- Options Trading in Your Spare Time ( Get this book )

- The Bible of Options Strategies ( Get this book )

- How to Make a Million Dollars Trading Options ( Get this book )

- Options Volatility and Pricing ( Get this book )

- The Complete Guide to Option Selling ( Get this book )

- Trading Options Greeks ( Get this book )

Let us discuss each options trading book in detail, along with its key takeaways and reviews.

#1 - Options as a Strategic Investment

by Lawrence G. McMillan

About the book

The book tells you how listed options and non-equity option products provide you with new and strategic opportunities for investment management. It also offers you the latest market-tested tools that can improve your portfolio’s earning potential while limiting its downside risk irrespective of the market performance.

Book review

It is one of the best qualitative books on options strategies, providing you with a directional view of the market. It thoroughly explains the complex options investing topics in a very simple way. It also discusses how you can construct various classic options strategies and how these options work despite market movements. It covers hordes of business-tested tactics and proven techniques you can employ while investing in innovative and fresh options products. The author has provided many examples and exhibits that help you understand the power of each strategy. After reading the book, you will realize that there are multiple ways to earn profits using different options and strategies irrespective of any possible market view.

Key Takeaways

- If you are planning to start trading options, this is a must-read for you as it serves as a guide and a reference book.

- This comprehensive book explains different concepts and applications of the available options strategies.

#2 - Options Trading Crash Course

The #1 Beginner’s Guide to Make Money With Trading Options in 7 Days Or Less!

by Frank Richmond

About the book

This book provides a brief overview of how options trading works in the real business world and explains some simple strategies for trading options.

Book review

The options market is very difficult to comprehend, especially for novice traders. To start options trading, you must build your understanding of what lies underneath the options market. In this book, the author explains various trading strategies and how you can utilize all of them to generate healthy profits. It also teaches you how to identify patterns in the market, how to recognize great investment opportunities, and how to make money out of them. At the end of the book, you will realize that understanding the fundamental principles of the options market is not as difficult as it appears from a distance.

Key Takeaways

- It can be an excellent guide for beginners as it explains the functioning of the options market from scratch.

- This book is a collection of several fundamental concepts put together in one place.

- It is a straight-forward, simple, and easily understandable book.

#3 - Trading Options For Dummies

by Joe Duarte

About the book

The book will help you select the right options and trading strategies based on your investment needs. It will teach you to run the cost-benefit analysis for building a strategy that will always gain no matter how the market behaves.

Book review

The book is considered one of the best if you are interested in learning the fundamental principles and strategies of options trading. If you are a professional investor with some knowledge of trading, then this book can help you better understand new techniques, associated risk factors, and profit profiles. Options trading can be effective risk management, and the author provides details explaining the same. The book covers a lot of information, including technical analysis, Exchange Traded Funds (ETFs), and trading strategies that can be useful for you if you plan to become a trader soon. Effectively, the author gives you enough theories that you can understand quickly and put into action.

Key Takeaways

- It is a comprehensive book about options trading, which can serve as a good reference book.

- This book is not best suited for beginners. You need some trading knowledge to draw maximum benefits from the explanations provided in it.

#4 - The Options Playbook

by Brian Overby

Book Review

The objective of getting this top Options Trading book into existence was to simplify option trading and offer guidance to investors for trading under various market conditions. It covers more than 40 option trading strategies broken down into intriguing plays, which will keep the readers engrossed and feel involved. The format of the play has been kept uniform, which will offer information on:

- Strategies considered and implemented

- Break-even at expiration

- Sweet Spot for trade execution

- Maximum Potential of making a profit or Loss

- A requirement of Margin Money

- Time constraints

- Implied Volatility

This expanded edition consists of 10 new plays and 56 new pages of content describing:

- A brief history of options

- Five common mistakes made by options traders and how could they be avoided

- Expanded Glossary

- Explaining the difference between Index and Stock options

- Managing early exercise and assignment

- It calculates position delta and its use to manage overall position risk in case of a multi-leg option strategy.

Key Takeaways

This Options Trading Book is framed in a very simplified but constructed manner, which benefits new and experienced traders. It will cover the basic definitions and concepts required to understand the market, especially for new traders, tips to avoid common beginner's mistakes, and suggested strategies to get a good grip on the market.

To cater to the experienced traders, the emphasis is laid on Implied volatility with a detailed section on the Option Greeks, which will help understand how option pricing gets impacted by market conditions.

#5 - Get Rich with Options: Four Winning Strategies Straight from the Exchange Floor

by Lee Lowell

Book Review

It is a trustworthy Options Trading Book rich with in-depth insights and expert guidance, offering strategies and knowledge required for achieving optimal results within the options market. It will swiftly cover the basics before moving on to the four options-trading strategies, which have helped the author profit in this arena over time. The strategies are:

- Buying Deep-in-the-money call options

- Selling Naked Put options

- Selling Credit Spread Options

- Selling of covered calls

Key Takeaways

This Best Options Trading Book is packed with real-life examples of actual trades and detailed discussions of how options can be used as a Hedging, Speculating, or income-producing tool. It will broadly cover up:

- A detailed operation of the strategies is mentioned above.

- Explaining how to set up a home-based business with the best options trading software, tools, and websites.

- A detailed discussion of Delta and Volatility can be used to the trader's advantage.

#6 - Options Trading: Quick Start Guide

by ClydeBank Finance

Book Review

This Best Options Trading book is a straightforward premier with a lot of information packed into an easy-to-read book. It walks the readers through many strategic trading decisions, displaying how a trader thinks and how they arrive at resolving critical decisions. It motivates the trader to be ambitious and become a formidable, sharp, and cunning options trader. The chapters in this Options Trading book include:

- Basics of Options

- Trading Fundamental about Call and Put options

- Sound Options Trading Strategy for Beginners

- Key influencers on the pricing of options

- Importance of Option Greeks

- Popular and Complex options strategies under various market conditions.

Key Takeaways

Whether the reader is a newcomer to options or an established veteran looking for a fresh take on basic strategy, the plain-spoken style and colorful scenarios will keep the readers engrossed and motivated to gain more knowledge.

#7 - Rogue Options

by Rogue Options

Book Review

This Top Options Trading book will teach how traders can make money online by trading options with fine details and clear images supplementing the information provided. One need not have a finance or technical background to implement these techniques, and it can be done by anyone who wants to make money through online trading.

The author delves deep into the many options and strategies for consistently making money online. Exact details are provided, from what each trade does to how it is required to be set up within the trading software. Step-by-step instructions with screenshots are included to make it easy to follow the instruction manual on profitable trading strategies. The author is confident of traders gaining success in the options market with an investment of as low as $50 though it is not a guaranteed approach.

Key Takeaways

Most of the readers who are traders have highly appreciated the contents of this book, and it can be implemented in most of the option strategies under various conditions. Hence, it will not only sharpen the practical knowledge but also the way the trading platform needs to be handled gets improvised. It comes with several Scanning setups to be used in ThinkorSwim, one of the leading trading platforms and is Free to be used as a part of this top options trading book.

#8 - Options Trading in Your Spare Time

by Virginia McCullough

Book Review

This book on Options Trading is geared specifically toward women, describing and encouraging them to be successful options traders despite holding a full-time job or being full-time homemakers. It offers a step-by-step guide in an easy-to-understand language for beginners and advanced investors. The primary focus is on executing trades online and communicating what is required to know for being a successful trader.

Though option trading is not a risk-free method of investment, for women who have limited spare money to be utilized for investing, options trading can be a very lucrative method to make money.

Key Takeaways

Excellent guidance has been offered towards the Buying of Calls and Puts. Neat and tidy charts and candlesticks have been regularly shown, making it interesting, especially for beginners, to understand the performance of the options. Few other caveats have been identified by the readers, such as making the charts more colorful or including some other strategies which could have made it more interesting. Overall, it is a definite read for someone who desires to explore the market with a limited risk appetite.

#9 - The Bible of Options Strategies

by Guy Cohen

Options Trading Book Review

This book on Options Trading is a practical module from start to end, offering guidance on how flexible and advantageous option trading can be. It has an easy-to-understand language with simple examples easily cross-referenced so that one can find what is required quickly and take advantage of opportunities even if they are short-lived. All the major areas which are essential to know while indulging in options strategies have been covered by the author.

Key Takeaways

The author has successfully explained most of the complex techniques smoothly, making them easier to understand for any trader, even with modest experience in trading options. Apart from offering outstanding value, it is a definitive reference to contemporary options trading. Some of the critical aspects are:

- Control more amount of assets for a limited amount of money

- Trade with leverage

- Trade for a substantial amount of income

- How to make a profit from declining stocks

- Reduction or elimination of risks

- Profit from volatility or protection against a variety of factors

Many readers and traders have successfully highlighted and acknowledged a number of aspects with respect to explaining details of option spreads, how to use them, the selection of stocks, and their benefits and drawbacks.

#10 - How to Make a Million Dollars Trading Options

by Cameron Lancaster

Book Review

This book on Options Trading is a relatively short read, but the author has done an exceptional job teaching the readers how to trade options? With ease. The truth about trading options and making money is clear and simple. It exposes the secret of options hidden by Wall Street. It highlights that options do not fairly reflect the chances of the stock going up or down, and put/call parity can be exploited.

The important concepts highlighted are:

- Basics of Options

- Volatility / Put-call parity

- Expected Value of Options Contracts

- Risk Management and Trade Sizing

- Where and how to source trades

- Additional bonus tips on trading

- Reasons why option traders are losing money

Key Takeaways

It is an interesting book on options trading, which has been highly recommended by several traders worldwide who are new or even experienced in this field. It was known to be controversial since it was e-mailed to Wall Street and printed to the outer world.

#11 - Options Volatility and Pricing

by Sheldon Natenberg

Options Trading Book Review

This best options trading book has been recognized as one of the best sellers for new professional traders as they are given to learn the trading strategies and various techniques of risk management essential for success in the options markets. It offers a comprehensive guide covering a wide range of topics as diverse and exciting as the market itself, including the following aspects:

- The foundations of Options Theory

- Dynamic Hedging

- Risk Analysis

- Volatility and Directional Trading strategies

- Volatility Contracts

- Management of the positions which are held.

Key Takeaways

This options trading book stresses that options trading is a science and an art and how one can extract the maximum benefit from them. One can gain a complete understanding of how the theoretical pricing techniques are implemented in the practical models which are in use. The traders can also apply the principle of option evaluation for creating strategies that have the greatest chances of success, given a trader's assessment of market conditions.

#12 - The Complete Guide to Option Selling

by James Cordier/Michael Gross

Book Review

Making any investment has taken a giant leap over the past few decades. The buy and hold strategy has now been replaced with buy and hope. A wide array of factors can now have a widespread impact on the performance of the investment. An investor needs to consider all the macroeconomic factors before committing or growing any investment. This guide will take a leaf from the pros and radically change the entire philosophy toward building a robust and high-yielding portfolio.

A step-by-step guide is provided throughout the entire process for helping to earn steady and high profits even under choppy market conditions. Some of the important aspects which this best options trading book will focus on are:

- Fundamentals of Option Selling

- Option-Selling as a Strategy and its associated Risk Management

- Analysis of Markets and Writing of Options

Key Takeaways

Selling premium is a regular strategy in getting a niche in the market as it puts probability on the trader's side. It stresses that selling options are less stressful and excusable than traditional and direct trading strategies. Not much reference has been made to Greeks or complex mathematical calculations, making it more practical and less theoretical. It also will briefly mention seasonality and utilization of fundamentals for commodity futures and others.

#13 - Trading Options Greeks

by Dan Passarelli/William Brodsky

Book Review

The overall options market is highly dynamic and challenging, and the traders must know the Option Greeks for the valuation of options and execution of trades regardless of market conditions. These Option Greeks include:

- Delta

- Gamma

- Theta

- Vega

- Rho

Key Takeaways

It will skilfully highlight how trading strategies can be used to gain profits from aspects such as Volatility, Time Decay, or changes in interest rate. It also uses New Charts and examples with discussions on how the proper application of these Greeks can lead to the accuracy of pricing and trading while offering alerts to a range of other opportunities.

These tools are kept in perspective for aspiring and professional traders, explaining a straightforward and accessible style.

It also offers advice on investments through spreads, put-call parity, synthetic options, trading volatility, and advanced options trading. All of these options are interdependent and play a vital role in determining the price of an option. In a crunch market scenario, these Option Greeks need to be taken advantage of, and at times, it is the trading pulse that can decide the future course of the investment.

Additionally, it holds pertinent new information on how accuracy in pricing can be a driving force of the profits earned.

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com