Table Of Contents

Golden Parachute Meaning

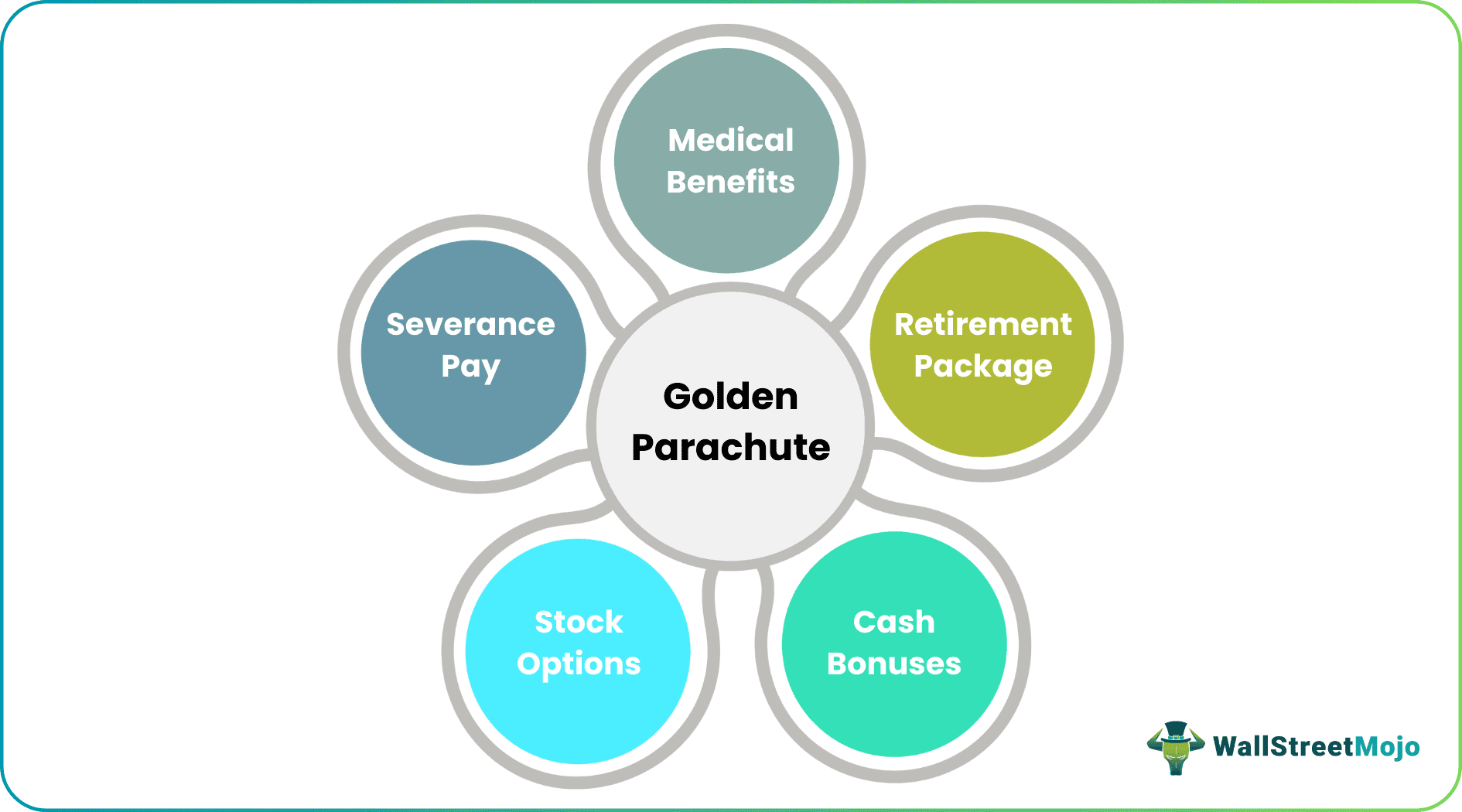

A golden parachute is a contract between the company and its employees. Usually, the top management receives significant benefits such as cash bonuses, medical benefits, stock options, severance pay, a retirement package, etc., if their employment in the company terminates due to any corporate restructuring activity.

The name “Golden Parachute” denotes the soft and safe landing of the terminated executive with monetary benefits way above the standard severance packages. Typically, the value of golden parachute payments is two to three times their salary and bonuses, along with other benefits. It is also commonly referred to as severance pay.

Table of contents

- Golden Parachute Meaning

- A golden parachute refers to a an agreement between a firm and its employees.

- Generally, the top management obtains compelling advantages like cash bonuses, medical benefits, stock options, severance pay, a retirement package, etc., when employment in the company finishes due to any corporate restructuring activity.

- The name “Golden Parachute” stands for the terminated executive soft and safe landing with monetary advantages above the standard severance packages.

- Charles C. Tillinghast Jr. of Trans World Airlines became the first recipient in 1961. It said that between the tug of war to leave Howard Hughes, Tillinghast Jr. provided a generous golden parachute when Hughes got the company control and fired Tillinghast.

Golden Parachutes Explained

A golden parachute is a contract between the company and its top-level management. The executives offered considerable benefits if the latter terminated due to restructuring package, medical benefits, and handsome severance pay. It may also use as a tool for the Anti-takeover mechanism or Poison pill to dissuade any potential merger. The quantum of benefits or compensation promised to the crème-de-la-crème of the company might lead many acquirers to change their takeover decision.

The ongoing opposition has gained considerable momentum over a couple of years. So much so that Congress has released tax rules to discourage rampant golden parachute strategy involving “too generous” severance packages. Additionally, in 2010, section 951 of the Dodd-Frank Wall Street Reform and Consumer Act also made it compulsory to obtain advisory shareholder votes on all instances of the golden parachute clause henceforth.

In 2011, the U.S. Securities Exchange Commission unveiled a new clause on the say-on-pay vote and golden parachute. The say-on-pay vote requests investors to vote on the compensation of the company's top executives – the CEO, the Chief Financial Officer (CFO), and at least three other most highly compensated executives.

The U.S. Securities Exchange Commission mandated that – Companies comply with the golden parachute shareholder advisory vote and disclosure requirements in proxy statements to approve a merger or acquisition, and similar forms initially filed on or after April 25, 2011.”

According to Pearl Meyer, a consultancy, the data between 2011 and 2014 reveals that merely around 5% of golden parachute votes garnered less than majority support. However, shareholders were not opposed to the actual merger in most cases. However, concerned shareholders are now taking a stand against this as they do not deem it appropriate.

Video Explanation of Golden Parachute

History

It dates back to 1961 when Charles C. Tillinghast Jr. of Trans World Airlines became its first recipient. It said that amidst the tug of war to push off Howard Hughes, Tillinghast Jr. offered a generous golden parachute if Hughes gained control of the company and fired Tillinghast. However, the tide of events was different, and Charles C. Tillinghast Jr. continued in the company for fifteen more years. Amusingly, he also never collected the parachute.

The name “Golden Parachute” denotes the soft and safe landing of the terminated executive with monetary benefits way above the standard severance packages.

While this was an isolated incident in the 1960s, it soon became a preferred way of compensating white-collar employees, particularly in the late 1970s. Hostile takeovers became the order of the day in the 1980s, and the U.S. corporate landscape saw a surge in the golden parachutes. As per Harvard Business Review, by 1986, around 35% of the largest 250 U.S. corporations had implemented a clause stating that they would provide their executives with cash payments and a range of other benefits in case there is a change of hands.

Source: Harvard Business Review

The graph shows a significant rise in the golden parachute contracts between 1980 and 1990. The cumulative number of contracts escalated from 75 to 300. Earlier, only small companies fell prey to hostile takeovers. However, with the popularity of the junk bond market, financing became comparatively easier, and even large multinationals and Fortune 500 companies became easy targets of hostile takeovers. During this period, several companies included the clause of the golden parachute in their employment contracts to retain highly qualified employees. High-level executives considered it a major security element of security before they took up jobs in merger-prone industries. It was a defensive mechanism also for hostile takeovers as it increased the cost of seizures considerably.

Source:Mondaq.com

An advisory firm, Institutional Shareholder Service (ISS), has revealed a trend that the quantum of a golden parachute as a percentage of the equity value increases as the deal size becomes smaller. The graph shows the extent of reported golden parachute payments as a percentage of the target’s equity value for the 25 largest deals announced between May 2013 and April 2014 and also includes the 65 companies that enhanced compensation for executives.

Taxation

The internal revenue code has three components about the golden parachutes. First, as per Section 4999 of the IRS, a 20% excise tax is imposed, additional to the normal income tax, on “excess parachute payments,” while section 280G deems the payments under golden parachute non-deductible to the company. Congress passes these provisions as a part of the Deficit Reduction Act of 1984. Lastly, section 162(a) of the internal revenue code denies tax-deductibility of any compensation over and above $1 million unless the same links to the executive's performance. This way, the underperforming high-ranking executives, when compensated with a hefty package, will come under the purview of this section.

Example

"Marissa Mayer will make over $44 million if Verizon fires her,"- quoted the Business Insider a few months ago. CEO Marissa Mayer became the subject of widespread speculation for reasons other than her performance at Yahoo! Ever since Verizon agreed to buy the internet giant. The industry has been abuzz with the exorbitant Golden Parachute that Marissa would be flying within if the former decides to terminate her.

source: Yahoo Schedule 14A

Advantages & Disadvantages

Let us understand the advantages or benefits and criticisms or disadvantages of having a golden parachute strategy in place through the discussion below:

Advantages

- First, no company can function if there is a conflict of interest at the key management level. While certain takeovers are hostile, some can benefit the company’s future and growth. If the key personnel become insecure about their job, they may hinder the merger or takeover process. On the other hand, employees can be secure about their compensation and offer complete co-operation with the merger procedures.

- Once the severance package terms are laid out, the exit of white-collar executives becomes more cordial. Things go per a predetermined agreement, and there is no bad blood. It also protects a company from being tarnished by its key personnel in the event of termination due to a merger.

- The possibility of hostile takeovers is reduced with the golden parachutes clause being included in the contract. However, the acquiring company might not find it appealing to shed such an expensive package if it plans to oust the key employees already in control.

Disadvantages

Something seemingly so attractive cannot be sans controversies and criticisms. Golden parachutes have been the favorite punching bag for many critics. The groups particularly miffed with it are the shareholders and other employees of the company. A few reasons why golden parachutes are usually opposed are: -

- The quantum of the package is mammoth, which leads other employees entitled to a generic severance package to feel deprived, neglected, and less privileged. This dissatisfaction amongst existing employees hinders the smooth functioning of a company.

- Often, top-level executives underperform or do something unethical to lose their jobs. Unfortunately, many companies offering the golden parachute are silent on these aspects, and the clause ends up being an incentive to erring managers who terminate. In addition, shareholders and employees will not feel good about it. E.g. Tony Hayward, the Chief Executive officer for British Petroleum, was removed due to the perceived lack of leadership during the infamous oil spill that tarnished his tenure. However, he is reported to have walked away with a severance package of more than a million dollars and an eight-digit pension amount.

- Critics feel that it is the responsibility of the management to act in the company's best interest. For example, suppose a white-collar executive loses his job because of a friendly merger. In that case, the company does not need to compensate them in addition to their already fat package.

- Another logic against it is that if the acquirer has deep pockets, the compensation cost may be a trivial amount for him. Hence, the idea of using this approach as an anti-takeover mechanism is rendered futile.

Shareholders, in particular, are not too fond of golden parachutes because many believe it is an unnecessary waste of shareholders' money. Moreover, they feel many CEOs who promised hefty severance packages will only be enamored by it and not work for the company's long-term goals. Whether or not their fears are genuine is challenging to be concluded, though. Moreover, they feel many CEOs who are promised hefty severance packages will only be enamored by it and not work for the company's long-term goals. Whether or not their fears are genuine is challenging to be concluded, though.

In a research paper titled-"Golden Parachutes and the Wealth of Shareholders" by Lucian A. Bebchuk, Alma Cohen, and Charles C. Y. Wang states that over the long term, it may harm shareholder value. Companies that implement the golden parachute clause obtain lower risk-adjusted stock returns than their counterparts, even though the latter is more likely to be acquired. The researchers explained that it makes an acquisition like a cakewalk for CEOs, and they are not afraid of being acquired. Therefore, they are not motivated enough to enhance shareholder value.

Golden Parachute vs. Golden Handshake vs. Golden Handcuff

Many times, few terms are interchangeably used. One of them is the golden handshake. A golden handshake is an upgraded form of the golden parachute. The severance package in the golden handshake is a bit more generous than the latter. Another minor variation is that golden handshakes are offered to high-ranking executives terminated through dismissal, corporate restructuring, or even during their scheduled retirement. The severance package for the golden handshake includes cash, equity, and certain stock options. Other elements can also be included in it, which solely depends on the company's discretion.

Another term used in a similar sense is golden handcuffs. Golden handcuffs act oppositely, while golden parachutes and handshakes may make the high-level CEOs more inclined towards the exit to receive the hefty package waiting for them. They act as a disincentive for executives to leave the company and join the competitors. It is said that under golden handcuffs, executives have to give back the bonuses and rewards received if they go before a stipulated period.

Golden Parachutes Video

Frequently Asked Questions (FAQs)

Golden parachutes are the kind of compensation provided to essential executives while selling a public company, and the crucial executives lose jobs, or their responsibilities are short-lived.

To negotiate a golden parachute, one must know the leverage, keep targets in mind, anticipate above the paycheck, and contemplate any professional consultancy.

The corporations cannot write off golden parachute payments, and payment recipients must pay a 20% excise tax with standard income taxes. It is a punishing tax law that may negatively influence both the buyer and seller engaged in the acquisition.

A golden parachute ensures compensation during a job loss. It boosts executives to work for the company’s best interests instead of being engaged with their financial safety.

Recommended Articles

This article is a guide to Golden Parachute & its meaning. We discuss its taxation along with vs golden handshake & handcuffs, advantages, & disadvantages. You may learn more about financing from the following articles: -