Table Of Contents

What is Equity Value?

Equity Value, also known as market capitalization, is the total of the shareholders' values available for the business and can be calculated by multiplying the market value per share by the total number of shares outstanding. It is very important for a business owner, especially when he plans to sell his business, as it gives a good measure of what a seller of business would receive after the debt has been paid.

Let us look at the above graph of the Equity Market Value of Exxon, Apple, and Amazon. We note that in 2007-08, Exxon was far ahead in market value compared to Amazon and Apple. However, Apple and Amazon's market value has catapulted over the years, and now they are leading companies. Does it even matter?

Equity Value Formula

There are two ways in which you can calculate Market Value of Equity

Formula #1 -

Equity Value = Share Price x Number of Oustanding Shares

- The share price is the last traded price of the stock

- The number of Oustanding shares should be the latest figures available

Formula #2 -

This second equity market value formula is commonly used to find the "fair equity value" (using DCF Approach)

We use the following steps to calculate the fair equity market value -

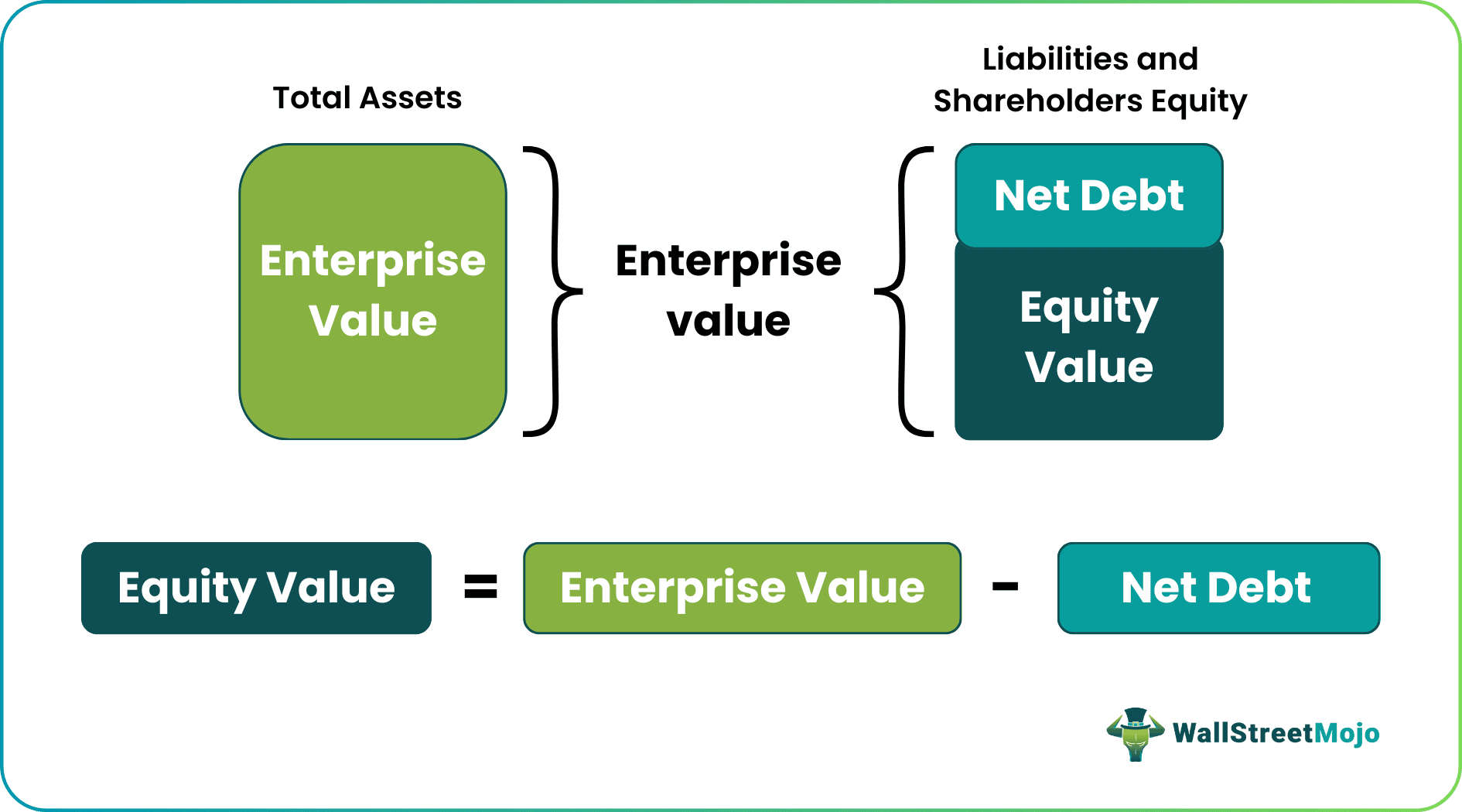

- Use the DCF approach using FCFF to find the Enterprise value of the firm. DCF will provide us with the fair valuation of the total firm (Enterprise value).

- Use the formula, Enterprise Value (calculated using DCF) = Fair Equity Value + Preferred Shares + Minority Interest + Outstanding Debt – Cash & Bank balances

- We can calculate Fair Equity Value = Enterprise Value - Preferred Shares - Minority Interest - Outstanding Debt + Cash & Bank Balances

Target Price of the stock = Fair Equity Value / Number of Oustanding Shares

Please note that the Market Price of stock and the Target Price of stock are two different things.

Let us assume that the Market Price of Apple is $110 per share. Using DCF, you may get a target price of Apple stock as $135 per share. This means that Apple is undervalued and should reach the target of $135 per share shortly.

Interpretation

Equity value is more useful to a business seller than an investor. Let's have a detailed look at this.

Let's say that Mr. A has a company he wants to sell. Now he is concerned about the valuation of the company. One day, while searching for buyers for his business, Mr. A got a proposal from Mr. B. Mr. B said he would buy Mr. A's business at a certain valuation. Mr. A went back home and thought about the valuation Mr. B gave. Mr. A mentioned that he had taken some loans for his business, which have not been fully paid yet. Mr. B said he would pay the same as the valuation he had calculated; however, Mr. A will only receive the money after paying the debt. And that's "market value of equity" in the true sense.

Now let's understand it in numbers. Mr. B said he would pay the US $10 million for Mr. A's business before knowing that Mr. A still has to pay some debt. Mr. A mentioned that the outstanding debt is US $2 million. Then Mr. B agreed to pay Mr. A US $10 million for the business, including the outstanding debt. That means Mr. A would only get US $8 million. Here the US $10 million is the enterprise value, and the US $8 million in the equity market value.

Equity Value Video Explanation

Equity Value Example

Let us do a basic example of comparing two companies based on market value and finding the larger one. Here are the details of Company A and Company B –

| In US $ | Company A | Company B |

|---|---|---|

| Outstanding Shares | 30000 | 50000 |

| Market Price of Shares | 100 | 90 |

In this case, we have been given both the numbers of outstanding shares and the market price of shares. So let's calculate the equity market value of Company A and Company B.

| In US $ | Company A | Company B |

|---|---|---|

| Outstanding Shares (A) | 30000 | 50000 |

| Market Price of Shares (B) | 100 | 90 |

| Market Value (A*B) | 3,000,000 | 4,500,000 |

We note that the market value is more than the market value of Company B. But let's tweak a few things and calculate Enterprise Value and let's see how it turns out for investors.

Equity Value Calculation

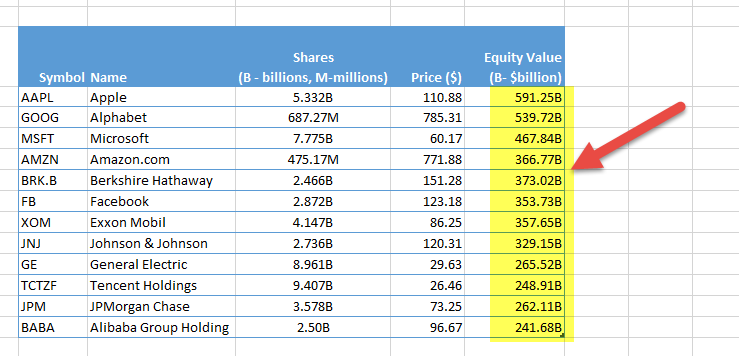

Please have a look at the table below.

source: ycharts

- Column 1 contains the number of outstanding shares.

- Column 2 is the current market price.

- Column 3 is the Equity Value calculation = Shares Outstanding (1) x Price (2)

If you want to calculate the Market Value of Facebook, it is simply the outstanding number of shares (2.872 billion) x Price ($123.18) = $353.73 billion.