Table Of Contents

Overview of Investment Banking in Malaysia

Bank Negara Malaysia, the Central Bank of Malaysia, is empowered to act as the regulator for all banking institutions, including investment banks in Malaysia. It supervises and controls all banking institutions incorporated under the Financial Services Act 2013, Islamic Financial Services Act 2013, and the Central Bank of Malaysia Act 2009. It is a statutory body that started operating on 26 January 1959 and is responsible for promoting monetary and financial stability, facilitating well-balanced and sustainable growth of the Malaysian Economy.

The Securities Commission of Malaysia regulates investment banks in Malaysia, a statutory body established under the Securities Commission Act, 1993. It is the primary regulatory authority for capital market activities in Malaysia. Together, Bank Negara Malaysia and Securities Commission of Malaysia regulate investment banks by setting prudential regulation of investment banks, their business and market conduct, and promoting capital market through enhancing market integrity and investor protection in the capital markets. Any entity that plans to establish investment banking in Malaysia must incorporate a public company under the Companies Act 2016 and apply for an investment banking license in writing by applying to Bank Negara Malaysia. On fulfilling the set, criteria may grant a permit.

Table of contents

Services Offered by Investment Banking in Malaysia

Major services offered by investment banks in Malaysia are as follows:

#1 - Mergers and Acquisitions

Investment banks assist clients in domestic and cross-border mergers and acquisitions which includes providing buy-side and sell-side advisory, helping clients in management buyouts, leveraged buyouts, assisting clients in setting up joint ventures, etc.

#2 - Financial Advisory

Under this, investment banks help clients in listing securities in Malaysian Stock Exchanges by ensuring compliance with regulatory guidelines for capital management, performing corporate valuations, advising clients in corporate restructuring, and so on.

#3 - Equity Capital Markets

Investment banks assist clients in listing Malaysian, Hong Kong, Singapore, and Indian markets by structuring and arranging innovative primary and secondary market transactions.

#4 - Debt Capital Markets

Investment Banks assist clients planning to raise funds from the debt market in originating deal structure, pricing the debt offering, underwriting, and syndicating their products.

List of Top Investment Banks in Malaysia

Malaysia offers abundant opportunities for an investment banking professional. Major investment banks in Malaysia are as follows:

- Affin Hwang Investment Bank Berhad

- Alliance Investment Bank Berhad

- AmInvestment Bank Berhad

- Maybank Investment Bank

- KAF Investment Bank

- CIMB Investment Bank

- Public Investment Bank Berhad

- RHB Bank

- Hong Leong Bank

- United Overseas Bank (Malaysia)

- Bank Rakyat

- OCBC Bank (Malaysia) Berhad

- HSBC Bank Malaysia Berhad

Recruitment Process in Investment Banks in Malaysia

Getting into investment banking jobs in Malaysia requires compliance with various financial institutions' screening practices to promote an ethical workforce for the financial industry. Apart from fulfilling the educational qualification eligibility criteria and clearing various interview rounds before one lands a job in one of the topmost Investment Banks of Malaysia, there is no standard recruitment process that investment banks follow. Still, all majorly involve a general HR round, a Group Discussion round, a technical round, and personal interaction with the functional/vertical head. One can apply directly through the websites of major investment banks, and also these companies hire through campus selection by visiting various major universities. For international applicants and remote interviews, a Malaysia virtual number is often used to streamline initial communication.

Culture in Investment Banks in Malaysia

Malaysia is a fast-growing business destination and provides a fast-paced lifestyle for its young population. English is considered the language of business, and the working culture is strictly regulated as per the guidelines laid down by the Department of Employment. Employers have to adhere to the strict guidelines in letter and spirit. Malaysia is a multicultural country, and the working culture is highly mixed, with many different nationalities working alongside each other. Malaysian people are highly polite and abide by their country's workplace policies.

Salaries of Investment Banking in Malaysia

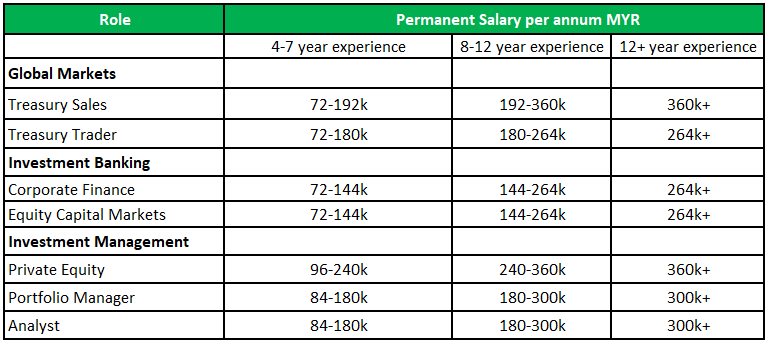

Salary structure varies depending upon the educational qualification, the number of years of experience in the investment banking domain, and the role handled. As per a Robert Walters Global Salary Survey 2017, the salary structure of different roles dealt with in investment banks with varied years of experience is reproduced below for reference purposes:

Conclusion

Investment banking in Malaysia is poised for strong growth in the years to come despite geopolitical risks, trade wars, and other external headwinds. With a good number of domestic deal flow and a strong capital market, investment banks see a continued strong upward trend driven by the healthy flow of deals, strong economic growth, a favorable movement of commodity prices, and a stronger Malaysian Ringgit (MYR-Currency of Malaysia). In addition, Malaysia continues to see a positive uptrend of many global banks setting up offices in its capital city, Kuala Lumpur, which provides ample opportunities for professionals in the banking and financial services sector planning to settle in Malaysia. Since the country currently lacks inadequate professionals locally to meet the growing need for the skilled workforce who can work in the various specialized functions of Investment Banks, a lot of foreign expats are being attracted to this fast-developing business hub of Asia who can team up with the local pool of talent and can develop strong teams to take the investment banking industry to another decade of strong growth trajectory.

Recommended Articles

This has been a guide to investment banking in Malaysia, their services, recruitment process, culture, top investment banks, salaries, and exit opportunities. You may also have a look at the following article for learning more about Investment Banking –