Table of Contents

Late Payment Meaning

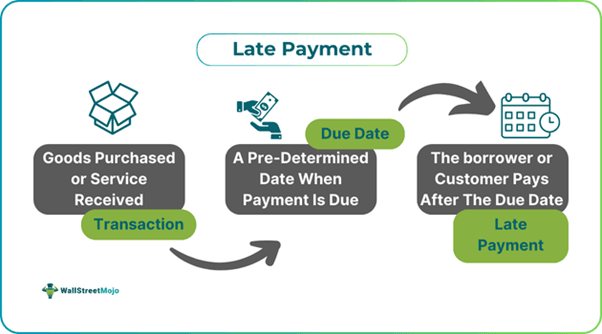

Late payment is a sum that a borrower processes in favor of the lender beyond the due date but within the same billing cycle. These payments get delayed due to various reasons such as management issues, unpaid invoices from the borrower’s borrowers, market conditions, or any issues with the order. These delays can affect the lender’s cash flow.

Moreover, most lenders add a late payment charge to the principal amount if the payment exceeds a certain number of grace days. As a result, it can lead to increased costs and tarnished reputation and business relationships. Large amounts that are delayed or not paid on time may also attract legal issues.

Key Takeaways

- Late payment is when a borrower or a customer pays their lender or supplier post a pre-determined deadline. The payment is made nonetheless, albeit late.

- Typically, paying beyond the due date or deadline attracts late fees or interest on the due amount, which adds to the financial woes of the borrower. Paying late also affects the lender’s cash flow and operations.

- In some cases, it may also result in a drop in the borrower's credit score, which shall also be reflected in their credit report.

- Borrowers can opt to automate payments, set reminders, or negotiate more flexible terms with lenders to avoid late payments.

Late Payment Explained

Late payment in the commercial context refers to delaying payment beyond the due date for the goods purchased or services received. It is one of the most common problems faced by businesses globally. It can have a significant impact on the lending business’s cash flow.

Since the lending business or the supplier faces issues due to non-payment despite rendering services or delivering goods, they add a late payment fee to compensate for the extra pressure on their cash flow and operations.

If customers are regularly late with their payments, their suppliers are less likely to engage in business deals with them in the future. Because the payment history is not smooth, dealers may perceive these businesses as unreliable.

Sometimes, businesses or individual lenders may file lawsuits for late payments. As a result, the borrowing business may face additional financial and legal burdens to take care of in addition to their already existing financial woes and declining credit scores in some cases.

No business or individual delays payments on purpose. A few of the most common reasons why payments stretch beyond the due date include market conditions, management issues, outstanding invoices from the borrower’s customers, or some issues with the order.

However, settling these payments needs a strategic approach and clear communication with suppliers or vendors. Businesses may shift to digital invoices, add payment reminders, and negotiate better payment terms for timely payments to reduce the likelihood of such delays.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Reasons To Avoid

Any payment due on a certain date must be cleared on or before the date as a part of fundamental financial principles. However, circumstances may force a business to do the opposite in some situations.

It is all the more important to devise a strategy to avoid attracting late payment interest, as it may attract unnecessary hassles in different areas, such as:

- The foremost reason to pay on time is that delaying the payment beyond the pre-determined date may attract an additional fee or interest that adds to the overall cost of the product or service.

- In some cases where a bank or a formal entity is involved, it may also affect the credit score.

- Consistent delays in payment may lead suppliers or lenders to refrain from doing business in the future, leading to damaged business relationships.

- To settle the payment and avoid higher fees, businesses may sometimes take up further debt to cover the financial constraints.

- If a business or an individual pays after the due date regularly, it may lead to their creditworthiness or trust factor declining among their peers and counterparts in the market.

How It Affects Credit Score?

Late payments on credit cards or other forms of borrowing directly linked to a borrower’s account can significantly impact their credit score. A few specifics of the effect include:

- The immediate effect is that it impacts the credit score. If the borrower pays their bill beyond the due date, they shall experience a 50-150 point drop in their credit score, depending on the duration of the delay.

- Paying a late payment fee is not the end of woes for borrowers, as a late payment remark may reflect on the credit report for seven years.

- A low or sub-par credit score may also affect the prospects of acquiring debt in the future.

- The future borrowing rate might go up incredibly as the risk of default is also perceived to be significantly higher.

- Rebuilding credit score may take several months. However, paying dues on time during this period is important to ensure that the score is on its way to restoration. Otherwise, the score might further deteriorate.

Examples

Let us look at the examples to comprehend the concept better:

Example #1

Josh borrowed purchased goods worth $10,000 from ABC & Sons. The invoice was due for payment on 30th May 2024, 30 days from the purchase date. However, since Josh’s customers were yet to make payments and market conditions were unfavorable, he could not process the payment on the due date.

ABC & Sons imposed a late fee of $50 each day beyond the due date. Josh paid his dues on 10th June 2024. As a result, he paid $10,500 and settled the payment.

Example #2

IndiGo is one of the largest operating airlines in India. It was fined a little over $5,800 by the US Customs & Border Protection in July 2024 for the late payment concerning immigration user fees. However, IndiGo explored its chances to waive the penalty.

The company also clarified that there were no material impacts on operations or financials. IndiGo's parent company, InterGlobe Aviation, rose 1.22% on the Bombay Stock Exchange (BSE).

How To Avoid?

As mentioned earlier, avoiding late payment fees is a strategic decision for individuals and businesses. Below are a few effective ways to avoid them.

- The most logical and straightforward way to ensure not missing payments is to set reminders a few days before and on the due date. This way, individuals and businesses can plan and allocate funds accordingly.

- If setting up reminders for separate payments on different tasks does not seem practical, borrowers may set the same date for all payments, such as the first of every month. It makes allocating cash easier on the same day.

- For businesses, having the same payment day might be difficult as different suppliers may have different credit periods and the dates on which invoices were raised. Therefore, businesses can link their bank accounts to automate these payments on the due dates.

- Another straightforward way to avoid missing payments is to review financial statements regularly to stay on top of all financial obligations.

- If borrowers still struggle to stick to the due date, they can negotiate terms and secure a more flexible deal to settle payments in part or pay the amount after a slightly extended period.

Late Payment Vs Missed Payment

The distinctions between late payment charges and missed payments are as mentioned below.

Late Payment

- Late payment is when a customer or borrower makes a payment after the due date. The payment is made nonetheless.

- Late payments typically attract interest charges and late fees or affect the credit score.

- It can lead to significant reputational damage and may affect prospects of getting credit in the future.

- It may impact credit scores and increase the borrowing rate in the future, as the default risk is perceived to be higher if the borrower has more than one instance of paying late.

Missed Payment

- Missed payment is when a financial obligation is not made or missed completely.

- It carries far more serious consequences than paying late. It hurts credit scores and attracts significantly higher fees.

- Creditors may seek legal action or initiate account delinquency.

- Repeated missed payments may result in repossession of assets.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.