Table Of Contents

What Is Merchant Discount Rate (MDR)?

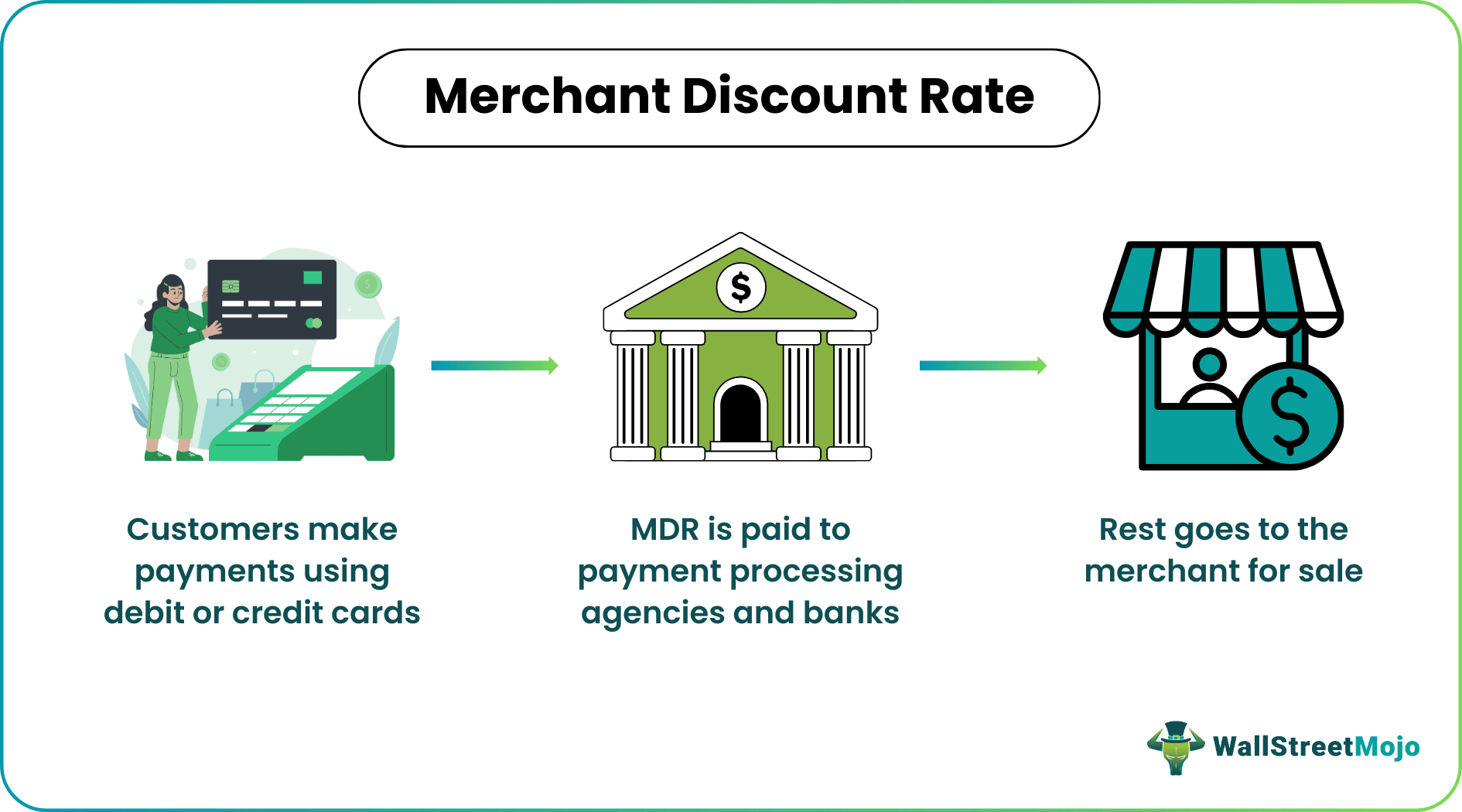

The Merchant Discount Rate (MDR) is a fee acquirers charge businesses in exchange for enabling and processing card (credit and debit) payments made by customers. Merchants set up merchant accounts with acquirers, and the MDR is fixed based on business volume, card types, interchange charges, and transaction method, among other factors. Simply put, it is the cost of processing digital payments.

The MDR receivable by acquirers per transaction is determined by the agreement with the merchant, in addition to other factors (discussed in the sections below). It is typically paid to banks or companies providing services such as card processing, digital infrastructure services, and point of sale (PoS) service providers. The MDR is charged as a percentage of the total transaction amount. Depending on different markets and market factors, practices or rules related to MDR may vary from country to country.

Key Takeaways

- Merchant discount rate is a transaction processing fee deducted from the sales proceeds and distributed among acquirers (payment processors, card service providers, banks, etc.).

- The rate is expressed as a percentage of the total transaction amount; it ensures every entity involved in transaction processing on behalf of the merchant is paid adequately to cover interchange costs and risks.

- MDRs are typically higher for e-commerce websites and businesses because of the additional security costs.

- Merchants may add a surcharge on credit and debit card transactions to compensate for the added costs (MDR).

How Does Merchant Discount Rate Work?

Merchant discount rates are fees acquirers (banks, financial institutions, payment gateways, etc.) charge to facilitate transactions via cards (credit and debit). Online transactions also attract MDR charges. These payments go to entities that streamline digital payments. The rate acquirers charge e-commerce businesses for online transactions may be relatively higher than POS or other in-person methods of payment, such as physical card swiping, payments via QR code scanning, mobile wallets, etc. It ensures security, speed, and reliability.

Assessment fees (charges for maintenance, upgrades, tech and customer support, etc.) and interchange fees (cost of transferring money from the customer’s account to the merchant’s account) are important components of MDR.

The MDR amount is payable by merchants to card issuers, payment processing agencies, and banks, among other parties. The merchant discount rate meaning can be presented as the commission payable to acquirers or agencies that process transactions. It includes the relevant charges and taxes, including miscellaneous fees, payment card network charges, point-of-sale fees, etc. These rates depend on the types of transactions and cards, the sector in which the merchant operates, rules applicable to businesses in the region, transaction volume, and the agreement between acquirers and merchants.

A key aspect of MDR is the Merchant Category Code (MCC). It takes the business type into account and considers the payment processing risks associated with such businesses. The general MDR levied for transaction processing is between 1% and 3%. In some countries, the MDR costs are transferred to customers through a surcharge on transactions.

Another important MDR concept is the zero merchant discount rate, where merchants do not pay acquirers for processing customer payments via cards or other digital modes. This facility is primarily offered in countries interested in promoting digital payments. In such cases, the payment processing costs may be borne by government agencies, financial institutions, and banks.

An important point to note is that merchants may be able to negotiate favorable terms and get a reduction in MDR by increasing their sales or transaction volume. However, whether this is practiced depends on several factors, including the rules and regulations that apply to digital payments in a given country.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

How To Calculate?

The MDR is calculated as a percentage of the transaction amount. The computation formula is given below:

MDR = Transaction Amount * Rate

The transaction amount is the amount a customer pays for the product or service, and the rate refers to the percentage at which the MDR is computed (per the agreement).

Another concept is the effective merchant discount rate. The formula is:

Effective MDR = Total fees a merchant pays an acquirer / Total sales or business volume * 100

The total fees refer to all the charges paid by the merchant to an acquirer. The sales volume, which is nothing but the transaction volume, refers to the sales logged in by the merchant through a specific acquirer (debit cards, credit cards, online payments, etc.).

Examples

Here are two examples of merchant discount rates.

Example #1

Merchant discount rates are imposed on both credit and debit transactions. Suppose a grocery store owner accepts credit card payments. A customer buys groceries and pays through a credit card. If the total order was $2,700 and the store owner has agreed to a 4% merchant discount rate, he will be charged 4% on the total transaction amount.

Therefore, 4% of $2,700 = $108

Hence, the grocery store owner will pay 108 to the acquirer and bank as transaction processing fees. He will be left with $2700 - $108 = $2,593.

The $108 will be distributed to various entities involved in transaction processing. They may include card issuers, banks, and other payment processing agencies.

Example #2

Assume the following scenario: Adam is a florist who accepts online orders. Given the nature of his business, he can only fulfill local orders through his logistical network. The merchant discount rate is payable on online transactions. Suppose the agreed rate is 3%, and a customer makes a payment of $900.

Therefore, 3% of $900 = $27 is the amount Adam must pay the banks, card issuers, and other service providers for online transaction processing and risk management.

He receives only $873 ($900 - $27) as sales proceeds from this particular sale. If Adam wishes to reduce the rate, he will likely need an adequately high sales volume to negotiate better terms with acquirers.

Importance

The importance of the merchant discount rate has been discussed in the section below.

- It helps credit card companies and issuers, banks, and other relevant agencies receive adequate compensation for payment processing services and the associated risks they handle during transaction processing.

- The services acquirers provide benefit merchants because the transaction processing is handled independently, making transactions smooth and easy.

- When merchants offer digital payment options, customers get several payment choices, including credit facilities.

- The MDR system facilitates e-commerce, encourages shopping, and offers convenience.

- Merchants operating via merchant accounts to grow their businesses and increase market reach are known to flourish. This is because customers enjoy the convenience of multiple payment options and automated point-of-sale systems.

- With digital payments, the risks of handling cash decline dramatically. Hence, even if business owners forgo a part of their sales proceeds due to the MDR, it is a profitable deal in the end.

- The MDR system may simplify and rationalize the accounting and financial management processes of a merchant.

Merchant Discount Rate vs Interchange Fee

The merchant discount rate and interchange fee are key aspects of transaction processing. The key differences have been discussed in the table below:

| Basis | Merchant Discount Rate | Interchange Fee |

|---|---|---|

| Meaning | The merchant discount rate is a transaction processing fee merchants pay acquirers for handling transaction risks and directing the money via online channels into the merchant’s account. | The interchange fee is paid by the merchant’s bank to the customer’s bank. It is a charge paid by an acquirer to a customer’s bank to facilitate the exchange of money between the merchant (business) and customer accounts. |

| Application | MDR is expressed as a percentage of the transaction value. | The interchange fee is included in the merchant discount rate. |

| Rule | It is a fee payable on every transaction executed via electronic payment modes. | An interchange fee, included in the MDR, covers the interchange cost, i.e., the cost an acquirer’s bank pays to a customer’s bank. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A single entity cannot finalize the rate. It is determined by the interplay between various entities in the payment processing network, such as card issuers, payment gateways, banks, and payment processors. The rules that apply to a country are a key determinant of the MDR. Also, negotiations between the merchant and service providers play an important role in finalizing the MDR.

Statutory regulations govern if MDR will be applicable and how much will be charged. It also depends on various factors, and many stakeholders play a significant role in its finalization. Hence, regional or national regulations and independent agreements determine if a ceiling will be applied.

The payment processing mechanism for QR code transactions is quite complex as it involves several functions. These include making the right payment processing infrastructure and information systems available, ensuring transaction security, monitoring the settlement of every transaction, and activating the reconciliation process whenever necessary, to name a few.