Table Of Contents

Bad Debts Meaning

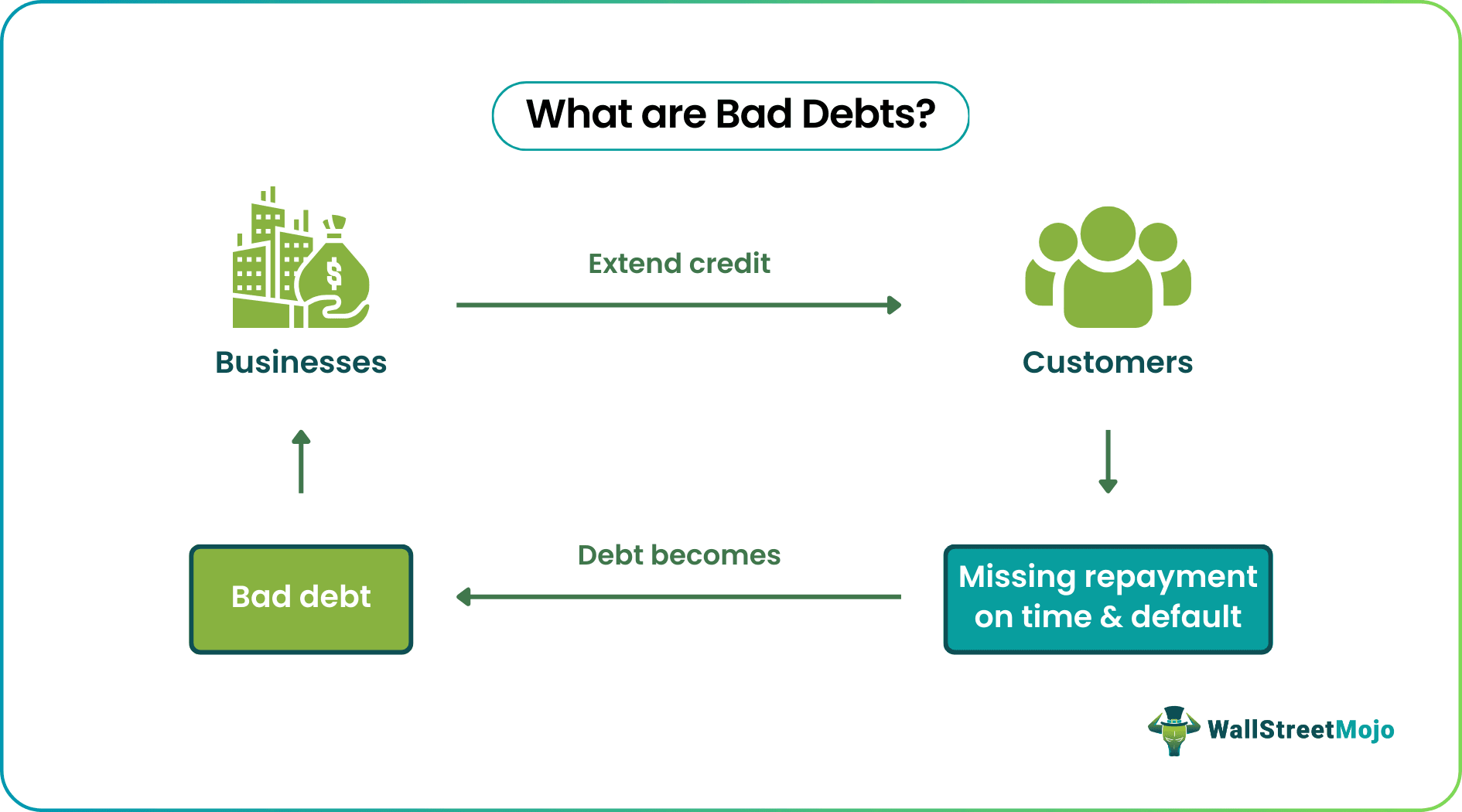

Bad debts are credits that businesses extend to customers, but the repayment of which seems uncollectable. In short, when the repayment is irrecoverable, the debt is bad. Such incidents occur when customers experience financial turmoil and struggle to repay the outstanding amount to businesses.

Credits, however, are not always bad. They are good when businesses extend credit to customers, and the latter repays on time. These turn bad only with the non-recovery of the due amount within the promised period. Recording these debts is crucial as the repayment is uncertain until received.

Key Takeaways

- Bad debt refers to the extended credit that businesses offer customers, which they fail to repay within the promised tenure.

- It adversely affects any business organization being identified as an unforeseen loss of working capital.

- These are irrecoverable receivables considered an expense in a journal entry for bad debts.

- The uncollectable debts are recorded using either direct write-off or provision/allowance.

Bad Debts Explained

Bad debts are irrecoverable receivables. Businesses extend credit to customers after verifying credentials and expect the repayment within the specified tenure. When this outstanding amount becomes uncollectable, such debts are classified as bad. The events of defaults are identified when customers delay or miss consecutive repayments.

While delayed or missed payments result from the customers' changing financial capabilities, there are instances where recipients intentionally skip repayments. In addition, when lenders offer loans to seekers who are incapable of repaying, it also leads to irrecoverable debts. The instances can occur anywhere, including trading, loans, etc.

In trading, businesses can allow customers to pay for goods and services later. Though many of them stick to the tenure and pay off before the deadline, some skip it intentionally and escape. On the other hand, when people take up loans from banking and financial institutions, they borrow huge amounts and default on repaying the installments, calling for legal actions against them.

Recognition

Bad debts are recognized as expenses for a business as the recovery is doubtful until the customer repays on time. While the consecutive delays and misses detect the increasing chance of defaults, there are statistical methods that analysts use to compare historical data throughout the years of operation of a business. Then, they figure out the chances of the debts likely to turn bad for a business based on their analysis.

Businesses consider a percentage of net sales to identify the debts with chances of turning bad. This is done based on the history of the company with irrecoverable debts. Companies, therefore, keep introducing and transforming allowance for suspicious accounts. The allowance amount is credited with respect to the revenue generated, which is recorded as a debit.

Bad Debts Accounting

A bad debts expense is recorded using two accounting methods - direct write-off and provision or allowance. While small businesses with a cash basis of accounting use the former, those with an accrual accounting basis opt for the latter.

Direct Write-Off

The bad debts to be written off are instantly recorded. This is the method applied as and when businesses identify such debts on the accounts. The irrecoverable amount, in this process, becomes a debit on the expense side, and it is the credit for the accounts receivables section.

Allowance/Provision For Bad Debts

A bad debt provision is meant for the extended credits that seem irrecoverable. The financial analysts in a firm recognize the doubtful debts and estimate the amount that might not come back to them. Once the irrecoverable amount is identified, they debit the bad debt expense while filling the credit side with the same amount for the irrecoverable debt provision contra account.

It is important to know that the write-off method does not comply with generally accepted accounting principles (GAAP). Therefore, businesses using GAAP for their accounting must opt for the other option, i.e., provision/ allowance.

Examples

Let us consider the following examples to understand the concept better:

Example 1

Mark and Louis run a supermarket where goods are sold on both cash and credit basis. In April 2019, they sold goods worth Rs. $ 20,00,000 to Larry Trading Corporation on a credit period of 100 days. In May '19, the latter declared bankruptcy. Later, in September 2019, under the bankruptcy procedure, it was observed that only 20% of the claim amount could be retained, which showed signs of recovery after write-off, making it an income.

Based on a given set of data, the entries made looked like this:

It is important to know that the write-off method does not comply with generally accepted accounting principles (GAAP). Therefore, businesses using GAAP for accounting must go to the other option, i.e., provision/ allowance.

Example 2

Tony trading corporation shares the following details of his debtors and realization based on past trends.

| Particulars | Amount ($) |

|---|---|

| Sales During April'19 | 5,000,000 |

| Bad Debts Trend | 5% |

| Provide Journal entries with respect to bad debts accounting treatment if: - | |

| (A) Actual Realisation | 4,700,000 |

| (B) Actual Realisation | 4,750,000 |

| (C) Actual Realisation | 4,800,000 |

Since Tony Trading Corp. has a predefined set of an estimate having a 5% bad debts ratio, it will be maintaining provision in the same percentages-

The entries are as follows: –

Recovering Irrecoverable Debt

Bad debt recovery is the recovered outstanding amount after being written off or previously considered irrecoverable. As companies already record them as losses, they become their earnings when received. There are multiple ways in which these irrecoverable amounts can be collected.

Businesses can have an in-house or third-party entity to collect the due amount. In addition, they can take legal actions and issue court orders to get back their extended credit. Above everything, a business lending an amount to another party can make it collateral-based. As a result, it secures the loan amount against the property of the recipient. In that case, companies can sell the property if customers default.