Table of Contents

What Is Payment Times Reporting (PTR)?

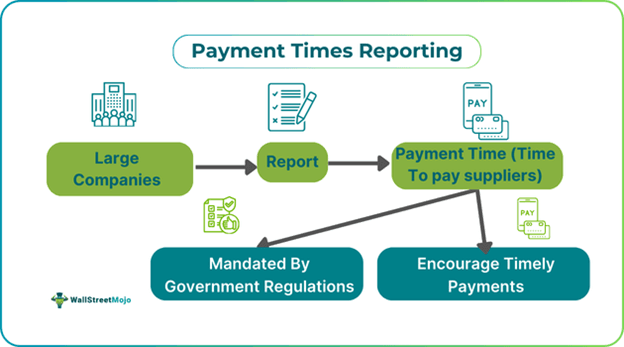

Payment Times Reporting (PTR) is a system that requires large business entities to report their payment terms and the time it takes to engage with small businesses. It is a fundamental aspect of a scheme known as the Payment Times Reporting Scheme (PTRS) established by the Australian government.

The Payment Times Reporting Register publishes details on payment practices, providing insights into how large businesses interact with small suppliers and manage payments, helping small businesses make informed decisions and estimate their cash flows. It enhances the transparency of business performance, making data accessible to the public and further emphasizing its importance.

Key Takeaways

- Payment Times Reporting (PTR) is a system where large companies report their payment practices to small businesses. Reports are submitted every six months.

- These reports provide insights into invoice payments, procurement activities, and payment standards.

- Reporting entities include large companies and government agencies with incomes exceeding $100 million, either individually or as part of a group, along with other qualifying criteria.

- The benefits of PTR include faster payments to small businesses, increased transparency, and an enhanced brand image for large companies.

- Challenges include difficulties with data collection and quality reporting and the risk of reputational damage in case of errors.

How Does Payment Times Reporting Work?

Payment Times Reporting is the reporting of payment terms and practices by large entities in relation to small businesses. Entities must submit these reports every six months detailing procurement activities and the percentage of total value obtained from small business suppliers during the reporting period. Additionally, the reports include information on the shortest and longest payment times offered, the percentage of invoices paid within specified timeframes, and any use of supply chain finance arrangements.

The system operates according to the Payment Times Reporting Rules 2020. Under these rules, large businesses and government enterprises, classified as reporting entities, are required to submit payment times reports to a regulator through the Payment Times Reporting Portal. In order to qualify as reporting entities, businesses must have total or group income exceeding $100 million. Subsidiaries within such groups, with incomes over $10 million, are also required to report their payment times. Regulators appointed by the government receive these reports twice a year and publish the data on the Payment Times Reporting Register. They are responsible for ensuring the information on payment terms and performance is accurate and accessible to the public.

Examples

Let us look at some examples to better understand the concept of Payment Times Reporting (PTR):

Example #1 - A Hypothetical Example

Suppose Dan is a businessman. He owns a clothing company that purchases materials from several small businesses. Since his company has an individual revenue of $100 million, it qualifies as a reporting entity and must file PTR reports. Dan accesses the Payment Times Reporting Portal and registers his company. His team gathers data on payments made to small suppliers and submits the payment terms and timing details.

After submitting the reports, Dan checks the Payment Times Reporting Register to ensure the data is updated. This process helps small businesses plan their finances and run their operations more efficiently. It also ensures Dan’s company complies with Australian law

Example #2 - A Real-Life Example

The Australian government reviewed the effectiveness of the Payment Times Reporting Act and made several recommendations, leading to updates in the legislation. Some of the key changes include:

- Reporting entities must notify the regulator if they cease to be a reporting entity.

- Entities are required to report twice per financial year instead of the income year.

- The regulators' monitoring and investigative powers have been expanded.

- Regulators can disclose certain protected information, among other changes.

Benefits

Some of the key benefits that arise from the Payment Times Reporting (PTR) system are the following:

- PTR promotes transparency in the payment practices of large businesses.

- The transparency helps encourage timely payments to small business suppliers.

- PTR reveals how supply chain financing is utilized.

- This reporting system compares the aggregated performance of a company's payment methods to preset benchmarks.

- Helps small businesses get paid faster.

- Improves the brand image of large companies by demonstrating prompt payment practices.

- The public registry information aids businesses in making informed decisions about potential customers.

- PTR system enables businesses to run more efficiently and profitably by improving their understanding of payment activities.

- Encourages the development of best practice standards.

Challenges

Listed below are some challenges that arise from the use of the PTR system:

- Large businesses must generate timely and accurate payment reports every six months, which can be labor-intensive and resource-consuming.

- Identifying which supplier invoices should be included or excluded from payment times can be challenging.

- Reporting obligations for entities under a controlling corporation can be complex.

- Accurately capturing and tracking invoice payments is difficult.

- Data extraction, cleaning, structuring, and ensuring data quality compliance can be problematic.

- Entities may face governance and submission approval issues.

- Errors or inaccuracies in the data, which is publicly available, can lead to reputational damage.

- Missing reporting deadlines or other mistakes can result in penalties for the entities involved.