Table Of Contents

Profit Before Tax Definition

Profit before tax (PBT) is a line item in a company's income statement that measures profits earned after accounting for operating expenses like COGS, SG&A, Depreciation & Amortization, etc. non-operating expenses like interest expense, but before paying off the income taxes. This is a significant measure because it gives the company's overall profitability and performance before making corporate taxes payments.

PBT is further used to calculate net profits by deducting income tax.

The Formula of Profit Before Tax

The following formula can simply calculate PBT:

PBT = Revenue – (Cost of Goods Sold – Depreciation Expense – Operating Expense –Interest Expense)

An income statement that starts with revenue or sales goes on to calculate PBT as follows:

Format of Profit Before Tax

Revenue or Sales

Less: Cost of goods sold

Gross profit

Less: Operating expense

Less: Interest expense

Note

This is a simple format for PBT calculation and can vary in complexity.

Examples of Profit Before Tax

Example #1

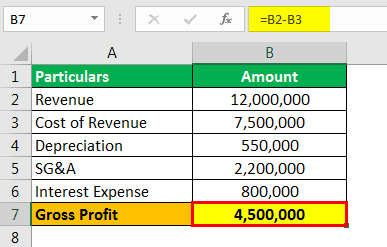

Company XYZ limited has US $12 million in Sales and wants to measure its PBT. The table below gives insight into different costs/expenses.

From the above data, we get the following information.

- Revenue: 12,000,000

- Cost of Revenue: 7,500,00

- Depreciation: 550,00

- SG&A: 2,200,000

- Interest Expense: 800,000

Subtract the Cost of revenue to get Gross profit.

Gross Profit will be -

- =12000000-7500000

- Gross Profit = 4500000

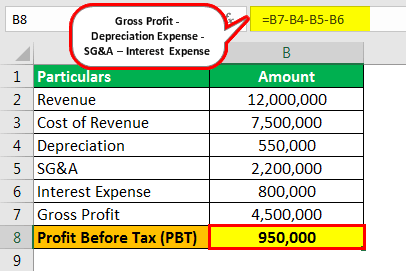

Subtract depreciation, SG&A expenses, and interest expense further to obtain profit before tax.

Therefore, the calculation of PBT as per the formula

- = 4500000-550000-2200000-800000

- PBT = 950000

Example #2

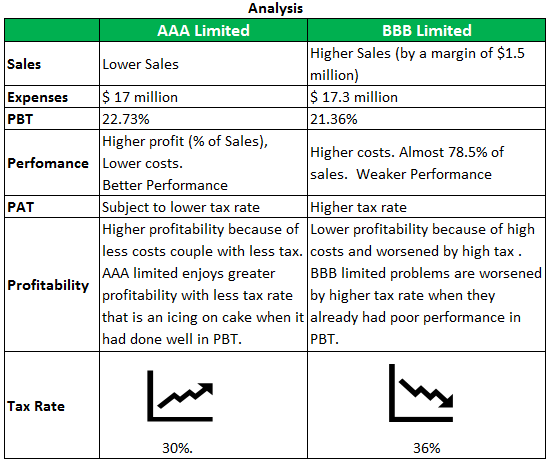

AAA Limited and BBB Limited operate in similar industries with similar scales and product lines. A team of analysts wants to make a comparative analysis of the PBTs of these two companies, and they have the following information-

From the above data, we get the following information.

| Company | AAA Limited | BBB Limited |

|---|---|---|

| Sales | $22,000,000 | $235,000,000 |

| Cost of Goods Sold | $14,000,000 | $14,800,000 |

| Operating Expenses | $3,000,000 | $2,500,000 |

| Profit Before Tax | ? | ? |

| Income Tax Rate | 30% | 36% |

| Profit After Tax | ? | ? |

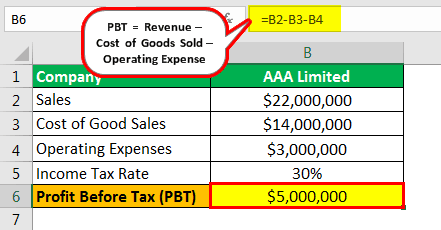

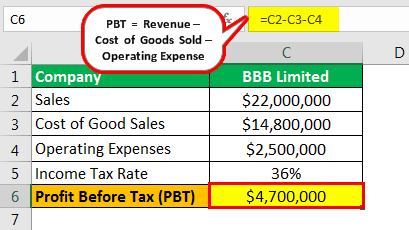

Calculation of Profit Before Tax

Therefore, the calculation of PBT of AAA limited as per the formula is as follows,

- =$22000000-$14000000-$3000000

- PBT = $5000000

Therefore, the calculation of PBT of BBB limited as per the formula is as follows,

- =$22000000-$14800000-$2500000

- PBT = $4700000

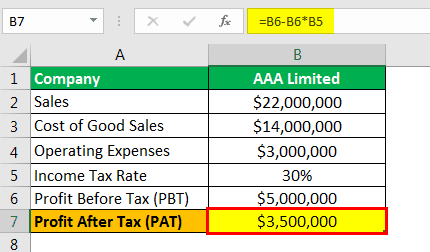

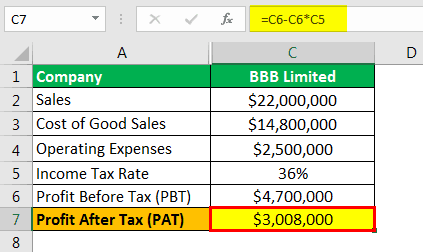

Calculation of Profit After Tax

Therefore, the calculation of PAT of AAA limited as per the formula is as follows,

- =$5000000-$5000000*30%

- PAT = $3500000

Therefore, the calculation of PAT of BBB limited as per the formula is as follows,

- =$4700000-$4700000*36%

- PAT = $3008000

This shows that while profit before tax measures performance, it does not reflect correctly on the profitability. PBT, on the other hand, better gauges profitability but falls short of giving insights on parameters like productivity, efficiencies, and performance levels.

Advantages of PBT Measure

Companies with similar business, characteristics, and scale can be analyzed on a comparative basis about their Profits before tax:

- PBT can mislead companies' comparative performances because of its subjectivity to different tax systems. Hence, a preceding line item, PBT, better considers the comparability by eliminating the varied nature of taxes.

- PBT, as opposed to PAT (Profit after tax), is a measure of performance. Regarding varied tax policies, PAT is more inclined toward profitability calculation than performance measurement.

- Profit before tax also acknowledges the debt obligations of a company. The long-term debt and lease obligations in a company's balance sheet are reflected in its income statement interest expense column.

Disadvantages of PBT Measure

- Profits that are not taxed do not give a true account of companies' free cash flows (FCF). This makes for a skeptical valuation of a company if FCF methods are used.

- PBT is not a complete measure for comparison purposes if the operations of the companies under consideration are not similar – in nature and scale.

Limitation of PBT as a Measure of Profitability/Performance

Although PBT gives a clear picture of how companies have performed in terms of their sales and costs, both operating and non-operating, it becomes difficult to gauge the bottom line of companies operating in different business settings.

- Taxation policies vary significantly across the world.

- The company's profits might be eligible for tax benefits.

These conditions make a substantial difference in companies' bottom line and redefine profitability if not performance.

Significance of PBT and Points to Note

While there are many other factors based on which a company's performance can be evaluated, profit before tax becomes important because it takes note of all the expenses incurred by the company. As we go into finer details, the analysis becomes better and provides greater insights into the business's health.

However, any analysis that overlooks qualitative factors concerning the business is incomplete. For that matter, even Profit after tax will be rendered futile if analysts neglect the qualitative analysis of the company. It should be noted that companies are not evaluated on the numerical values of their respective PBTs. Therefore, underlying assumptions and reasons are equally important to drawing near-complete analyses of companies.

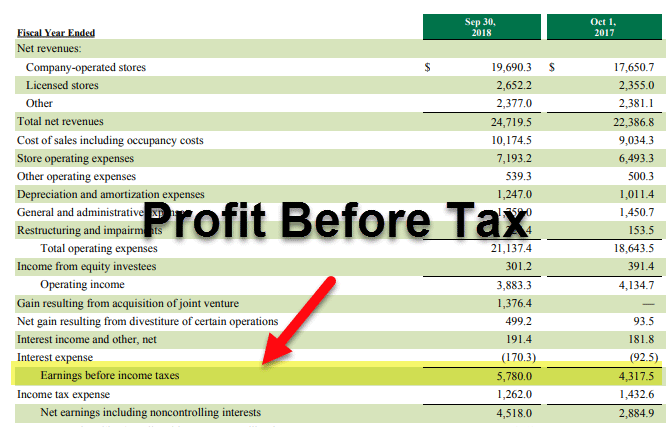

Profit before tax can also represent as Earnings before tax:

Earnings before tax, EBT = EBIT – interest expense = PBT

Conclusion

PBT is an important concept in business. It measures business performance in so far as everything except taxes. Unlike gross and operating profit, where expenses are not included, PBT analysis should always consider different expense recognition principles followed by different businesses.

A company's interest payments will capture its high leverage and give analysts a true picture of its indebtedness. Unfortunately, while PBT is a good indicator measure, EBITDA and EBIT fail to sense the same.

From an investor's perspective, PBT is a useful measure for comparing businesses located in different economies, thus subject to different taxes. The extent to which PBT reflects performance in such cases is probably the finest of all – Sales, EBITDA, and EBIT.