Table of Contents

Key Takeaways

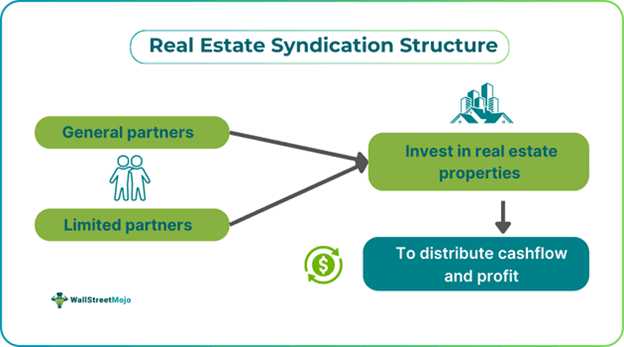

- A real estate syndication structure is an investment arrangement where funds are pooled from multiple investors to invest in the real estate market.

- An experienced operator or developer majorly funds them. The cash flow and profits are later distributed as per agreements.

- It can take the form of equity or debt investments. There are two parties involved: the general partners and the limited partners.

- Syndication structure types include straight split models, waterfall models, debt investments, and hybrid models.

- Benefits of the structures include high returns, portfolio diversification, and limited liability.

Types

Given below are the types of syndication structures:

- Straight Split - The structure is a simple model in which sponsors and investors agree to receive a specific percentage of ownership in the invested project. Under this arrangement, both equity and profits are split within a predetermined range based on percentage ownership.

- Waterfall Model - The structure awards differing amounts of profit to the investors depending on the actual levels of profit. Under this model, passive investors are given preferred returns of the first 6-8% of the profits. If the profit received exceeds 8%, then general partners are given a share of the profits. There are different breakpoints, such as receiving 100% of the first 6-8%, then 80% of returns from the 6-10% of profits, and more than 50% if the returns are above 10%.

- Debt Investments - Under this structure, investors lend money to the structures in hopes that it will be paid back with full interest. The debt investors do not have a share in the profits or equity resulting from the deal. These structures facilitate the entry of non-accredited investors. However, the SEC requires accredited investors to be equity investors.

- Hybrid Model - The model allows syndication of the provision of passive income for limited partners and the rewarding of general partners.

Examples

Let us look into some of the examples to understand the concept better.

Example #1

Suppose Dan is an investor. He regularly invests in stocks and purchases gold but wants to diversify his portfolio. He finds the real estate market an attractive option. The market is not volatile, but the returns can be multifold when given enough time. He is interested in developing a family residential project in the suburban areas that provide luxurious amenities.

However, Dan doubts whether he can manage the project and is worried about how he will fund it. After much deliberation, he seeks the option of real estate syndication structures. This allows him to invest in such a project without incurring much financial burden. Management will also be done by someone else, but they could provide him with returns.

Example #2

Brad Sumrok, a U.S. investor, has been in the news for owning 7700 rental properties. His expertise lies in property syndication, where he brings in investors to pool money to buy apartment complexes. The pooling of money helps these investors acquire massively priced properties. Sumrok repairs and modifies these properties and then rents them at huge profits.

Sumrok ideologies have inflated rental prices in certain areas. Investors who followed similar practices are in debt because they did not consider variable-rate loan issues. This issue reminds us that although the concept offers high returns, it can also be highly risky.

Investment Benefits

Given below are some of the benefits of the syndication arrangement:

- The structure gives high returns.

- It helps in connecting with fellow investors and finding out about unique investment projects in the real estate market.

- It provides the opportunity for inexperienced investors to participate in new projects.

- It is a good choice for portfolio diversification.

- It helps investors invest in projects they believe in, even when they are short of funds.

- It is a great choice for investors who desire limited liability to have an additional income.

- It facilitates making multiple investments.