Table Of Contents

What Was The Stock Market Crash In 1987?

Stock Market Crash in 1987, also known as Black Monday, marks the period of stock price decline where Dow Jones Industrial Average (DJIA) fell 22% (508 points) on a single day (19 October 1987) and had a contagious effect in the sense that the fall not only affected the US but the whole world.

The increase in the selling pressure on October 19, 1987, occurred following the consecutive decline in stock prices for five consecutive days. This is what led to the crash, making that Monday – the Black Monday.

Table of contents

Stock Market Crash in 1987 Explained

The stock market crash in 1987 had a global impact. Although it had had a record fall, it recovered quickly and made a new high in two years. No recession followed the crash as anticipated until the oil crises of the 1990s. The 1987 crash, as believed and researched by many, was more due to technical and less due to fundamental reasons. The technical reasons and flaws in the trading system were overhauled to prevent any such situation from occurring again.

In the early 1980s, the world went into recession, mainly affecting developed economies. The US, after the recession, saw rapid growth until the year 1985, after which the economy grew at a slower pace. But the stock market, despite a slowing economy, had a bull run from late 1985 till August 1987. Inflation was rising, and the stock market's price-to-earnings ratio was well above its historical PE. These were the ominous signs of the things to come, and the crash looked imminent.

There were already talks of a slowdown and bear market per the stock market crash in 1987 chart, which led to the falling of the US stock market for a week before black Monday. People traded on stock exchanges with growing apprehension and fear. Before the opening of the stock market in the US on 19 October, a steep decline in stock markets in Asia and the UK was seen. This cumulative fear led to the piling up of sell orders on Black Monday, i.e., 19 October 1987, and the fall in Asia and UK acted as fuel to the fire and translated the already falling market to a crash in the US stock market.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

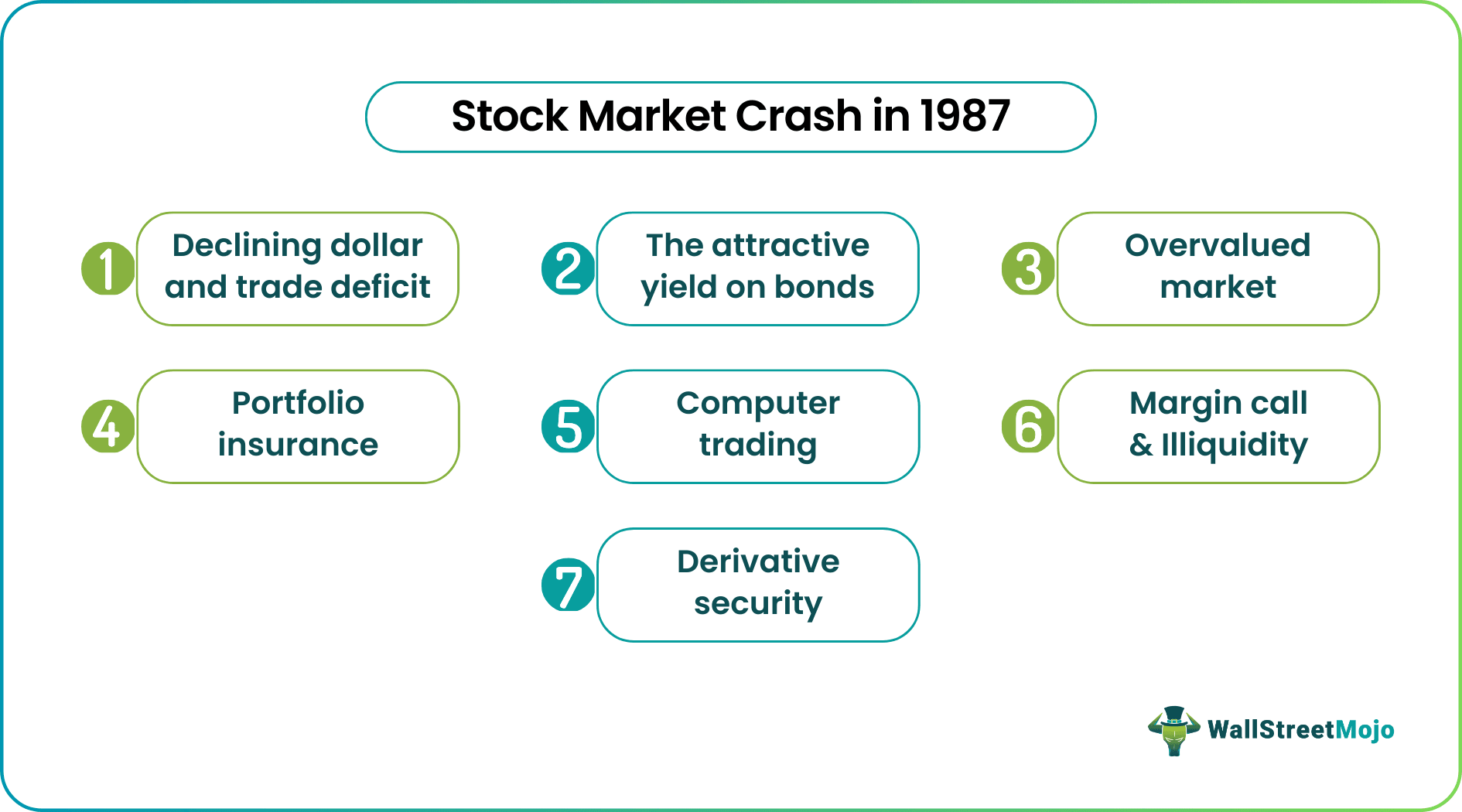

Causes

There have been many explanations for the cause of the 1987 crash. As per the stock market crash in 1987 facts, the causes have been jotted down below:

#1 - Declining Dollar and Trade Deficit

Many believe the announcement by the Department of Commerce regarding the widening trade deficit triggered the crash on that fateful day. Moreover, the announcement led to nervousness among foreigners and created fear among other market participants in anticipation of a weakening dollar. As a result, the foreigners pulled their money out of dollar-denominated assets, which further caused pressure on markets.

#2 - The Attractive Yield on Bonds

A falling dollar due to a widening trade deficit and market participants pulling their money out in dollar-denominated assets led to an increase in interest rates, thereby making yields attractive on bonds. For people who were already skeptical about the stock market, the attractive yield on bonds provided them with a good alternative.

#3 - Overvalued Market

There were signs of continuously deteriorating fundamentals of the stock market as they traded above their fair value. The stock market acts as a barometer of an economy, but the divergence between the economy and the stock market was visible. The apprehensions regarding the market's future course due to the slowing economy and evident bubble in the market led to panic selling.

#4 - Portfolio Insurance

It was considered one of the biggest reasons for the crash of 1987. Portfolio Insurance refers to a strategy to hedge or limit losses by buying and selling stocks and futures. People tend to buy in a rising market, which may create a bubble, and sell in a falling market, which may lead to a crash, which it did. They short sell futures in expectation of the falling market, and if the market falls further, they short sell even more, thus destabilizing the market.

When the markets were opening lower day after day, computer models signaled to sell stock/index futures, further creating downward pressure. Then, after a further decline, models again recommended sales, which led to a piling up of sell orders that eventually led to the crash.

#5 - Computer Trading

Computerized trading was another culprit for causing the crash. Computer trading enables market participants and brokers to place and execute large orders quickly. Further, the programs and software were developed to execute stop-loss orders automatically if they fell below a certain percentage and were sold without any permission. As the market fell, stop losses were hit, and the program executed large stop-loss orders and liquidated those positions. It thus created a domino effect on the already tumbling market.

#6 - Margin Call & Illiquidity

When the market fell, margin calls were triggered, which required futures position holders to deposit a margin, failing, which resulted in the selling of future positions. Due to a large and sudden fall in the stock market, many futures position holders could not deposit margin, which led to the liquidation of their holding.

#7 - Derivative Security

Derivatives like futures and options derive their value from underlying stock in the spot market. But on 19 October 1987, futures were trading at a discount, whereas futures traded at a premium to their underlying. Due to selling pressure across the world on that day, large sell orders were placed on the stock market in the US. But the sell orders were so huge that buy orders could not fill them, and markets were shut for some time. Meanwhile, the futures market was open, and prices went down in the future market due to large sell orders.

Examples

Example 1

When the stock market opened, the difference between futures and the market was huge. Futures that are supposed to trade at a premium were trading at a huge discount. It created panic among investors, and they started winding up their positions. Many arbitrage traders also took this opportunity to make a riskless profit from this situation by buying futures and selling spots. Due to both these factors, the gap between futures and spots narrowed down, but it caused a stock market crash.

Example 2

The stock market crash of 1987 had a contagion effect that affected the whole world. Many countries had to develop liberal monetary policy measures to inject liquidity into the system and act as a lender to several brokerage houses that had to deposit margin money after the fall. It prevented the collapse of the whole financial system.

Effects

The stock market crash in 1987 taught many lessons regarding computer trading and automated programs and software. The trading-clearing process was examined, and rules like circuit breakers were introduced to stop trading in a massive fall.

After the record fall, markets recovered quickly and gave stellar returns in upcoming years. The overall effect of the crash was relatively less than what was expected.

Stock Market Crash in 1929 Vs Stock Market Crash in 1987

The stock market crash of 1929 was a series of crashes that occurred on Thursday (also known as Black Thursday), on which the stock market fell by 11%. On Monday, the following Thursday, the market fell another 13%, and it again fell on Tuesday. Whereas in 1987, the market crashed in a single day. The 1929 crash led to the great depression, which was the worst ever economic recession the world has seen. Unemployment rose, banks defaulted, companies went bankrupt, and the Fed didn't act swiftly to inject money into the system. In 1987, stock markets crashed, but the recession didn't follow the crash due to the money injected into the system by the fed; also, the reasons were more of technical nature rather than fundamental.

It took almost ten years for the world to come out of the great depression of 1929. The depression affected the world vastly, and it took a lot of time to recover from the recession. Markets in 1987 recouped in 2 years without going into depression and gave stellar returns afterward. However, its effect was much lower than predicted. Although the 1987 crash saw the greatest-ever fall in the market, its effect was limited compared to the 1929 crash, which led to one of the highest-ever unemployment rates and the shutting down of banks.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Recommended Articles

This article is a guide to what was the Stock Market Crash in 1987. We explain its causes, effects, examples, and its differences with the stock market crash in 1929. You can learn more about it from the following articles –